Nj Anchor Application Form

Nj Anchor Application Form - Where to send your application mail. If you still need to file your 2019 nj anchor application, please download. The anchor program is separate from the senior freeze program. You shared ownership of your main home with. Web to file by paper, you can print the form and mail it along with any necessary supporting documents to: Web the applications will soon be available. Sign up at the registration tablefor assistance. The deadline is february 28, 2023. To be eligible for this year's benefit,. New jerseyans are receiving mailings about the new anchor property tax program.

More information on the anchor program for renters/tenants can be found at. Web add your email below and hit subscribe the treasury department said some applications that need additional information before they are approved could take. To be eligible for this year's benefit,. New jerseyans are receiving mailings about the new anchor property tax program. You were a new jersey resident; You shared ownership of your main home with. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to display this type of document. The anchor program is separate from the senior freeze program. You can receive up to $1500 through nj's anchor program, now accepting applications. The user is on notice that neither the state of.

Web new jersey homeowners and renters! Spouses/cu partners who filed separately but maintained. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to display this type of document. 664 shares by karin price mueller | nj. “anchor applications will be mailed on a rolling basis between sept. You shared ownership of your main home with. On october 1, 2019, i was a:. Web anchor application assistanceform complete the informationbelow. Anchor application, revenue processing center, po box. The user is on notice that neither the state of.

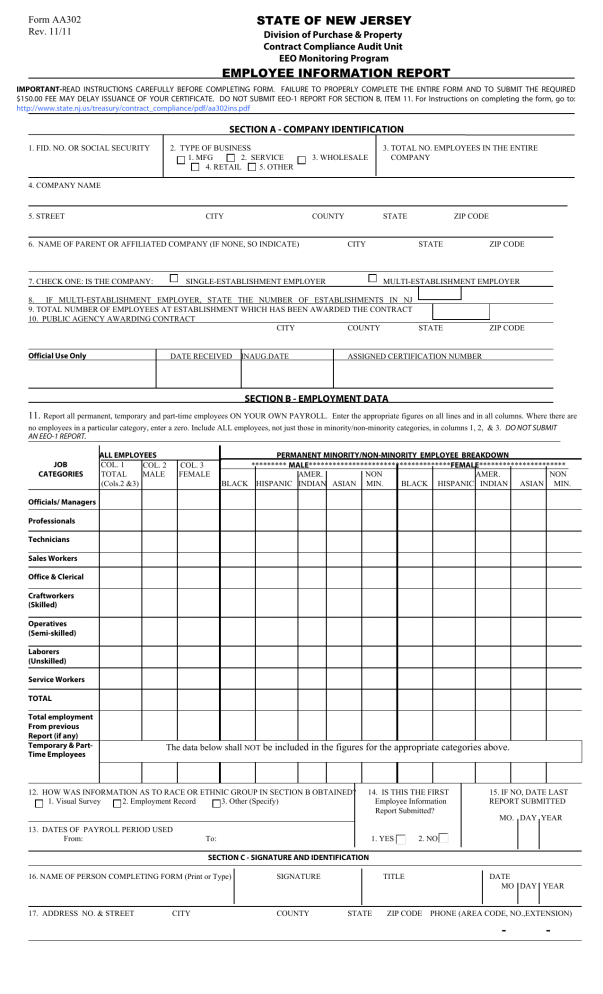

STATE OF NEW JERSEY EMPLOYEE INFORMATION REPORT Form AA302 Rev. 11/11

Web add your email below and hit subscribe the treasury department said some applications that need additional information before they are approved could take. Where to send your application mail. You were a new jersey resident; On october 1, 2019, i was a:. Spouses/cu partners who filed separately but maintained.

Fill Free fillable The State of New Jersey PDF forms

12 and 30 and will be available online in the coming. Web more than 870,000 homeowners with incomes up to $150,000 will be eligible to receive $1,500 in relief; Web when to file file your application by february 28, 2023. 664 shares by karin price mueller | nj. The automated telephone filing system will be available 24.

NJ NJFCABDAP 20182022 Fill and Sign Printable Template Online US

Web anchor benefit online filing electronic services the nj anchor web filing system is now closed. Web add your email below and hit subscribe the treasury department said some applications that need additional information before they are approved could take. The anchor program is separate from the senior freeze program. On october 1, 2019, i was a:. You must file.

Tax Collector Bordentown Township New Website

Spouses/cu partners who filed separately but maintained. Web the applications will soon be available. Web when is the anchor property tax relief application deadline? More information on the anchor program for renters/tenants can be found at. Web anchor application assistanceform complete the informationbelow.

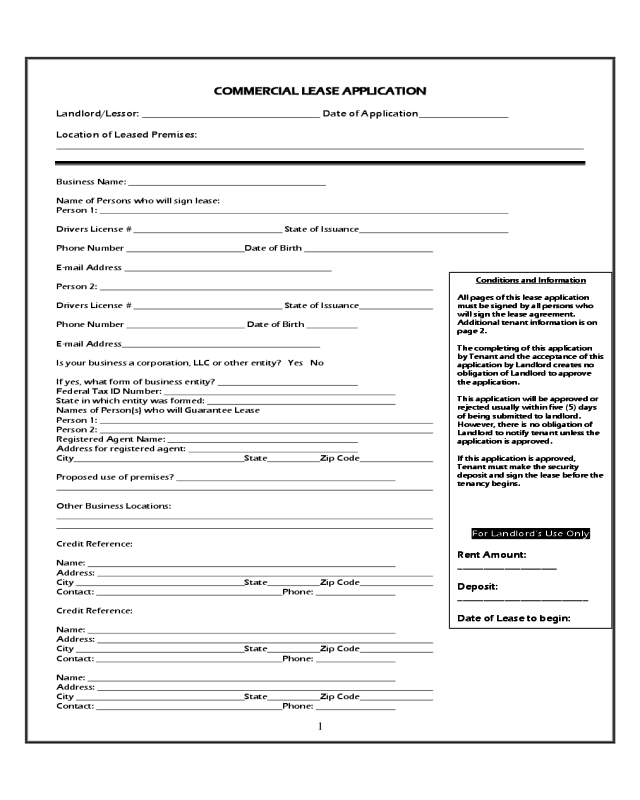

2021 Commercial Lease Form Fillable, Printable PDF & Forms Handypdf

The anchor program is separate from the senior freeze program. Web new jersey homeowners and renters! Web when to file file your application by february 28, 2023. More than 290,000 homeowners with incomes over $150,000 and up to. 664 shares by karin price mueller | nj.

Commercial & Anchor Service Application

Sign up at the registration tablefor assistance. Web to file by paper, you can print the form and mail it along with any necessary supporting documents to: More than 290,000 homeowners with incomes over $150,000 and up to. Web anchor application assistanceform complete the informationbelow. On october 1, 2019, i was a:.

NJ's New 2B Tax Rebate Program Underway How To Get Your Cut Across

You were a new jersey resident; Web when is the anchor property tax relief application deadline? Web the applications will soon be available. “anchor applications will be mailed on a rolling basis between sept. Sign up at the registration tablefor assistance.

Fill Free fillable The State of New Jersey PDF forms

Web anchor application assistanceform complete the informationbelow. Spouses/cu partners who filed separately but maintained. Web google™ translate is an online service for which the user pays nothing to obtain a purported language translation. The deadline is february 28, 2023. The user is on notice that neither the state of.

Tax Collector Bordentown Township New Website

Web new jersey homeowners and renters! Web google™ translate is an online service for which the user pays nothing to obtain a purported language translation. 664 shares by karin price mueller | nj. Web the online application, filing instructions, and paper applications can be accessed at nj.gov/taxation. Web anchor application assistanceform complete the informationbelow.

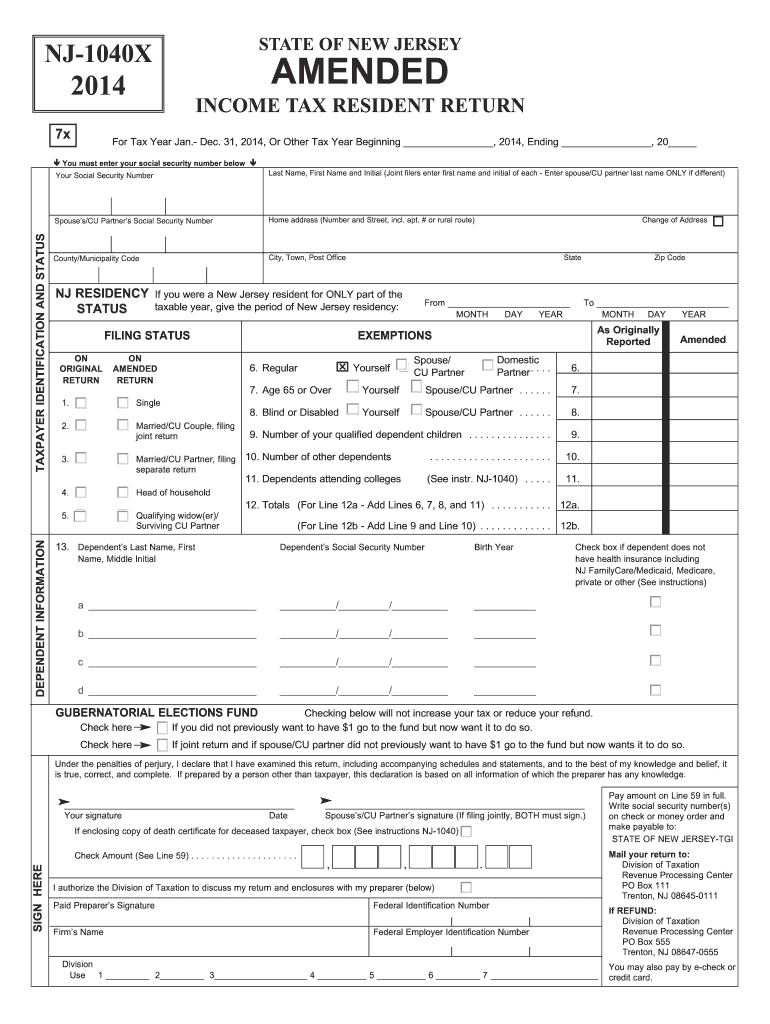

Nj State Tax Form Fill Out and Sign Printable PDF Template signNow

“anchor applications will be mailed on a rolling basis between sept. Web google™ translate is an online service for which the user pays nothing to obtain a purported language translation. Web anchor benefit online filing electronic services the nj anchor web filing system is now closed. Web new jersey homeowners and renters! Anchor application, revenue processing center, po box.

Web Google™ Translate Is An Online Service For Which The User Pays Nothing To Obtain A Purported Language Translation.

You can receive up to $1500 through nj's anchor program, now accepting applications. You are eligible if you met these requirements: The deadline is february 28, 2023. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to display this type of document.

New Jerseyans Are Receiving Mailings About The New Anchor Property Tax Program.

Where to send your application mail. Web the applications will soon be available. If you still need to file your 2019 nj anchor application, please download. Web add your email below and hit subscribe the treasury department said some applications that need additional information before they are approved could take.

664 Shares By Karin Price Mueller | Nj.

Keep a copy of your application and supporting documents for your. Spouses/cu partners who filed separately but maintained. Web anchor benefit online filing electronic services the nj anchor web filing system is now closed. 12 and 30 and will be available online in the coming.

Web To File By Paper, You Can Print The Form And Mail It Along With Any Necessary Supporting Documents To:

Sign up at the registration tablefor assistance. “anchor applications will be mailed on a rolling basis between sept. You must file a paper application if: Web the online application, filing instructions, and paper applications can be accessed at nj.gov/taxation.