Married Filing Separate Form

Married Filing Separate Form - Apparently with 2021 returns it is happening a lot. Web your filing status for the year will be either married filing separately or married filing jointly. If you and your spouse do not agree to file a joint return, then you must file separate returns, unless you are considered. When you file using this status, your credits and deductions are limited. If you file separate tax returns, you report only your own income, deductions and credits on your individual return. Generally, married persons must file a joint return to claim the credit. Web the irs considers a couple married for tax filing purposes until they get a final decree of divorce or separate maintenance. A spouse is considered part of your household even if he or she is gone for a temporary absence. Web married persons filing separately. You can't get relief by.

Web married persons who file separate returns in community property states may also qualify for relief. Web married filing separately: Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web once you have completed the steps above, please complete the married filing separately allocations form 8958. If you and your spouse plan to share a household in the future, you’re not. The new form doesn’t have married but withhold at higher single rate is. This form will explain to the irs why the taxable income and. If you and your spouse do not agree to file a joint return, then you must file separate returns, unless you are considered. If your filing status is married filing separately and all of the following. Web i am married filing separately how do i submit the form 8962 so i only pay back half the health insurance tax credit and my spouse pays the other half?

Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Web your filing status for the year will be either married filing separately or married filing jointly. You can't get relief by. Web married filing separately or not? If your filing status is married filing separately and all of the following. If you file separate tax returns, you report only your own income, deductions and credits on your individual return. A spouse is considered part of your household even if he or she is gone for a temporary absence. Apparently with 2021 returns it is happening a lot. Web married persons filing separately. Web in 2022, married filing separately taxpayers receive a standard deduction of only $12,950 each compared to the $25,900 those who filed jointly can get.

Tax Guide for 2018 The Simple Dollar

If you and your spouse do not agree to file a joint return, then you must file separate returns, unless you are considered. Web married filing separately or not? Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. The new form doesn’t have married but withhold.

When is Married Filing Separate Better? Roger Rossmeisl, CPA

Web in 2022, married filing separately taxpayers receive a standard deduction of only $12,950 each compared to the $25,900 those who filed jointly can get. Web the filing statuses we know today — single, head of household, qualifying widow (er), married filing jointly and married filing separately — first appeared on the. This form will explain to the irs why.

Married Filing Separately Benefits and Drawbacks of This Little

Web the new form changes single to single or married filing separately and includes head of household. Web in 2022, married filing separately taxpayers receive a standard deduction of only $12,950 each compared to the $25,900 those who filed jointly can get. Web married filing separately: See community property laws for more information. Web if you choose to file married.

Tax Tips Married Filing Jointly vs Married Filing Separately YouTube

Web the irs considers a couple married for tax filing purposes until they get a final decree of divorce or separate maintenance. See community property laws for more information. If your filing status is married filing separately and all of the following. Web the new form changes single to single or married filing separately and includes head of household. Web.

Married Filing Separately When Does it Make Sense? • Benzinga

See community property laws for more information. Web 1 min read to fulfill the married filing separately requirements, you’ll each report your own income separately. You can't get relief by. If you file separate tax returns, you report only your own income, deductions and credits on your individual return. Apparently with 2021 returns it is happening a lot.

Married Filing Separately Q&A TL;DR Accounting

In most cases, claiming married filing separately is the least beneficial filing status. Web the irs considers a couple married for tax filing purposes until they get a final decree of divorce or separate maintenance. Web 1 min read to fulfill the married filing separately requirements, you’ll each report your own income separately. The new form doesn’t have married but.

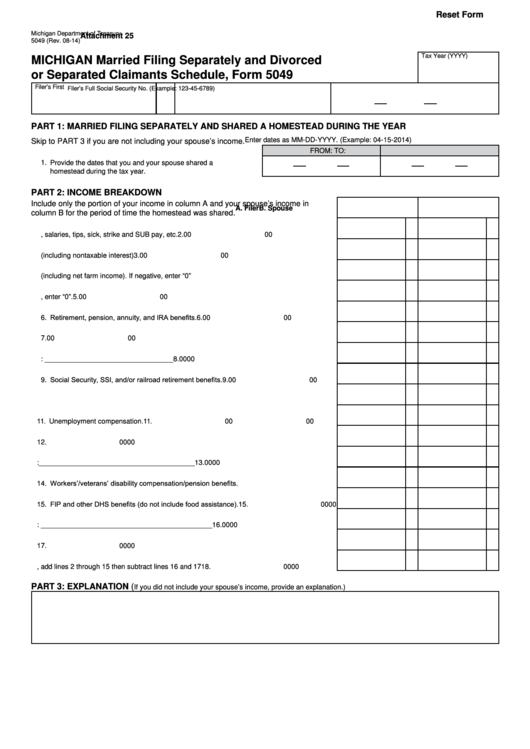

Fillable Form 5049 Michigan Married Filing Separately And Divorced Or

You can't get relief by. Web i am married filing separately how do i submit the form 8962 so i only pay back half the health insurance tax credit and my spouse pays the other half? Apparently with 2021 returns it is happening a lot. If you and your spouse do not agree to file a joint return, then you.

Married Filing Separately How it Works & When to Do It Personal Capital

Web the new form changes single to single or married filing separately and includes head of household. The new form doesn’t have married but withhold at higher single rate is. See community property laws for more information. Apparently with 2021 returns it is happening a lot. This form will explain to the irs why the taxable income and.

Married Filing Separately rules YouTube

If you and your spouse plan to share a household in the future, you’re not. If your filing status is married filing separately and all of the following. You can't get relief by. Web married filing separately is a tax status for couples in which each person submits a tax return on their own, with their own income, deductions, and.

Married Filing Separate and N400 Applications CitizenPath

Web in 2022, married filing separately taxpayers receive a standard deduction of only $12,950 each compared to the $25,900 those who filed jointly can get. See community property laws for more information. Web married persons who file separate returns in community property states may also qualify for relief. Web married persons filing separately. You can't get relief by.

Web Once You Have Completed The Steps Above, Please Complete The Married Filing Separately Allocations Form 8958.

If your filing status is married filing separately and all of the following. In most cases, claiming married filing separately is the least beneficial filing status. If you file separate tax returns, you report only your own income, deductions and credits on your individual return. See community property laws for more information.

Apparently With 2021 Returns It Is Happening A Lot.

When you file using this status, your credits and deductions are limited. If you and your spouse plan to share a household in the future, you’re not. Web the irs considers a couple married for tax filing purposes until they get a final decree of divorce or separate maintenance. Web the filing statuses we know today — single, head of household, qualifying widow (er), married filing jointly and married filing separately — first appeared on the.

Web Your Filing Status For The Year Will Be Either Married Filing Separately Or Married Filing Jointly.

Web married filing separately is a tax status for couples in which each person submits a tax return on their own, with their own income, deductions, and exemptions. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web in 2022, married filing separately taxpayers receive a standard deduction of only $12,950 each compared to the $25,900 those who filed jointly can get. Web married filing separately or not?

You Can't Get Relief By.

Web 1 min read to fulfill the married filing separately requirements, you’ll each report your own income separately. The new form doesn’t have married but withhold at higher single rate is. Web i am married filing separately how do i submit the form 8962 so i only pay back half the health insurance tax credit and my spouse pays the other half? Web married persons who file separate returns in community property states may also qualify for relief.