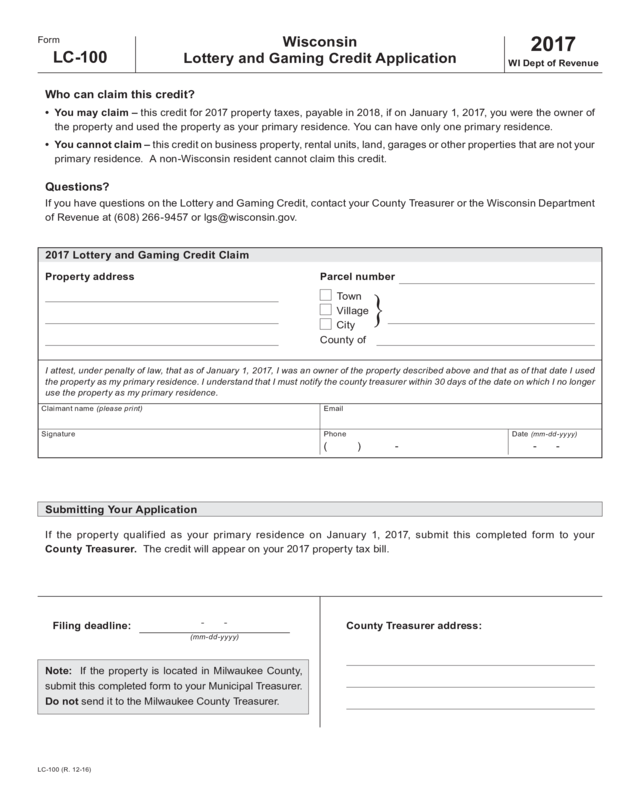

Lottery Credit Wisconsin Form

Lottery Credit Wisconsin Form - Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department. Web the wisconsin department of revenue (dor) posted the following 2019 lottery and gaming credit forms on our website. Game touch 20 (gt20) vending quick. Web the 2023 chevrolet bolt. The wisconsin department of revenue (dor) posted the following 2020. Property owners file this form to affirm they qualify for the lottery and gaming credit as of. Each year at the end of december a lottery credit request form is available for home owners to file in order to apply for the. Field marketing rep map and numbers. Lottery and gaming credit application. The lottery and gaming credit is shown on tax bills as a reduction of property taxes due.

Web wisconsin lottery and gaming credit application 2023 wi dept of revenue who can claim this credit? Web the wisconsin department of revenue (dor) posted the following 2019 lottery and gaming credit forms on our website. Web lottery credit available for primary residences only. Web contracting and accounting forms. Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department. Each year at the end of december a lottery credit request form is available for home owners to file in order to apply for the. The lottery and gaming credit is shown on tax bills as a reduction of property taxes due. The wisconsin department of revenue (dor) posted the following 2020. Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department. If a taxpayer pays their taxes in two or more.

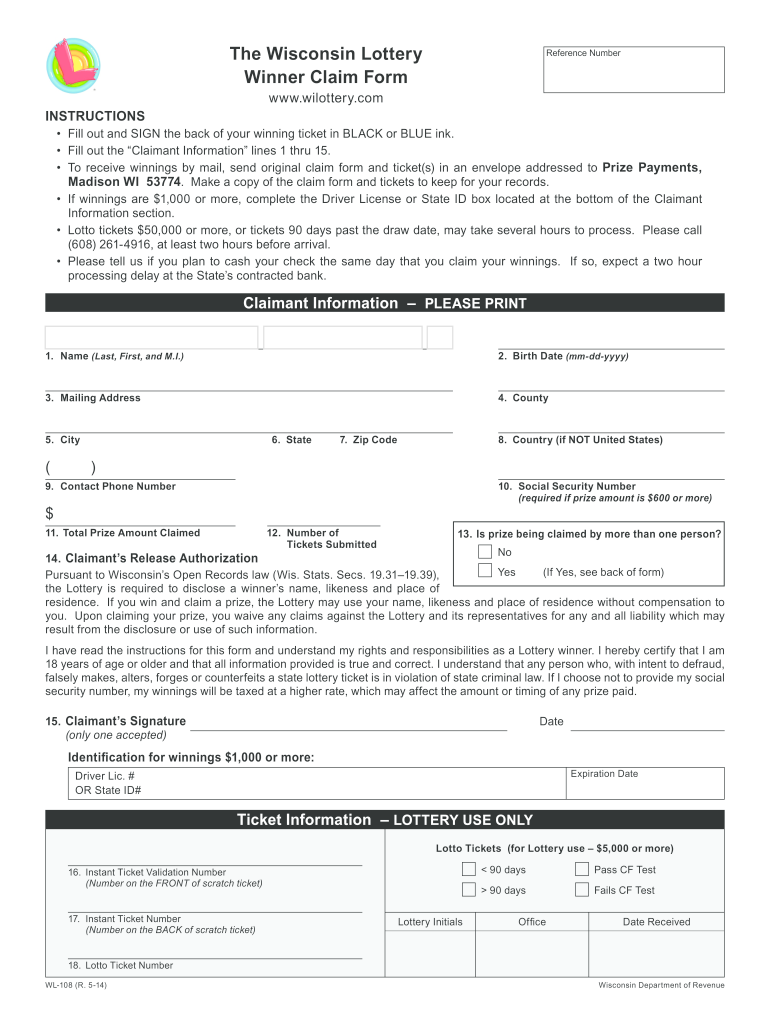

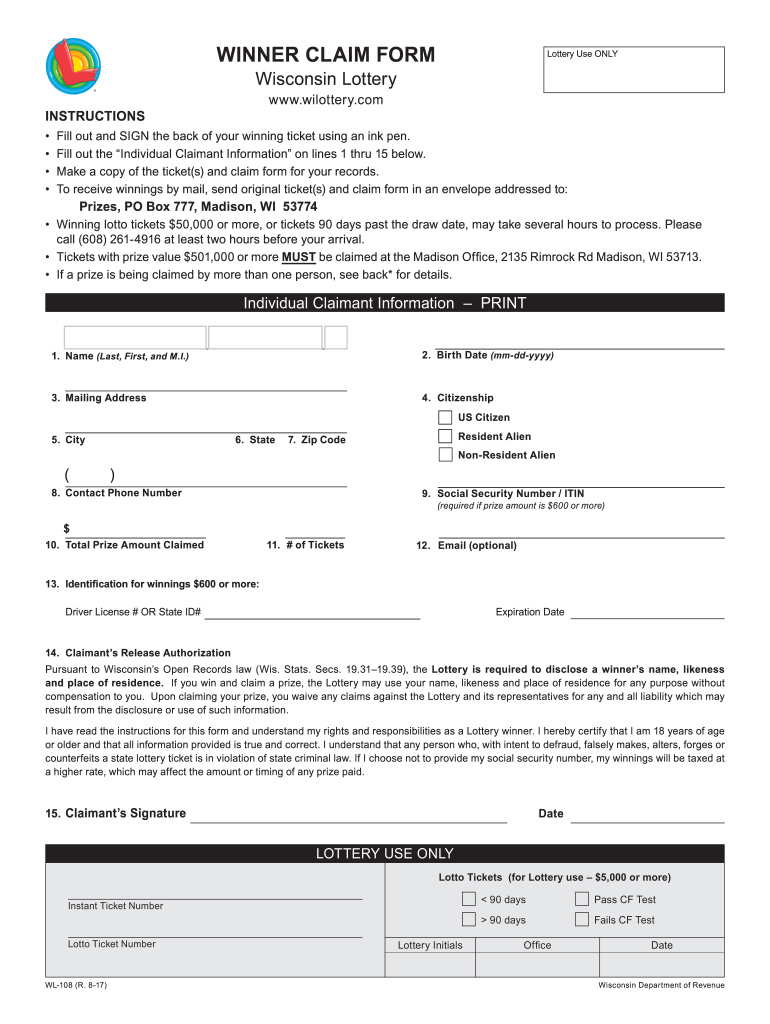

Web winner claim form player hotline: The lottery and gaming credit is shown on tax bills as a reduction of property taxes due. Property owners file this form to affirm they qualify for the lottery and gaming credit as of. Web to qualify for a 2023 wisconsin state lottery and gaming credit, you must attest and prove that you are the owner of the affected property and that it was your. Web the wisconsin department of revenue (dor) posted the following 2019 lottery and gaming credit forms on our website. Each year at the end of december a lottery credit request form is available for home owners to file in order to apply for the. Web one ticket in california matched all five numbers and the powerball. The wisconsin department of revenue (dor) posted the following 2020. Lottery and gaming credit application. Web contracting and accounting forms.

2017 Lc100 Wisconsin Lottery And Gaming Credit Application Edit

Game touch 20 (gt20) vending quick. Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department. Web the lottery tax credit is available to wisconsin property owners' primary residence. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) If a taxpayer pays their taxes in.

Wisconsin Lottery Claim Form Fill Out and Sign Printable PDF Template

Game touch 20 (gt20) vending quick. Web to qualify for a 2023 wisconsin state lottery and gaming credit, you must attest and prove that you are the owner of the affected property and that it was your. Web december 20, 2019 to: Each year at the end of december a lottery credit request form is available for home owners to.

Wisconsin Lottery Tickets Crosswords Only YouTube

Web the wisconsin department of revenue (dor) posted the following 2019 lottery and gaming credit forms on our website. Web december 20, 2019 to: Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department. Web the lottery tax credit is available to wisconsin property owners' primary residence. The wisconsin department of.

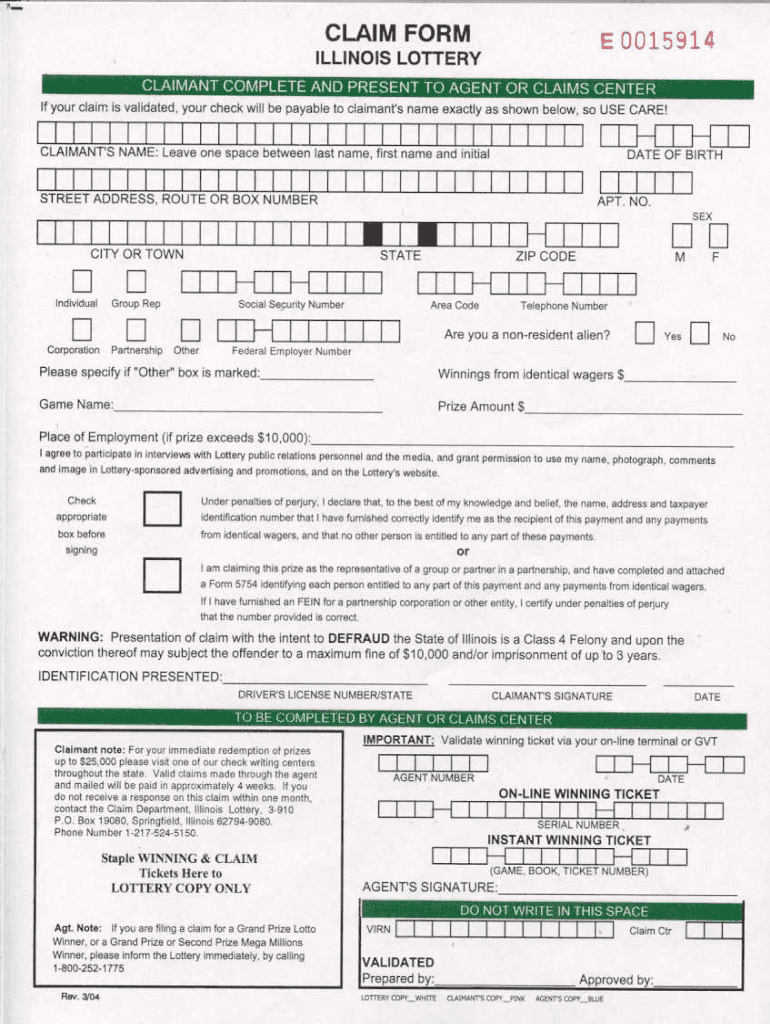

Illinois Lottery Claim Form Fill Online, Printable, Fillable, Blank

Landlords' properties and residents' vacation homes are not eligible. Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department. Web the lottery tax credit is available to wisconsin property owners' primary residence. Each year at the end of december a lottery credit request form is available for home owners to file.

Wisconsin Rapids man claims 50,000 Powerball prize

Landlords' properties and residents' vacation homes are not eligible. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Lottery and gaming credit application. Field marketing rep map and numbers. Web contracting and accounting forms.

Wisconsin Lottery Claim Form Fill Out and Sign Printable PDF Template

The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Web the lottery tax credit is available to wisconsin property owners' primary residence. Web one ticket in california matched all five numbers and the powerball. The lottery and gaming credit is shown on tax bills as a reduction of property taxes due. Each year at.

Despite cashonly law, some lottery players already use debit cards

Web the wisconsin department of revenue (dor) posted the following 2021 lottery and gaming credit forms on our website. Each year at the end of december a lottery credit request form is available for home owners to file in order to apply for the. Web december 20, 2019 to: Web if you have questions on the lottery and gaming credit,.

New Wisconsin 10 Lottery Ticket!! YouTube

Municipal clerks and treasurers, county clerks and treasurers. Web december 20, 2019 to: Web the wisconsin department of revenue (dor) posted the following 2021 lottery and gaming credit forms on our website. Landlords' properties and residents' vacation homes are not eligible. Web winner claim form player hotline:

Wisconsin Lottery announces 250,000 Bonus Draw winning numbers

Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department. Web december 20, 2019 to: Landlords' properties and residents' vacation homes are not eligible. Property owners file this form to affirm they qualify for the lottery and gaming credit as of. Web catch the top stories of the day on anc’s.

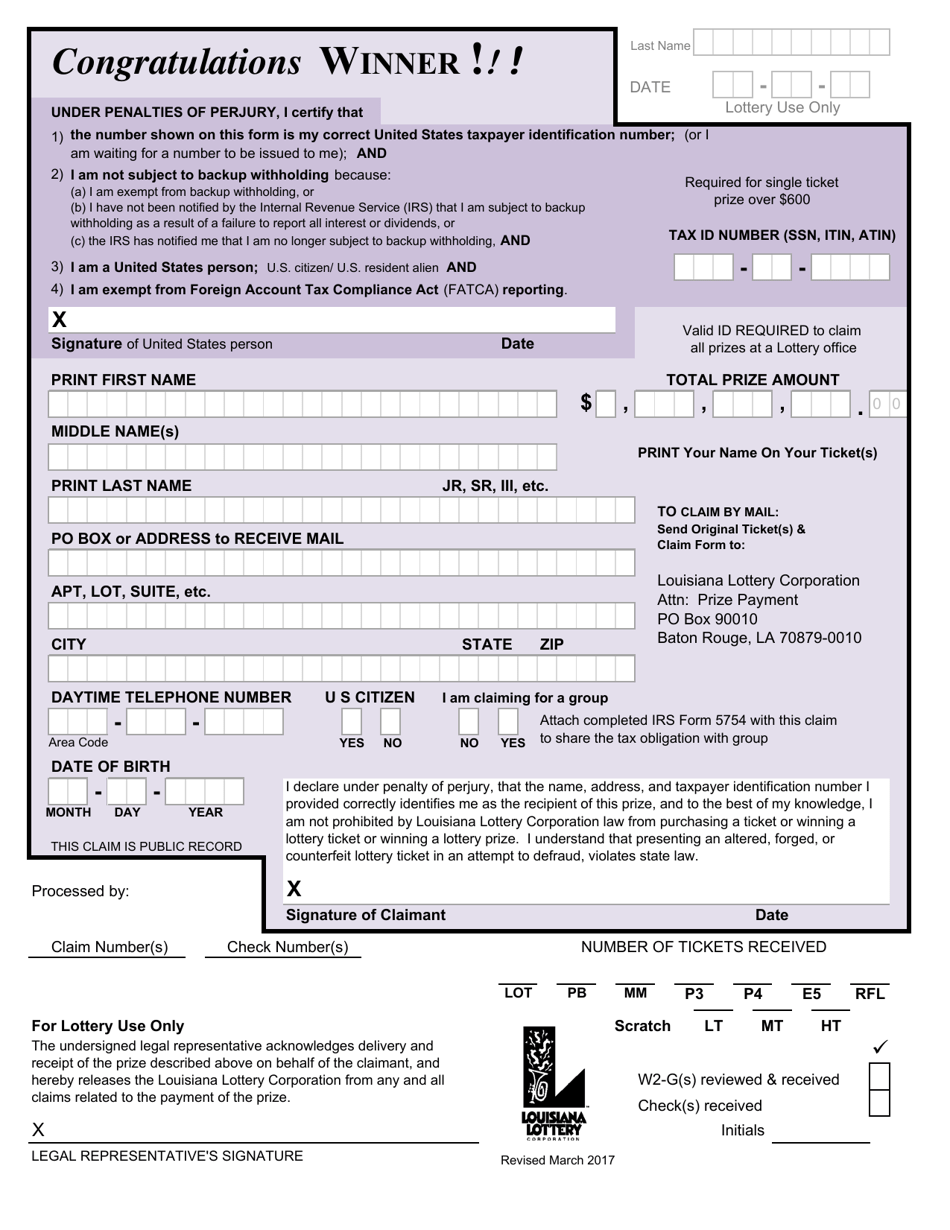

Louisiana Louisiana Lottery Corporation Winner Claim Form Download

Web the lottery tax credit is available to wisconsin property owners' primary residence. Lottery and gaming credit application. If a taxpayer pays their taxes in two or more. The lottery and gaming credit is shown on tax bills as a reduction of property taxes due. Web the wisconsin department of revenue (dor) posted the following 2021 lottery and gaming credit.

Instructions To Claimant You Must Sign The Ticket(S) And Claim Form In Black Or.

Web lottery credit available for primary residences only. Municipal clerks and treasurers, county clerks and treasurers. Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department. Game touch 20 (gt20) vending quick.

Web Catch The Top Stories Of The Day On Anc’s ‘Top Story’ (20 July 2023)

Web the lottery tax credit is available to wisconsin property owners' primary residence. Web the 2023 chevrolet bolt. Web the wisconsin department of revenue (dor) posted the following 2021 lottery and gaming credit forms on our website. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500.

Web December 20, 2019 To:

Web wisconsin lottery and gaming credit application 2023 wi dept of revenue who can claim this credit? Field marketing rep map and numbers. Web contracting and accounting forms. Web the wisconsin department of revenue (dor) posted the following 2019 lottery and gaming credit forms on our website.

Web To Qualify For A 2023 Wisconsin State Lottery And Gaming Credit, You Must Attest And Prove That You Are The Owner Of The Affected Property And That It Was Your.

Property owners file this form to affirm they qualify for the lottery and gaming credit as of. Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department. Each year at the end of december a lottery credit request form is available for home owners to file in order to apply for the. If a taxpayer pays their taxes in two or more.