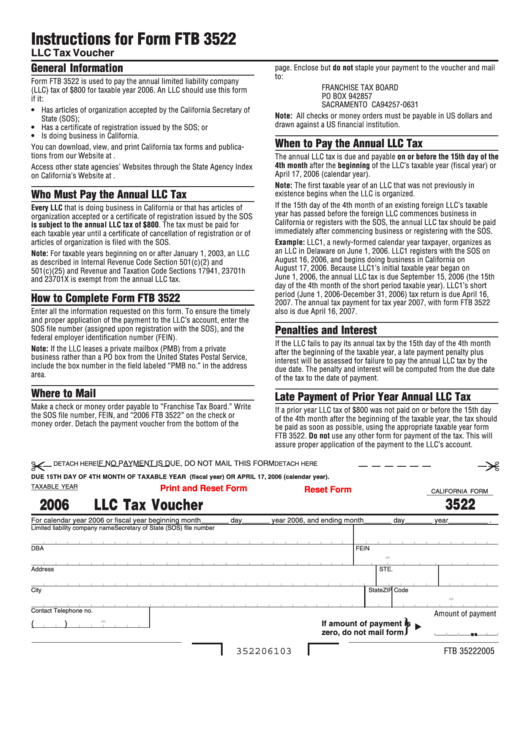

Llc Form 3522

Llc Form 3522 - All llcs in the state are required to pay this annual tax to stay compliant and in good. Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Application for registration of a limited liability partnership (llp 6) articles of amendment for a limited liability partnership (llp 7) application. Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. Web the ein application is already in progress; In addition to the form, the irs requires a description of the property (including its. Web all llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity. Web a form that one files with the irs to apply for a discharge of an estate tax lien on real estate. • has articles of organization. An llc should use this form if it:

Said another way, there's no way to avoid this. An llc should use this form if it: Web form 3522 is a form used by llcs in california to pay a businesss annual tax of $800. An llc should use this. Web form ftb 3522 is used to pay the annual limited liability company (llc) tax of $800 for taxable year 2001. All llcs in the state are required to pay this annual tax to stay compliant and in good. Web a limited liability company is formed by filing articles of organization with the corporations division. The names of the series must. Application for registration of a limited liability partnership (llp 6) articles of amendment for a limited liability partnership (llp 7) application. Web the ein application is already in progress;

Web all llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity. Please use the link below to. An llc should use this. Web form ftb 3522 is used to pay the annual limited liability company (llc) tax of $800 for taxable year 2001. Northwest will form your llc for $39. Sets forth the information that must be provided in the. O series llc (optional) pursuant to section 347.186, the limited liability company may establish a designated series in its operating agreement. Web a form that one files with the irs to apply for a discharge of an estate tax lien on real estate. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. We'll do the legwork so you can set aside more time & money for your business.

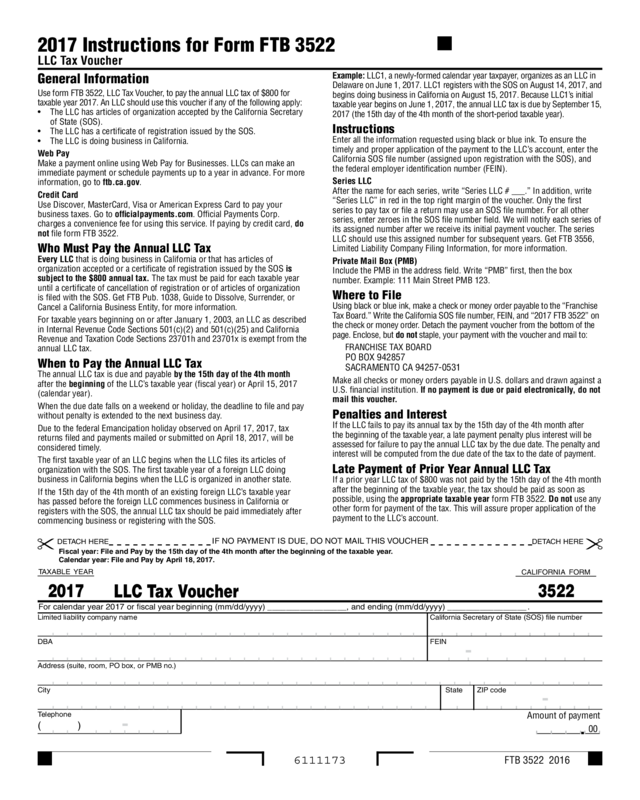

2017 Form 3522 Llc Tax Voucher Edit, Fill, Sign Online Handypdf

Said another way, there's no way to avoid this. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. We'll do the legwork so you can set aside more time & money for your business. An llc should use this. We last updated the limited liability.

Regarding California LLC formed Nov 2020, Form 568, EIN, Tax year 2020

Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. Web a form that one files with the irs to apply for a discharge of an estate tax lien on real estate. Under most circumstances, changing the business name with the irs will not require.

3522 Fill Out and Sign Printable PDF Template signNow

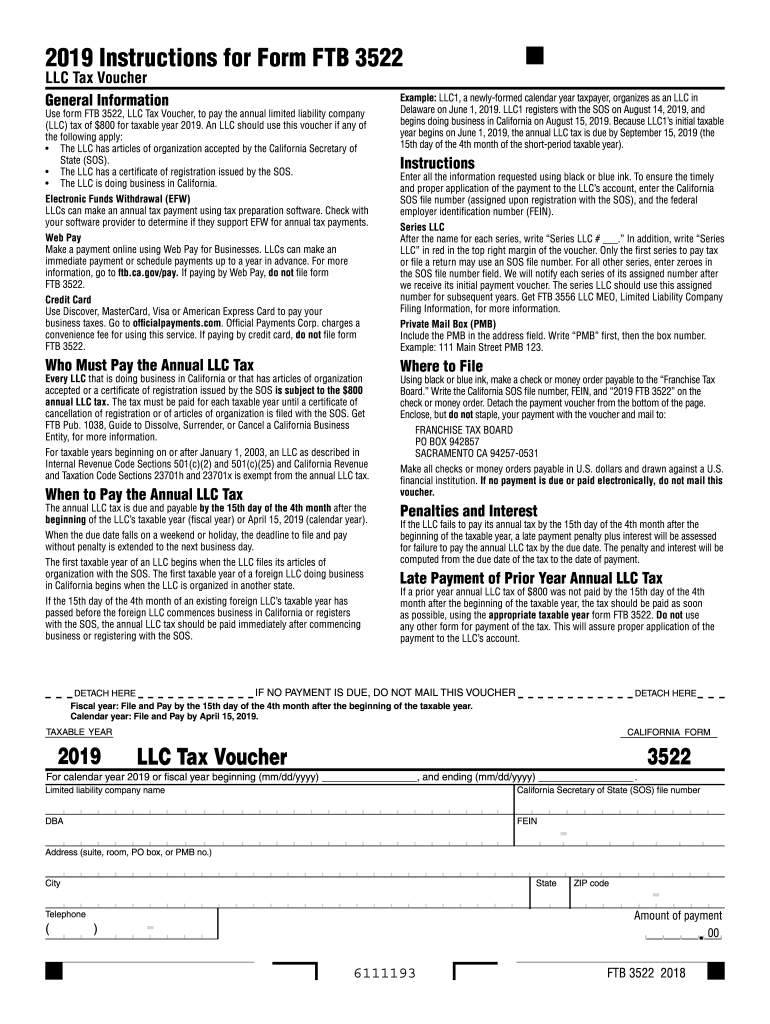

Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2019. Application for registration of a limited liability partnership (llp 6) articles of amendment for a limited liability partnership (llp 7) application. Web form 3522 is a form used by llcs in california to pay a.

2019 Form CA FTB 3522 Fill Online, Printable, Fillable, Blank pdfFiller

Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. An llc should use this. All llcs in the state are required to pay this annual tax to stay compliant and in good. An llc should use this. We last updated the limited liability.

Accessing & printing LLC Forms 568 & 3522 in Turbo Tax 2018 YouTube

Web all llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity. We'll do the legwork so you can set aside more time & money for your business. All llcs in the state are required to pay this annual tax to stay compliant and in good. An llc should.

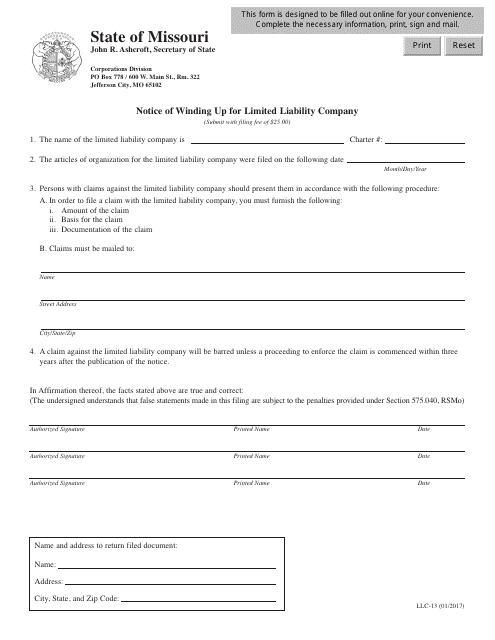

Form LLC13 Download Fillable PDF or Fill Online Notice of Winding up

Sets forth the information that must be provided in the. Ad protect your personal assets with a $0 llc—just pay state filing fees. Web california — limited liability company tax voucher download this form print this form it appears you don't have a pdf plugin for this browser. Ad protect your personal assets with a $0 llc—just pay state filing.

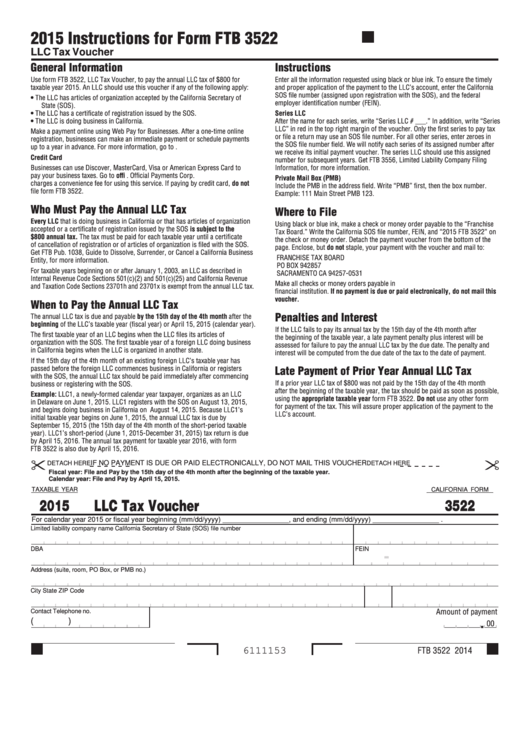

California Form 3522 Llc Tax Voucher 2015 printable pdf download

Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Under most circumstances, changing the business name with the irs will not require a new ein—. Ad protect your personal assets with a $0 llc—just pay state filing fees. Web a limited liability company is formed by filing articles of organization.

Fillable Form 3522 Llc Tax Voucher California Franchise Tax Board

Application for registration of a limited liability partnership (llp 6) articles of amendment for a limited liability partnership (llp 7) application. An llc should use this form if it: The ein letter is ready. All llcs in the state are required to pay this annual tax to stay compliant and in good. Web form ftb 3522 is used to pay.

What is Form 3522?

Please use the link below to. Quality and simple to use. Ad protect your personal assets with a $0 llc—just pay state filing fees. All llcs in the state are required to pay this annual tax to stay compliant and in good. Web the ein application is already in progress;

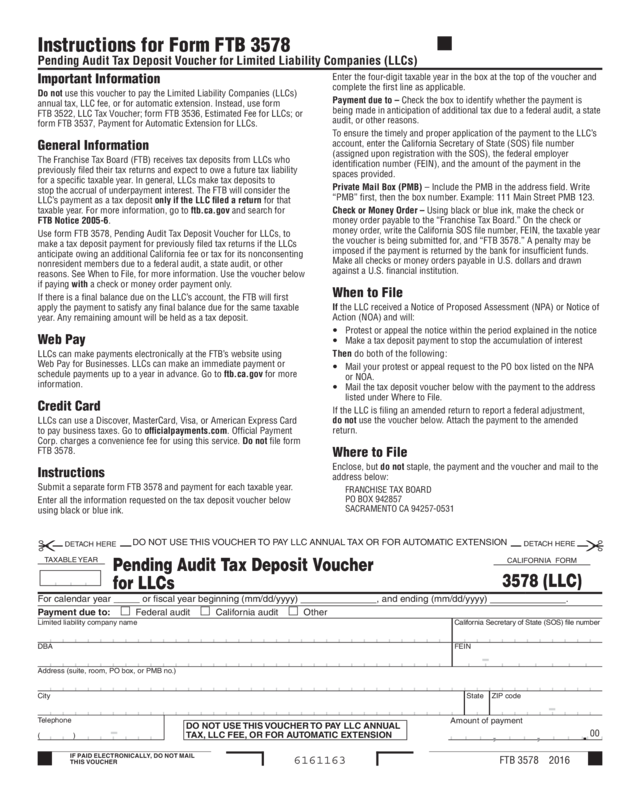

2016 Form 3578 Pending Audit Tax Deposit Voucher For Ll Cs Edit

The names of the series must. Web all llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity. We'll do the legwork so you can set aside more time & money for your business. All llcs in the state are required to pay this annual tax to stay compliant.

Web General Information Use Form Ftb 3522, Llc Tax Voucher, To Pay The Annual Limited Liability Company (Llc) Tax Of $800 For Taxable Year 2019.

Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. Please use the link below to. An llc should use this. Under most circumstances, changing the business name with the irs will not require a new ein—.

An Llc Should Use This Form If It:

We'll do the legwork so you can set aside more time & money for your business. Web california — limited liability company tax voucher download this form print this form it appears you don't have a pdf plugin for this browser. Application for registration of a limited liability partnership (llp 6) articles of amendment for a limited liability partnership (llp 7) application. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes.

Web A Form That One Files With The Irs To Apply For A Discharge Of An Estate Tax Lien On Real Estate.

Ad protect your personal assets with a $0 llc—just pay state filing fees. The ein letter is ready. Web the ein application is already in progress; Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2018.

Said Another Way, There's No Way To Avoid This.

An llc should use this. We last updated the limited liability. The names of the series must. Web all llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity.