Nationwide 401K Rollover Form

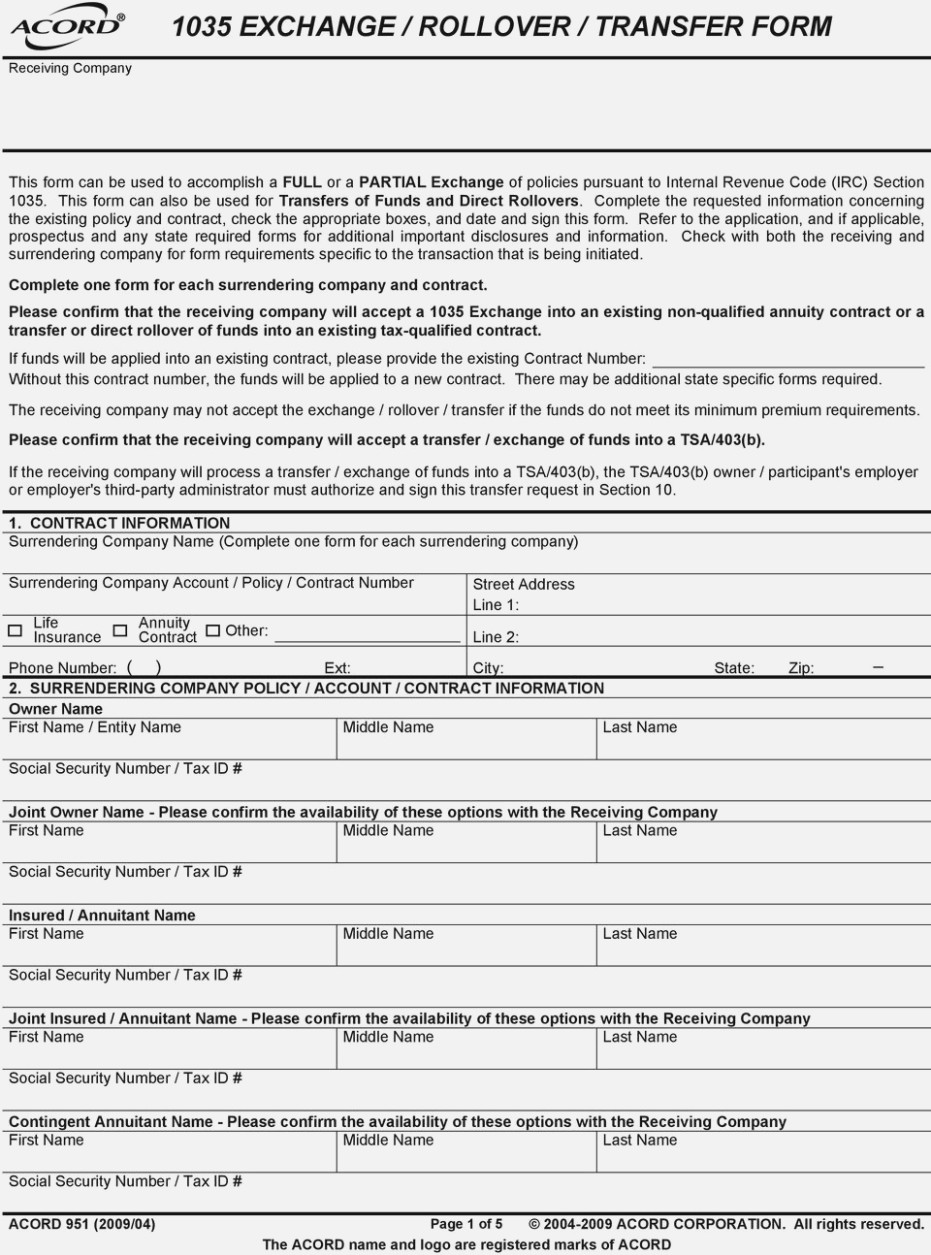

Nationwide 401K Rollover Form - Check out the benefits of rolling them into one. Nationwide retirement solutions mail check to: C all c 457(b) c 401(a) c 403(b) c 401(k) source (select one): Provide information about your beneficiary, if any, and your desired payment options. Web when you separated from your previous employer, your retirement plan assets were converted to an ira automatic rollover with nationwide funds. Typically, with direct rollover, you can simply. Account options form for all accounts add or update banking information add or update automatic. Please choose the appropriate direct rollover. Web rollover and transfer funds. Web income for the year distributed.

Web find the form you need for your nationwide mutual fund, including iras. 402 (f) special tax notice (pdf) review this form for information regarding special tax information for plan payments. Web subject to the early distribution tax that applies to 401(a)/401(k) plans unless an exception applicable to 401(a)/401(k) plans applies. Web up to $40 cash back this could be a full or partial withdrawal, a loan, or a rollover. In general, a 401 (k) is a retirement account that your employer sets up. C all c 457(b) c 401(a) c 403(b) c 401(k) source (select one): Web you retire keep in mind that there are some ira rollover rules: Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early distribution tax that applies to 401(a) /. Web rollover and transfer funds. Account options form for all accounts add or update banking information add or update automatic.

Web find the form you need for your nationwide mutual fund, including iras. Web log in to access the forms and applications necessary for your work with annuities, life, business life, retirement plans and investments Please choose the appropriate direct rollover. You can’t take a loan from your ira with a traditional ira, you must begin minimum distributions at age 72 you. [1] some plans may have. Web when you separated from your previous employer, your retirement plan assets were converted to an ira automatic rollover with nationwide funds. Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early distribution tax that applies to 401(a) /. In general, a 401 (k) is a retirement account that your employer sets up. Nationwide retirement solutions mail check to: Web you retire keep in mind that there are some ira rollover rules:

401k Rollover Tax Form Universal Network

Web you retire keep in mind that there are some ira rollover rules: Web completing a 401 (k) rollover to a new 401 (k) plan is very simple. Please choose the appropriate direct rollover. Provide information about your beneficiary, if any, and your desired payment options. Web when you separated from your previous employer, your retirement plan assets were converted.

Paychex 401k Withdrawal Form Universal Network

Nationwide will not withhold federal or state taxes unless specifically requested in section 6. Web rollover funds from plan type (select one): Web log in to access the forms and applications necessary for your work with annuities, life, business life, retirement plans and investments Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans.

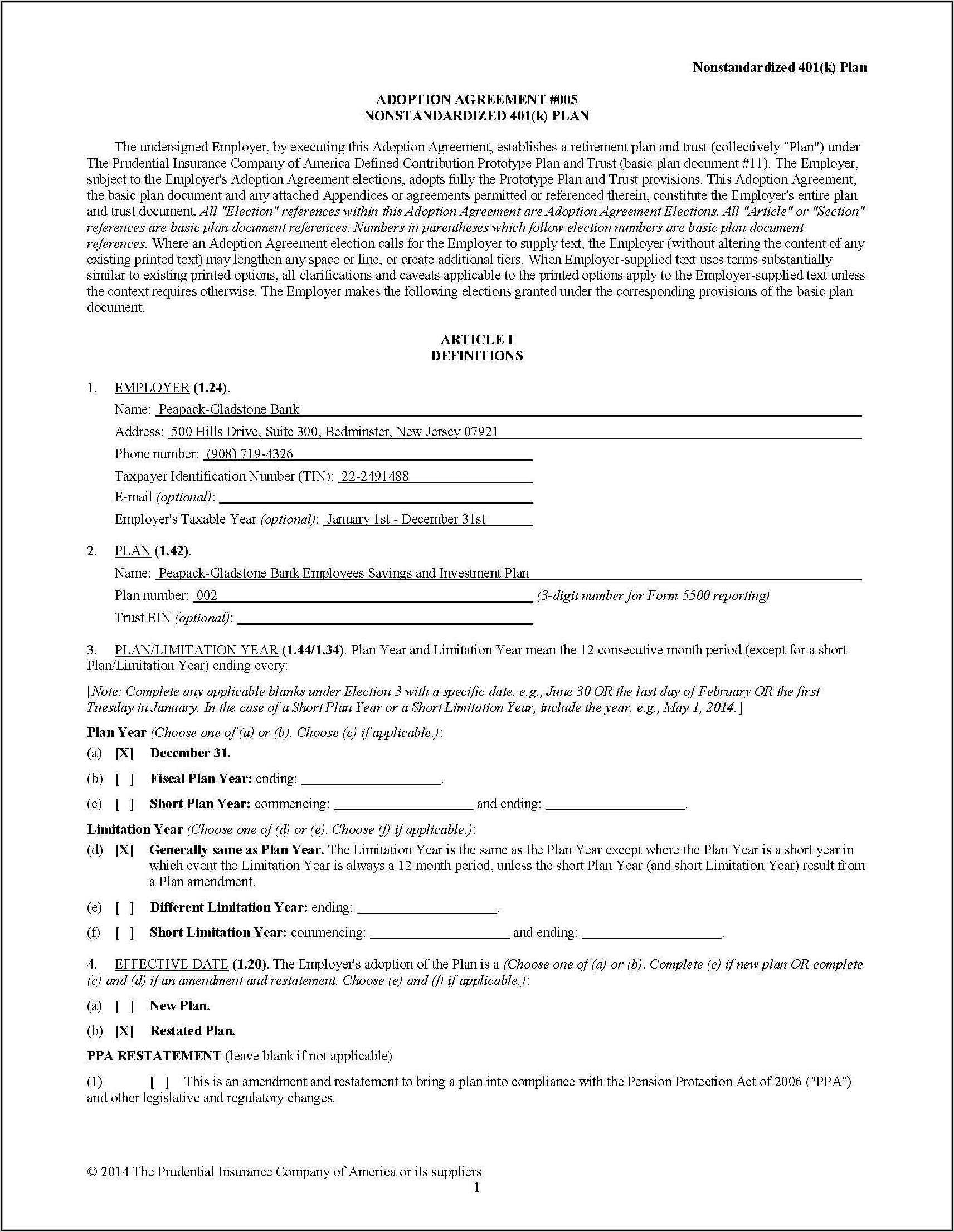

Prudential 401k Beneficiary Form Universal Network

Check out the benefits of rolling them into one. Typically, with direct rollover, you can simply. It takes no more than two steps—as long as you follow the rollover rules. Web subject to the early distribution tax that applies to 401(a)/401(k) plans unless an exception applicable to 401(a)/401(k) plans applies. C all c 457(b) c 401(a) c 403(b) c 401(k).

Slavic 401k Rollover Form Universal Network

Web up to $40 cash back this could be a full or partial withdrawal, a loan, or a rollover. Web see how a retirement plan works and learn about the power you have to control your financial future. Nationwide retirement solutions fbo (participant name, ssn) p.o. Qualified retirement plans, deferred compensation plans and. Nationwide retirement solutions mail check to:

401k Rollover Tax Form Universal Network

Web when you separated from your previous employer, your retirement plan assets were converted to an ira automatic rollover with nationwide funds. Web rollover and transfer funds. Web find the form you need for your nationwide mutual fund, including iras. Nationwide retirement solutions fbo (participant name, ssn) p.o. C all c 457(b) c 401(a) c 403(b) c 401(k) source (select.

401k Rollover Form Fidelity Investments Form Resume Examples

Web subject to the early distribution tax that applies to 401(a)/401(k) plans unless an exception applicable to 401(a)/401(k) plans applies. You can’t take a loan from your ira with a traditional ira, you must begin minimum distributions at age 72 you. Typically, with direct rollover, you can simply. Web participant withdrawal/direct rollover request private sector operations. Web up to $40.

401k Rollover Form Fidelity Universal Network

Nationwide retirement solutions fbo (participant name, ssn) p.o. It takes no more than two steps—as long as you follow the rollover rules. Rollover contributions are subject to the. Web rollover funds from plan type (select one): Web direct rollover the first option and the simpler of the two types of rollovers is what’s known as a direct rollover.

401k Rollover Form 5498 Universal Network

Web rollover contributions to governmental 457(b) plans that originated from qualified plans, iras and 403(b) plans are subject to the early distribution tax that applies to 401(a) /. Web use this form when requesting a distribution from traditional or roth sources of money for participant accounting or investment only plans when nationwide® is designated the. Web rollover funds from plan.

Paychex 401k Rollover Form Universal Network

Web make check payable to: Typically, with direct rollover, you can simply. Provide information about your beneficiary, if any, and your desired payment options. Account options form for all accounts add or update banking information add or update automatic. Web see how a retirement plan works and learn about the power you have to control your financial future.

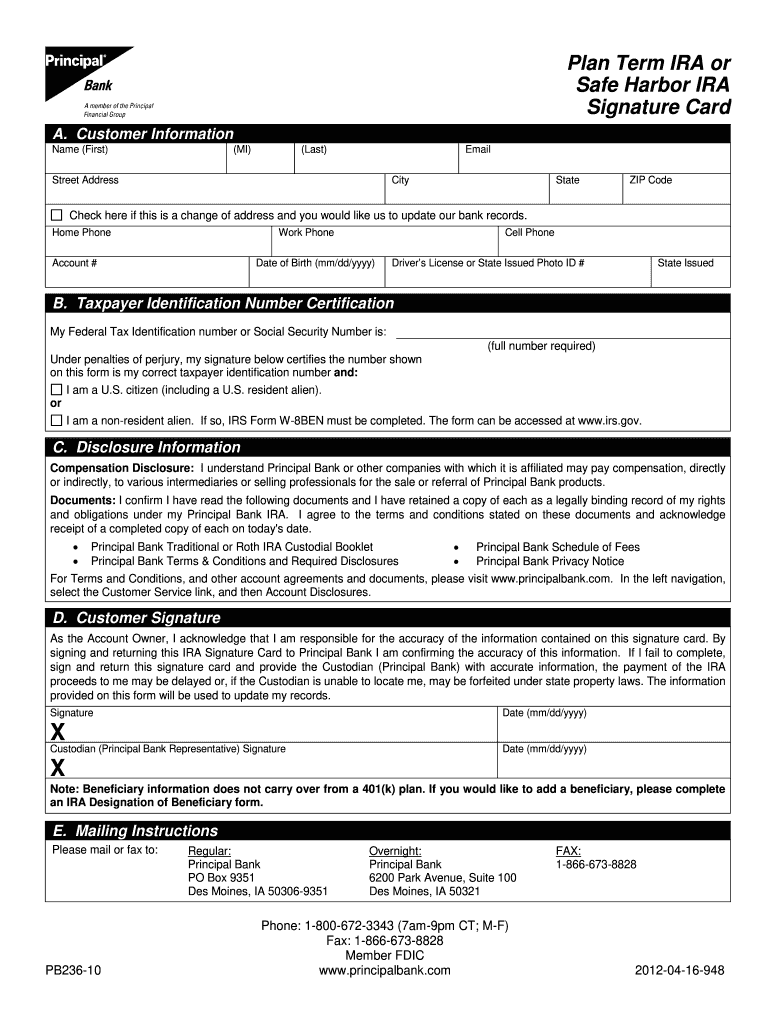

Principal 401k Withdrawal Fill Online, Printable, Fillable, Blank

Nationwide retirement solutions mail check to: Web completing a 401 (k) rollover to a new 401 (k) plan is very simple. Nationwide will not withhold federal or state taxes unless specifically requested in section 6. Web income for the year distributed. Web participant withdrawal/direct rollover request private sector operations.

• Return This Form And All Paperwork From Your Prior Provider/Custodian (If Required) To.

Nationwide will not withhold federal or state taxes unless specifically requested in section 6. Web up to $40 cash back this could be a full or partial withdrawal, a loan, or a rollover. Web make check payable to: Typically, with direct rollover, you can simply.

Web When You Separated From Your Previous Employer, Your Retirement Plan Assets Were Converted To An Ira Automatic Rollover With Nationwide Funds.

Check out the benefits of rolling them into one. Web direct rollover the first option and the simpler of the two types of rollovers is what’s known as a direct rollover. In general, a 401 (k) is a retirement account that your employer sets up. 402 (f) special tax notice (pdf) review this form for information regarding special tax information for plan payments.

Web Subject To The Early Distribution Tax That Applies To 401(A)/401(K) Plans Unless An Exception Applicable To 401(A)/401(K) Plans Applies.

Qualified retirement plans, deferred compensation plans and. Rollover contributions are subject to the. [1] some plans may have. Web managing multiple retirement accounts can become overwhelming.

Web Participant Withdrawal/Direct Rollover Request Private Sector Operations.

Provide information about your beneficiary, if any, and your desired payment options. Nationwide retirement solutions fbo (participant name, ssn) p.o. Web rollover funds from plan type (select one): Account options form for all accounts add or update banking information add or update automatic.