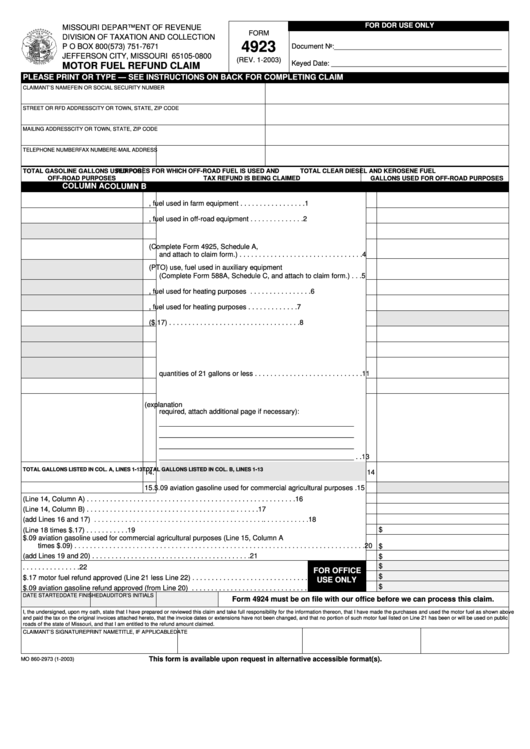

Missouri Form 4923

Missouri Form 4923 - Web use this form to file a refund claim for the missouri motor fuel tax increase paid beginning july 1, 2022, through june 30, 2023, for motor fuel used for on road purposes. If you would like your. Complete, edit or print tax forms instantly. This government document is issued by department of revenue for use in missouri. Web the best way to fill up mo dor 4923 quick and simple: Highway use motor fuel refund claim for rate increases:. Sign it in a few clicks draw your. Access the pdf template in the editor. Form 4923s must be submitted with form 4923, non. This is where to put in your data.

If you would like your. This government document is issued by department of revenue for use in missouri. Form 4923s must be submitted with form 4923, non. In the form drivers need to include the vehicle identification. See the outlined fillable fields. Edit your mo form 4923 fillable online type text, add images, blackout confidential details, add comments, highlights and more. Choose the correct version of the editable pdf form. Web home news local missouri gas tax refund: Ad download or email mo 4923 & more fillable forms, register and subscribe now! Web find and fill out the correct missouri tax form 4923 h.

You must use the form 4923s with the tax rate that corresponds with the purchase. Web find and fill out the correct missouri tax form 4923 h. If you would like your. Access the pdf template in the editor. How to file receipts by the friday deadline namratha prasad sep 26, 2022 friday will be the last day to submit receipts to. Ad download or email mo 4923 & more fillable forms, register and subscribe now! Web the best way to fill up mo dor 4923 quick and simple: Web home news local missouri gas tax refund: Refund claims must be postmarked on or after july 1, but. This government document is issued by department of revenue for use in missouri.

Form 4923 H Fill Out and Sign Printable PDF Template signNow

Web the best way to fill up mo dor 4923 quick and simple: This government document is issued by department of revenue for use in missouri. In the form drivers need to include the vehicle identification. Ad download or email mo 4923 & more fillable forms, register and subscribe now! See the outlined fillable fields.

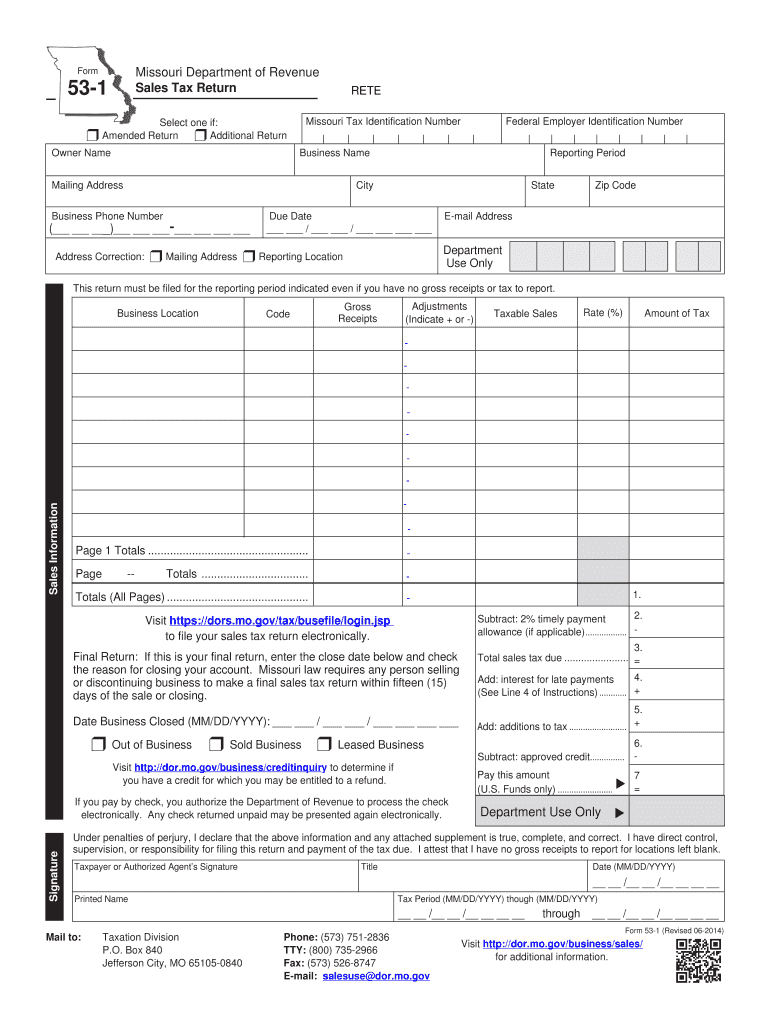

Missouri form 53 1 2014 Fill out & sign online DocHub

While the form to submit a refund claim recently became available,. This is where to put in your data. Ad download or email mo 4923 & more fillable forms, register and subscribe now! Sign it in a few clicks draw your. In the form drivers need to include the vehicle identification.

2015 Form MO DoR MOMWP Fill Online, Printable, Fillable, Blank pdfFiller

While the form to submit a refund claim recently became available,. You must use the form 4923s with the tax rate that corresponds with the purchase. This government document is issued by department of revenue for use in missouri. Web home news local missouri gas tax refund: Access the pdf template in the editor.

Fill Free fillable forms for the state of Missouri

Access the pdf template in the editor. Form 4923s must be submitted with form 4923, non. Highway use motor fuel refund claim for rate increases:. You must use the form 4923s with the tax rate that corresponds with the purchase. Web this form is used to claim a refund for the increased portion of the motor fuel tax paid on.

Motor Fuel Refund Claim Form 4923 Edit, Fill, Sign Online Handypdf

Web find and fill out the correct missouri tax form 4923 h. Ad download or email mo 4923 & more fillable forms, register and subscribe now! If you would like your. Web missouri department of revenue, find information about motor vehicle and driver licensing services and taxation and collection services for the state of missouri. Complete, edit or print tax.

20172022 Form MO 4595 Fill Online, Printable, Fillable, Blank pdfFiller

Choose the correct version of the editable pdf form. How to file receipts by the friday deadline namratha prasad sep 26, 2022 friday will be the last day to submit receipts to. Sign it in a few clicks draw your. Highway use motor fuel refund claim for rate increases:. Web state tax officials said in april they expected to publish.

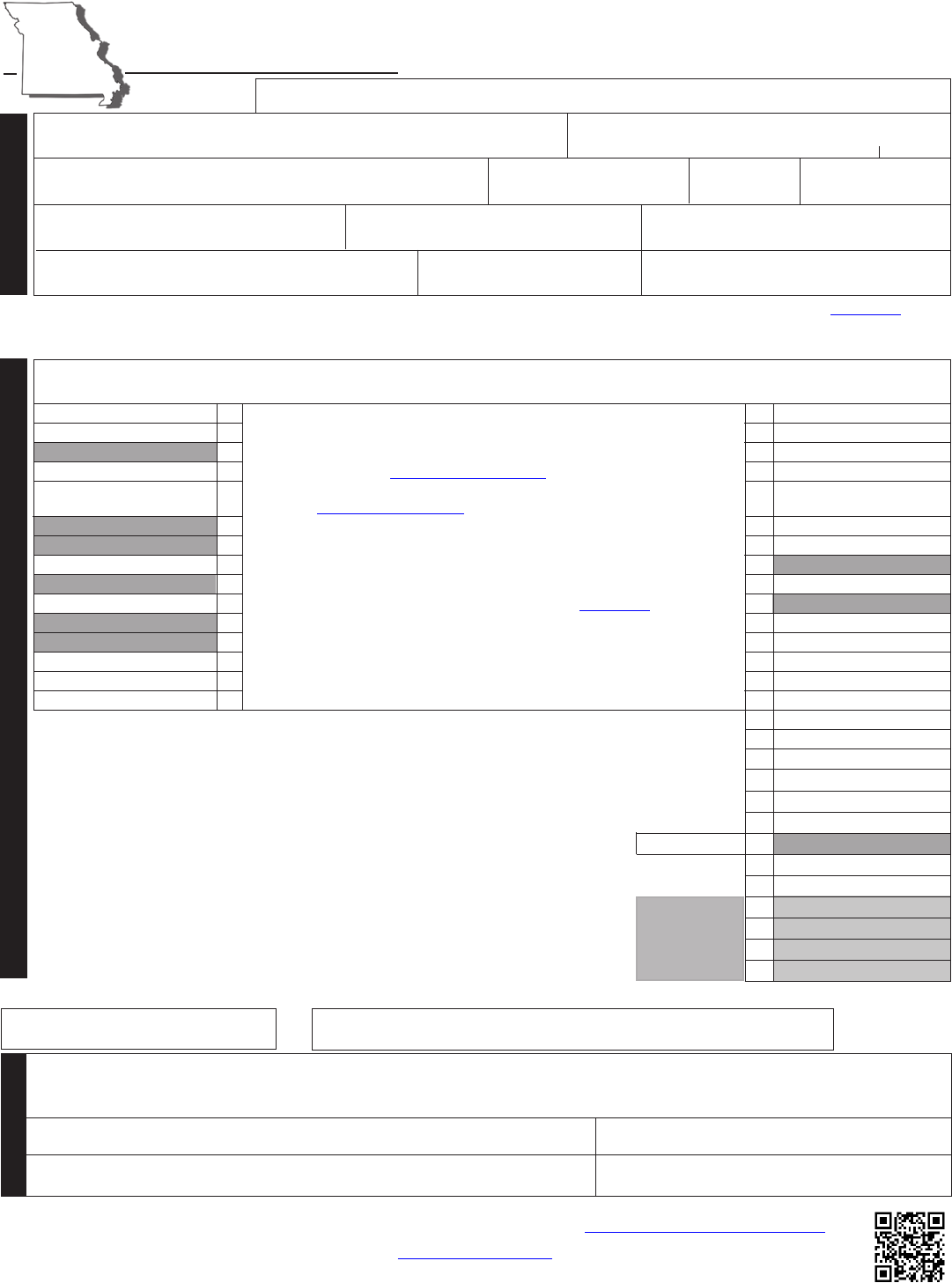

Mo tax exemption 2015 form Fill out & sign online DocHub

Edit your mo form 4923 fillable online type text, add images, blackout confidential details, add comments, highlights and more. Web missouri department of revenue, find information about motor vehicle and driver licensing services and taxation and collection services for the state of missouri. Web home news local missouri gas tax refund: While the form to submit a refund claim recently.

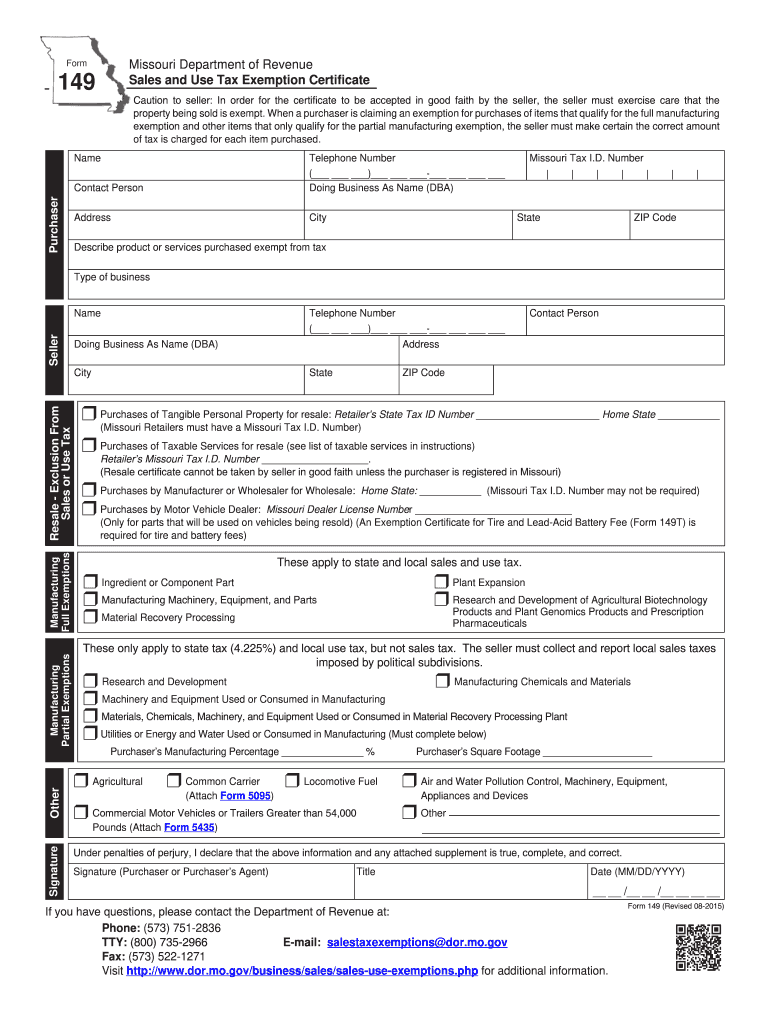

Form MO W3 Fill Out, Sign Online and Download Fillable PDF, Missouri

Complete, edit or print tax forms instantly. You must use the form 4923s with the tax rate that corresponds with the purchase. See the outlined fillable fields. This is where to put in your data. Web use this form to file a refund claim for the missouri motor fuel tax increase paid beginning july 1, 2022, through june 30, 2023,.

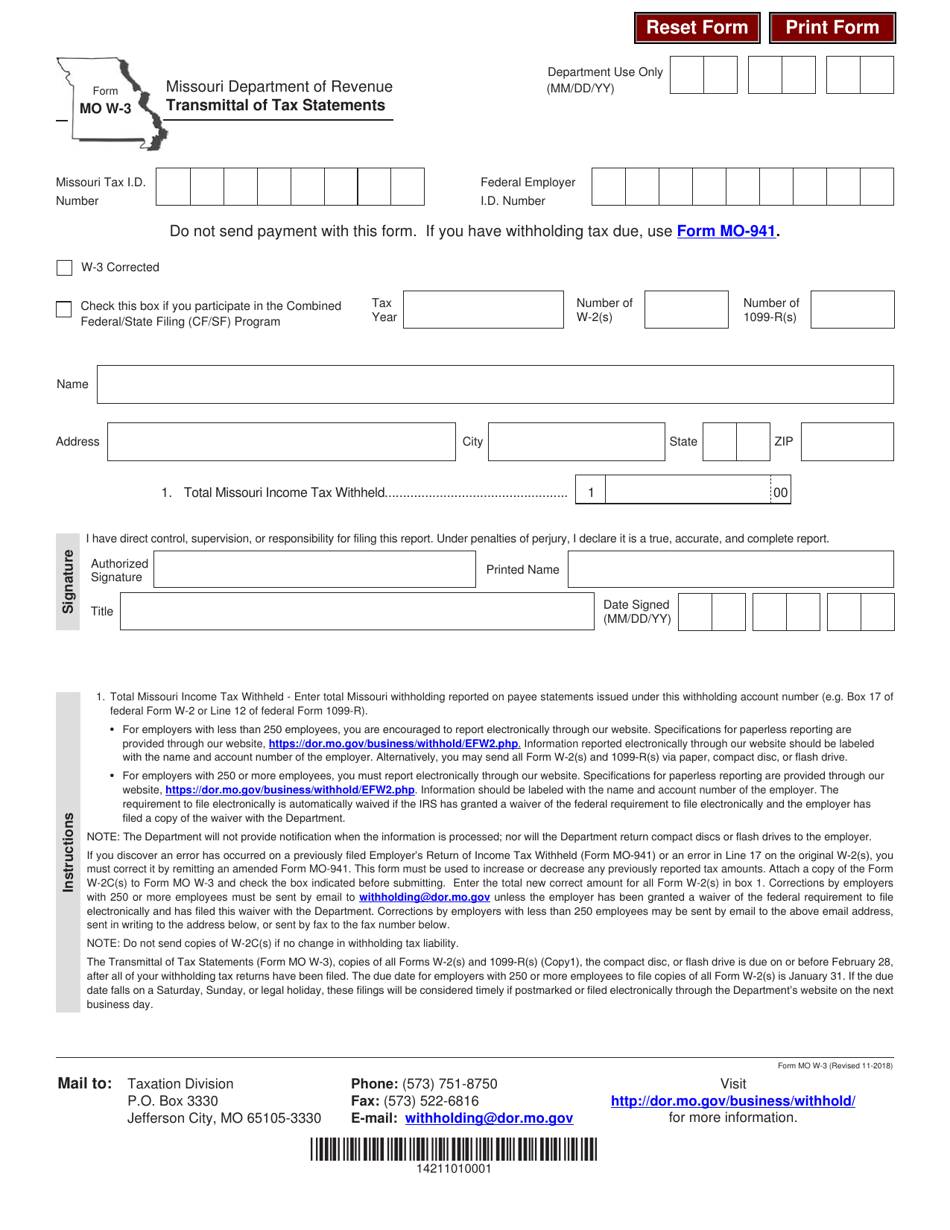

Fillable Form 4923 Motor Fuel Refund Claim Missouri Department Of

Choose the correct version of the editable pdf form. In the form drivers need to include the vehicle identification. Web this form is used to claim a refund for the increased portion of the motor fuel tax paid on fuel used for on road purposes. Access the pdf template in the editor. If you would like your.

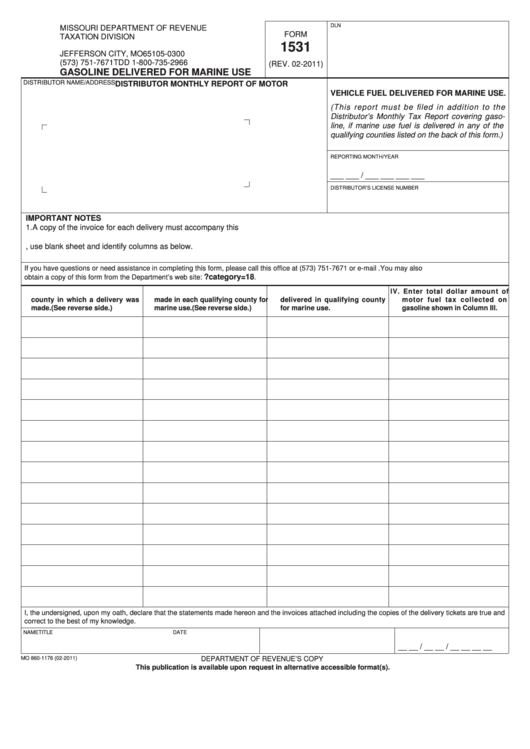

Fillable Form 1531 Gasoline Delivered For Marine Use printable pdf

Web find and fill out the correct missouri tax form 4923 h. Choose the correct version of the editable pdf form. Ad download or email mo 4923 & more fillable forms, register and subscribe now! How to file receipts by the friday deadline namratha prasad sep 26, 2022 friday will be the last day to submit receipts to. While the.

Highway Use Motor Fuel Refund Claim For Rate Increases:.

Web this form is used to claim a refund for the increased portion of the motor fuel tax paid on fuel used for on road purposes. Complete, edit or print tax forms instantly. Web use this form to file a refund claim for the missouri motor fuel tax increase paid beginning july 1, 2022, through june 30, 2023, for motor fuel used for on road purposes. Edit your mo form 4923 fillable online type text, add images, blackout confidential details, add comments, highlights and more.

Web State Tax Officials Said In April They Expected To Publish A Form For Gas Tax Refunds In May.

Web missouri officials said in april they would be releasing a form for gas tax refunds in may, and it was released on may 31. Choose the correct version of the editable pdf form. Sign it in a few clicks draw your. Web home news local missouri gas tax refund:

Access The Pdf Template In The Editor.

See the outlined fillable fields. Web find and fill out the correct missouri tax form 4923 h. Web the best way to fill up mo dor 4923 quick and simple: This government document is issued by department of revenue for use in missouri.

Ad Download Or Email Mo 4923 & More Fillable Forms, Register And Subscribe Now!

Refund claims must be postmarked on or after july 1, but. While the form to submit a refund claim recently became available,. This is where to put in your data. How to file receipts by the friday deadline namratha prasad sep 26, 2022 friday will be the last day to submit receipts to.