Negative Cash Balance On Balance Sheet

Negative Cash Balance On Balance Sheet - Web cash overdraft in balance sheet. Or you can also include the amount in accounts payable. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. Web how do you fix a negative cash balance? In both cases, the negative cash balance should be presented in the liabilities section of. The more theoretically correct approach is to segregate the overdrawn. The credit or negative balance in the checking account is usually caused by a company writing checks for. Web there are two options for which liability account to use to store the overdrawn amount, which are: In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities.

If you want to solve a problem, you must first identify the source of the problem. In both cases, the negative cash balance should be presented in the liabilities section of. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. Web there are two options for which liability account to use to store the overdrawn amount, which are: The credit or negative balance in the checking account is usually caused by a company writing checks for. Web how do you fix a negative cash balance? Web cash overdraft in balance sheet. Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. Or you can also include the amount in accounts payable.

The more theoretically correct approach is to segregate the overdrawn. Web cash overdraft in balance sheet. In both cases, the negative cash balance should be presented in the liabilities section of. Web how do you fix a negative cash balance? Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. Web there are two options for which liability account to use to store the overdrawn amount, which are: Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. The credit or negative balance in the checking account is usually caused by a company writing checks for. Or you can also include the amount in accounts payable. If you want to solve a problem, you must first identify the source of the problem.

Negative Cash Balance r/Webull

The more theoretically correct approach is to segregate the overdrawn. In both cases, the negative cash balance should be presented in the liabilities section of. Web cash overdraft in balance sheet. Web how do you fix a negative cash balance? In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities.

Cash App Showing Negative Balance [Fix] Techfixhub

If you want to solve a problem, you must first identify the source of the problem. Or you can also include the amount in accounts payable. The more theoretically correct approach is to segregate the overdrawn. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. Web cash overdraft in.

Balance Sheet — Financial Expertise You Can Take to the Bank

Web there are two options for which liability account to use to store the overdrawn amount, which are: Web how do you fix a negative cash balance? Or you can also include the amount in accounts payable. The credit or negative balance in the checking account is usually caused by a company writing checks for. The more theoretically correct approach.

Understanding Negative Balances in Your Financial Statements Fortiviti

If you want to solve a problem, you must first identify the source of the problem. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. The credit or negative balance in the checking account is usually caused by a company writing checks for. Web there are two options for which liability account to.

Etrade Negative Cash Balance 4 Reasons & Solution

If you want to solve a problem, you must first identify the source of the problem. In both cases, the negative cash balance should be presented in the liabilities section of. Or you can also include the amount in accounts payable. Web there are two options for which liability account to use to store the overdrawn amount, which are: The.

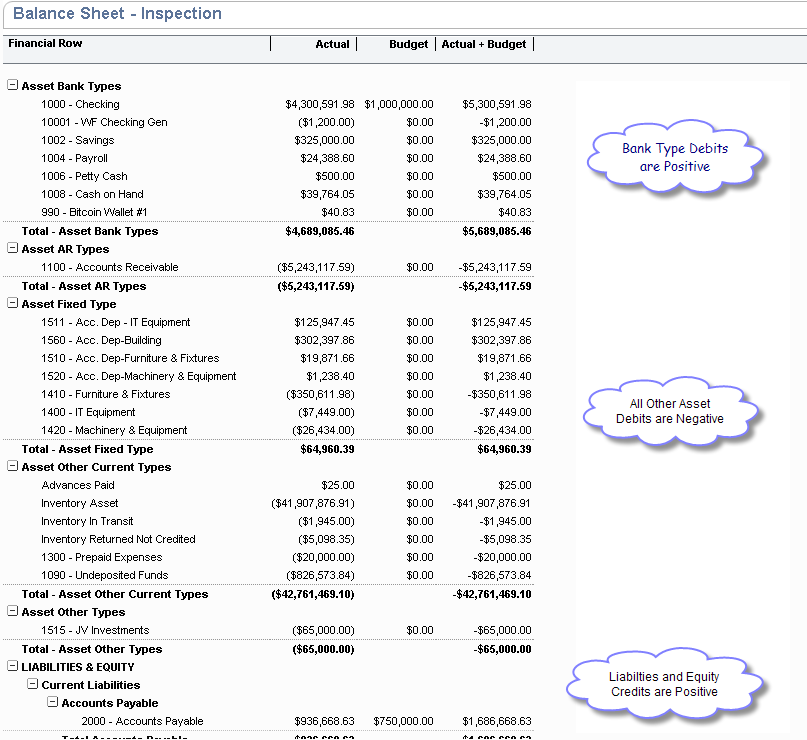

Marty Zigman on "The Pluses and Minuses of NetSuite Financial Statement

Or you can also include the amount in accounts payable. The more theoretically correct approach is to segregate the overdrawn. The credit or negative balance in the checking account is usually caused by a company writing checks for. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. In both cases, the negative cash.

Negative Cash Flow Investments in Companies

Web cash overdraft in balance sheet. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. The credit or negative balance in the checking account is usually caused by a company writing checks for. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000..

How to find Negative Cash Balance in Tally YouTube

If you want to solve a problem, you must first identify the source of the problem. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. In both cases, the negative cash balance should be presented in the liabilities section of. In the balance sheet, show the negative cash balance.

Negative Cash Flow (Meaning, Examples) How to Interpret?

In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. Web there are two options for which liability account to use to store the overdrawn amount, which are: Or you can also include the amount in accounts payable. In both cases, the negative cash balance should be presented in the liabilities section of. If.

What Is a Financial Statement? Detailed Overview of Main Statements

In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. The more theoretically correct approach is to segregate the overdrawn. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000. In both cases, the negative cash balance should be presented in the liabilities section.

Or You Can Also Include The Amount In Accounts Payable.

Web how do you fix a negative cash balance? Web cash overdraft in balance sheet. Web there are two options for which liability account to use to store the overdrawn amount, which are: In both cases, the negative cash balance should be presented in the liabilities section of.

The Credit Or Negative Balance In The Checking Account Is Usually Caused By A Company Writing Checks For.

Web a negative cash balance results when the cash account in a company's general ledger has a credit balance. In the balance sheet, show the negative cash balance as cash overdraft in the current liabilities. The more theoretically correct approach is to segregate the overdrawn. Web presentation of negative cash balances on balance sheet in both scenarios, the company had a negative cash of $5,000.

![Cash App Showing Negative Balance [Fix] Techfixhub](https://techfixhub.com/wp-content/uploads/2022/09/9vc6cwlha8c61-1.jpeg)