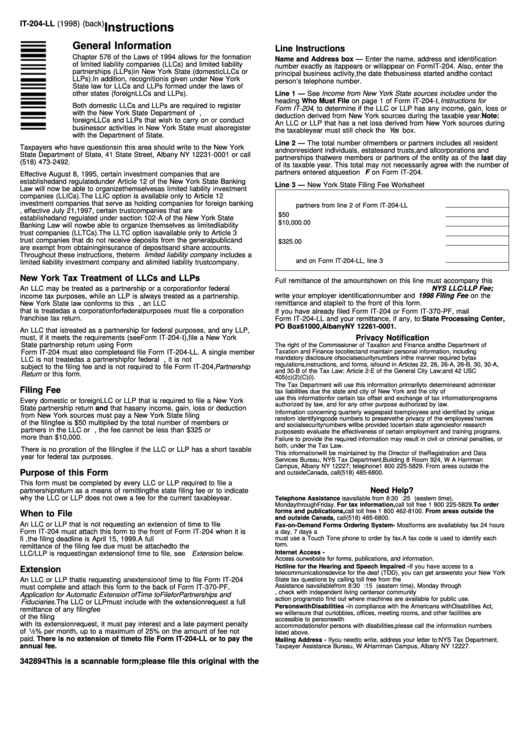

It-204-Ll Form

It-204-Ll Form - Web 19 rows partnership return; Web quick steps to complete and esign form it 204 ll online: Start completing the fillable fields and. An llc or llp that is. To complete the full new york partnership return: Save or instantly send your ready documents. Every llc that is a disregarded entity for. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,. Use get form or simply click on the template preview to open it in the editor.

Use get form or simply click on the template preview to open it in the editor. \u2022 limited liability company (llc). To complete the full new york partnership return: Web quick steps to complete and esign form it 204 ll online: Easily fill out pdf blank, edit, and sign them. An llc or llp that is. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Liability partnership filing fee payment form, must be filed by. Web 19 rows partnership return; Every llc that is a disregarded entity for.

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Liability partnership filing fee payment form, must be filed by. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. \u2022 limited liability company (llc). Web quick steps to complete and esign form it 204 ll online: Easily fill out pdf blank, edit, and sign them. Start completing the fillable fields and. Use get form or simply click on the template preview to open it in the editor. Save or instantly send your ready documents. Every llc that is a disregarded entity for.

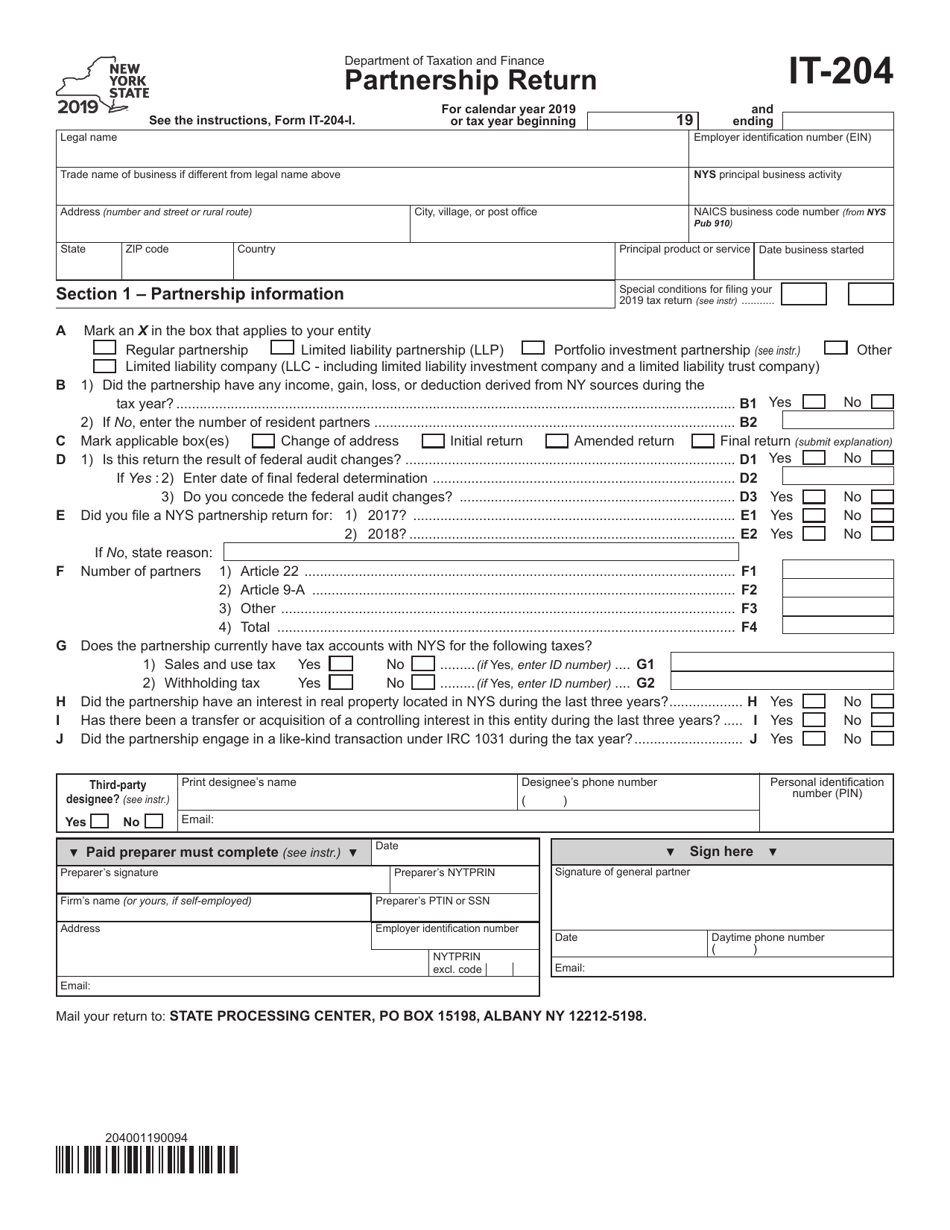

Form IT204 Download Fillable PDF or Fill Online Partnership Return

To complete the full new york partnership return: \u2022 limited liability company (llc). Easily fill out pdf blank, edit, and sign them. Web 19 rows partnership return; Used to report income, deductions, gains, losses and credits from the operation of a partnership.

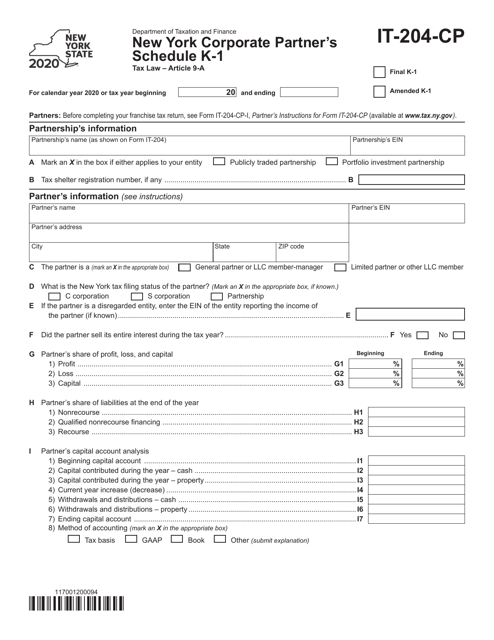

Form IT204CP Download Fillable PDF or Fill Online New York Corporate

Web 19 rows partnership return; Start completing the fillable fields and. Web quick steps to complete and esign form it 204 ll online: Used to report income, deductions, gains, losses and credits from the operation of a partnership. Liability partnership filing fee payment form, must be filed by.

Infratech IT204C американский Эоп Gen3 ITT /100т.р. продам.

Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,. Every llc that is a disregarded entity for. Save or instantly send your ready documents. \u2022 limited liability company (llc). Used to report income, deductions, gains, losses and credits.

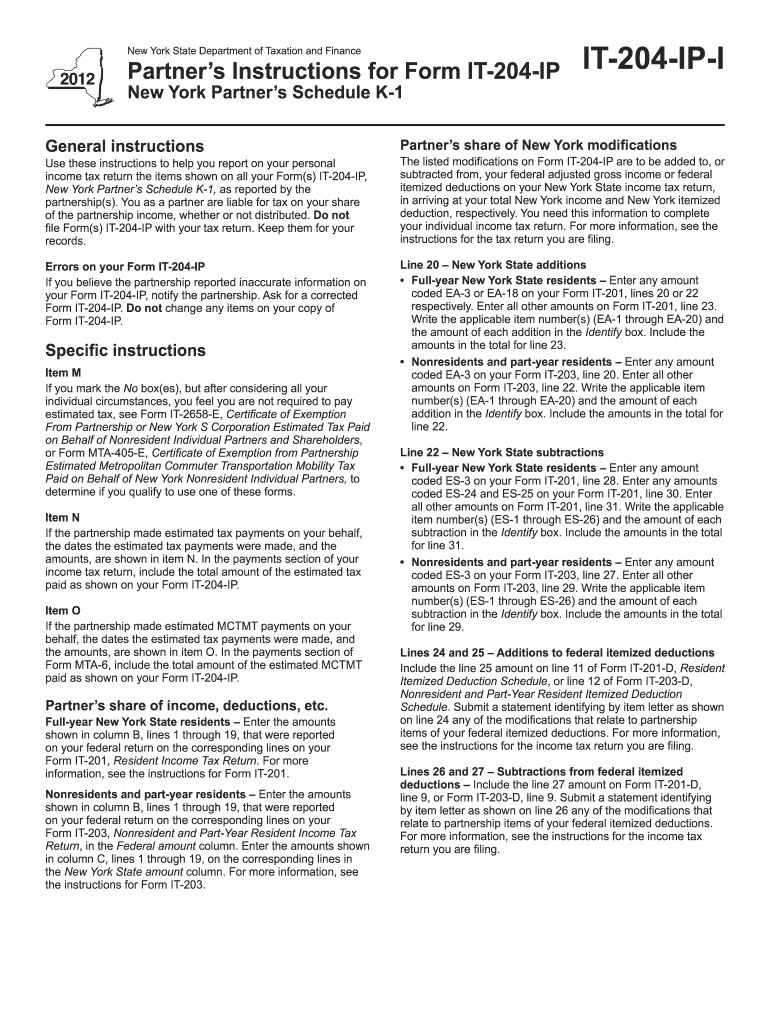

2012 Form NY IT204IPI Fill Online, Printable, Fillable, Blank

An llc or llp that is. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web 19 rows partnership return; Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,. Payment vouchers are.

Idm 1 Month Free / All Four Love DIY Month to Month Stickers Idm

Start completing the fillable fields and. Every llc that is a disregarded entity for. \u2022 limited liability company (llc). To complete the full new york partnership return: An llc or llp that is.

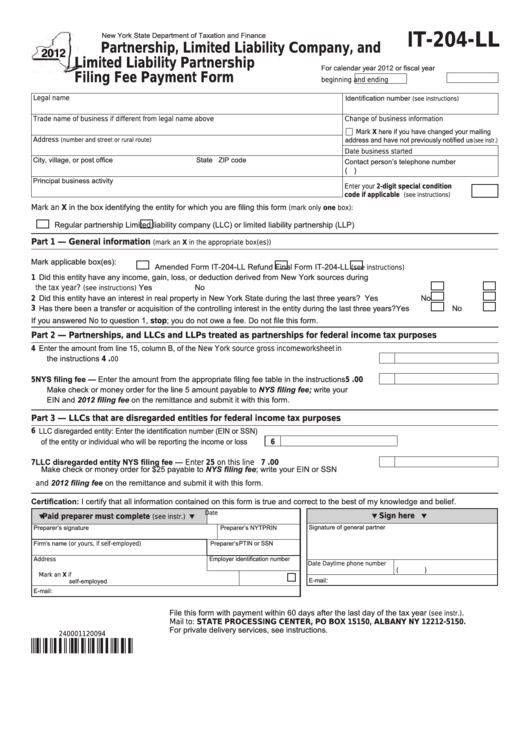

NY IT204LL 20152021 Fill and Sign Printable Template Online US

To complete the full new york partnership return: Start completing the fillable fields and. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,..

204 Form YouTube

Every llc that is a disregarded entity for. Liability partnership filing fee payment form, must be filed by. Easily fill out pdf blank, edit, and sign them. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web 19 rows partnership return;

Fillable Form It204Ll Partnership, Limited Liability Company, And

\u2022 limited liability company (llc). Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,. Liability partnership filing fee payment form, must be filed by. An llc or llp that is. Used to report income, deductions, gains, losses and.

Infratech IT204C американский Эоп Gen3 ITT /100т.р. продам.

Every llc that is a disregarded entity for. Web 19 rows partnership return; Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,. Web quick steps to complete and esign form it 204 ll online: \u2022 limited liability company.

Instructions For Form It204Ll Limited Liability Company/limited

Start completing the fillable fields and. Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,. \u2022 limited liability company (llc). Every llc that is a disregarded entity for. An llc or llp that is.

\U2022 Limited Liability Company (Llc).

Every llc that is a disregarded entity for. An llc or llp that is. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Liability partnership filing fee payment form, must be filed by.

Payment Vouchers Are Provided To Accompany Checks Mailed To Pay Off Tax Liabilities, And Are Used By The Revenue.

Use get form or simply click on the template preview to open it in the editor. Save or instantly send your ready documents. Web but every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of new york state, or (2) any income, gain,. Easily fill out pdf blank, edit, and sign them.

Start Completing The Fillable Fields And.

To complete the full new york partnership return: Web quick steps to complete and esign form it 204 ll online: Web 19 rows partnership return;