Maryland 500 Form

Maryland 500 Form - Get everything done in minutes. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. 5 other matters extension of time to file if unable to file. You can also download it, export it or print it out. Web if no tax is due with this extension, file the extension at: Print using blue or black ink only staple. Or fiscal year beginning 2022, ending. Corporations expected to be subject to estimated tax requirements should use form. Web electronic form 510 must be filed and the form 500cr section must be completed through line 25, part y, for the pte to pass on these business tax credits to its members. Web we last updated the maryland corporation income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022.

Web every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is inactive. Web electronic form 510 must be filed and the form 500cr section must be completed through line 25, part y, for the pte to pass on these business tax credits to its members. Or fiscal year beginning 2022, ending. Web we last updated the maryland corporation income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022. 5 other matters extension of time to file if unable to file. Or fiscal year beginning 2021, ending. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. Web 2022 maryland form 500. You can download or print. Edit your comptroller of maryland form 500 online.

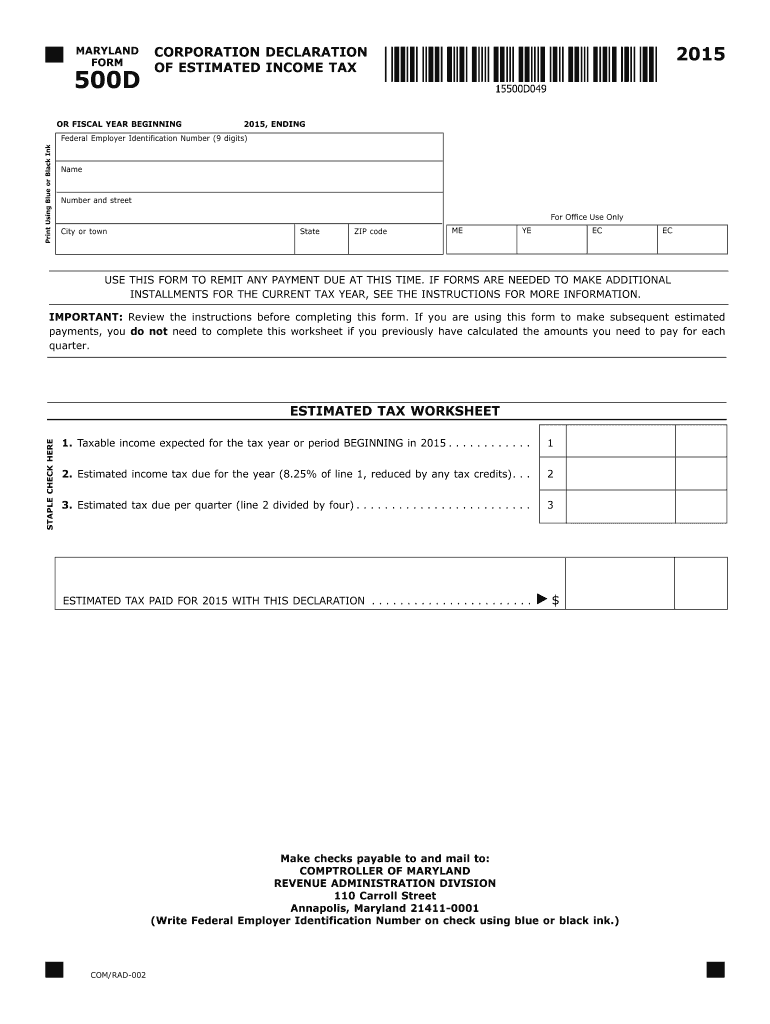

Print using blue or black ink only staple. Web form 500d is used by a corporation to declare and remit estimated income tax. Edit your comptroller of maryland form 500 online. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is inactive. You can also download it, export it or print it out. Maryland corporation income tax return: 5 other matters extension of time to file if unable to file. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. Web we last updated the maryland corporation income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022.

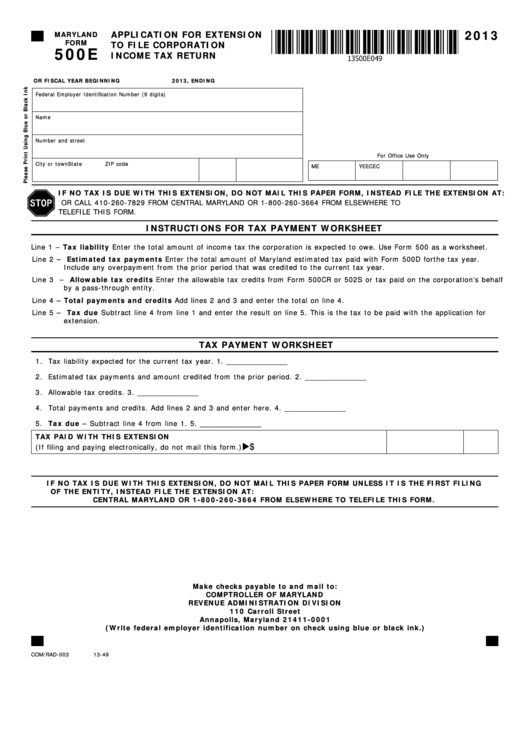

Fillable Maryland Form 500e Application For Extension To File

Corporations expected to be subject to estimated tax requirements should use form. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Or fiscal year beginning 2022, ending. Print using blue or black ink only staple check. In addition to filing form 500 to calculate and pay the corporation income tax,.

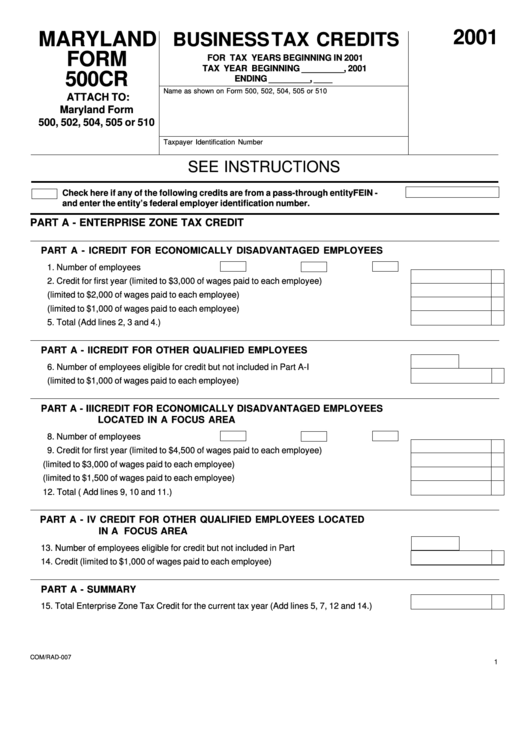

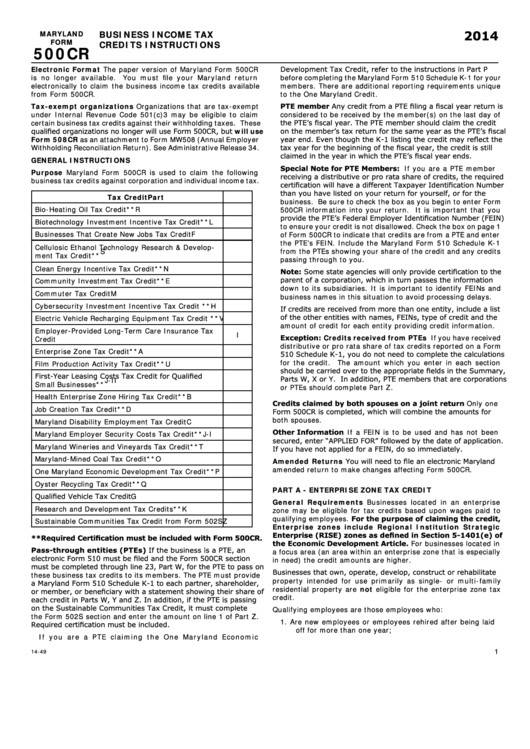

Fillable Form 500cr Maryland Business Tax Credits 2001 printable

Web if no tax is due with this extension, file the extension at: Print using blue or black ink only staple. You can download or print. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. Web form 500d is used by a corporation to declare and remit.

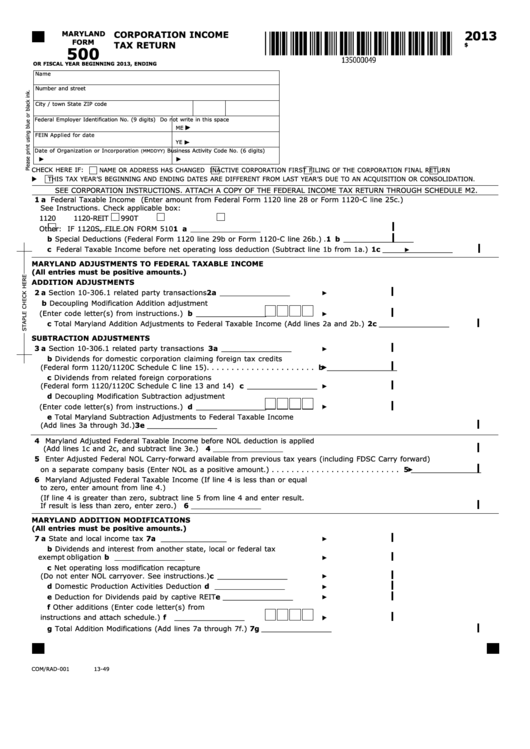

Fillable Maryland Form 500 Corporation Tax Return 2013

5 other matters extension of time to file if unable to file. Get everything done in minutes. Web electronic form 510 must be filed and the form 500cr section must be completed through line 25, part y, for the pte to pass on these business tax credits to its members. Check out how easy it is to complete and esign.

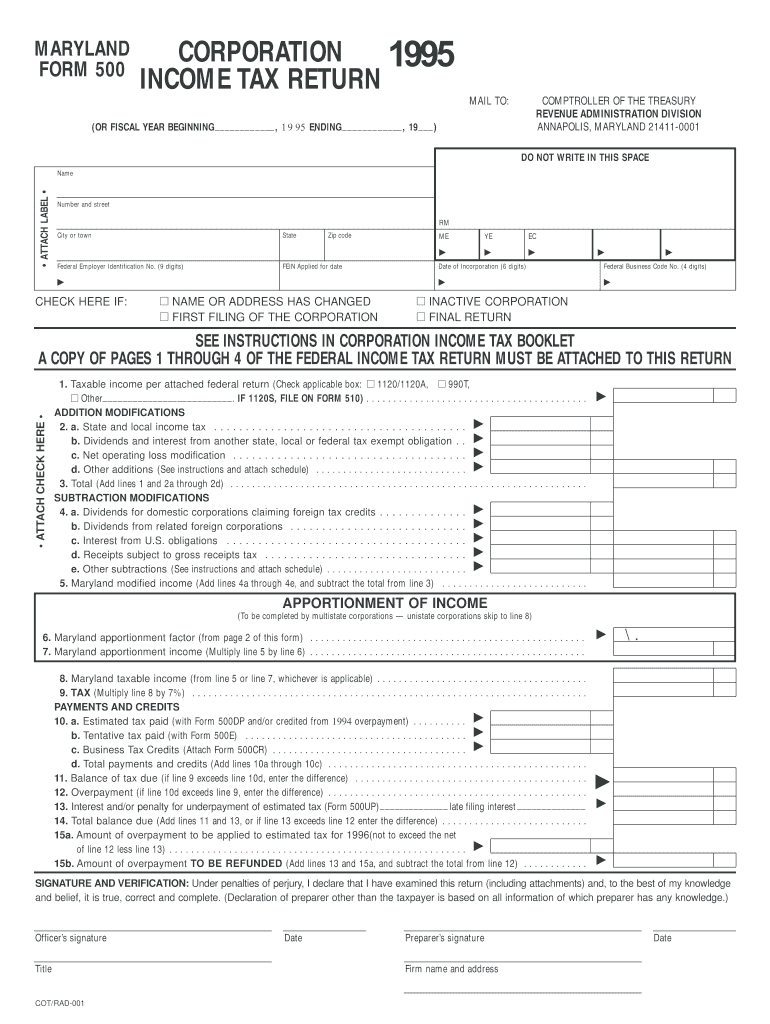

1995 MD Form 500 Fill Online, Printable, Fillable, Blank pdfFiller

Or fiscal year beginning 2021, ending. You can download or print. Type text, add images, blackout. Web form 500d is used by a corporation to declare and remit estimated income tax. Web if no tax is due with this extension, file the extension at:

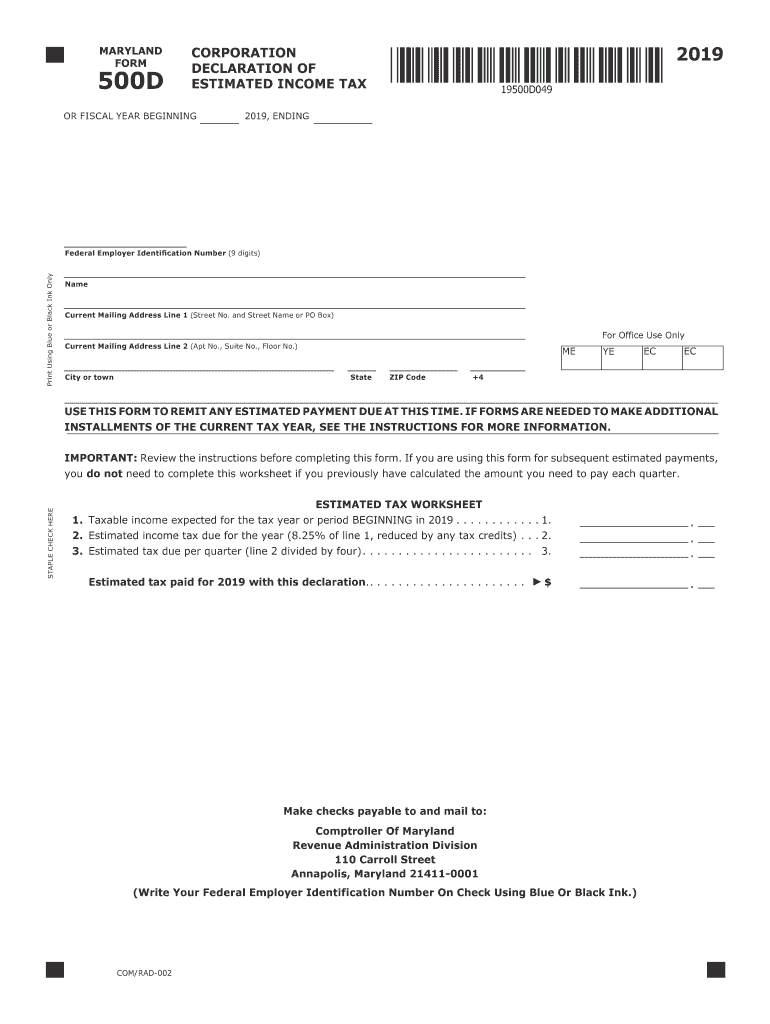

2019 Md State Estimated Tax Form Fill Out and Sign Printable PDF

In addition to filing form 500 to calculate and pay the corporation income tax, also file form 510. You can also download it, export it or print it out. Corporations expected to be subject to estimated tax requirements should use form. Type text, add images, blackout. Web form 500d is used by a corporation to declare and remit estimated income.

Maryland Form 500cr Business Tax Credits Instructions 2014

Web if no tax is due with this extension, file the extension at: Web every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is inactive. Print using blue or black ink only staple. Form used by a corporation and certain other organizations to file an income tax.

Maryland Form 500D Fill Out and Sign Printable PDF Template signNow

Maryland corporation income tax return: 5 other matters extension of time to file if unable to file. Print using blue or black ink only staple check. Web form 500d is used by a corporation to declare and remit estimated income tax. Or fiscal year beginning 2022, ending.

Medical 500 form Fill out & sign online DocHub

Web send md 500 form via email, link, or fax. Web if no tax is due with this extension, file the extension at: Web electronic form 510 must be filed and the form 500cr section must be completed through line 25, part y, for the pte to pass on these business tax credits to its members. Type text, add images,.

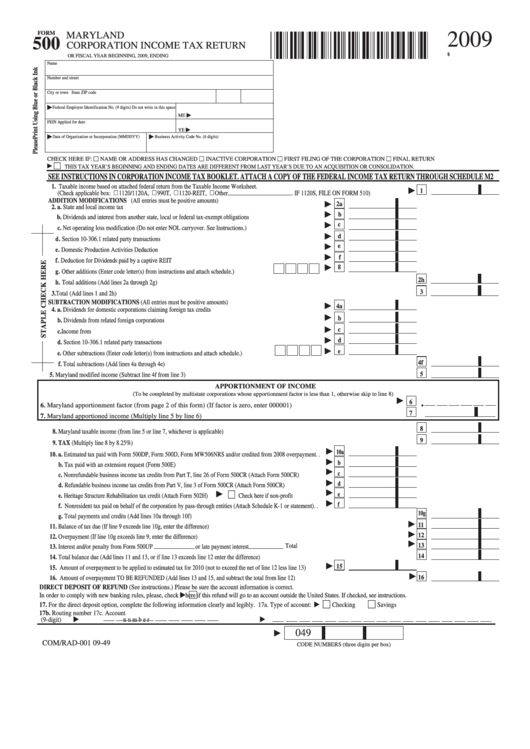

Fillable Form 500 Maryland Corporation Tax Return 2009

Maryland corporation income tax return: Web send md 500 form via email, link, or fax. You can also download it, export it or print it out. Web front of form 500. You can download or print.

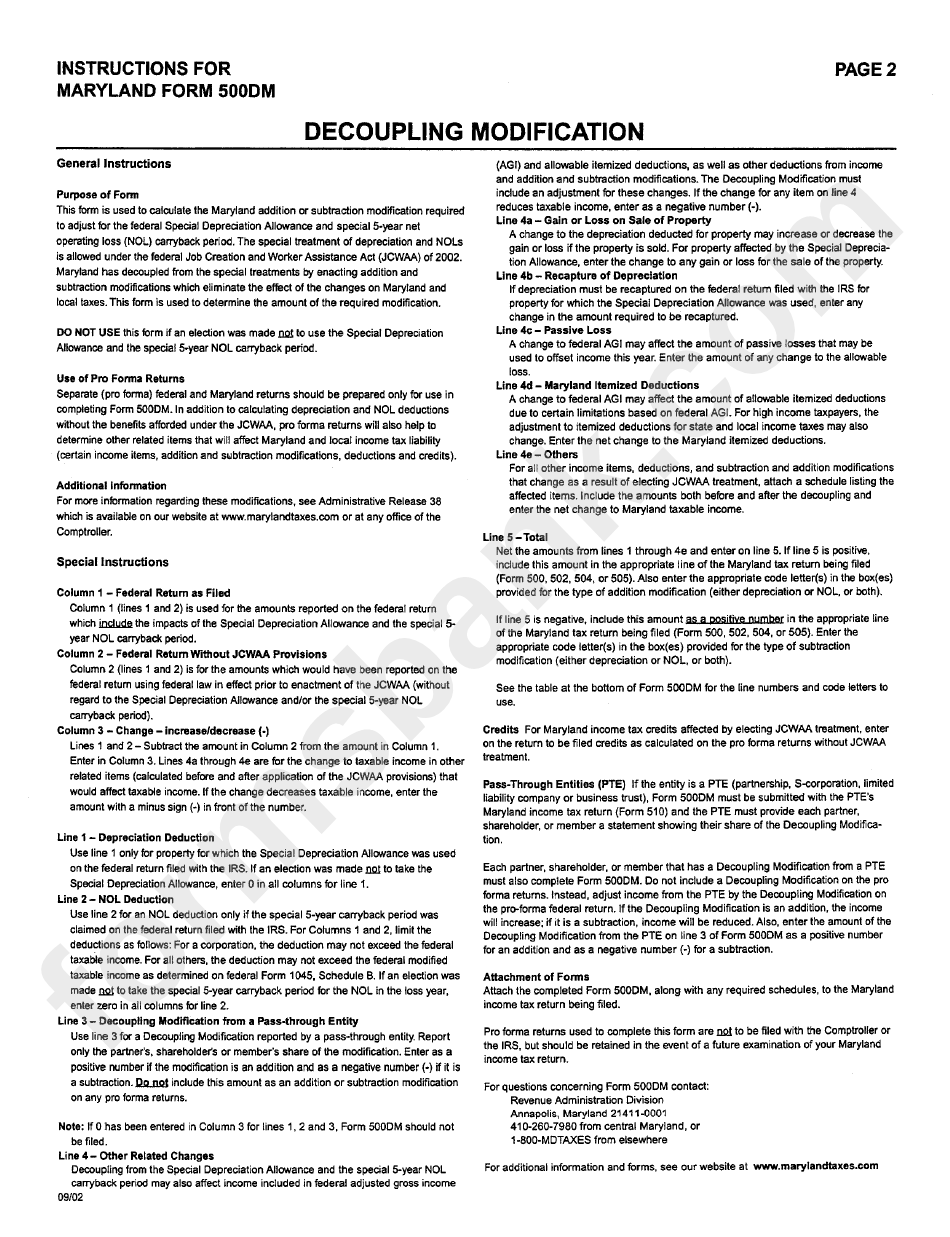

Instructions For Maryland Form 500dm printable pdf download

Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. Or fiscal year beginning 2021, ending. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web we last updated the maryland corporation income tax return in january 2023,.

Or Fiscal Year Beginning 2021, Ending.

Web electronic form 510 must be filed and the form 500cr section must be completed through line 25, part y, for the pte to pass on these business tax credits to its members. Print using blue or black ink only staple check. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web if no tax is due with this extension, file the extension at:

Or Fiscal Year Beginning 2022, Ending.

Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. Get everything done in minutes. Web 2022 maryland form 500. Edit your comptroller of maryland form 500 online.

Maryland Corporation Income Tax Return:

Web send md 500 form via email, link, or fax. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Corporations expected to be subject to estimated tax requirements should use form.

Web We Last Updated The Maryland Corporation Income Tax Return In January 2023, So This Is The Latest Version Of Form 500, Fully Updated For Tax Year 2022.

Web every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is inactive. You can download or print. 5 other matters extension of time to file if unable to file. Web front of form 500.