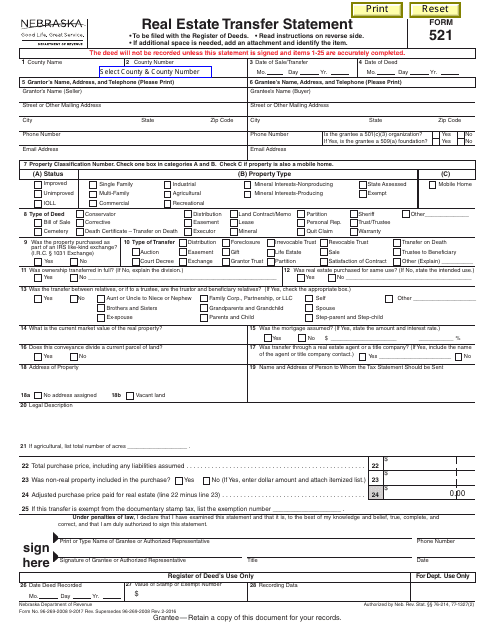

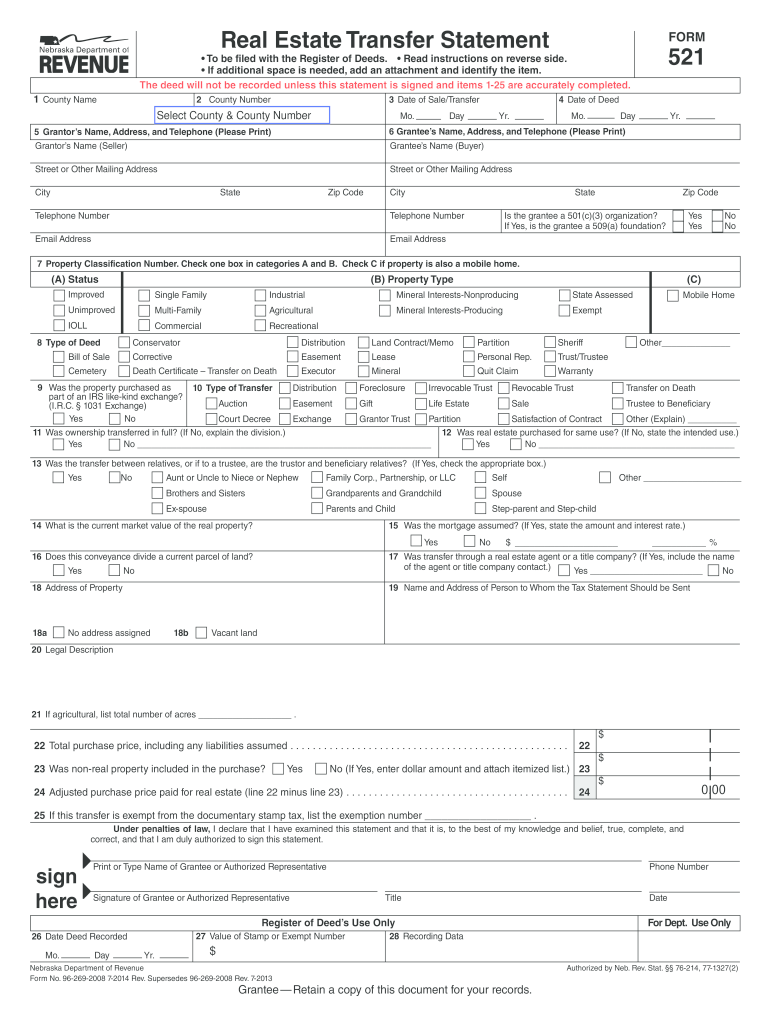

Nebraska Form 521

Nebraska Form 521 - Web estate transfer statement, form 521, is signed. Web death certificate pursuant to a transfer on death deed cover sheet: Previous years' income tax forms. A cover sheet is required to be filed with a copy of a death certificate conveying real estate pursuant to a previously recorded transfer on death deed. When and where to file. If the grantee or purchaser fails to furnish a completed form 521, nebraska law Web this certificate of exemption is to be filed with the real estate transfer statement, form 521, when exemption #5b is claimed in item 25 on the form 521. Web must file form 521. Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed Under penalties of law, i declare that the information provided above is true, complete, and correct and that i am familiar with all of the relevant

Web must file form 521. Form 521mh must be filed with the county treasurer in the county where the application for title Numeric listing of all current nebraska tax forms. Every deed or any other instrument affecting title to real property is required to be recorded with the county register of deeds. When and where to file. Web statement, form 521mh, when seeking a certificate of title for manufactured housing. Web real estate transfer statement, form 521, at the time such deed or document is presented for recording with the county register of deeds. Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521. Web estate transfer statement, form 521, is signed. Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed

When and where to file. Web estate transfer statement, form 521, is signed. Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed require a completed form 521, which are not subject to the documentary stamp tax until the deed is. Every deed or any other instrument affecting title to real property is required to be recorded with the county register of deeds. Web real estate transfer statement, form 521, at the time such deed or document is presented for recording with the county register of deeds. Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed A cover sheet is required to be filed with a copy of a death certificate conveying real estate pursuant to a previously recorded transfer on death deed. Previous years' income tax forms. Web estate transfer statement, form 521, is signed. Numeric listing of all current nebraska tax forms.

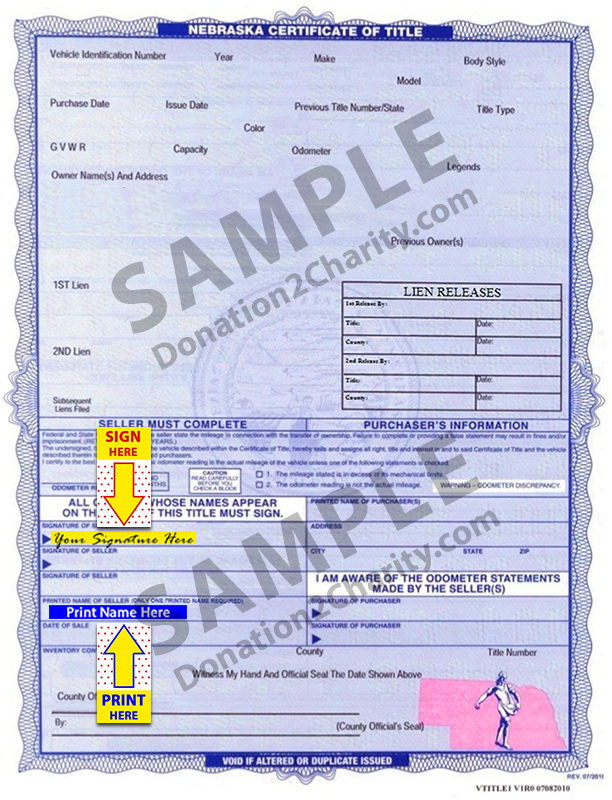

Nebraska Donation2Charity

Web estate transfer statement, form 521, is signed. Previous years' income tax forms. Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed Web estate transfer statement, form 521, is signed. Numeric listing of all current nebraska tax forms.

Form 521 Download Fillable PDF or Fill Online Real Estate Transfer

Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed Web must file form 521. Web estate transfer statement, form 521, is signed. A cover sheet is required to be filed with a copy of a death certificate conveying real estate pursuant to a previously recorded transfer on death deed. Every deed or.

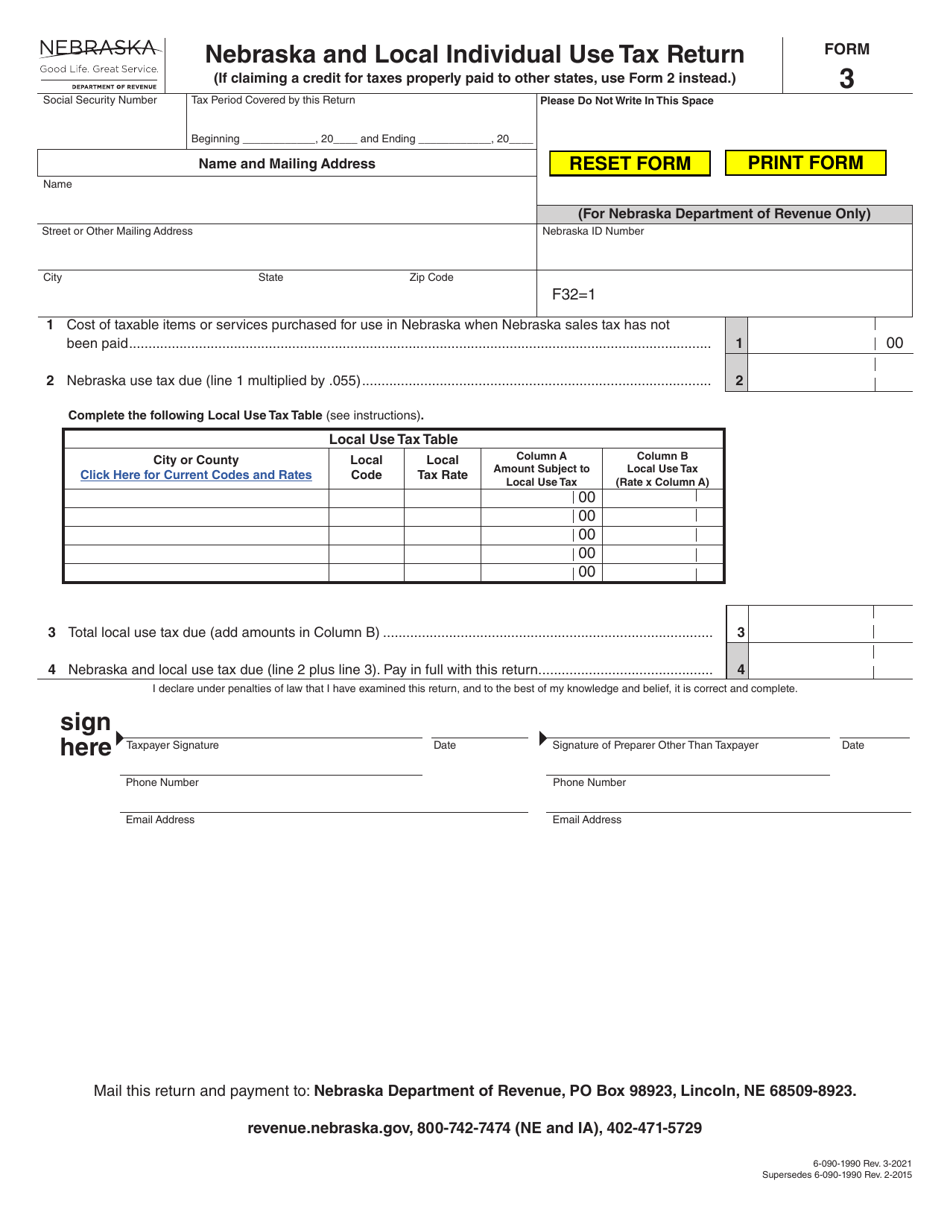

Form 3 Download Fillable PDF or Fill Online Nebraska and Local

Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed Previous years' income tax forms. Web estate transfer statement, form 521, is signed. Form 521mh must be filed with the county treasurer in the county where the application for title Under penalties of law, i declare that the information provided above is true,.

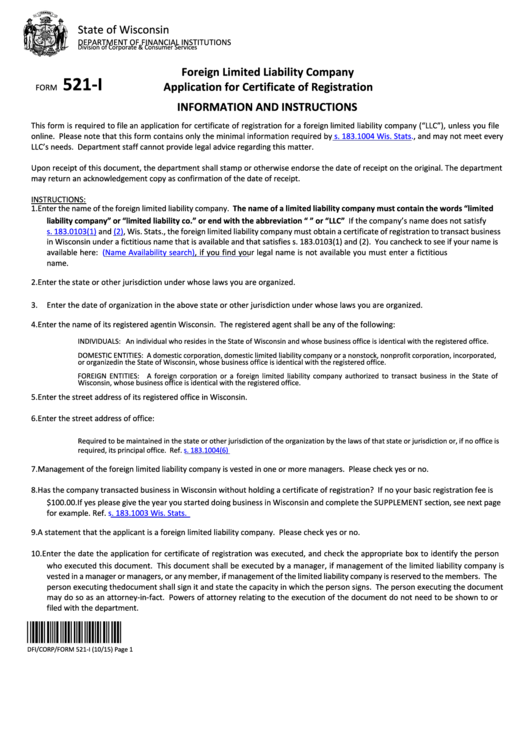

Form 521I Limited Liability Company Application For Certificate Of

Web must file form 521. Web real estate transfer statement, form 521, at the time such deed or document is presented for recording with the county register of deeds. Under penalties of law, i declare that the information provided above is true, complete, and correct and that i am familiar with all of the relevant Web the real estate transfer.

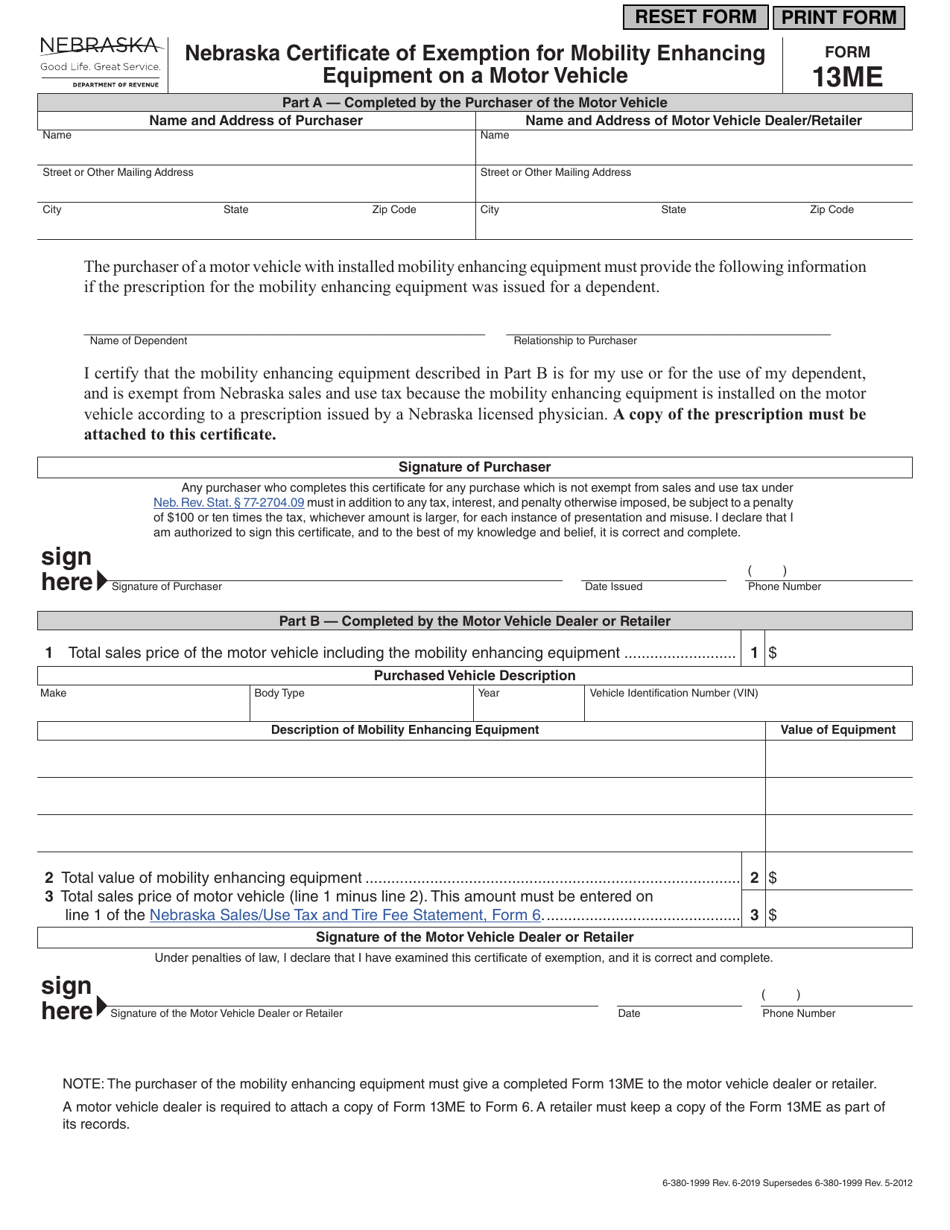

Form 13ME Download Fillable PDF or Fill Online Nebraska Certificate of

Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed require a completed form 521, which are not subject to the documentary stamp tax until the deed is. Web estate transfer statement, form 521, is signed. Numeric listing of all current nebraska tax forms. Web statement, form 521mh, when seeking a certificate of.

Nebraska Form 6 20202022 Fill and Sign Printable Template Online

Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed Under penalties of law, i declare that the information provided above is true, complete, and correct and that i am familiar with all of the relevant Web real estate transfer statement, form 521, at the time such deed or document is presented for.

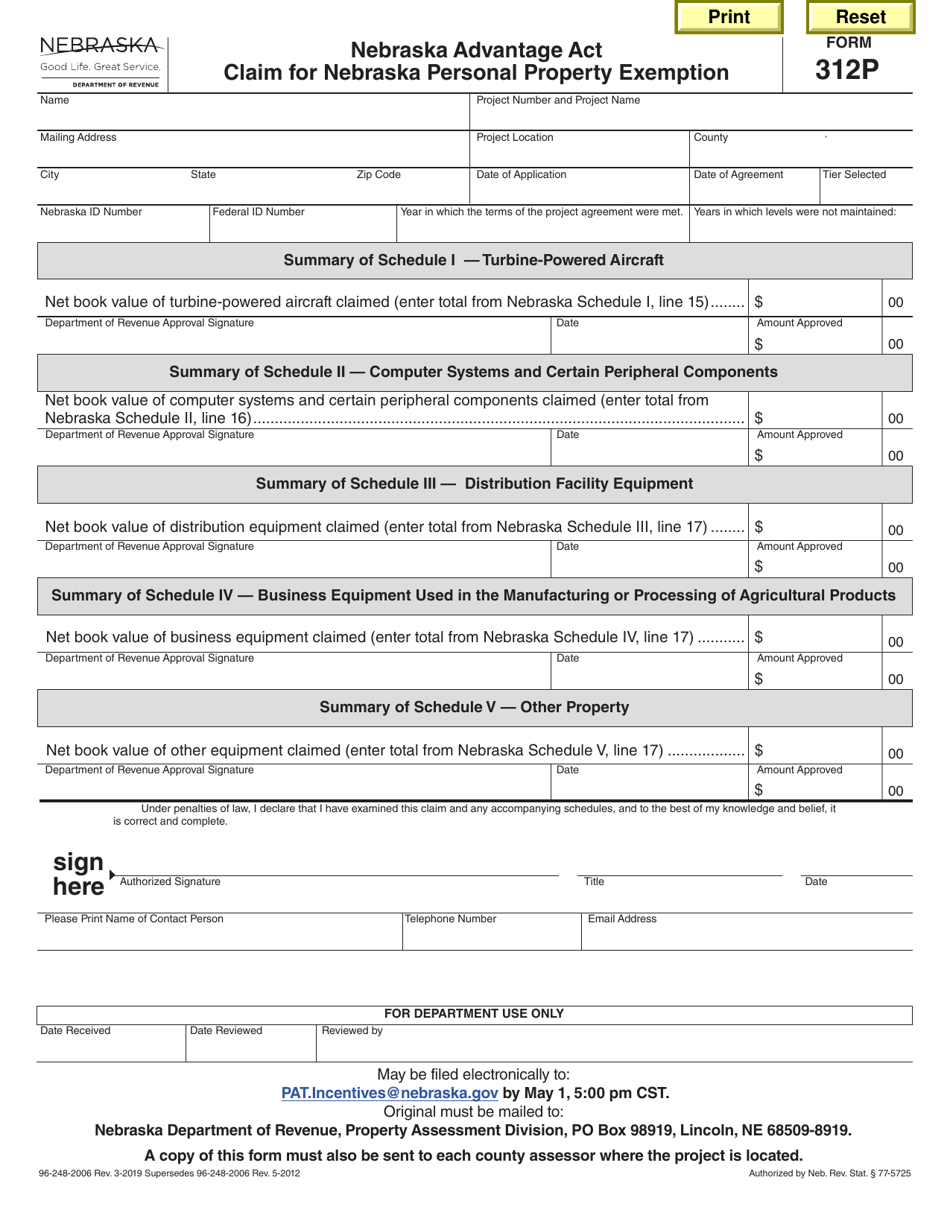

Form 312P Download Fillable PDF or Fill Online Nebraska Advantage Act

Previous years' income tax forms. Web estate transfer statement, form 521, is signed. Web statement, form 521mh, when seeking a certificate of title for manufactured housing. Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file.

Nebraska Form 521 Fill Out and Sign Printable PDF Template signNow

Web must file form 521. Numeric listing of all current nebraska tax forms. Web death certificate pursuant to a transfer on death deed cover sheet: Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521.a land contract or memorandum of contract requires a completed form 521, which is not subject to.

Interspousal Transfer Deed Form Massachusetts Form Resume Examples

Under penalties of law, i declare that the information provided above is true, complete, and correct and that i am familiar with all of the relevant Web estate transfer statement, form 521, is signed. A cover sheet is required to be filed with a copy of a death certificate conveying real estate pursuant to a previously recorded transfer on death.

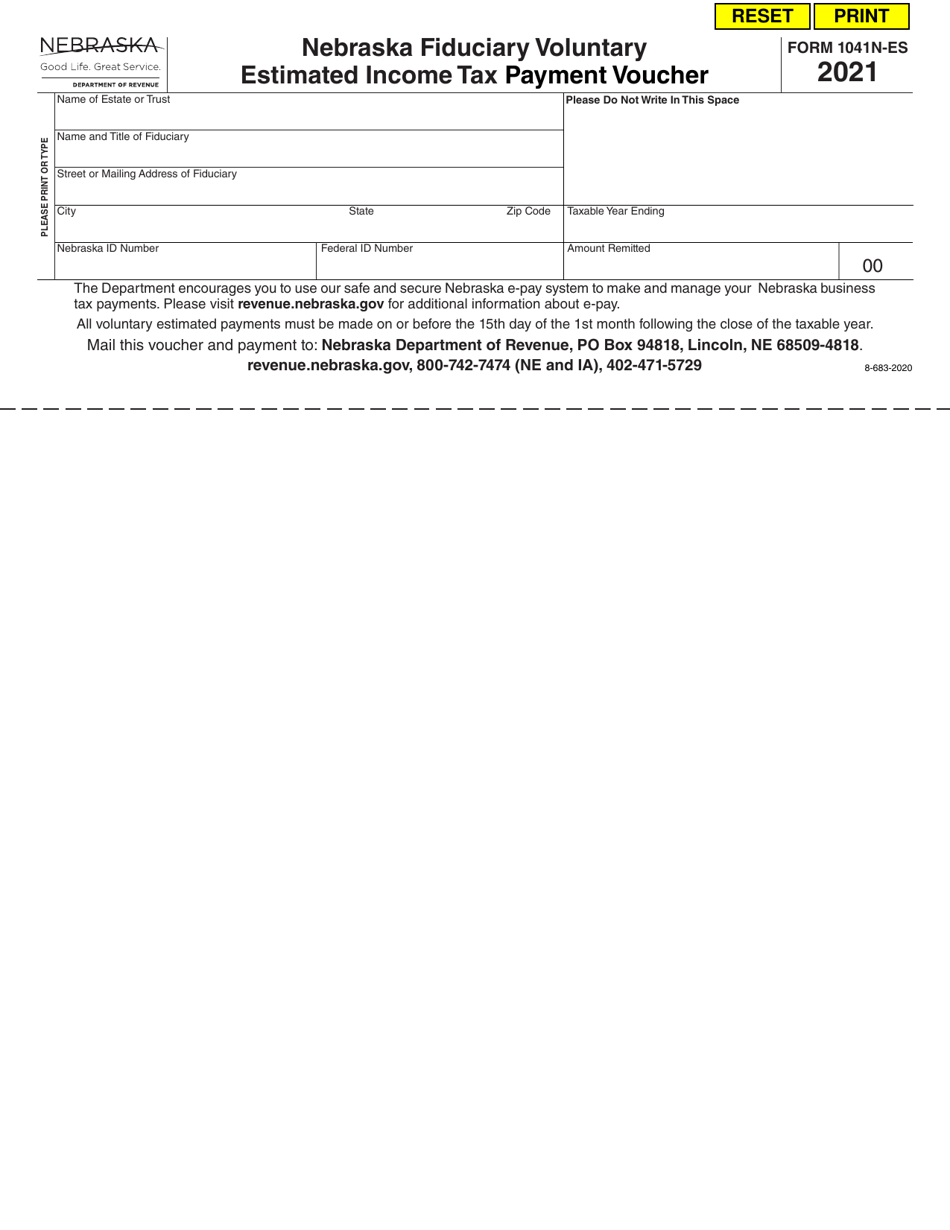

Form 1041NES Download Fillable PDF or Fill Online Nebraska Fiduciary

Web estate transfer statement, form 521, is signed. Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed Web this certificate of exemption is to be filed with the real estate transfer statement, form 521, when exemption #5b is claimed in item 25 on the form 521. Form 521mh must be filed with.

Web This Certificate Of Exemption Is To Be Filed With The Real Estate Transfer Statement, Form 521, When Exemption #5B Is Claimed In Item 25 On The Form 521.

Web statement, form 521mh, when seeking a certificate of title for manufactured housing. Any grantee, or grantee’s authorized representative, who wishes to record a deed to real property must file form 521.a land contract or memorandum of contract requires a completed form 521, which is not subject to the documentary stamp tax until the deed is presented for recording. Web death certificate pursuant to a transfer on death deed cover sheet: Numeric listing of all current nebraska tax forms.

Web Must File Form 521.

Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed require a completed form 521, which are not subject to the documentary stamp tax until the deed is. If the grantee or purchaser fails to furnish a completed form 521, nebraska law Previous years' income tax forms. Web estate transfer statement, form 521, is signed.

When And Where To File.

Every deed or any other instrument affecting title to real property is required to be recorded with the county register of deeds. Web estate transfer statement, form 521, is signed. Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed Web the real estate transfer statement (form 521) is used for the purpose of recording transfers of interest in real property.

Any Grantee, Or Grantee’s Authorized Representative, Who Wishes To Record A Deed To Real Property Must File Form 521.

A cover sheet is required to be filed with a copy of a death certificate conveying real estate pursuant to a previously recorded transfer on death deed. Under penalties of law, i declare that the information provided above is true, complete, and correct and that i am familiar with all of the relevant Form 521mh must be filed with the county treasurer in the county where the application for title Web real estate transfer statement, form 521, at the time such deed or document is presented for recording with the county register of deeds.