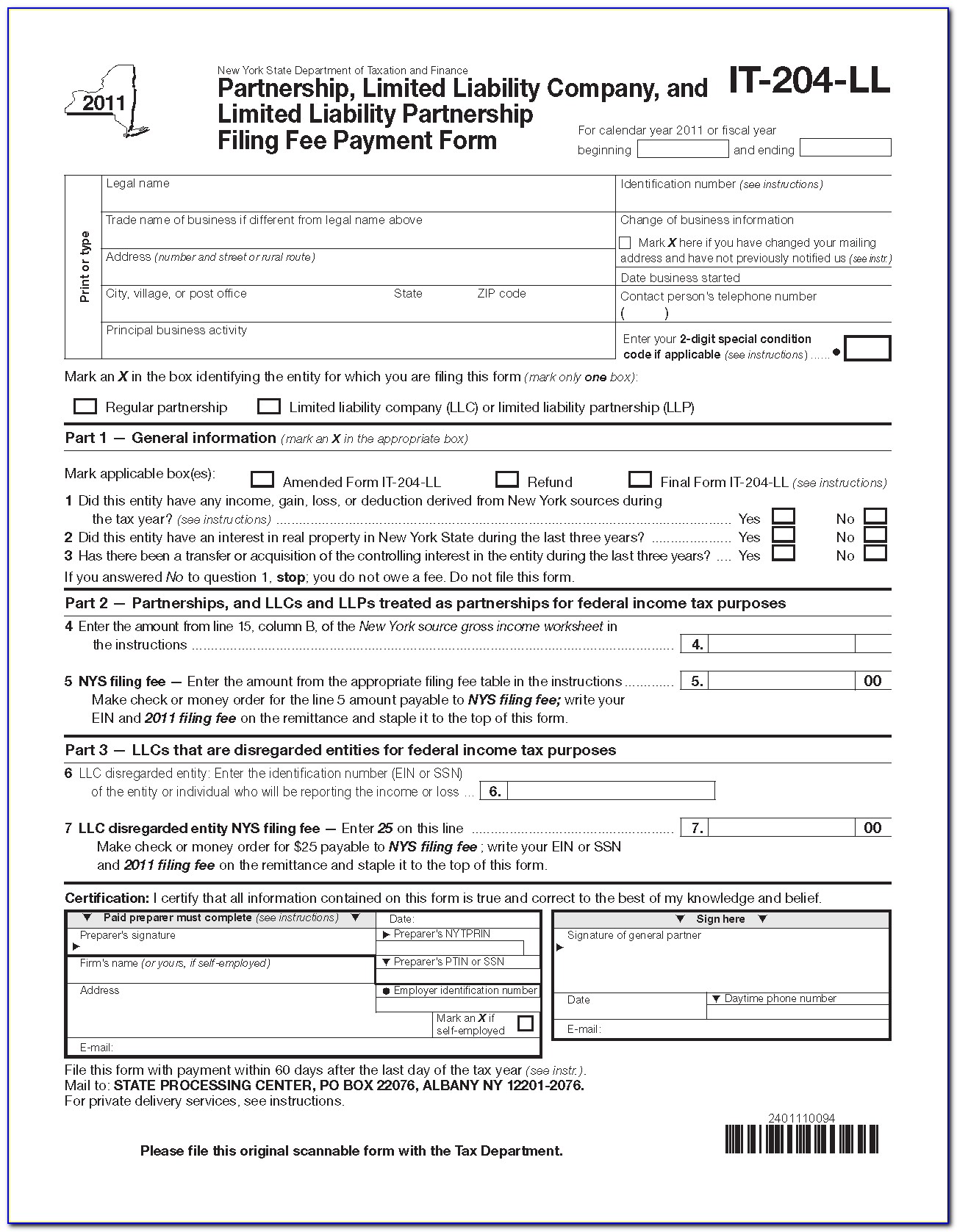

New York Llc Form It-204-Ll

New York Llc Form It-204-Ll - Every llc that is a disregarded. Returns for calendar year 2009 are due april 15, 2010. From within your taxact return (online or desktop), click state. Certain partnerships, limited liability companies (llcs), and limited liability partnerships (llps) must pay an annual. This will enable a fully calculating return,. Enter x in the entity did not have any income, gain, loss, or deduction from nys during the tax year field on. Just pay state filing fees. Every llc that is a disregarded entity for. Web 19 rows partnership return; Edit, sign and print tax forms on any device with uslegalforms.

An llc or llp that is. Creating formal paperwork by yourself is difficult and risky. Certain partnerships, limited liability companies (llcs), and limited liability partnerships (llps) must pay an annual. Returns for calendar year 2009 are due april 15, 2010. Just pay state filing fees. Kickstart your llc for free in minutes. Web this field is mandatory for new york state. From within your taxact return (online or desktop), click state. Every llc that is a disregarded entity for. Every llc that is a disregarded.

Every llc that is a disregarded. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Enter x in the entity did not have any income, gain, loss, or deduction from nys during the tax year field on. An llc or llp that is. Complete, edit or print tax forms instantly. Every llc that is a disregarded entity for. Web this field is mandatory for new york state. Web 19 rows partnership return; This will enable a fully calculating return,. From within your taxact return (online or desktop), click state.

How to Form an LLC in New York (with Pictures) wikiHow Life

Every llc that is a disregarded. Just pay state filing fees. Returns for calendar year 2009 are due april 15, 2010. Kickstart your llc for free in minutes. An llc or llp that is.

How to Form an LLC in New York (with Pictures) wikiHow Life

Creating formal paperwork by yourself is difficult and risky. Web 19 rows partnership return; From within your taxact return (online or desktop), click state. Every llc that is a disregarded. Every llc that is a disregarded entity for.

How to Form an LLC in New York (with Pictures) wikiHow Life

Kickstart your llc for free in minutes. This will enable a fully calculating return,. From within your taxact return (online or desktop), click state. Web this field is mandatory for new york state. Creating formal paperwork by yourself is difficult and risky.

NY IT204LL 20152021 Fill and Sign Printable Template Online US

Complete, edit or print tax forms instantly. Certain partnerships, limited liability companies (llcs), and limited liability partnerships (llps) must pay an annual. This will enable a fully calculating return,. Returns for calendar year 2009 are due april 15, 2010. Kickstart your llc for free in minutes.

How to Form an LLC in New York (with Pictures) wikiHow Life

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. This will enable a fully calculating return,. Complete, edit or print tax forms instantly. Web 19 rows partnership return; From within your taxact return (online or desktop), click state.

Download Instructions for Form IT204CP New York Corporate Partner's

Returns for calendar year 2009 are due april 15, 2010. Enter x in the entity did not have any income, gain, loss, or deduction from nys during the tax year field on. Kickstart your llc for free in minutes. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Every llc that.

New York LLC (7 Step) Guide on How To Start an LLC in NY

Form yours for $0 + filing fees. Creating formal paperwork by yourself is difficult and risky. Enter x in the entity did not have any income, gain, loss, or deduction from nys during the tax year field on. Web this field is mandatory for new york state. From within your taxact return (online or desktop), click state.

New York LLC Annual Report Requirements (and Filing) Tailor Brands

Web this field is mandatory for new york state. Every llc that is a disregarded entity for. Kickstart your llc for free in minutes. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Returns for calendar year 2009 are due april 15, 2010.

New York Llc Form It 204 Ll Form Resume Examples GwkQZrMDWV

Kickstart your llc for free in minutes. Enter x in the entity did not have any income, gain, loss, or deduction from nys during the tax year field on. Certain partnerships, limited liability companies (llcs), and limited liability partnerships (llps) must pay an annual. Every llc that is a disregarded. Web this field is mandatory for new york state.

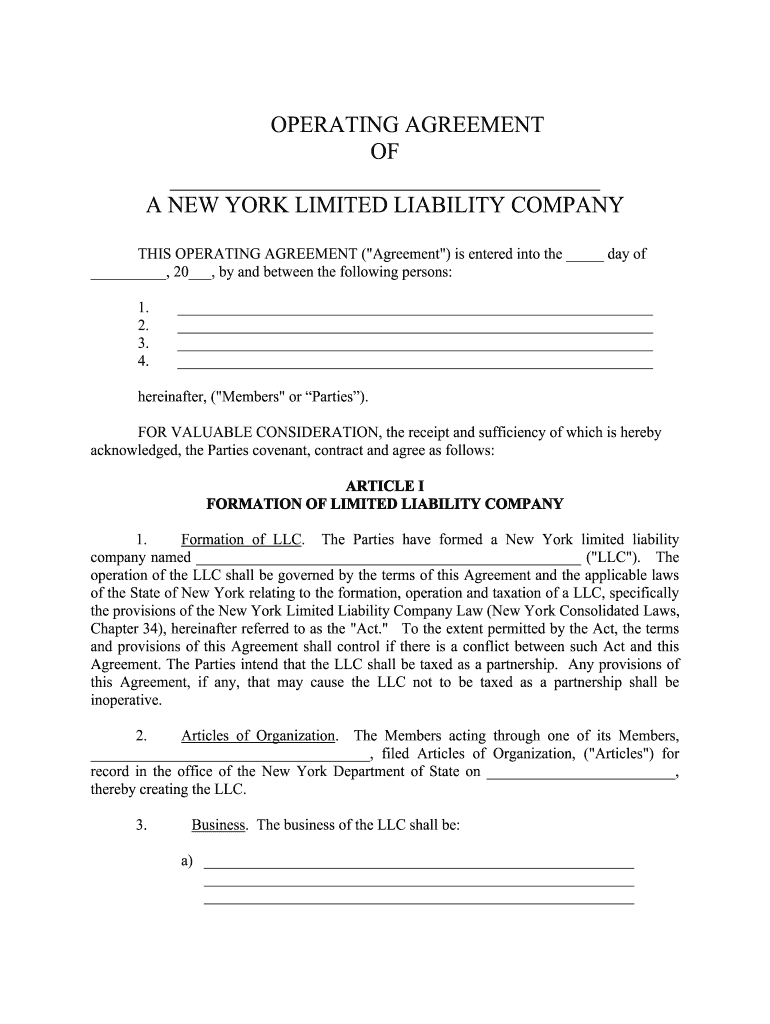

Llc Operating Agreement Ny Fill Online, Printable, Fillable, Blank

Web 19 rows partnership return; This will enable a fully calculating return,. Enter x in the entity did not have any income, gain, loss, or deduction from nys during the tax year field on. Creating formal paperwork by yourself is difficult and risky. Every llc that is a disregarded entity for.

Web This Field Is Mandatory For New York State.

An llc or llp that is. This will enable a fully calculating return,. Complete, edit or print tax forms instantly. Form yours for $0 + filing fees.

Web 19 Rows Partnership Return;

Returns for calendar year 2009 are due april 15, 2010. Creating formal paperwork by yourself is difficult and risky. Every llc that is a disregarded entity for. From within your taxact return (online or desktop), click state.

Edit, Sign And Print Tax Forms On Any Device With Uslegalforms.

Enter x in the entity did not have any income, gain, loss, or deduction from nys during the tax year field on. Every llc that is a disregarded. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Kickstart your llc for free in minutes.

Certain Partnerships, Limited Liability Companies (Llcs), And Limited Liability Partnerships (Llps) Must Pay An Annual.

Just pay state filing fees.