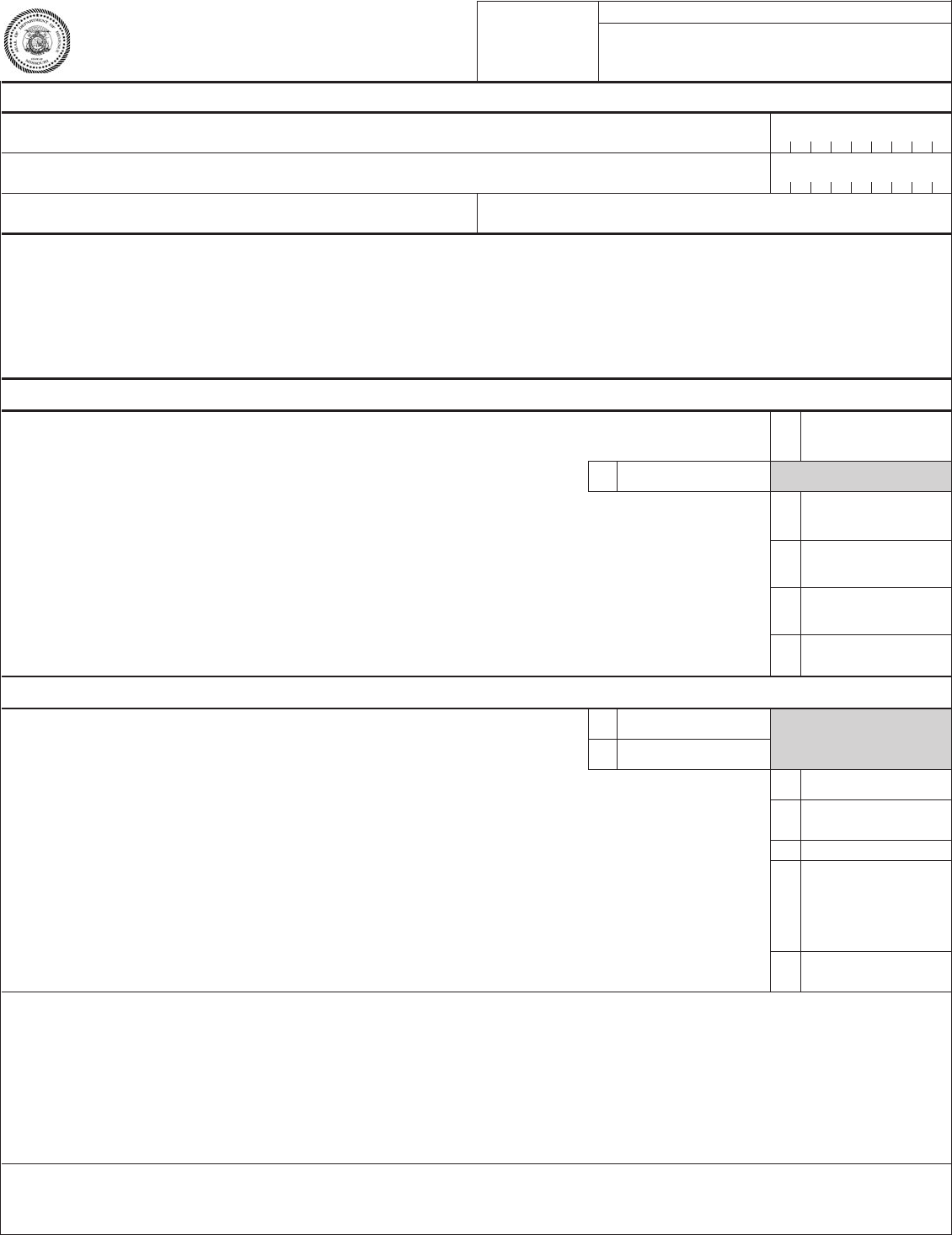

Missouri Form 2210

Missouri Form 2210 - Date return filed (if other than due date of return) We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. Web what is mo tax form 2210? Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments. This form is for income earned in tax year 2022, with tax returns due in april 2023. Enjoy smart fillable fields and interactivity. If it is not, you may owe a penalty on the underpaid amount. Filing an estimated declaration and paying the tax, calendar If it is not, you may owe a penalty on the underpaid amount. If it is not, you may owe a penalty on the underpaid amount.

Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments. If it is not, you may owe additions to tax on the underpaid amount. If it is not, you may owe a penalty on the underpaid amount. Filing an estimated declaration and paying the tax, calendar Follow the simple instructions below: Get your online template and fill it in using progressive features. If it is not, you may owe a penalty on the underpaid amount. This form is for income earned in tax year 2022, with tax returns due in april 2023. Enjoy smart fillable fields and interactivity. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government.

We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. If it is not, you may owe a penalty on the underpaid amount. Web what is mo tax form 2210? Enjoy smart fillable fields and interactivity. Follow the simple instructions below: Web how to fill out and sign missouri underpayment tax online? Filing an estimated declaration and paying the tax, calendar Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments. If it is not, you may owe additions to tax on the underpaid amount. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Follow the simple instructions below: Date return filed (if other than due date of return) Get your online template and fill it in using progressive features. If it is not, you may owe a penalty on the underpaid amount. Enjoy smart fillable fields and interactivity.

تعليمات نموذج الضريبة الفيدرالية 2210 أساسيات 2021

Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments. This form is for income earned in tax year 2022, with tax returns due in april 2023. Enjoy smart fillable fields and interactivity. Date return filed (if other than due date of return) Follow.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

If it is not, you may owe a penalty on the underpaid amount. This form is for income earned in tax year 2022, with tax returns due in april 2023. Filing an estimated declaration and paying the tax, calendar We will update this page with a new version of the form for 2024 as soon as it is made available.

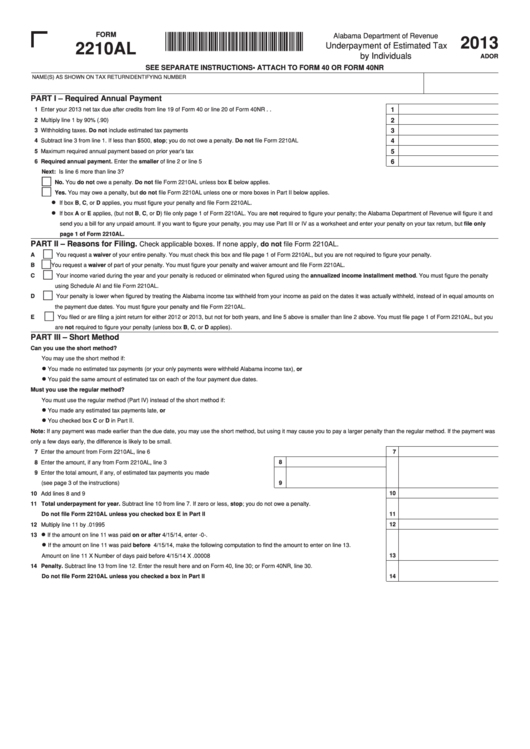

Fillable Form 2210al Underpayment Of Estimated Tax By Individuals

This form is for income earned in tax year 2022, with tax returns due in april 2023. Enjoy smart fillable fields and interactivity. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. Filing an estimated declaration and paying the tax, calendar Purpose of the.

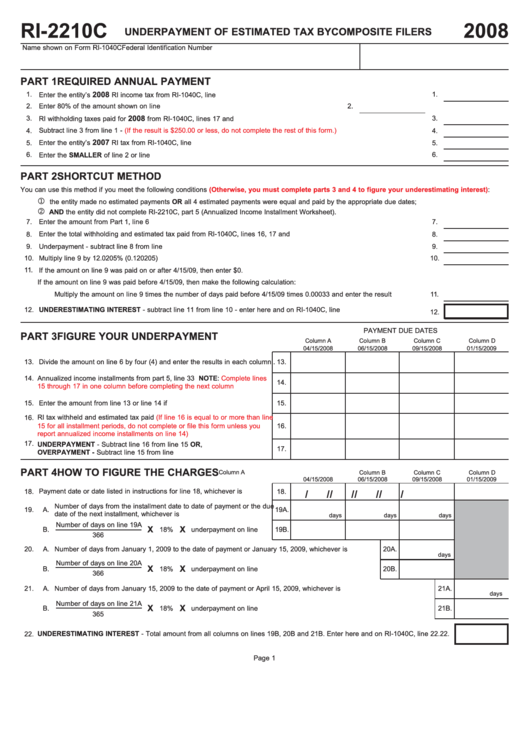

Form Ri2210c Underpayment Of Estimated Tax By Composite Filers

Get your online template and fill it in using progressive features. Web what is mo tax form 2210? Filing an estimated declaration and paying the tax, calendar We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. If it is not, you may owe additions.

JOHN DEERE 2210 For Sale In Gallatin, Missouri

If it is not, you may owe additions to tax on the underpaid amount. Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments. Follow the simple instructions below: Filing an estimated declaration and paying the tax, calendar Web what is mo tax form.

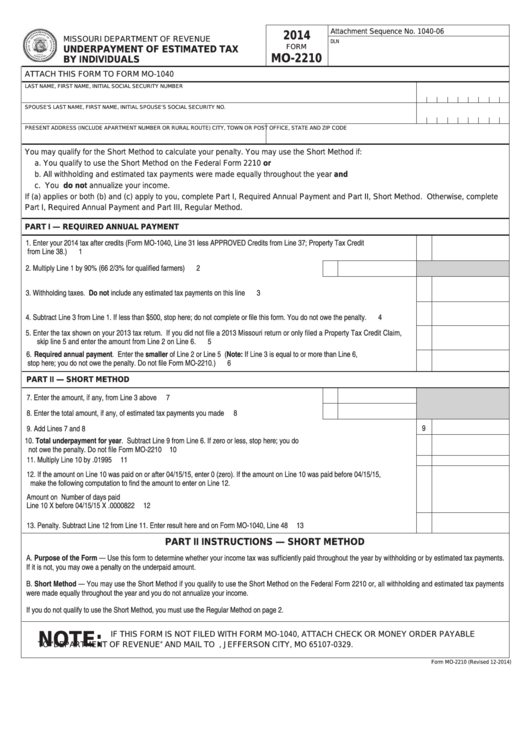

Fillable Form Mo2210 Underpayment Of Estimated Tax By Individuals

If it is not, you may owe a penalty on the underpaid amount. If it is not, you may owe a penalty on the underpaid amount. Get your online template and fill it in using progressive features. We will update this page with a new version of the form for 2024 as soon as it is made available by the.

Ssurvivor Irs Form 2210 Ai Instructions

Web what is mo tax form 2210? We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. This form is for income earned in tax year 2022, with tax returns due in april 2023. Follow the simple instructions below: If it is not, you may.

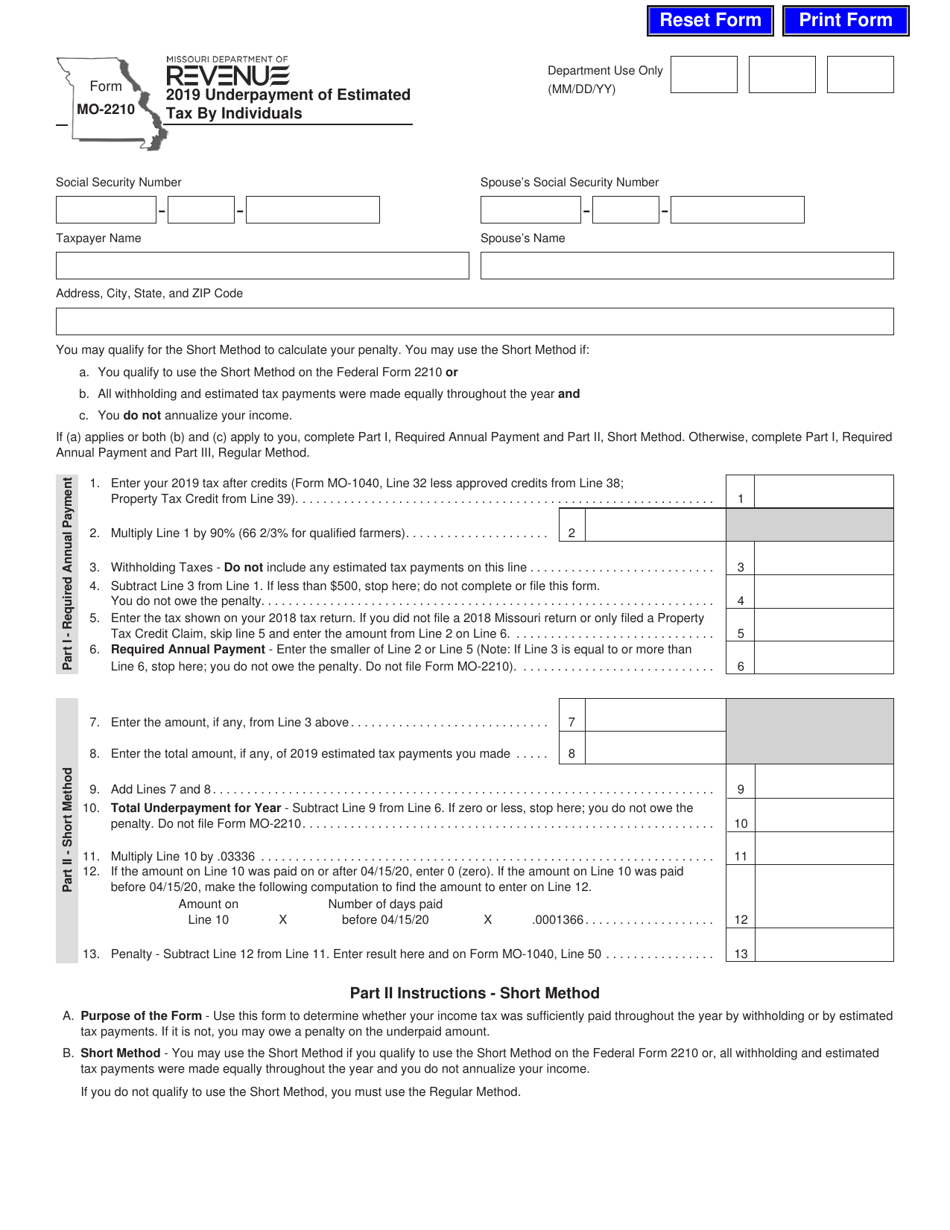

Form MO2210 Download Fillable PDF or Fill Online Underpayment of

If it is not, you may owe a penalty on the underpaid amount. Get your online template and fill it in using progressive features. Web how to fill out and sign missouri underpayment tax online? We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government..

Underpayment Of Estimated Tax By Individuals Form Mo2210 Edit, Fill

Enjoy smart fillable fields and interactivity. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. If it is not, you may owe a penalty on the underpaid amount. Follow the simple instructions below: Purpose of the form— use this form to determine whether your.

Web How To Fill Out And Sign Missouri Underpayment Tax Online?

Enjoy smart fillable fields and interactivity. If it is not, you may owe additions to tax on the underpaid amount. If it is not, you may owe a penalty on the underpaid amount. If it is not, you may owe a penalty on the underpaid amount.

If It Is Not, You May Owe A Penalty On The Underpaid Amount.

Get your online template and fill it in using progressive features. This form is for income earned in tax year 2022, with tax returns due in april 2023. Date return filed (if other than due date of return) Filing an estimated declaration and paying the tax, calendar

Follow The Simple Instructions Below:

Web what is mo tax form 2210? Purpose of the form— use this form to determine whether your income tax was sufficiently paid throughout the year by withholding or by estimated tax payments. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government.