Mo Use Tax Form

Mo Use Tax Form - The individual must be authorized to discuss the confidential information provided in the form. Web fill online, printable, fillable, blank form 501 (c).: Check the box at the top of the form. Web the use tax to missouri. I don't have a preprinted form to report my use tax. Web missouri use tax is not included on your individual tax return. A purchaser is required to file a use tax return if the cumulative purchasessubject to use tax exceed $2,000 in a calendar year. Local license renewal records and online access request[form 4379a] request for information or audit of local sales and use tax records[4379] request for information of state agency license no. All missouri short forms allow the standard or itemized deduction. You must provide the contact information for the individual filing this return.

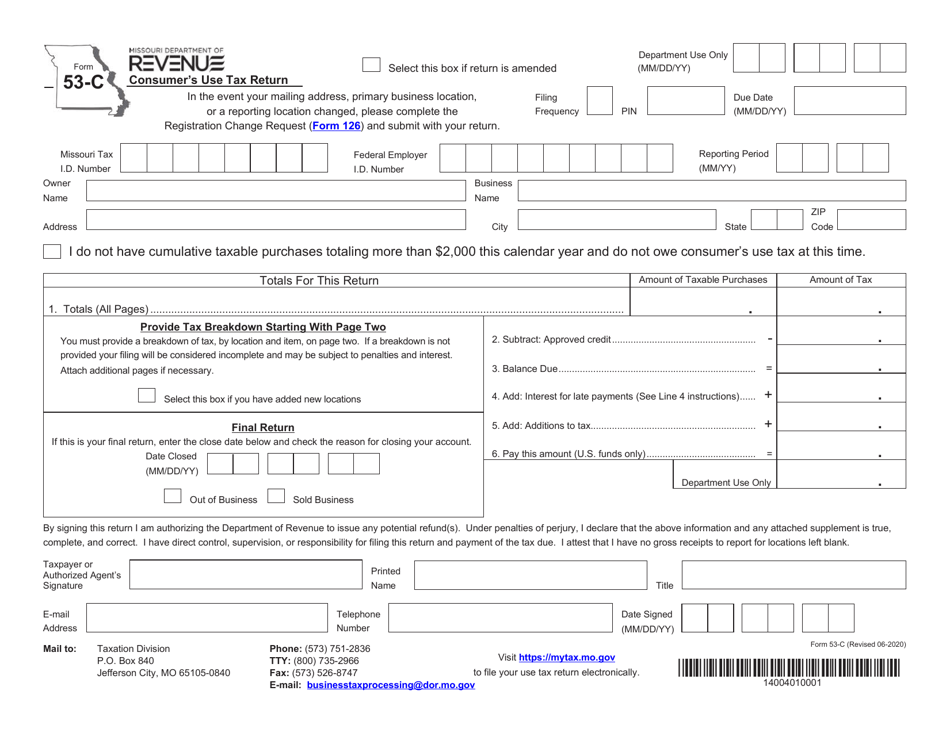

Check the box at the top of the form. Number federal employer owner business name name amount of tax 1. District that has enacted a local use tax on a separate location on your use tax return. A seller that is not engaged in business is not required to collect missouri tax, but the purchaser is responsible for remitting use tax to on their purchase. Web filing requirement a purchaser must file a consumer’s use tax return if the cumulative purchases subject to use tax exceed $2,000 in a calendar year. Choose continue and we'll ask you a series of questions to lead you to a simplified form that will reduce. Local license renewal records and online access request[form 4379a] request for information or audit of local sales and use tax records[4379] request for information of state agency license no. A purchaser is required to file a use tax return if the cumulative purchasessubject to use tax exceed $2,000 in a calendar year. The request for mail order forms may be used to order one copy or several copies of forms. Use fill to complete blank online missouri pdf forms for free.

Choose continue and we'll ask you a series of questions to lead you to a simplified form that will reduce. Web local government tax guide; You must provide the contact information for the individual filing this return. Having trouble viewing a form? Use fill to complete blank online missouri pdf forms for free. Should i pay sales tax or vendor's use tax? Web filing requirement a purchaser must file a consumer’s use tax return if the cumulative purchases subject to use tax exceed $2,000 in a calendar year. A seller that is not engaged in business is not required to collect missouri tax, but the purchaser is responsible for remitting use tax to on their purchase. If the total of your taxable purchases within the tax year is less than $2,000, you are not required to file this return. Web missouri use tax is not included on your individual tax return.

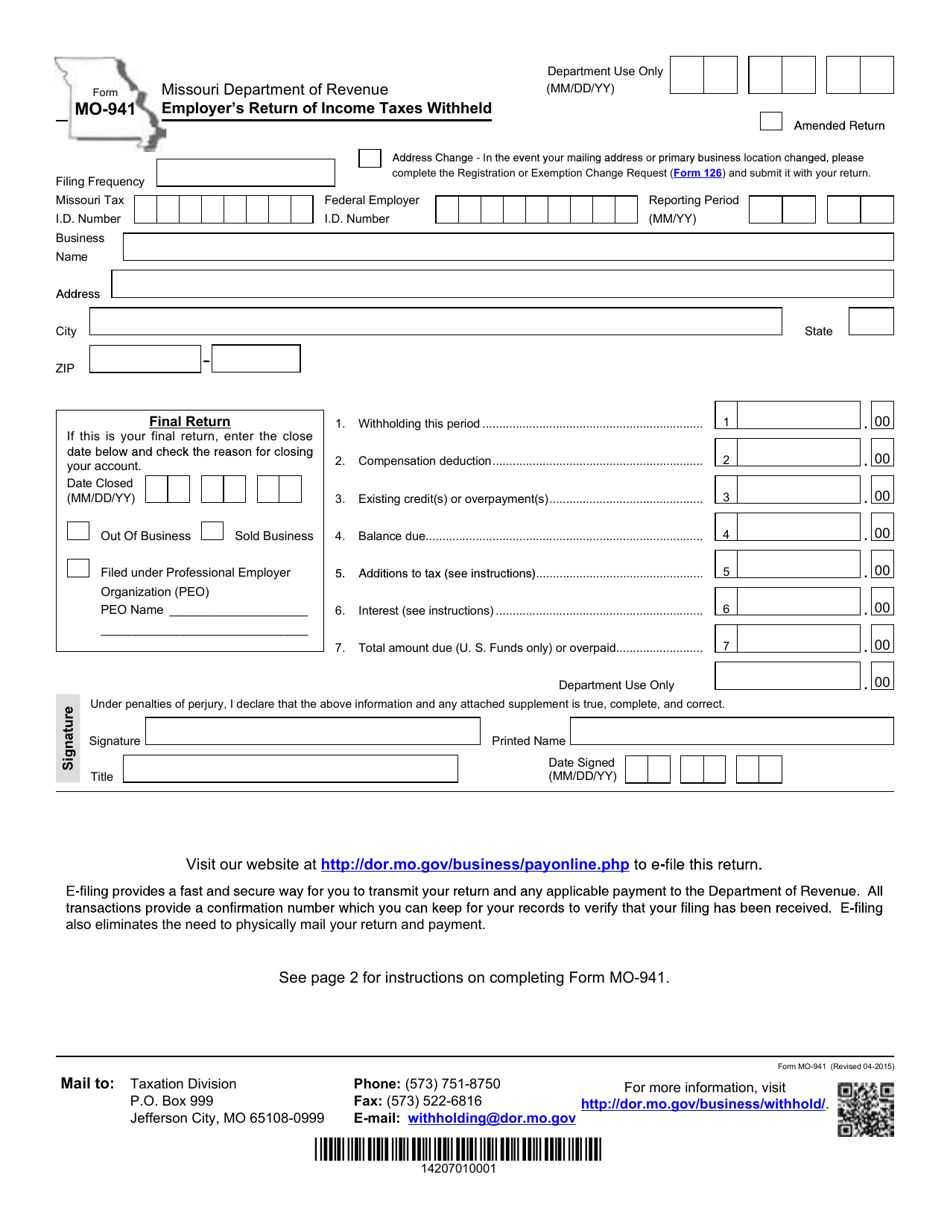

Form MO941 Download Fillable PDF or Fill Online Employer's Return of

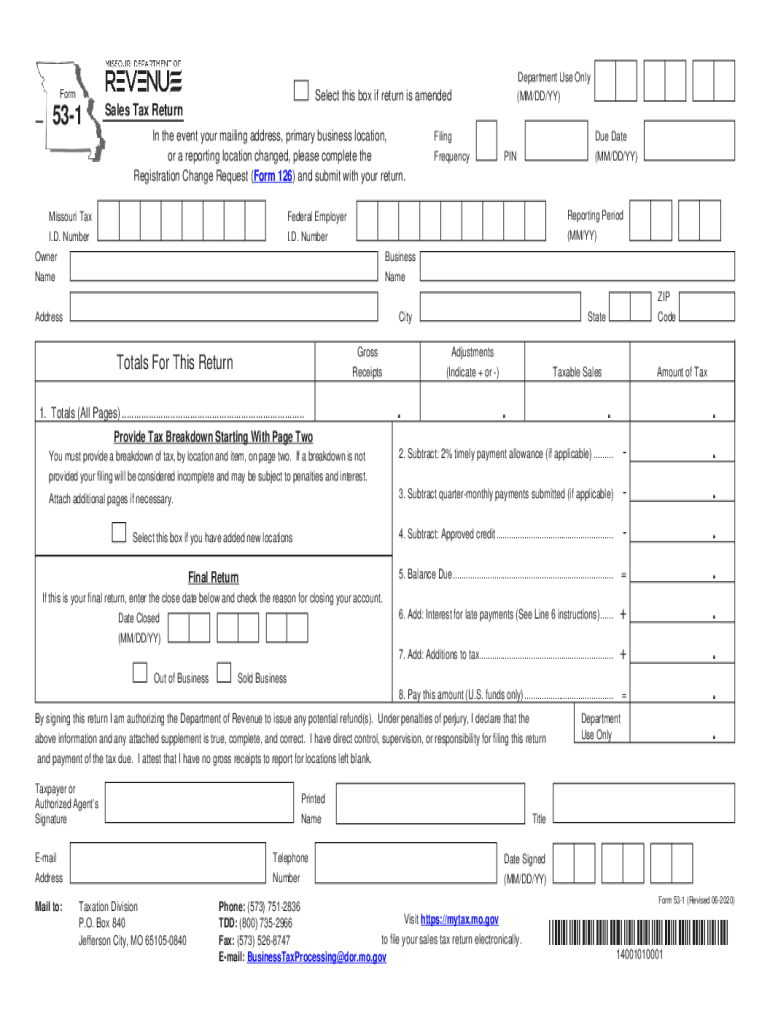

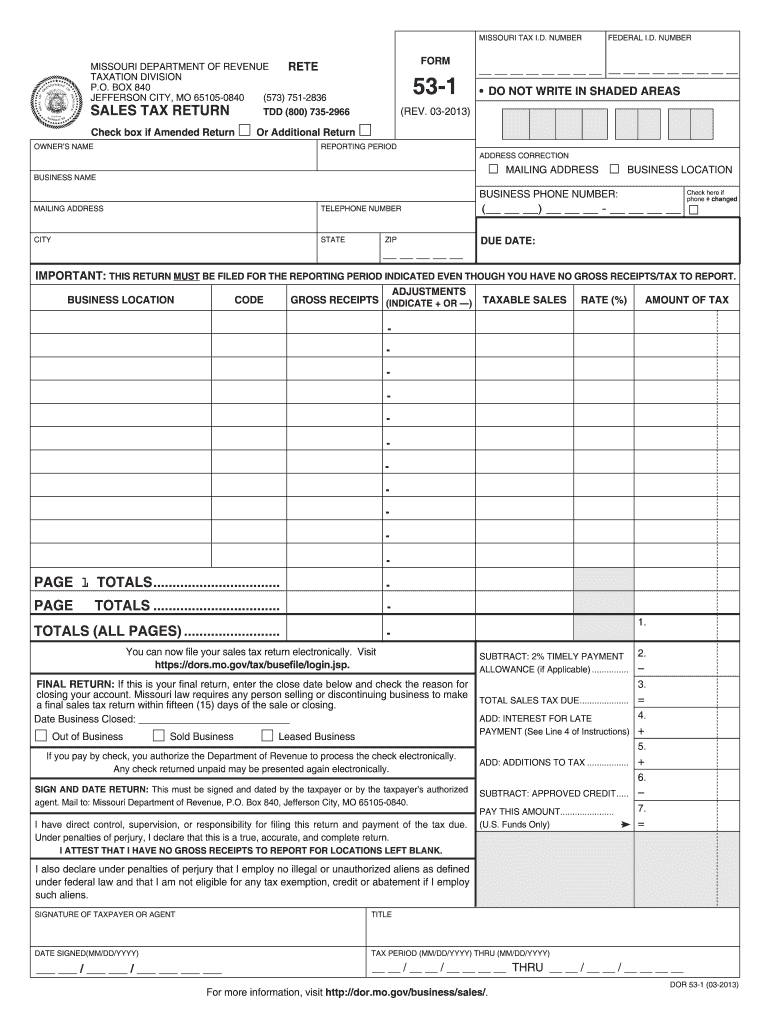

Contact information / office locations; Web the use tax to missouri. A purchaser is required to file a use tax return if the cumulative purchasessubject to use tax exceed $2,000 in a calendar year. Will my filing frequency ever change? Cities and counties may impose a local sales and use tax.

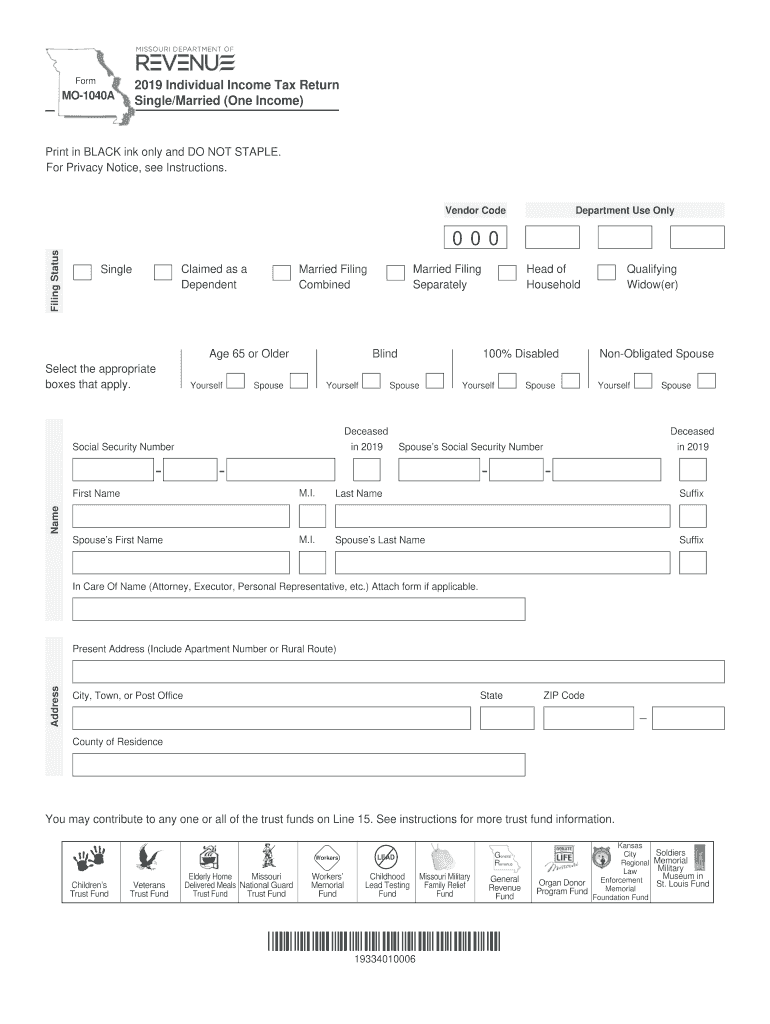

Mo 1040a Fillable Fill Out and Sign Printable PDF Template signNow

Alpha attach to code name of credit. Contact information / office locations; Web local government tax guide; Download adobe acrobat reader now. Use fill to complete blank online missouri pdf forms for free.

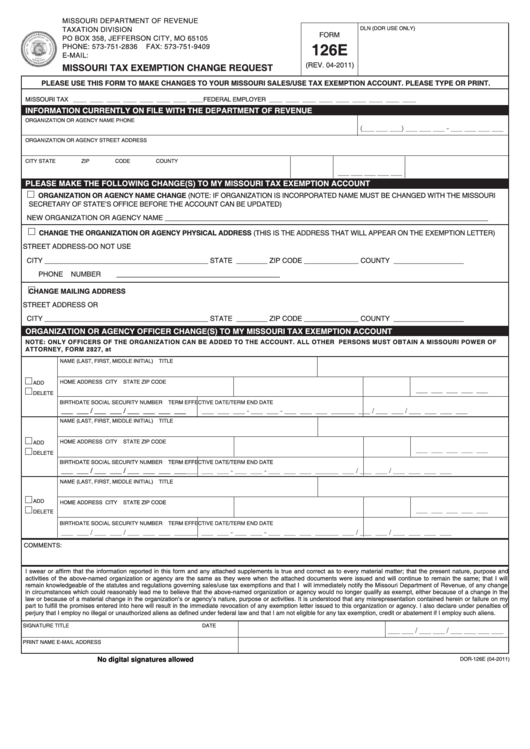

Top 26 Missouri Tax Exempt Form Templates free to download in PDF format

I don't have a preprinted form to report my use tax. Having trouble viewing a form? District that has enacted a local use tax on a separate location on your use tax return. Having trouble viewing a form? The dealer's license is issued by the missouri motor vehicle bureau or by the out of state registration authority that issues such.

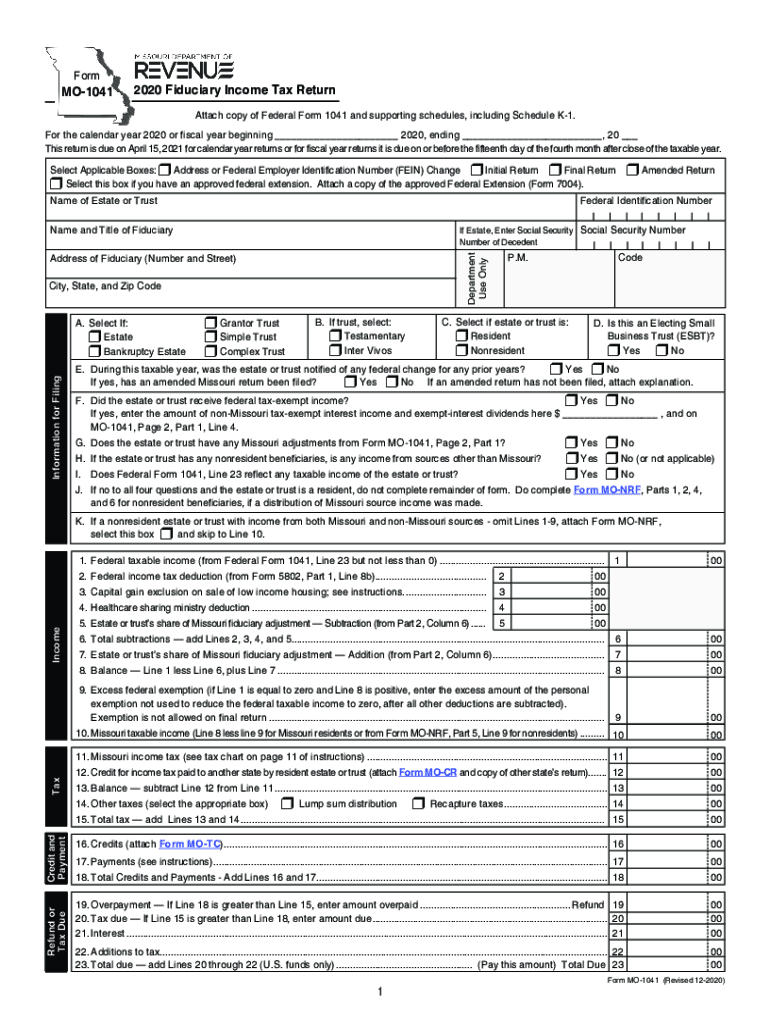

Mo 1041 Instructions Fill Out and Sign Printable PDF Template signNow

Missouri requires a taxpayer with more than $2,000 in taxable purchases, to file an individual consumer’s use tax return. You must provide the contact information for the individual filing this return. Download adobe acrobat reader now. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) All missouri short forms allow the standard or itemized.

Form 53C Download Fillable PDF or Fill Online Consumer's Use Tax

Web local government tax guide; Attach all schedules along with a copy of your federal changes and your federal form 1040x. Cities and counties may impose a local sales and use tax. Web the use tax to missouri. All items selected in this section are exempt from state and local sales and use tax under section 144.030, rsmo.

20202022 MO DoR Form 531 Fill Online, Printable, Fillable, Blank

Missouri requires a taxpayer with more than $2,000 in taxable purchases, to file an individual consumer’s use tax return. You will only need to provide your contact information once by signing up for a mytax missouri account. Web missouri use tax is not included on your individual tax return. Download adobe acrobat reader now. Will my filing frequency ever change?

Missouri Sales Tax Form 53 1 Instruction Fill Out and Sign Printable

License office locations / hours; You must pay consumer’s use tax on tangible personal propertystored, used, or consumed in missouri unless you paid tax to the seller or the property isexempt from tax. Will my filing frequency ever change? Web filing requirement a purchaser must file a consumer’s use tax return if the cumulative purchases subject to use tax exceed.

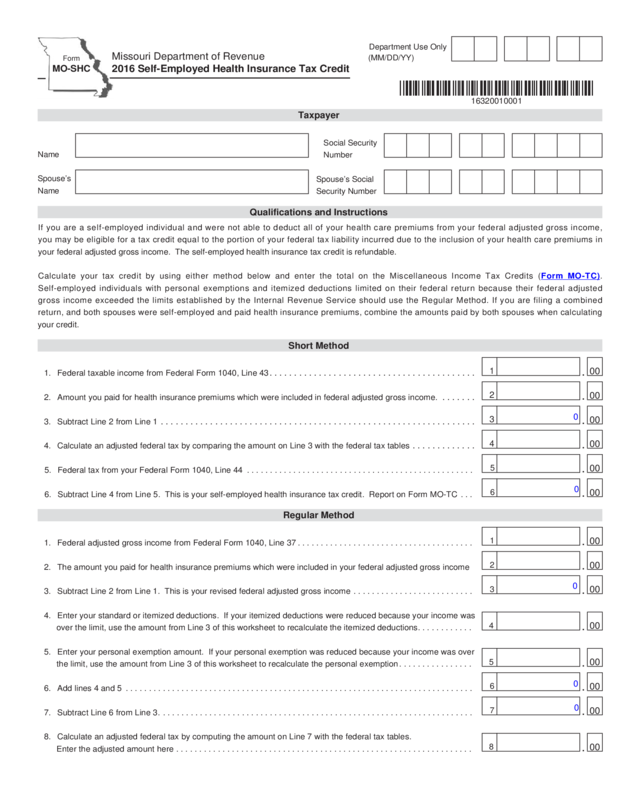

Form MoShc 2016 SelfEmployed Health Insurance Tax Credit Edit

Once completed you can sign your fillable form or send for signing. Use fill to complete blank online missouri pdf forms for free. Web what is subject to use tax in missouri? If you are due a refund, mail to: Web missouri use tax is not included on your individual tax return.

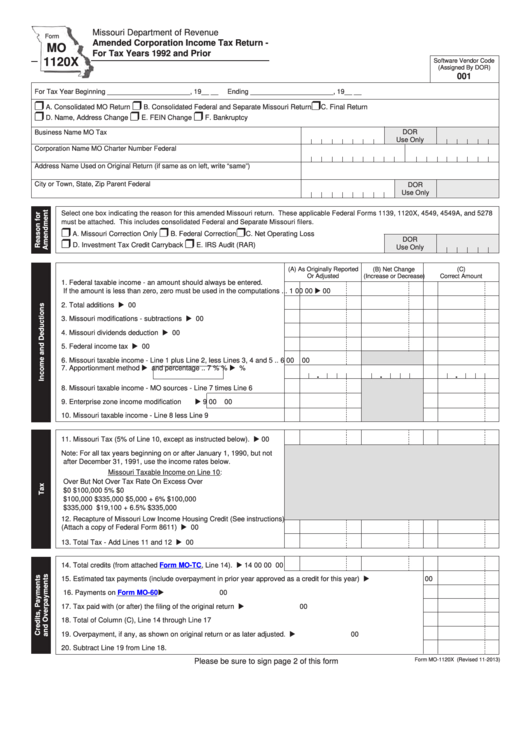

Fillable Form Mo 1120x Amended Corporation Tax Return For

The request for mail order forms may be used to order one copy or several copies of forms. Web the use tax to missouri. The individual must be authorized to discuss the confidential information provided in the return. Use fill to complete blank online missouri pdf forms for free. A purchaser is required to file a use tax return if.

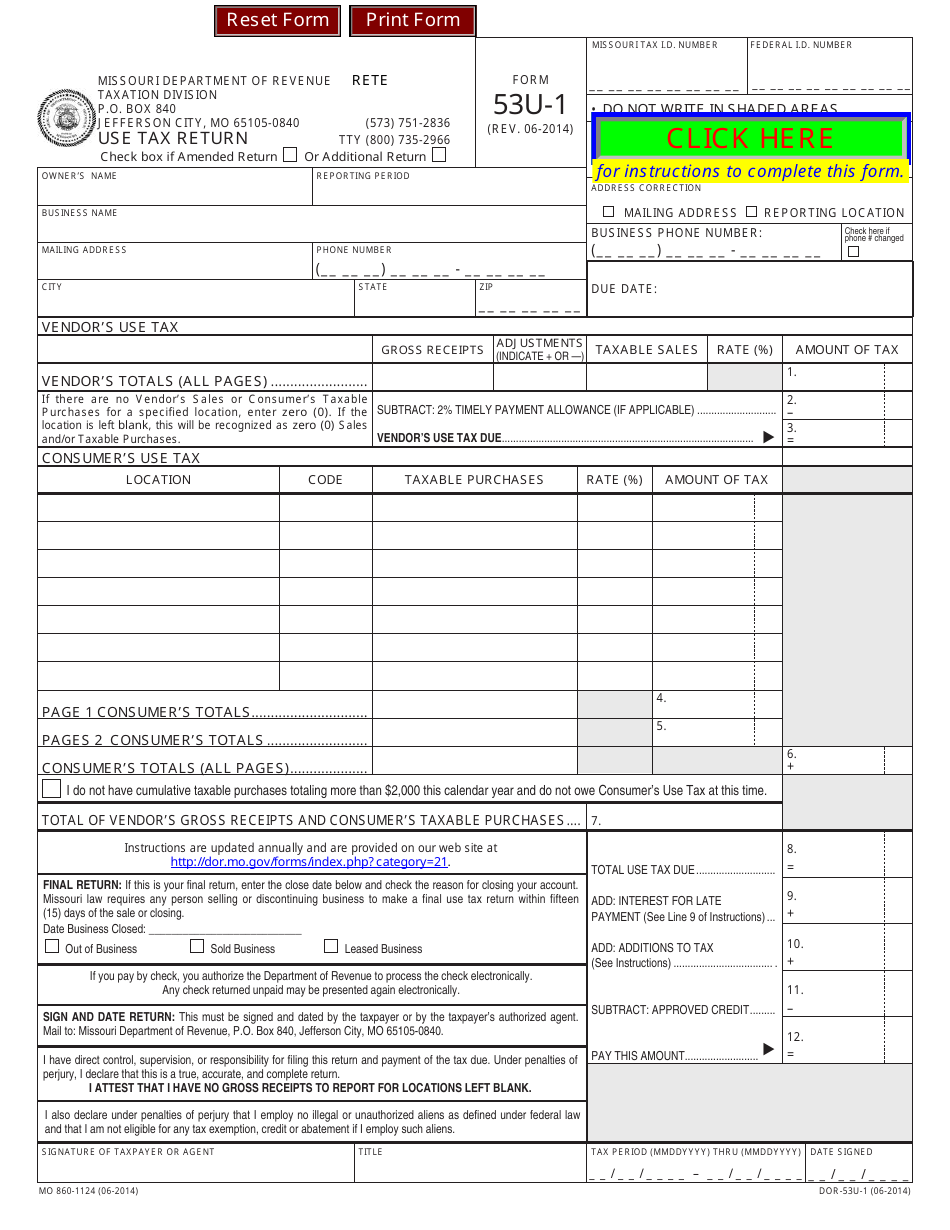

Form 53u1 Download Fillable PDF or Fill Online Use Tax Return Missouri

The request for mail order forms may be used to order one copy or several copies of forms. Report your sales to customers located in every city, county or. Web missouri use tax is not included on your individual tax return. All missouri short forms allow the standard or itemized deduction. Short forms help you avoid becoming confused by tax.

Contact Information / Office Locations;

The individual must be authorized to discuss the confidential information provided in the form. I don't have a preprinted form to report my use tax. Will my filing frequency ever change? You must pay consumer’s use tax on tangible personal propertystored, used, or consumed in missouri unless you paid tax to the seller or the property isexempt from tax.

The $2,000 Filing Threshold Is Not An Exemption Or Exclusion.

Missouri requires a taxpayer with more than $2,000 in taxable purchases, to file an individual consumer’s use tax return. Web fill online, printable, fillable, blank form 501 (c).: You must provide the contact information for the individual filing this form. You must provide the contact information for the individual filing this return.

Report Sales To Customers That Are Not Located Within A City, County Or District That Has.

Web local government tax guide; If the total of your taxable purchases within the tax year is less than $2,000, you are not required to file this return. A purchaser is required to file a use tax return if the cumulative purchasessubject to use tax exceed $2,000 in a calendar year. Web the use tax to missouri.

The Purchaser Is Required To File A Use Tax Return If The Cumulative Purchases Subject To Use Tax Exceed Two Thousand Dollars In A Calendar Year.

Missouri sales or use tax exemption (missouri) form. District that has enacted a local use tax on a separate location on your use tax return. All items selected in this section are exempt from state and local sales and use tax under section 144.030, rsmo. Web how do i select the easiest tax form that satisfies my tax filing needs?