New York Part Year Resident Tax Form

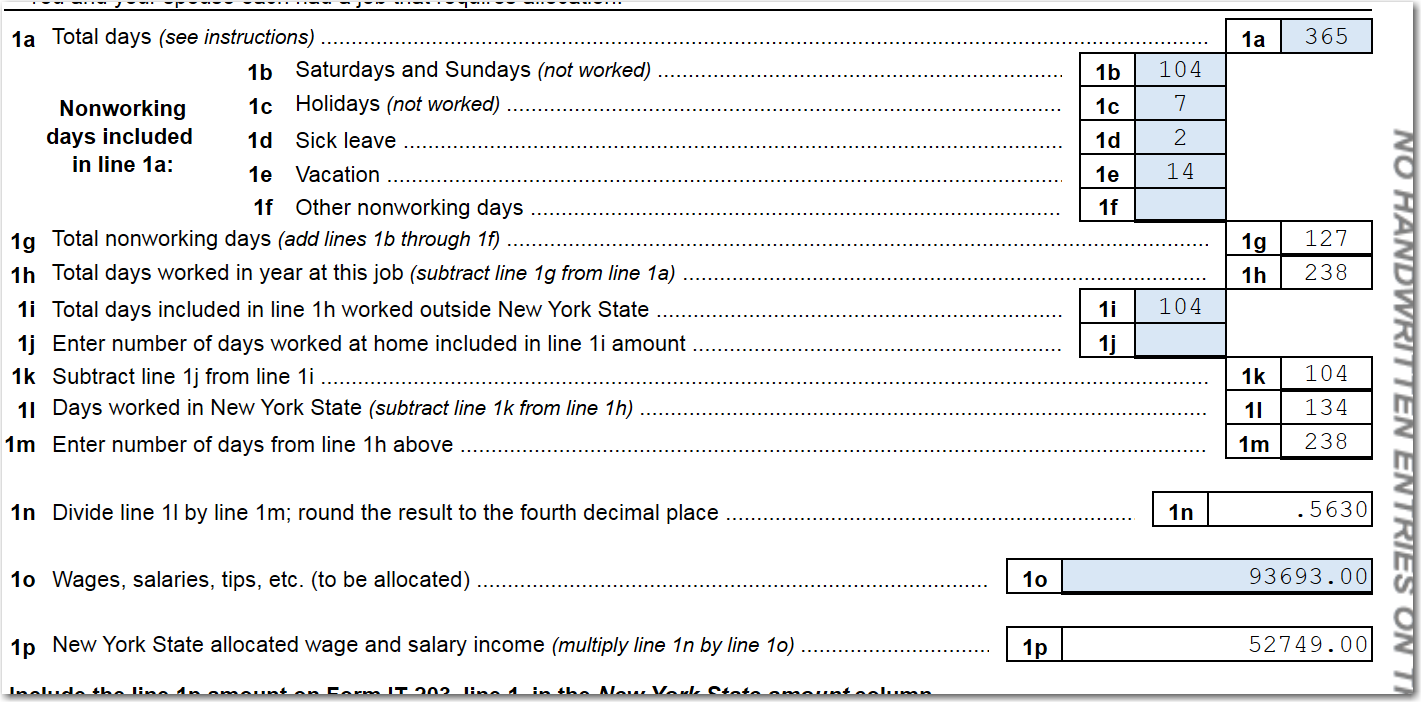

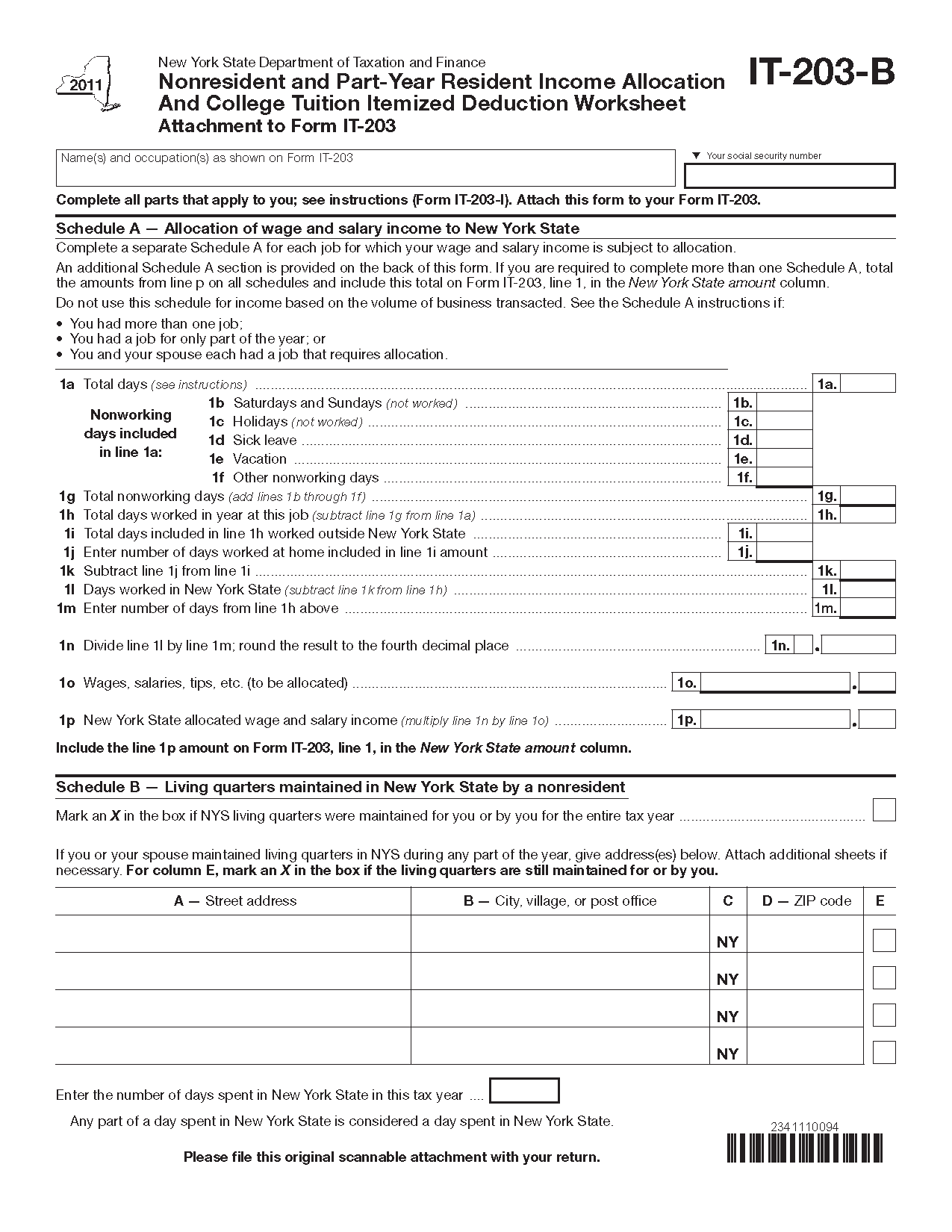

New York Part Year Resident Tax Form - Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web department of taxation and finance. And with that, comes completing and filing new. This form is used to. Information, to enter information related to part year and non residents for ny. How do i allocate the income i earned while a part year. Common questions about new york. On the last day of the tax year (mark an x in one. Dates of residency entered in this screen for new york city and yonkers are used in conjunction. Select who the form is.

Web department of taxation and finance. And with that, comes completing and filing new. On the last day of the tax year (mark an x in one. Income tax return new york state • new york city • yonkers • mctmt. Information, to enter information related to part year and non residents for ny. How do i allocate the income i earned while a part year. Web use screen 55.091, st. Dates of residency entered in this screen for new york city and yonkers are used in conjunction. Web 1 min read if you live in the state of new york or earn income within the state, it’s likely you will have to pay new york income tax. Select who the form is.

Web use screen 55.091, st. Were not a resident of new york state and received income during. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Common questions about new york. Web new york city and yonkers residents. Income tax return new york state • new york city • yonkers • mctmt. Web department of taxation and finance. Select who the form is. Web part year resident status here you will indicate if you moved into or out of new york and the date of your move. Information, to enter information related to part year and non residents for ny.

New York City Part Year Resident Tax Withholding Form

Web 1 min read if you live in the state of new york or earn income within the state, it’s likely you will have to pay new york income tax. Web part year resident status here you will indicate if you moved into or out of new york and the date of your move. Web department of taxation and finance..

What Is A Partyear Resident In New York? [The Right Answer] 2022

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) This form is used to. Web 1 min read if you live in the state of new york or earn income within the state, it’s likely you will have to pay new york income tax. Select who the form is. Web new york city and.

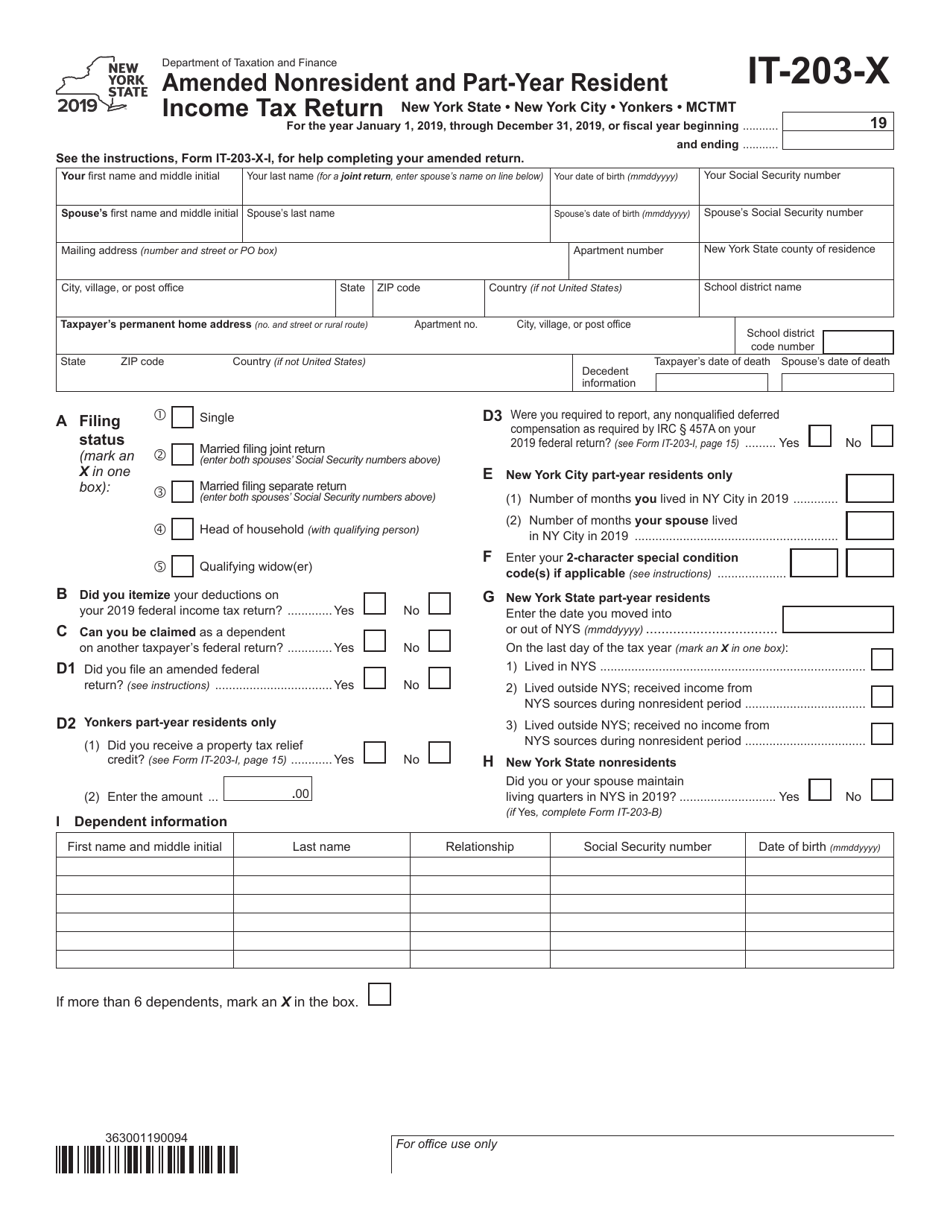

Form IT203X Download Fillable PDF or Fill Online Amended Nonresident

How do i allocate the income i earned while a part year. Web department of taxation and finance. This form is used to. Income tax return new york state • new york city • yonkers • mctmt. Web new york city and yonkers residents.

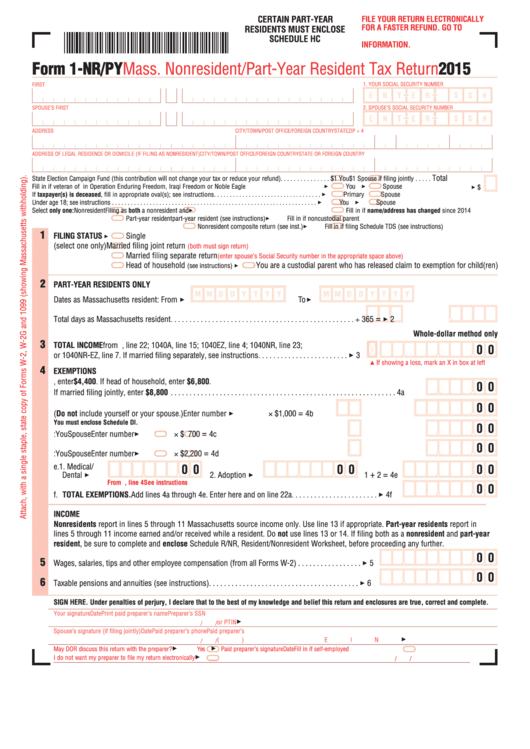

Form 1Nr/py Mass. Nonresident/partYear Resident Tax Return 2015

How do i allocate the income i earned while a part year. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) This form is used to. Income tax return new york state • new york city • yonkers • mctmt. Web new york city and yonkers residents.

Resident Tax Return New York Free Download

Common questions about new york. Web department of taxation and finance. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Were not a resident of new york state and received income during. Web part year resident status here you will indicate if you moved into or out of new york and the date of.

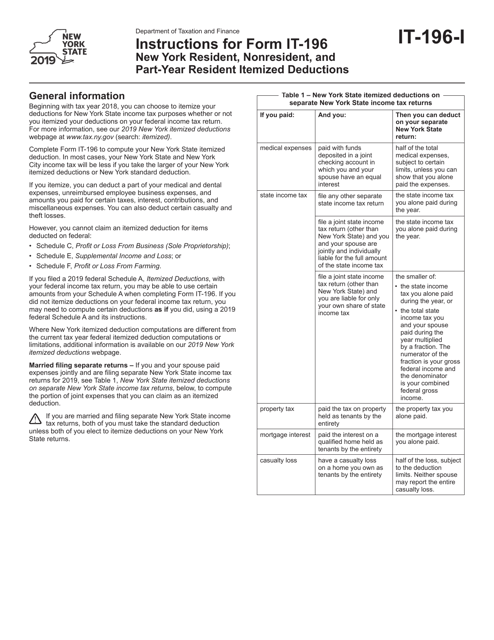

Download Instructions for Form IT196 New York Resident, Nonresident

And with that, comes completing and filing new. Web use screen 55.091, st. On the last day of the tax year (mark an x in one. Income tax return new york state • new york city • yonkers • mctmt. How do i allocate the income i earned while a part year.

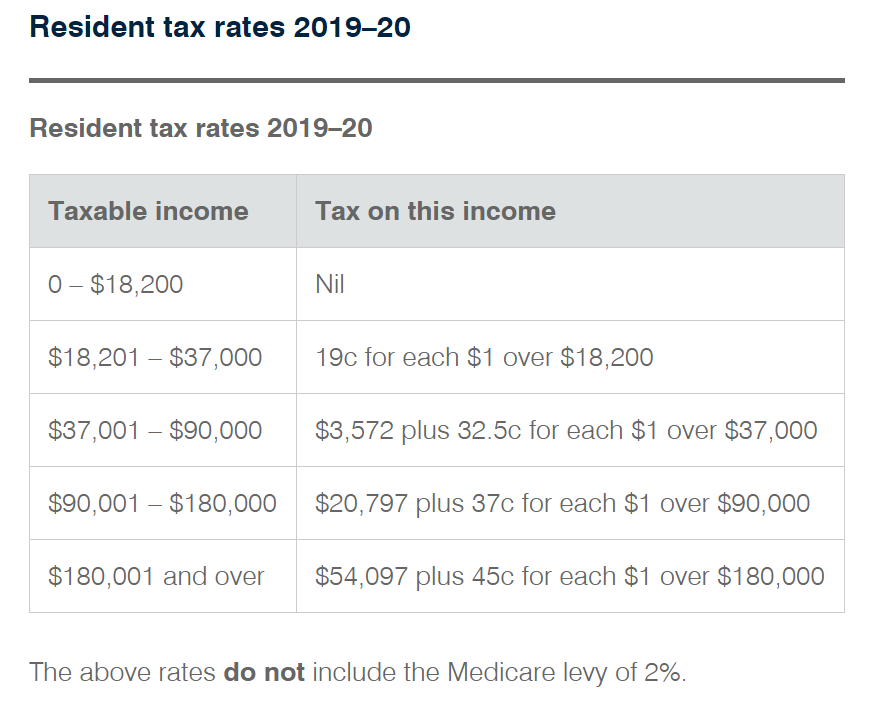

Doing business in Australia from India(n) perspective. Accurate

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web department of taxation and finance. Common questions about new york. Web part year resident status here you will indicate if you moved into or out of new york and the date of your move. Web use screen 55.091, st.

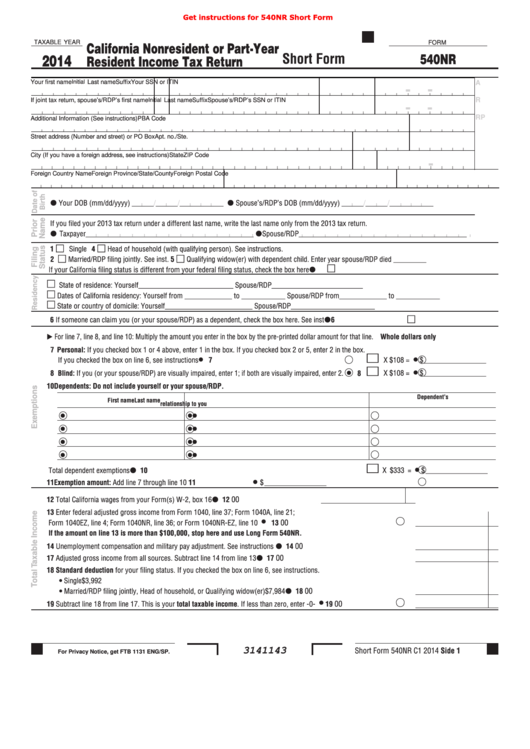

Fillable Form 540nr California Nonresident Or PartYear Resident

Information, to enter information related to part year and non residents for ny. How do i allocate the income i earned while a part year. This form is used to. Web part year resident status here you will indicate if you moved into or out of new york and the date of your move. Income tax return new york state.

New York City Part Year Resident General Chat ATX Community

Common questions about new york. How do i allocate the income i earned while a part year. Web part year resident status here you will indicate if you moved into or out of new york and the date of your move. Income tax return new york state • new york city • yonkers • mctmt. Web department of taxation and.

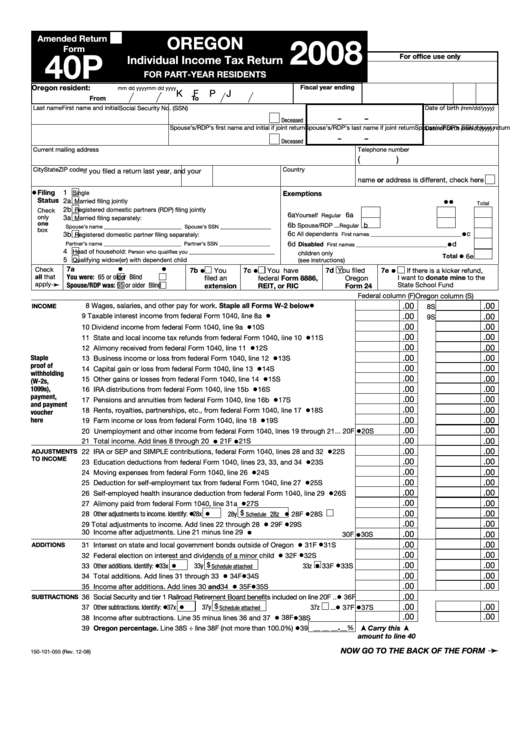

Fillable Form 40p Oregon Individual Tax Return For PartYear

Web 1 min read if you live in the state of new york or earn income within the state, it’s likely you will have to pay new york income tax. Were not a resident of new york state and received income during. And with that, comes completing and filing new. On the last day of the tax year (mark an.

Common Questions About New York.

Were not a resident of new york state and received income during. Web 1 min read if you live in the state of new york or earn income within the state, it’s likely you will have to pay new york income tax. How do i allocate the income i earned while a part year. Web part year resident status here you will indicate if you moved into or out of new york and the date of your move.

Web New York City And Yonkers Residents.

This form is used to. Information, to enter information related to part year and non residents for ny. And with that, comes completing and filing new. Web use screen 55.091, st.

Income Tax Return New York State • New York City • Yonkers • Mctmt.

Web department of taxation and finance. Select who the form is. On the last day of the tax year (mark an x in one. Dates of residency entered in this screen for new york city and yonkers are used in conjunction.

![What Is A Partyear Resident In New York? [The Right Answer] 2022](https://www.travelizta.com/wp-content/uploads/2022/09/what-is-a-part-year-resident-in-new-york.jpg)