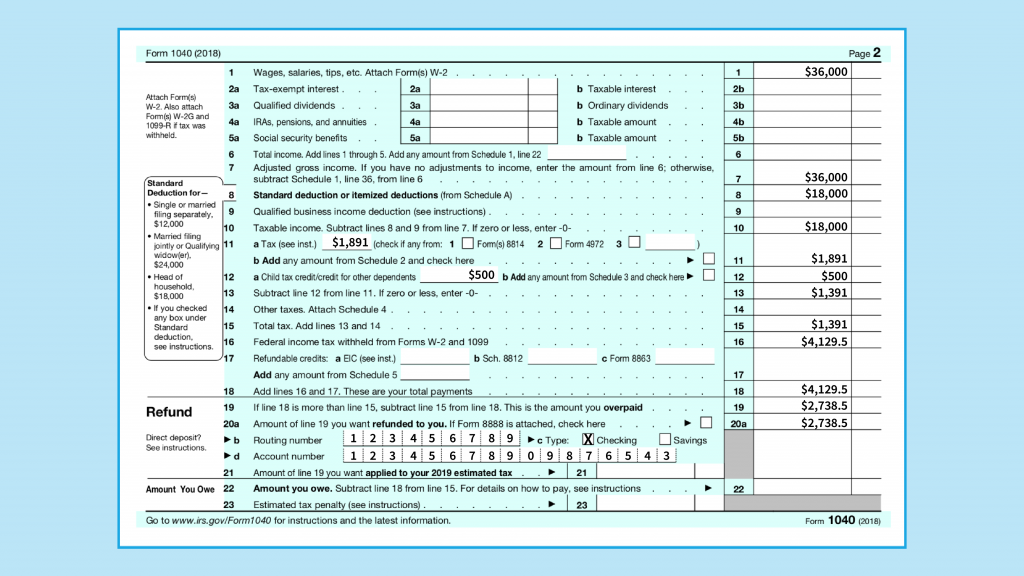

Line 4A Form 1040

Line 4A Form 1040 - (you generally don’t need to pay income tax on roth ira. If you completed this worksheet last year, skip line 3 and enter the amount. If you take any before age. Enter on line 4a the distribution from. Web use lines 4a and 4b to report a rollover, including a direct rollover, from one qualified employer's plan to another or to an ira or sep. Web in this case, all withdrawals are 100% taxable, and you must include them on lines 4a and 4b of your form 1040 for the year you take them. Any credit not attributable to. Form 1040a is a shorter version of the more detailed form 1040, but. Web the medical and dental expenses are addressed as part of schedule a, line 4 on the 1040 form. Individual income tax return according to the irs instructions.

Web the medical and dental expenses are addressed as part of schedule a, line 4 on the 1040 form. Web use lines 4a and 4b to report a rollover, including a direct rollover, from one qualified employer's plan to another or to an ira or sep. Web enter the total pension or annuity payments received in 2018 on form 1040, line 4a. Web the instructions for the irs form 1040 explain how to report contributions to your retirement account, whether they're related to the special rmd waiver or something. Web the credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. Exceptions to this are listed in the irs instructions for form 1040. If you take any before age. Web in this case, all withdrawals are 100% taxable, and you must include them on lines 4a and 4b of your form 1040 for the year you take them. If you completed this worksheet last year, skip line 3 and enter the amount. More to follow on this.

Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. Web the instructions for the irs form 1040 explain how to report contributions to your retirement account, whether they're related to the special rmd waiver or something. Web line 4a is where you write all your income from iras, and line 4b is for your taxable ira income. Web the taxact ® program will determine what amount (if any) needs to appear on lines 4a and 4b of form 1040 u.s. Web enter the total pension or annuity payments received in 2018 on form 1040, line 4a. Web the irs form 1040a is one of three forms you can use to file your federal income tax return. If you take any before age. (you generally don’t need to pay income tax on roth ira. Enter on line 4a the distribution from. When should you opt for itemizing your.

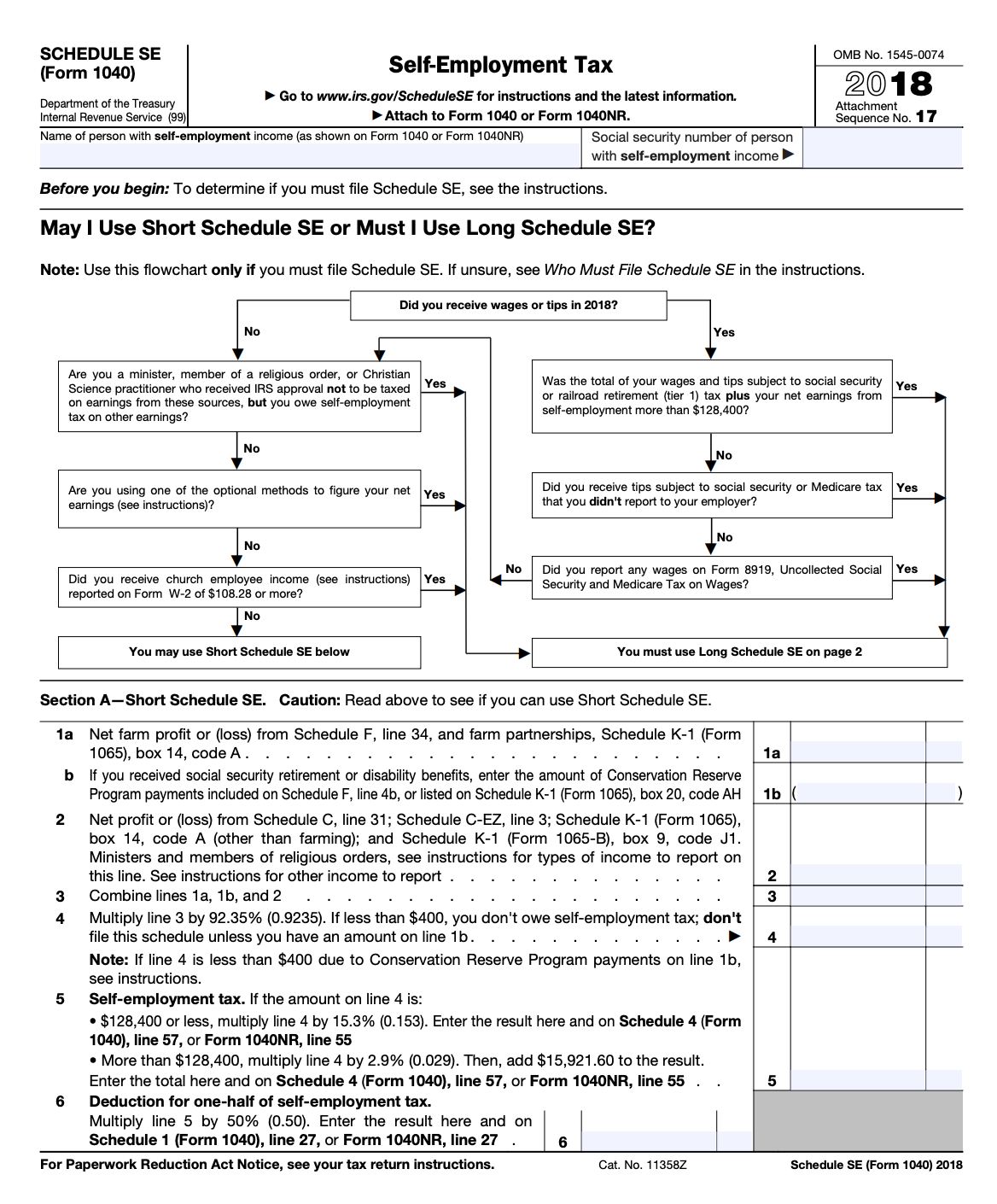

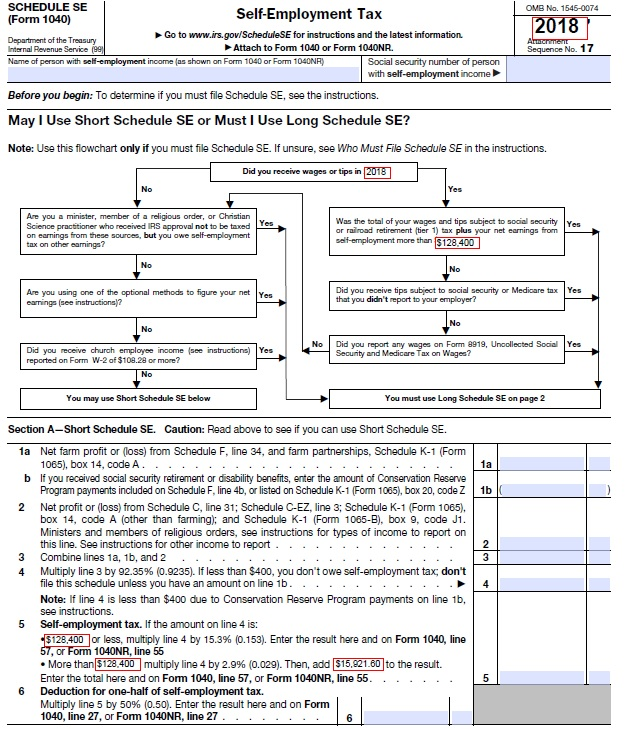

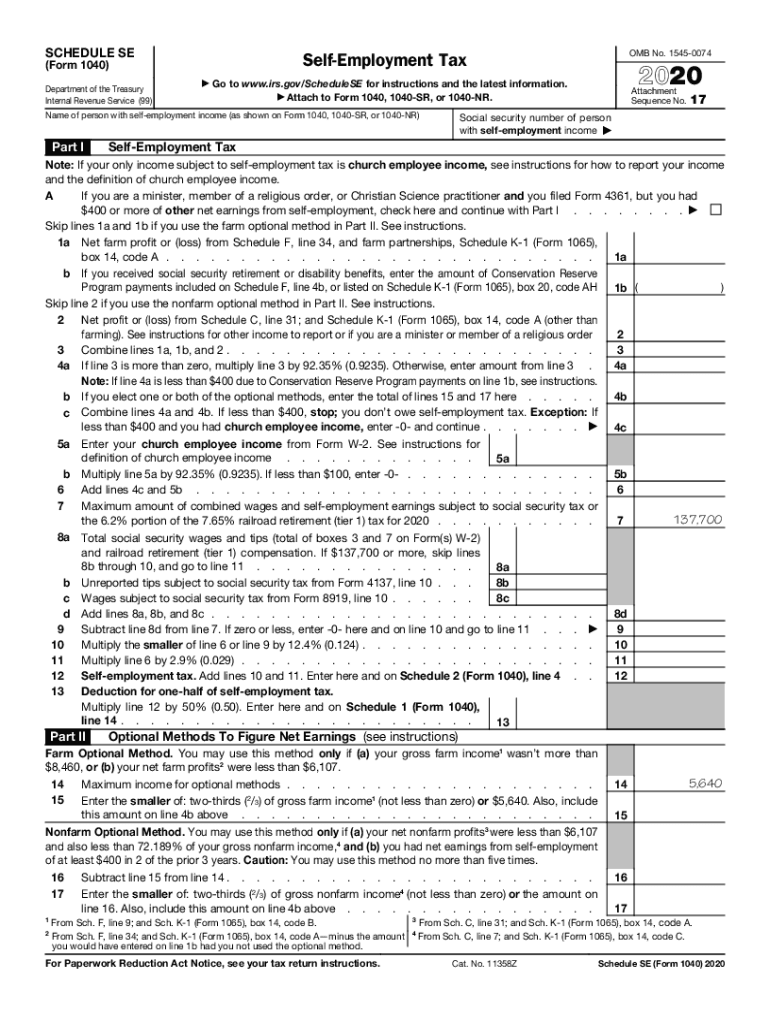

1040 Schedule C And Schedule Se Tax Form 1040 Form Printable

Web the taxact ® program will determine what amount (if any) needs to appear on lines 4a and 4b of form 1040 u.s. If you completed this worksheet last year, skip line 3 and enter the amount. Any credit not attributable to. Web the medical and dental expenses are addressed as part of schedule a, line 4 on the 1040.

Irs Form 1040 Schedule C Line 31 Ppp Second Draw Application Tutorial

Form 1040a is a shorter version of the more detailed form 1040, but. Web the taxact ® program will determine what amount (if any) needs to appear on lines 4a and 4b of form 1040 u.s. (you generally don’t need to pay income tax on roth ira. When should you opt for itemizing your. More to follow on this.

Form 1040 Line By Line Instructions 1040 Form Printable

Any credit not attributable to. If you take any before age. Web the taxact ® program will determine what amount (if any) needs to appear on lines 4a and 4b of form 1040 u.s. Web line 4a is where you write all your income from iras, and line 4b is for your taxable ira income. Web the medical and dental.

2020 Form IRS 1040 Schedule SE Fill Online, Printable, Fillable

If you take any before age. Web line 4a is where you write all your income from iras, and line 4b is for your taxable ira income. Web the taxact ® program will determine what amount (if any) needs to appear on lines 4a and 4b of form 1040 u.s. Any credit not attributable to. Web the instructions for the.

How to fill out the 2019 1040 tax form for singles with no dependents

Exceptions to this are listed in the irs instructions for form 1040. Web enter the total pension or annuity payments received in 2018 on form 1040, line 4a. Web line 4a is where you write all your income from iras, and line 4b is for your taxable ira income. Web in this case, all withdrawals are 100% taxable, and you.

3 Ways to Claim a Child Tax Credit wikiHow

Web the irs form 1040a is one of three forms you can use to file your federal income tax return. Web line 4a is where you write all your income from iras, and line 4b is for your taxable ira income. Web the instructions for the irs form 1040 explain how to report contributions to your retirement account, whether they're.

Form Mo1040A Missouri Department Of Revenue Edit, Fill, Sign

When should you opt for itemizing your. Web the instructions for the irs form 1040 explain how to report contributions to your retirement account, whether they're related to the special rmd waiver or something. Web enter the total pension or annuity payments received in 2018 on form 1040, line 4a. Form 1040a is a shorter version of the more detailed.

Form 1040 U.S. Individual Tax Return Definition

Individual income tax return according to the irs instructions. Exceptions to this are listed in the irs instructions for form 1040. If you completed this worksheet last year, skip line 3 and enter the amount. (you generally don’t need to pay income tax on roth ira. Web the instructions for the irs form 1040 explain how to report contributions to.

What Is the 1040 and What's the Difference Between the 1040, 1040A and

Web use lines 4a and 4b to report a rollover, including a direct rollover, from one qualified employer's plan to another or to an ira or sep. If you completed this worksheet last year, skip line 3 and enter the amount. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you.

Fill Free fillable Form 1040 2018 Simplified Method Worksheet lines

Exceptions to this are listed in the irs instructions for form 1040. Web the medical and dental expenses are addressed as part of schedule a, line 4 on the 1040 form. Web line 4a is where you write all your income from iras, and line 4b is for your taxable ira income. (you generally don’t need to pay income tax.

Exceptions To This Are Listed In The Irs Instructions For Form 1040.

Web in this case, all withdrawals are 100% taxable, and you must include them on lines 4a and 4b of your form 1040 for the year you take them. Web the medical and dental expenses are addressed as part of schedule a, line 4 on the 1040 form. Any credit not attributable to. If you take any before age.

(You Generally Don’t Need To Pay Income Tax On Roth Ira.

Web use lines 4a and 4b to report a rollover, including a direct rollover, from one qualified employer's plan to another or to an ira or sep. Web the credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. Individual income tax return according to the irs instructions. Web enter the total pension or annuity payments received in 2018 on form 1040, line 4a.

Web Single Married Filing Jointly Married Filing Separately (Mfs) Head Of Household (Hoh) Qualifying Surviving Spouse (Qss) If You Checked The Mfs Box, Enter The Name Of Your.

Web line 4a is where you write all your income from iras, and line 4b is for your taxable ira income. Web the taxact ® program will determine what amount (if any) needs to appear on lines 4a and 4b of form 1040 u.s. Web the instructions for the irs form 1040 explain how to report contributions to your retirement account, whether they're related to the special rmd waiver or something. More to follow on this.

Form 1040A Is A Shorter Version Of The More Detailed Form 1040, But.

When should you opt for itemizing your. Web usually, if the amount is fully taxable, line 4a is left blank and the total distribution is entered on line 4b. Enter on line 4a the distribution from. If you completed this worksheet last year, skip line 3 and enter the amount.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)