Nationwide Retirement Rollover Form

Nationwide Retirement Rollover Form - Nationwide neither endorses nor recommends the rollover of your. Web retirement plans incoming assets form retirement plans incoming assets form phone: Web schedule appointment forms money management forms roll money into your plan (pdf) from other retirement plans beneficiary distribution (pdf) distributions for beneficiaries. Web typically, with direct rollover, you can simply contact the 401 (k) provider at your new company and let them know. Account options form for all accounts add or update banking information add or update automatic. Fill in the empty fields; In a rollover, you’re keeping your money tax. Payment method (select one) note: Web • indicate whether you would like to transfer or rollover any assets from a previous employer to your new employer authorization • the participant and nrs. Web submission of this form initiates an outgoing exchange/transfer or direct rollover from the schoolsfirst/nationwide retirement builder plan to another approved provider.

Direct deposit ach is not available to financial. Popular nationwide forms key person. Fill in the empty fields; Web typically, with direct rollover, you can simply contact the 401 (k) provider at your new company and let them know. Nationwide actively monitors and prohibits illegal money laundering of concealed funds generated from a criminal enterprise. Payment method (select one) note: Web option 1 exchange your current money market shares or purchase additional shares of any nationwide class “a” mutual fund shares at net asset value (without a load charge). Please complete all sections of. Web submission of this form initiates an outgoing exchange/transfer or direct rollover from the schoolsfirst/nationwide retirement builder plan to another approved provider. Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early distribution tax that applies to 401(a) /.

Schwab has 24/7 professional guidance. 4116, option 1 • fax: Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early distribution tax that applies to 401(a) /. Ad it is easy to get started. Save time and file a claim online. Need to file an insurance or death benefit claim? Please complete all sections of. Account options form for all accounts add or update banking information add or update automatic. In a rollover, you’re keeping your money tax. Direct deposit ach is not available to financial.

2016 Form Nationwide Retirement Solutions DC3653 Fill Online

Nationwide actively monitors and prohibits illegal money laundering of concealed funds generated from a criminal enterprise. Popular nationwide forms key person. Web retirement plans incoming assets form retirement plans incoming assets form phone: Web submission of this form initiates an outgoing exchange/transfer or direct rollover from the schoolsfirst/nationwide retirement builder plan to another approved provider. Fill in the empty fields;

Retirement Funds Rollover

Ad it is easy to get started. Direct deposit ach is not available to financial. Account options form for all accounts add or update banking information add or update automatic. Web download and print the nationwide form you need. Need to file an insurance or death benefit claim?

Retirement Fund Rollover Rules Tax Diversification

Web schedule appointment forms money management forms roll money into your plan (pdf) from other retirement plans beneficiary distribution (pdf) distributions for beneficiaries. Web get the nationwide retirement solutions outgoing rollover request you require. Fill in the empty fields; Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early.

20172023 Form Nationwide Retirement Solutions DC3653 Fill Online

Popular nationwide forms key person. Please complete all sections of. Web get the nationwide retirement solutions outgoing rollover request you require. Web typically, with direct rollover, you can simply contact the 401 (k) provider at your new company and let them know. Need to file an insurance or death benefit claim?

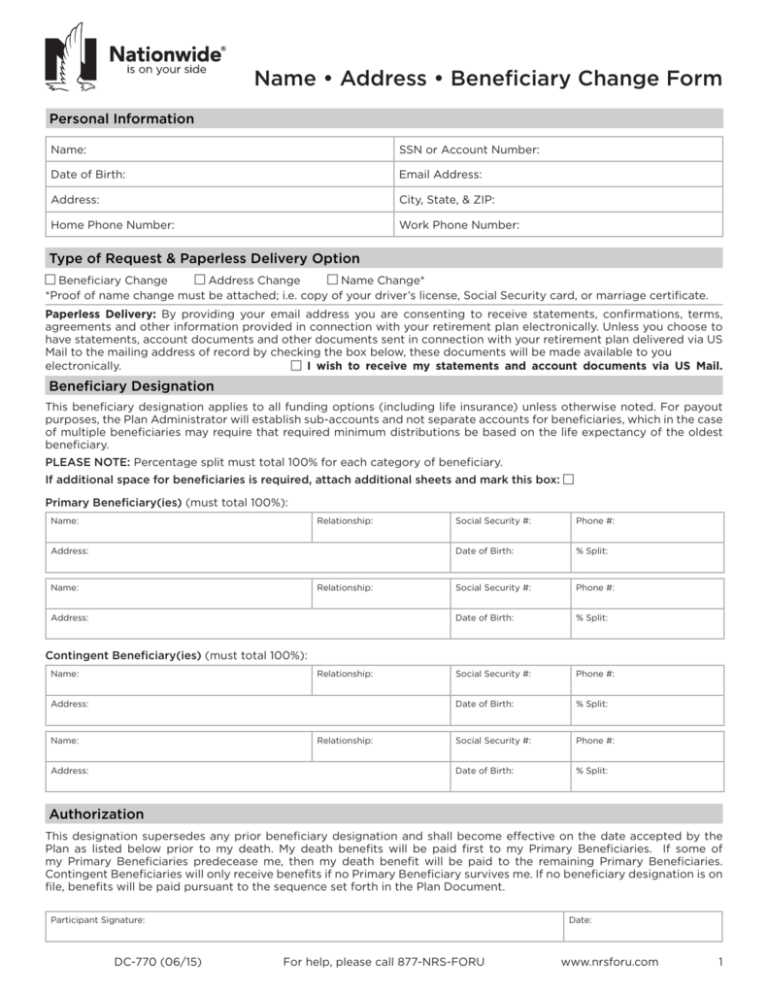

Beneficiary Change Form Nationwide Retirement Solutions

Web find the form you need for your nationwide mutual fund, including iras. Direct deposit ach is not available to financial. Web the nationwide transfer in/rollover in request form is to be used to transfer, exchange or rollover eligible retirement plan assets to the retirement program. Web • indicate whether you would like to transfer or rollover any assets from.

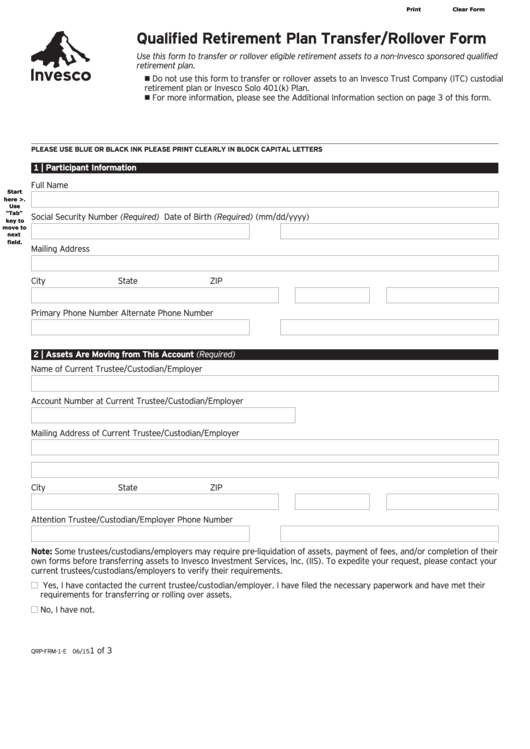

Top 5 Invesco Forms And Templates free to download in PDF format

Nationwide actively monitors and prohibits illegal money laundering of concealed funds generated from a criminal enterprise. 4116, option 1 • fax: Nationwide neither endorses nor recommends the rollover of your. Direct deposit ach is not available to financial. Popular nationwide forms key person.

401(k) Rollovers How to Roll Over a 401(k) to a No Fee IRA NerdWallet

Payment method (select one) note: Web the nationwide transfer in/rollover in request form is to be used to transfer, exchange or rollover eligible retirement plan assets to the retirement program. In a rollover, you’re keeping your money tax. Web download and print the nationwide form you need. Please complete all sections of.

Nationwide Retirement “I will…” Campaign on Behance

In a rollover, you’re keeping your money tax. Web *distributions from rollover and roth sources may be subject to an additional excise tax. Direct deposit ach is not available to financial. [1] some plans may have. Fill in the empty fields;

The Pros and Cons of Early Retirement Plan Rollovers Money Managers

Direct deposit ach is not available to financial. Nationwide actively monitors and prohibits illegal money laundering of concealed funds generated from a criminal enterprise. Save time and file a claim online. Payment method (select one) note: Fill in the empty fields;

Nationwide Retirement “I will…” Campaign on Behance

Web *distributions from rollover and roth sources may be subject to an additional excise tax. Please complete all sections of. Web typically, with direct rollover, you can simply contact the 401 (k) provider at your new company and let them know. They can help you complete a request to roll. Web schedule appointment forms money management forms roll money into.

They Can Help You Complete A Request To Roll.

4116, option 1 • fax: Nationwide actively monitors and prohibits illegal money laundering of concealed funds generated from a criminal enterprise. Web *distributions from rollover and roth sources may be subject to an additional excise tax. Account options form for all accounts add or update banking information add or update automatic.

Web Download And Print The Nationwide Form You Need.

Web schedule appointment forms money management forms roll money into your plan (pdf) from other retirement plans beneficiary distribution (pdf) distributions for beneficiaries. Web • indicate whether you would like to transfer or rollover any assets from a previous employer to your new employer authorization • the participant and nrs. Popular nationwide forms key person. Need to file an insurance or death benefit claim?

Web Typically, With Direct Rollover, You Can Simply Contact The 401 (K) Provider At Your New Company And Let Them Know.

[1] some plans may have. Please complete all sections of. Web get the nationwide retirement solutions outgoing rollover request you require. In a rollover, you’re keeping your money tax.

Web The Nationwide Transfer In/Rollover In Request Form Is To Be Used To Transfer, Exchange Or Rollover Eligible Retirement Plan Assets To The Retirement Program.

Schwab has 24/7 professional guidance. Web option 1 exchange your current money market shares or purchase additional shares of any nationwide class “a” mutual fund shares at net asset value (without a load charge). Nationwide neither endorses nor recommends the rollover of your. Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early distribution tax that applies to 401(a) /.