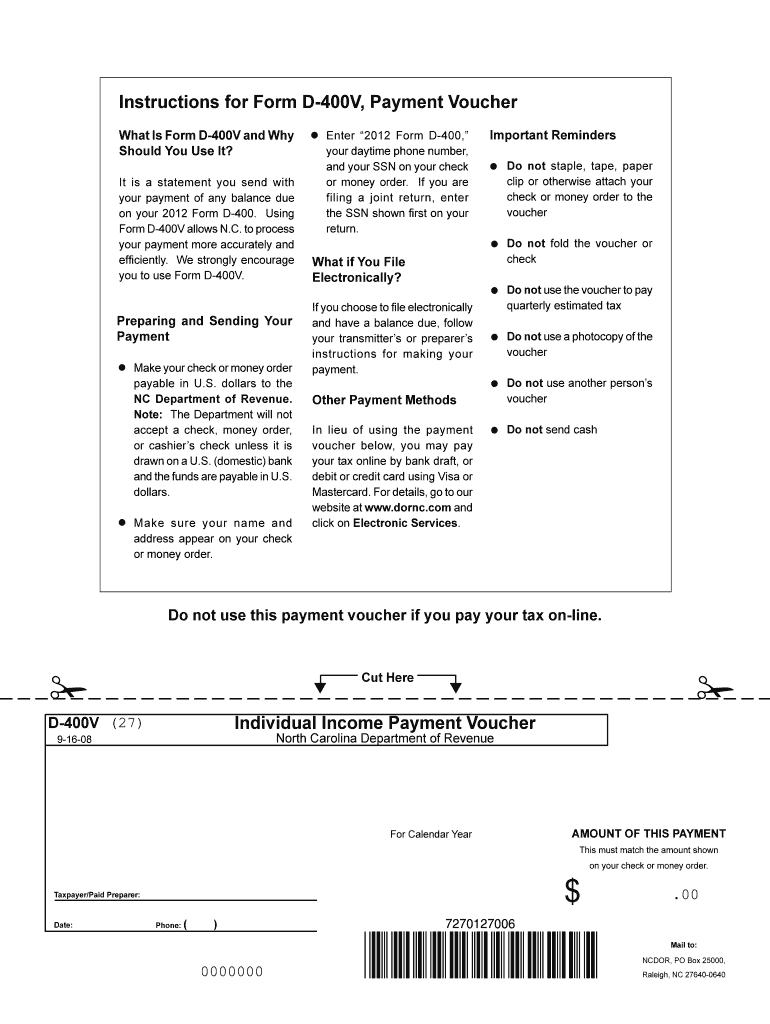

North Carolina Form D-400V

North Carolina Form D-400V - Single married filing joint head of household widow. Web follow the simple instructions below: Were you a resident of n.c. Were you a resident of n.c. However, with our preconfigured web templates, everything gets. Web north carolina taxable income. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. This payment application should be used only for the payment of tax owed on an amended north carolina individual. For more information about the north.

However, with our preconfigured web templates, everything gets. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Were you a resident of n.c. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. For more information about the north. Single married filing joint head of household widow. Were you a resident of n.c. Web follow the simple instructions below:

Web follow the simple instructions below: Were you a resident of n.c. For more information about the north. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Web north carolina taxable income. Single married filing joint head of household widow. However, with our preconfigured web templates, everything gets. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Fill in circle if you or, if married filing jointly, your spouse were out of the country on.

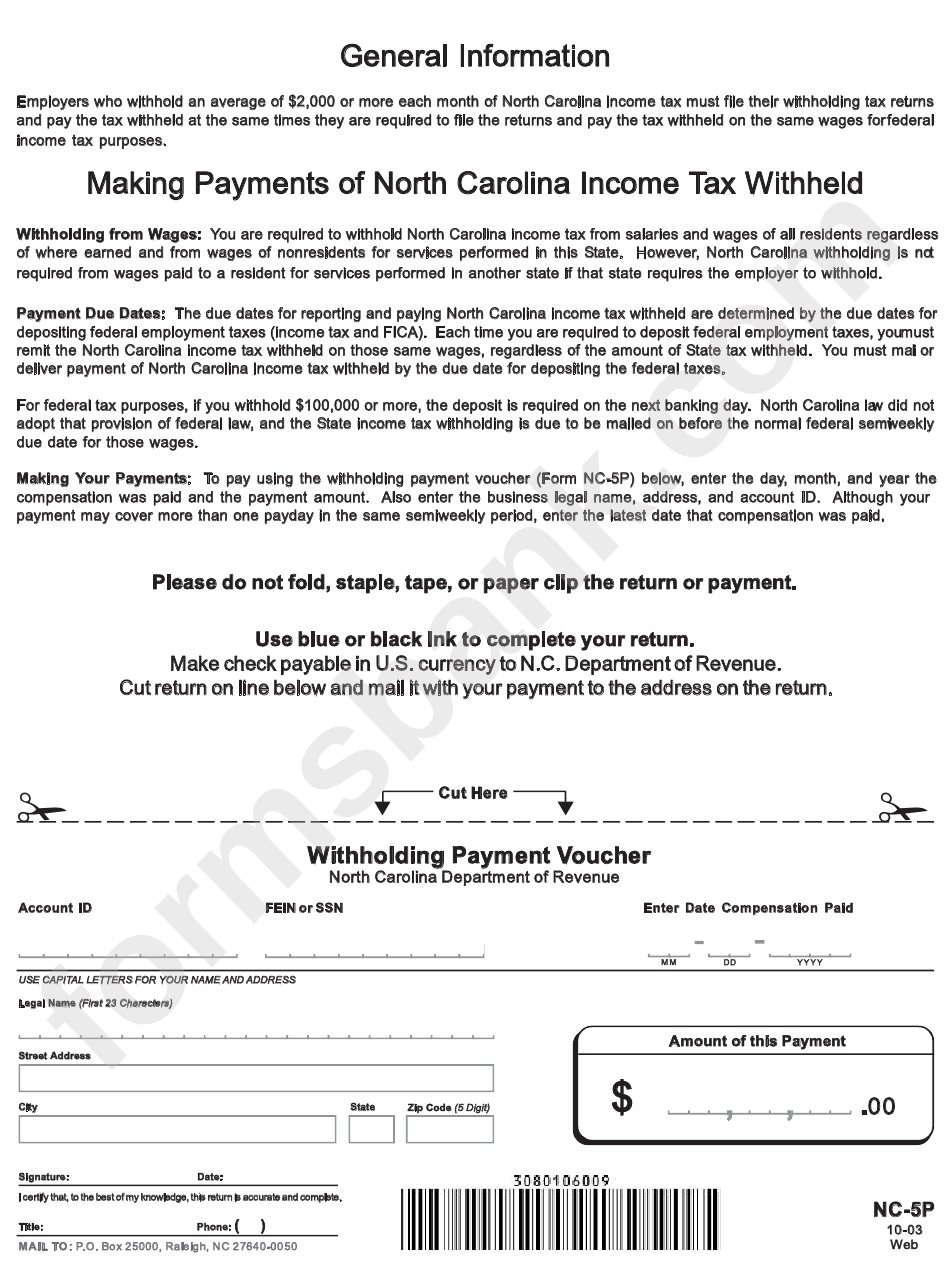

Form Nc5p Withholding Payment Voucher North Carolina Department Of

Single married filing joint head of household widow. Web follow the simple instructions below: Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Were you a resident of n.c.

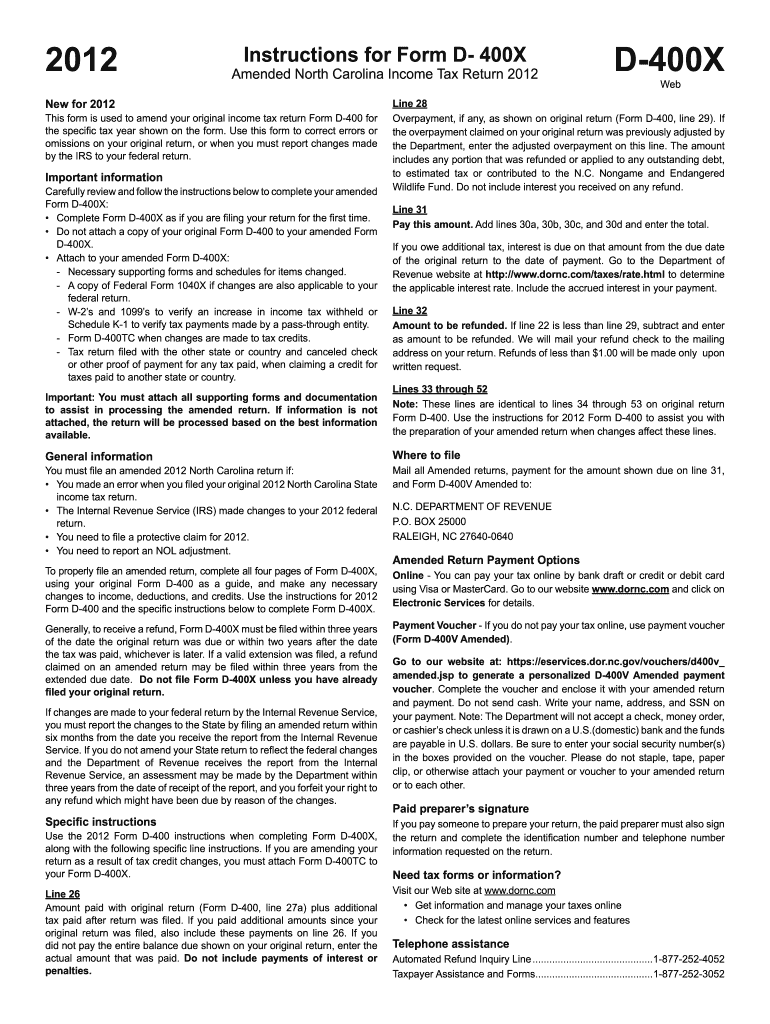

Nc d400 instructions 2016

Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Web north carolina taxable income. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Web follow the simple instructions below: For more information about the north.

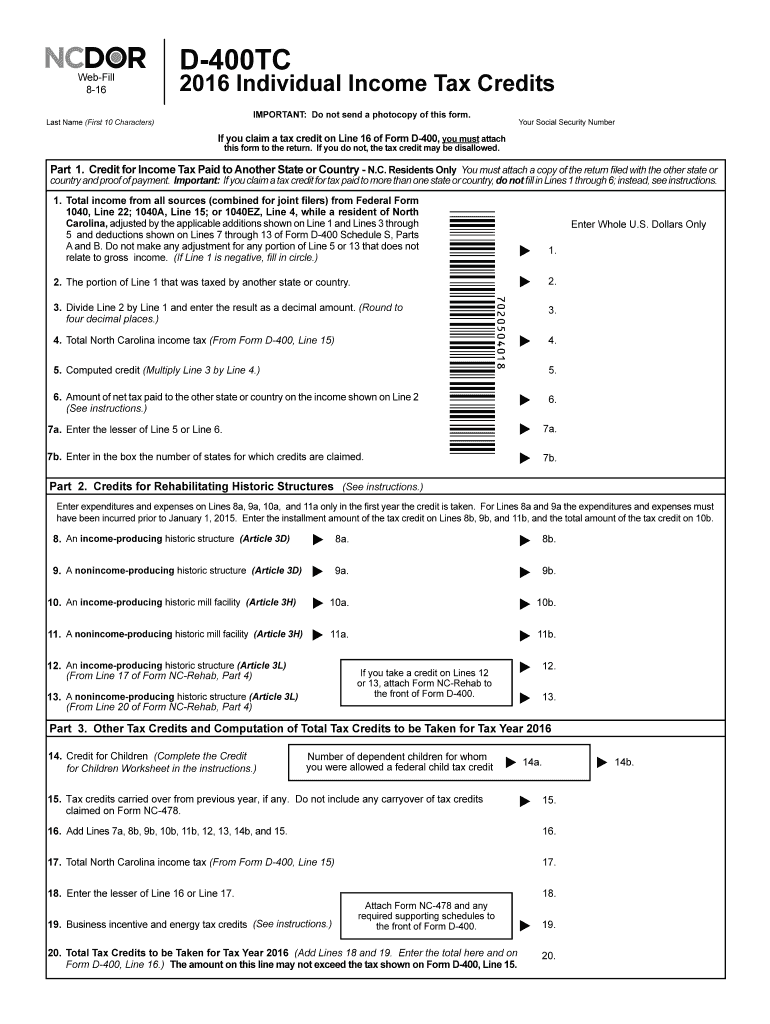

NC DoR D400TC 2016 Fill out Tax Template Online US Legal Forms

Were you a resident of n.c. However, with our preconfigured web templates, everything gets. Single married filing joint head of household widow. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Fill in circle if you, or if married filing jointly, your spouse were out of the country on.

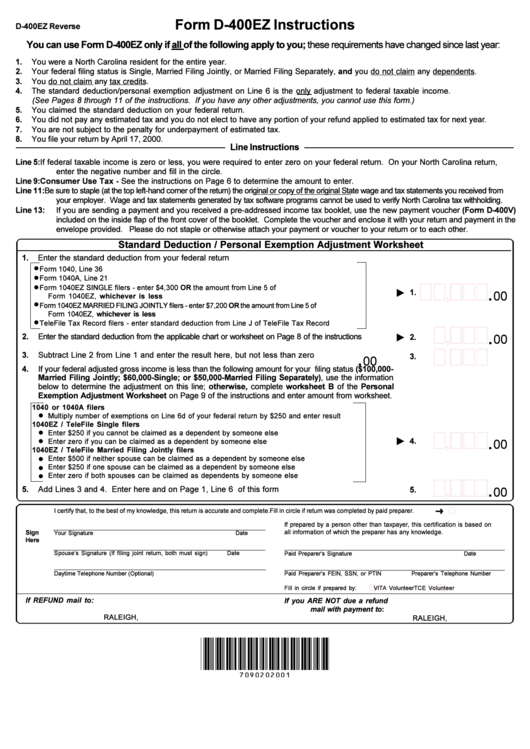

Form D400ez Instructions North Carolina Department Of Revenue

Were you a resident of n.c. Were you a resident of n.c. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Web north carolina taxable income. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north.

Printable D 400v Form Fill Online, Printable, Fillable, Blank pdfFiller

Were you a resident of n.c. Web follow the simple instructions below: For more information about the north. Web north carolina taxable income. However, with our preconfigured web templates, everything gets.

D 400v Payment Voucher 2020 Fill Online, Printable, Fillable, Blank

Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Single married filing joint head of household widow. This payment application should be used only for the payment of tax owed on an amended north carolina individual. Fill in circle if you or, if married filing jointly, your spouse were out of.

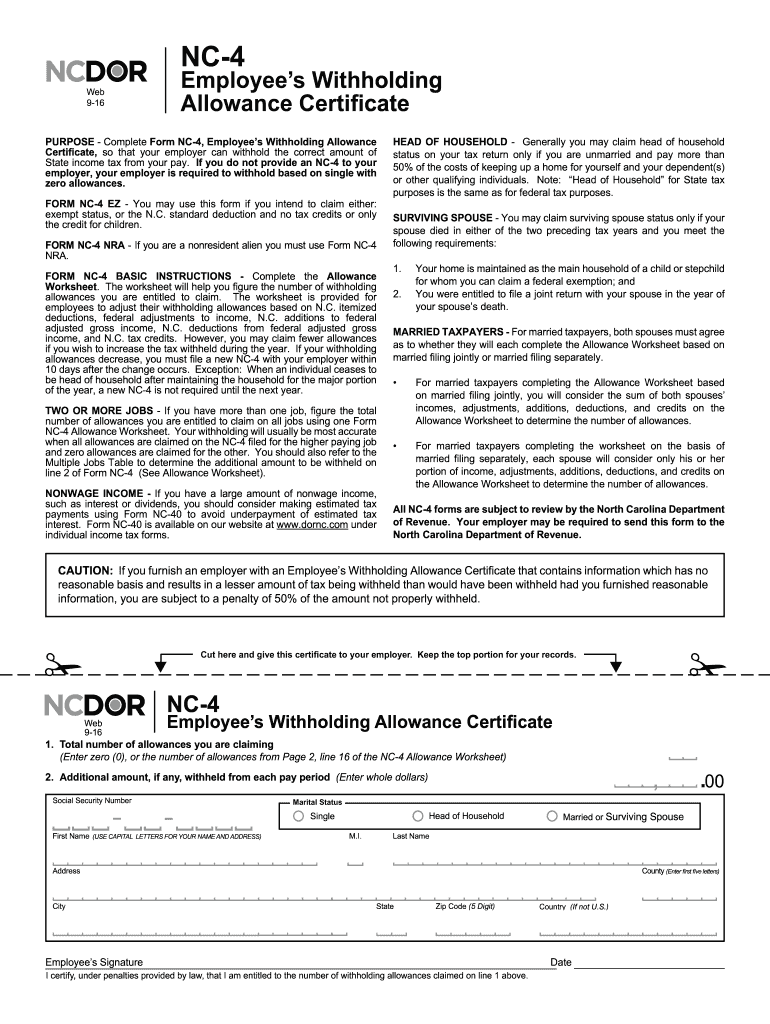

Form NC 4 North Carolina Department of Revenue Fill Out and Sign

However, with our preconfigured web templates, everything gets. Were you a resident of n.c. Web follow the simple instructions below: For more information about the north. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north.

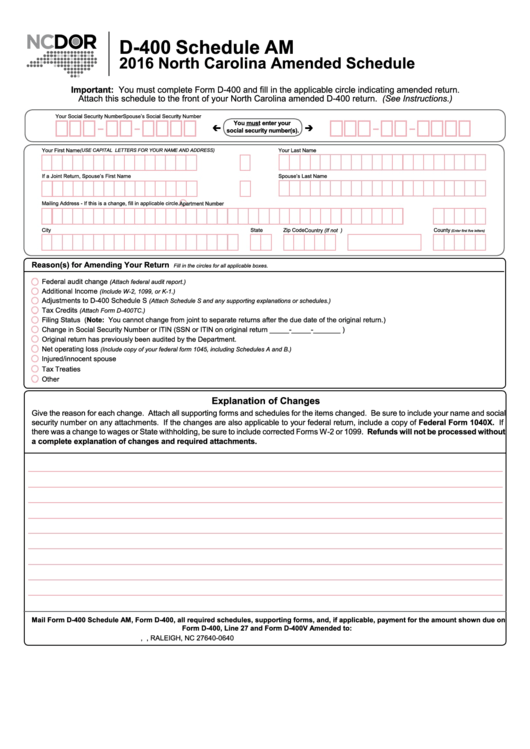

Form D400 Schedule Am North Carolina Amended Schedule 2016

Single married filing joint head of household widow. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Were you a resident of n.c. For more information about the north. Web north carolina taxable income.

Nc d400 instructions 2016

Web north carolina taxable income. However, with our preconfigured web templates, everything gets. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Single married filing joint head of household widow.

Nc d400 instructions 2016

Fill in circle if you, or if married filing jointly, your spouse were out of the country on. For more information about the north. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. This.

Web Follow The Simple Instructions Below:

This payment application should be used only for the payment of tax owed on an amended north carolina individual. For more information about the north. Were you a resident of n.c. Fill in circle if you or, if married filing jointly, your spouse were out of the country on.

Single Married Filing Joint Head Of Household Widow.

However, with our preconfigured web templates, everything gets. Fill in circle if you, or if married filing jointly, your spouse were out of the country on. Were you a resident of n.c. If you have additions to federal adjusted gross income, deductions from federal adjusted gross income, or north.