Maryland Tax Extension Form

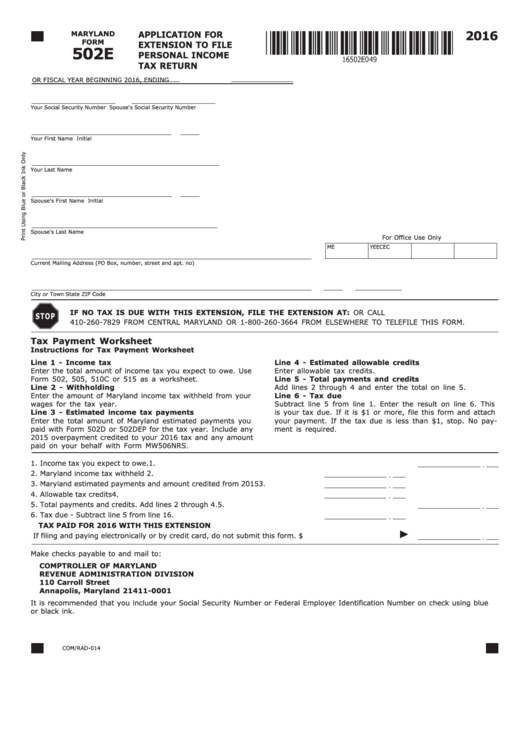

Maryland Tax Extension Form - However, that does not apply to estimated federal income tax payments that remain due. This system allows instant online electronic filing of the 500e/510e forms. Web welcome to the comptroller of maryland's internet extension request filing system. 12:07 pm est jan 28, 2022 sorry, this video is not available, please check back later. Payment with resident return (502). Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. First time filer or change in filing status 2. To get the extension you must: Web fy 2024 strategic goals. Web use form 502e to apply for an extension of time to file your taxes.

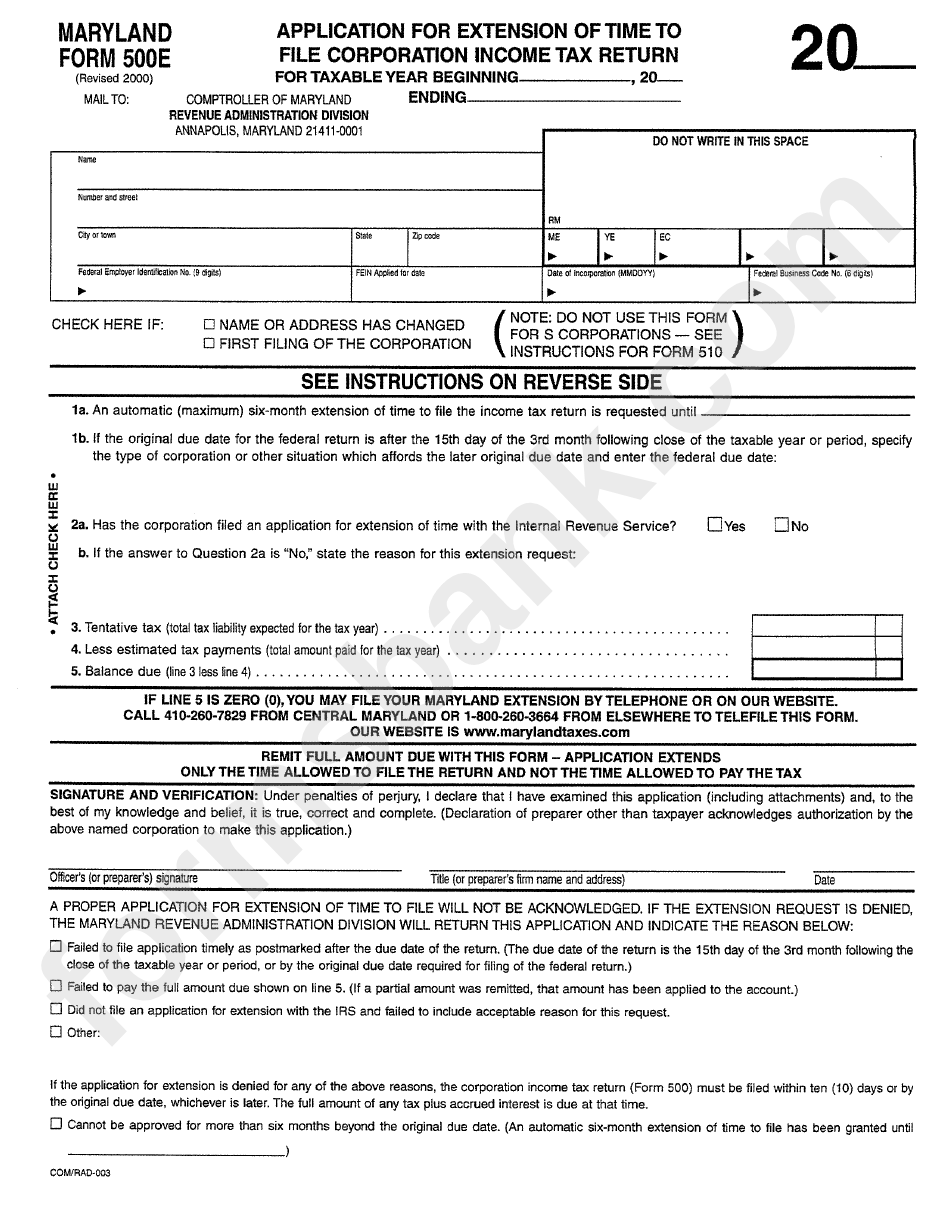

You should file form 502e only if. We will update this page with a new version of the form for 2024 as soon as it is made available. Estimated payment/quarterly (502d) tax year: Businesses can file the 500e or 510e. First time filer or change in filing status 2. If you have an approved federal tax extension ( irs form 4868 ), you will automatically receive a maryland tax extension. File it by the due date of. The irs moved the federal income tax filing deadline to monday, may 17; Web this form is for income earned in tax year 2022, with tax returns due in april 2023. The extension request filing system allows businesses to instantly file for an extension online.

In an effort to protect the environment and save maryland tax payer dollars, the department will no longer mail annual report and personal property tax. Web maryland tax extension form: Businesses can file the 500e or 510e. We will update this page with a new version of the form for 2024 as soon as it is made available. Opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. If you have an approved federal tax extension ( irs form 4868 ), you will automatically receive a maryland tax extension. The instruction booklets listed here do not include forms. Forms are available for downloading in the resident individuals income tax forms section. You should file form 502e only if. The irs moved the federal income tax filing deadline to monday, may 17;

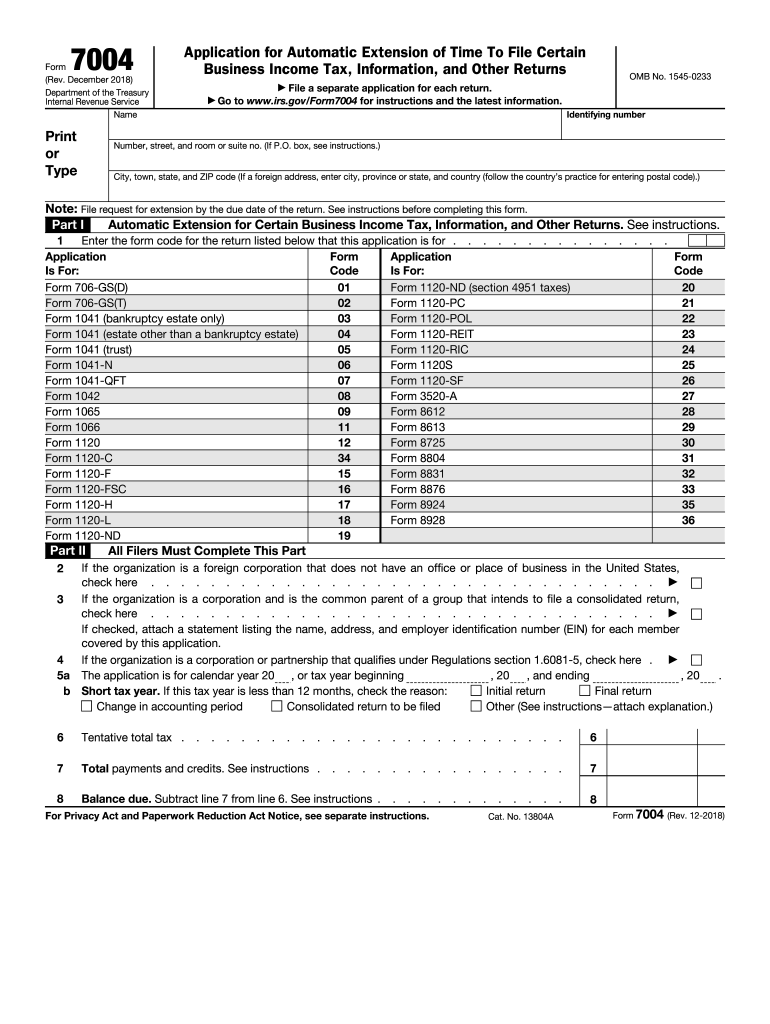

IRS 7004 2018 Fill and Sign Printable Template Online US Legal Forms

In an effort to protect the environment and save maryland tax payer dollars, the department will no longer mail annual report and personal property tax. First time filer or change in filing status 2. To get the extension you must: Forms are available for downloading in the resident individuals income tax forms section. Web use form 502e to apply for.

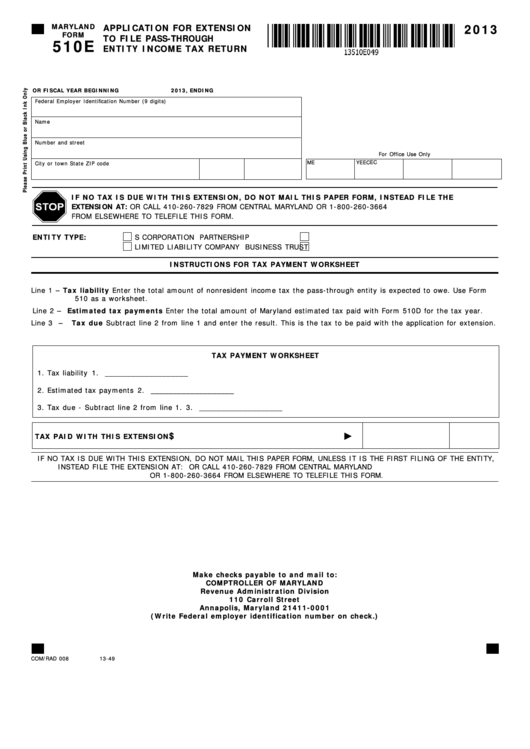

Fillable Maryland Form 510e Application For Extension To File Pass

Web request an extension of time to file. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. We will update this page with a new version of the form for 2024 as soon as it is made available. For more.

Every Little Bit Helps

This system allows instant online electronic filing of the 500e/510e forms. Web show sources > form 502e is a maryland individual income tax form. Web the maryland state department of assessments and taxation (sdat) today announced the availability of 2022 annual reports, personal property tax returns, and. First time filer or change in filing status 2. The extension request filing.

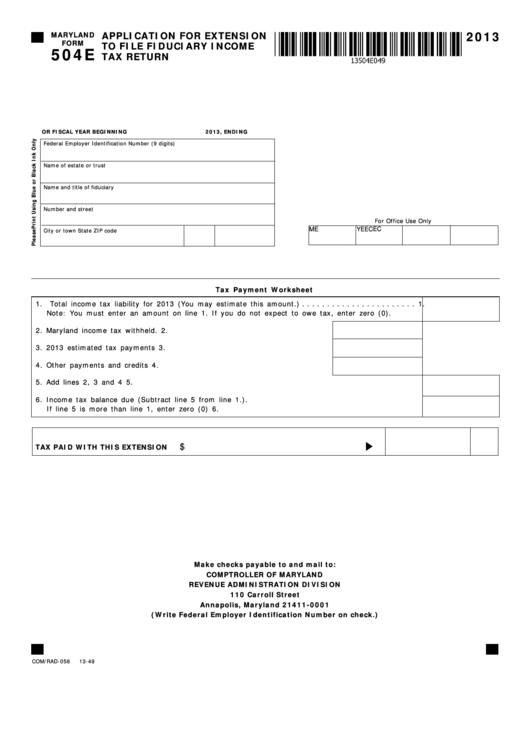

Fillable Maryland Form 504e Application For Extension To File

Web the maryland state department of assessments and taxation (sdat) today announced the availability of 2022 annual reports, personal property tax returns, and. First time filer or change in filing status 2. Extension request form maryland department of assessments and taxation maryland department of assessments and taxation extension request application (). Web this form is for income earned in tax.

Maryland Form 500e Application For Extension Of Time To File

12:07 pm est jan 28, 2022 sorry, this video is not available, please check back later. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web use form 502e to apply for an extension of time to file your taxes. Web fy 2024 strategic goals. To get the extension you must:

Maryland grants 90day tax payment extension Local

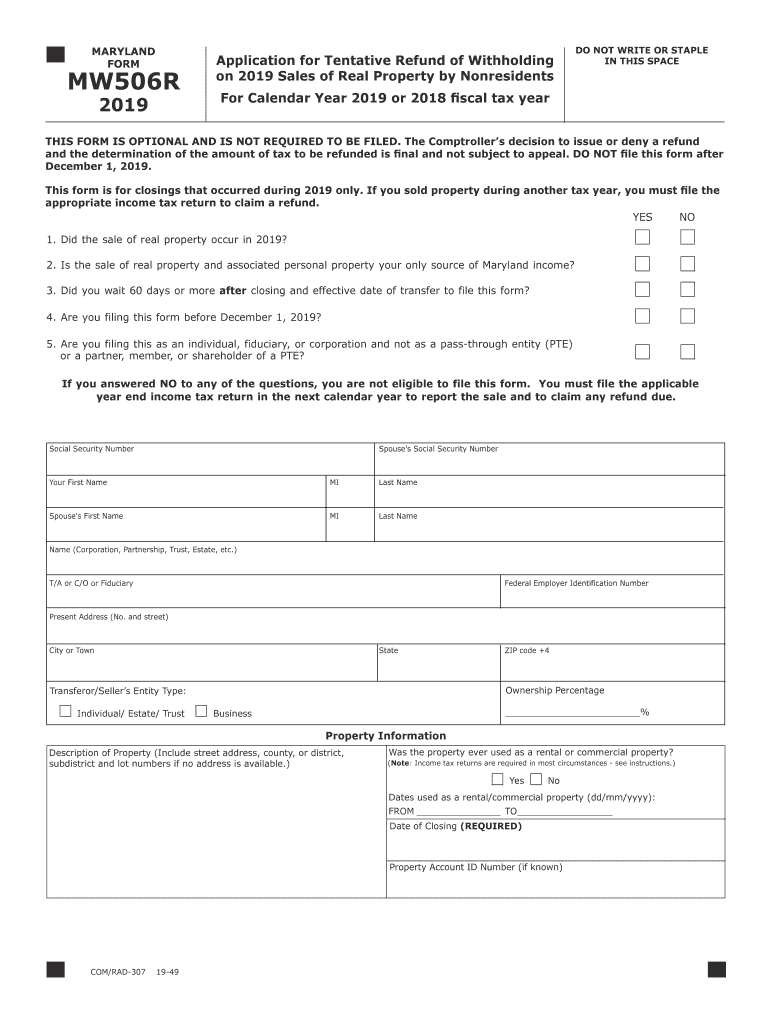

Web welcome to the comptroller of maryland's internet extension request filing system. Web of estimated tax paid with form 510/511d, mw506nrs, and any overpayment carried forward from the prior year (form 511). Web request an extension of time to file. Web fy 2024 strategic goals. The irs moved the federal income tax filing deadline to monday, may 17;

Printable 2021 Maryland Form PV (Tax Payment Voucher, Estimated tax

The instruction booklets listed here do not include forms. Web of estimated tax paid with form 510/511d, mw506nrs, and any overpayment carried forward from the prior year (form 511). This system allows instant online electronic filing of the 500e/510e forms. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a.

502e Maryland Tax Forms And Instructions printable pdf download

Web fy 2024 strategic goals. Opening of the 2022 tax filing system maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. First time filer or change in filing status 2. Web maryland tax extension form: Fill in form 504e correctly;

Tax Extension 2021

Estimated payment/quarterly (502d) tax year: Web the maryland state department of assessments and taxation (sdat) today announced the availability of 2022 annual reports, personal property tax returns, and. You should file form 502e only if. First time filer or change in filing status 2. Web maryland tax extension form:

Maryland Tax Forms 2021 2022 W4 Form

12:07 pm est jan 28, 2022 sorry, this video is not available, please check back later. Web of estimated tax paid with form 510/511d, mw506nrs, and any overpayment carried forward from the prior year (form 511). Web you can make an extension payment with form 502e (application for extension to file personal income tax return). Estimated payment/quarterly (502d) tax year:.

Web This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

The instruction booklets listed here do not include forms. Web maryland tax extension form: You should file form 502e only if. However, that does not apply to estimated federal income tax payments that remain due.

Estimated Payment/Quarterly (502D) Tax Year:

If you have an approved federal tax extension ( irs form 4868 ), you will automatically receive a maryland tax extension. For more information about the maryland income tax, see the maryland income tax page. Extension request form maryland department of assessments and taxation maryland department of assessments and taxation extension request application (). The irs moved the federal income tax filing deadline to monday, may 17;

Opening Of The 2022 Tax Filing System Maryland Will Begin Processing Personal Income Tax Returns For Tax Year 2022 On 01/25/2023 Or Earlier.

12:07 pm est jan 28, 2022 sorry, this video is not available, please check back later. First time filer or change in filing status 2. Businesses can file the 500e or 510e. Web show sources > form 502e is a maryland individual income tax form.

Web Of Estimated Tax Paid With Form 510/511D, Mw506Nrs, And Any Overpayment Carried Forward From The Prior Year (Form 511).

Web the maryland state department of assessments and taxation (sdat) today announced the availability of 2022 annual reports, personal property tax returns, and. Payment with resident return (502). Fill in form 504e correctly; Web request an extension of time to file.