Irs Form 8855

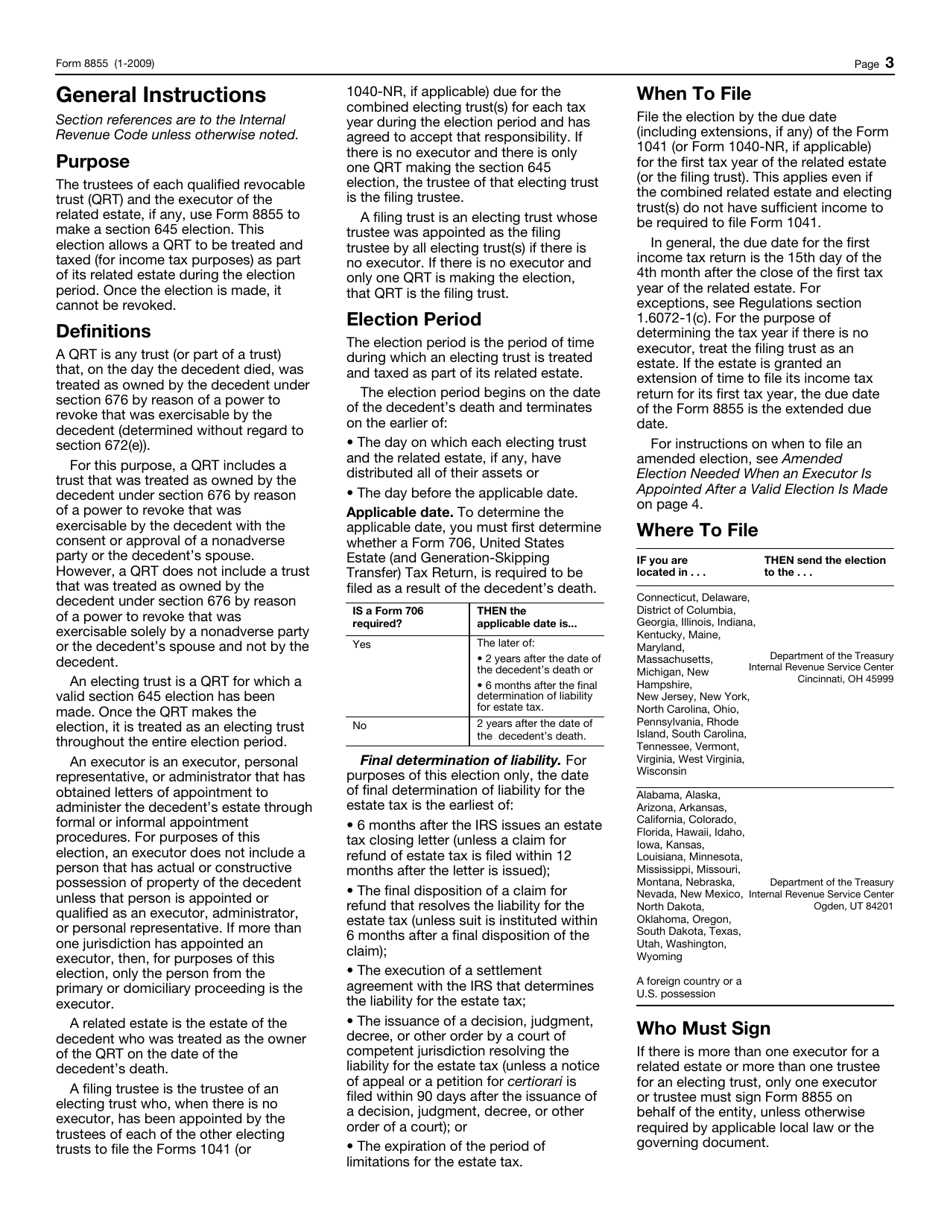

Irs Form 8855 - Web we believe a copy of form 8855 should be attached for all years during the election period, as the form provides valuable information for anyone who reviews form 1041, and therefore the language requiring the attachment of a statement should be deleted in the two places in which it appears. Without the election made, there would be two separate entities that would result in an irrevocable trust after the settler passes away as well as the decedent’s estate. Name of estate (or the filing trust, if applicable (see instructions)) Address to mail form to irs. December 2020) election to treat a qualified revocable trust as part of an estate department of the treasury internal revenue service go to www.irs.gov/form8855 for the latest information. Web what is irs form 8855? A health insurance program offered for state employees. Web the election, which is irrevocable, is made by filing form 8855, election to treat a qualified revocable trust as part of an estate, no later than the time prescribed for filing the return for the first tax year of the estate, including extensions, or, where no probate estate exists, the due date of the qrt's income tax return, including. Web the election is made by the trustee and executor on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s (or in a case where there is no executor of the estate, the filing trust’s) initial income tax return. Continuation coverage provided by the state under a state law that requires such coverage.

Web essentially, form 8855 is what makes it possible to combine a trust and an estate into one taxable entity. Also known as the “election to treat a qualified revocable trust as part of an estate,” irs form 8855 allows executors and trustees for qualified revocable trusts to make section 645 elections. Web the election, which is irrevocable, is made by filing form 8855, election to treat a qualified revocable trust as part of an estate, no later than the time prescribed for filing the return for the first tax year of the estate, including extensions, or, where no probate estate exists, the due date of the qrt's income tax return, including. December 2020) election to treat a qualified revocable trust as part of an estate department of the treasury internal revenue service go to www.irs.gov/form8855 for the latest information. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee,. This, in turn, allows the trust and estate in question to be treated as a single entity for tax purposes. A health insurance program offered for state employees. Web form 8855 is used to make a section 645 election, which election allows a qualified revocable trust to be treated and taxed (for income tax purposes) as part of its related estate during the election period. Continuation coverage provided by the state under a state law that requires such coverage. Address to mail form to irs.

Web the election is made by the trustee and executor on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s (or in a case where there is no executor of the estate, the filing trust’s) initial income tax return. Web form 8855 is used to make a section 645 election, which election allows a qualified revocable trust to be treated and taxed (for income tax purposes) as part of its related estate during the election period. Web where to file your taxes (for form 8855) if you are located in. Web essentially, form 8855 is what makes it possible to combine a trust and an estate into one taxable entity. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee,. A health insurance program offered for state employees. Also known as the “election to treat a qualified revocable trust as part of an estate,” irs form 8855 allows executors and trustees for qualified revocable trusts to make section 645 elections. This, in turn, allows the trust and estate in question to be treated as a single entity for tax purposes. Web what is irs form 8855? Continuation coverage provided by the state under a state law that requires such coverage.

IRS Form 8855 Download Fillable PDF or Fill Online Election to Treat a

Name of estate (or the filing trust, if applicable (see instructions)) Web what is irs form 8855? A health insurance program offered for state employees. Web the election is made by the trustee and executor on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s (or.

Real Invest Center St Cloud, Minnesota, United States Professional

Without the election made, there would be two separate entities that would result in an irrevocable trust after the settler passes away as well as the decedent’s estate. A health insurance program offered for state employees. December 2020) election to treat a qualified revocable trust as part of an estate department of the treasury internal revenue service go to www.irs.gov/form8855.

form 8855 instructions 2022 Fill Online, Printable, Fillable Blank

Web the election, which is irrevocable, is made by filing form 8855, election to treat a qualified revocable trust as part of an estate, no later than the time prescribed for filing the return for the first tax year of the estate, including extensions, or, where no probate estate exists, the due date of the qrt's income tax return, including..

Irs Form 668 Wc) Instructions Form Resume Examples MoYolrmVZB

Web essentially, form 8855 is what makes it possible to combine a trust and an estate into one taxable entity. Web where to file your taxes (for form 8855) if you are located in. Address to mail form to irs. This, in turn, allows the trust and estate in question to be treated as a single entity for tax purposes..

All About IRS Form 8855 Tax Resolution Services

This, in turn, allows the trust and estate in question to be treated as a single entity for tax purposes. Also known as the “election to treat a qualified revocable trust as part of an estate,” irs form 8855 allows executors and trustees for qualified revocable trusts to make section 645 elections. Without the election made, there would be two.

IRS, Summit partners issue urgent EFIN scam alert to tax professionals

Web what is irs form 8855? Without the election made, there would be two separate entities that would result in an irrevocable trust after the settler passes away as well as the decedent’s estate. Web the election is made by the trustee and executor on form 8855, election to treat a qualified revocable trust as part of an estate, by.

IRS Letter, Complaint letter regarding Foundation for Excellence in

Part i estate (or filing trust) information. Web the election, which is irrevocable, is made by filing form 8855, election to treat a qualified revocable trust as part of an estate, no later than the time prescribed for filing the return for the first tax year of the estate, including extensions, or, where no probate estate exists, the due date.

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

A health insurance program offered for state employees. Name of estate (or the filing trust, if applicable (see instructions)) If there is more than one executor of the estate or. Web where to file your taxes (for form 8855) if you are located in. This, in turn, allows the trust and estate in question to be treated as a single.

IRS Form 8855 Download Fillable PDF or Fill Online Election to Treat a

Address to mail form to irs. Web the election, which is irrevocable, is made by filing form 8855, election to treat a qualified revocable trust as part of an estate, no later than the time prescribed for filing the return for the first tax year of the estate, including extensions, or, where no probate estate exists, the due date of.

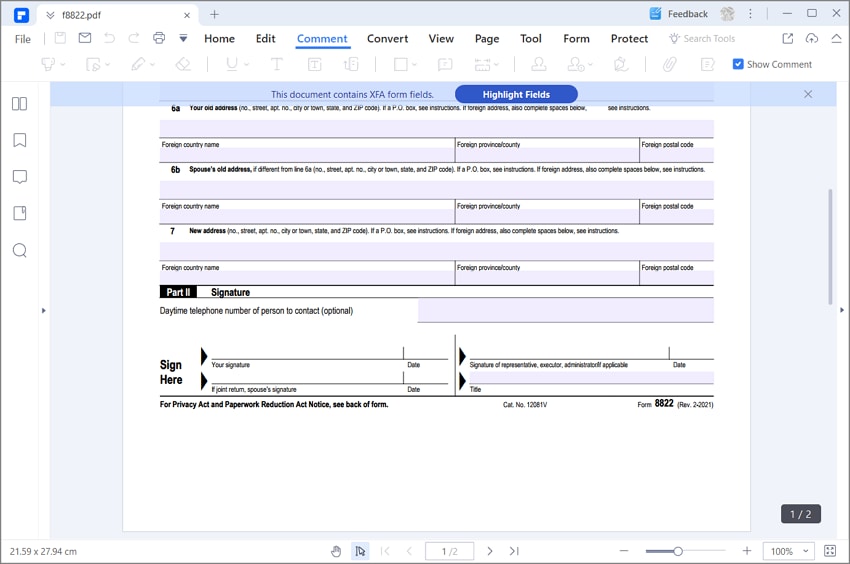

IRS Form 8822 The Best Way to Fill it

If there is more than one executor of the estate or. Web we believe a copy of form 8855 should be attached for all years during the election period, as the form provides valuable information for anyone who reviews form 1041, and therefore the language requiring the attachment of a statement should be deleted in the two places in which.

If There Is More Than One Executor Of The Estate Or.

Address to mail form to irs. Web the election is made by the trustee and executor on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s (or in a case where there is no executor of the estate, the filing trust’s) initial income tax return. Without the election made, there would be two separate entities that would result in an irrevocable trust after the settler passes away as well as the decedent’s estate. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee,.

Web The Election, Which Is Irrevocable, Is Made By Filing Form 8855, Election To Treat A Qualified Revocable Trust As Part Of An Estate, No Later Than The Time Prescribed For Filing The Return For The First Tax Year Of The Estate, Including Extensions, Or, Where No Probate Estate Exists, The Due Date Of The Qrt's Income Tax Return, Including.

This, in turn, allows the trust and estate in question to be treated as a single entity for tax purposes. Web what is irs form 8855? Web essentially, form 8855 is what makes it possible to combine a trust and an estate into one taxable entity. Part i estate (or filing trust) information.

Also Known As The “Election To Treat A Qualified Revocable Trust As Part Of An Estate,” Irs Form 8855 Allows Executors And Trustees For Qualified Revocable Trusts To Make Section 645 Elections.

December 2020) election to treat a qualified revocable trust as part of an estate department of the treasury internal revenue service go to www.irs.gov/form8855 for the latest information. Web form 8855 is used to make a section 645 election, which election allows a qualified revocable trust to be treated and taxed (for income tax purposes) as part of its related estate during the election period. A health insurance program offered for state employees. Name of estate (or the filing trust, if applicable (see instructions))

Web We Believe A Copy Of Form 8855 Should Be Attached For All Years During The Election Period, As The Form Provides Valuable Information For Anyone Who Reviews Form 1041, And Therefore The Language Requiring The Attachment Of A Statement Should Be Deleted In The Two Places In Which It Appears.

Continuation coverage provided by the state under a state law that requires such coverage. Web where to file your taxes (for form 8855) if you are located in.