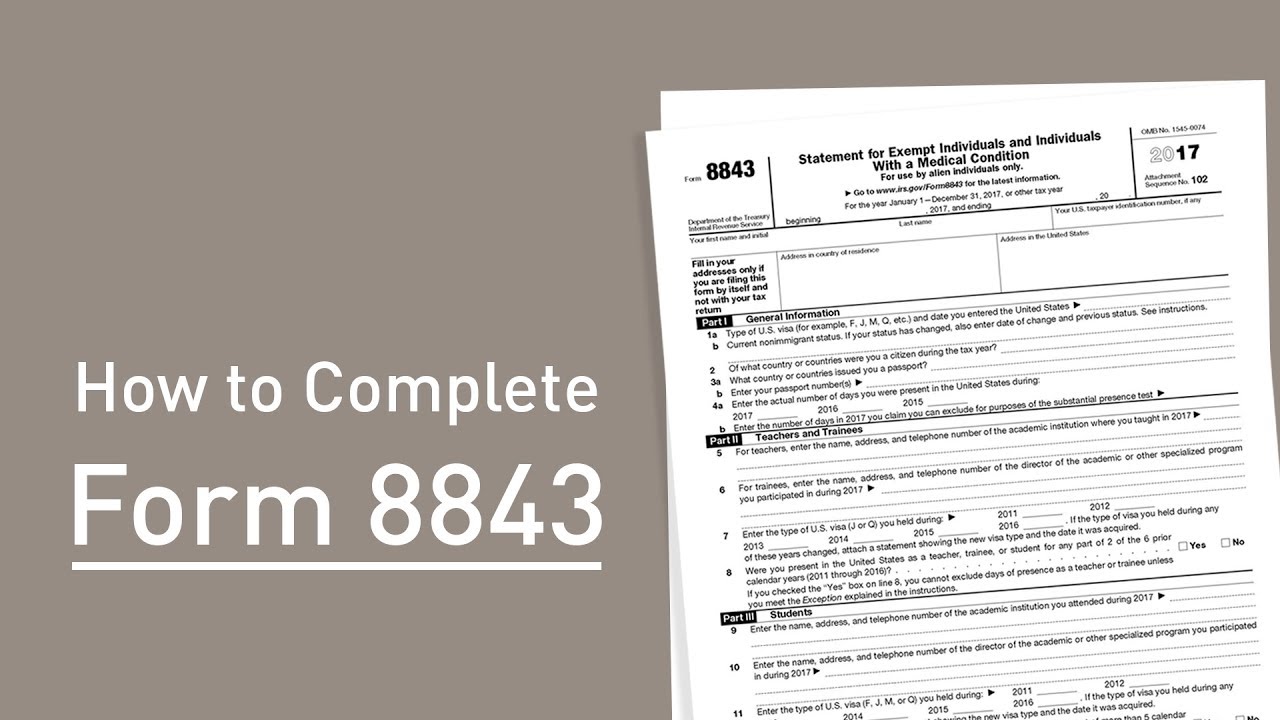

Irs Form 8843 Asu

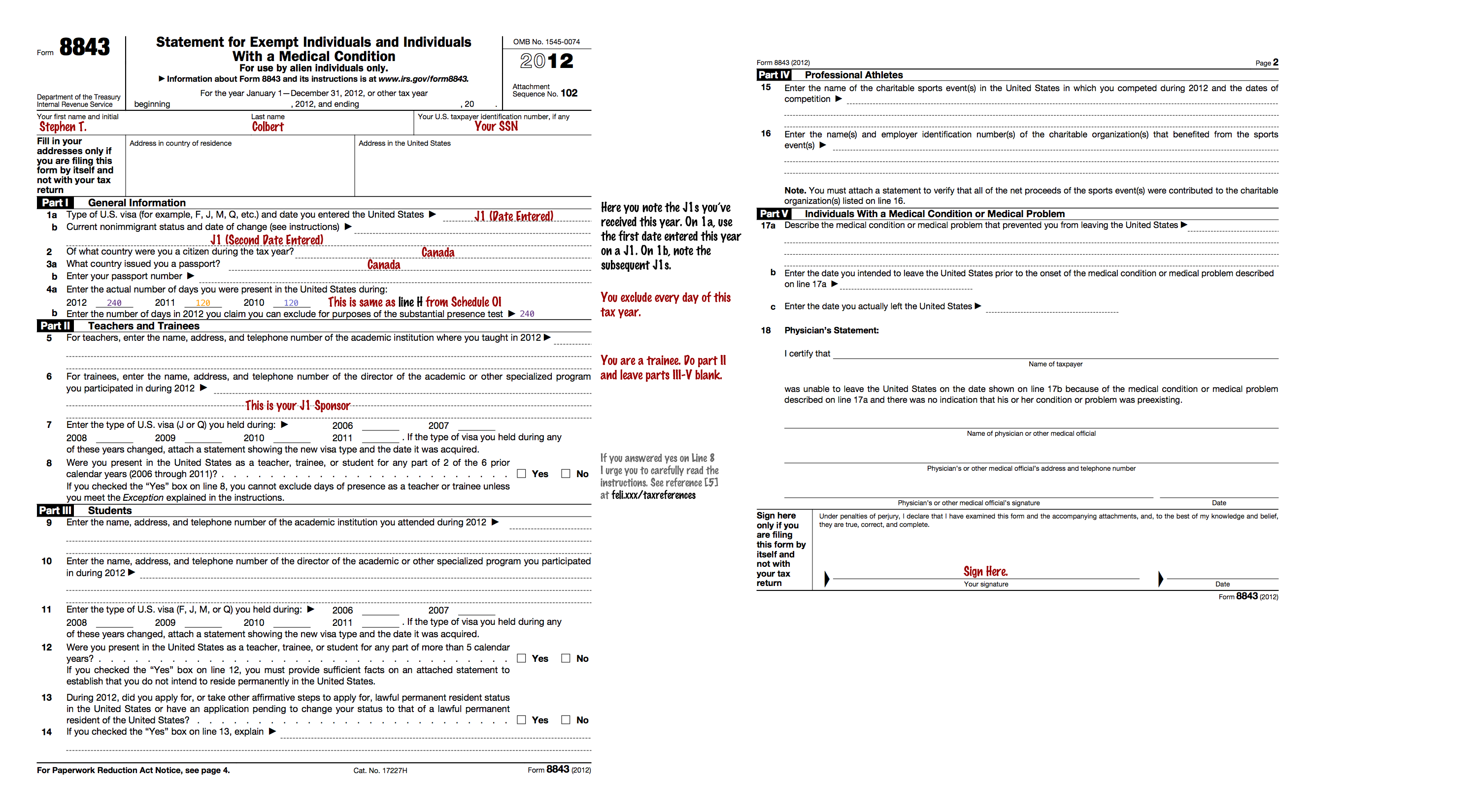

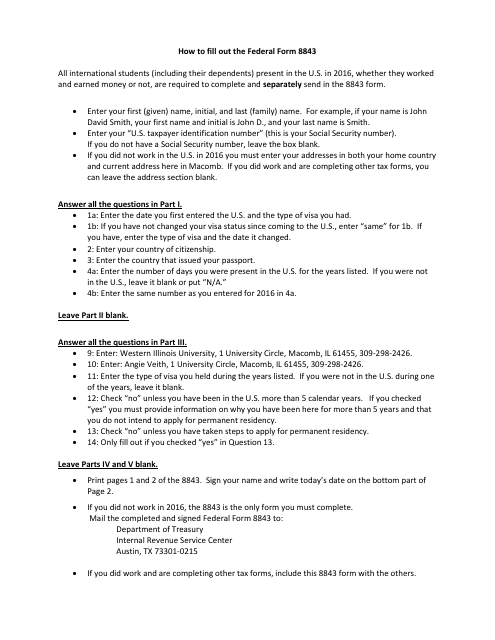

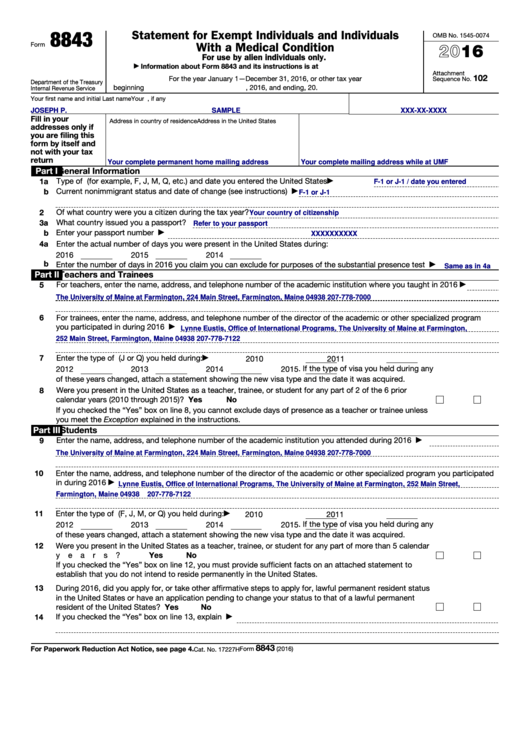

Irs Form 8843 Asu - Additional forms will be required based on your status as a resident or. Taxpayer identification number, if any you do not need an ssn or itin if you are only filing form 8843 yale university, new haven, ct 06520. Scholars complete parts i and ii of form 8843. You may also be required to file a tax return for every state you earned income in during 2022. Students who attend more than one academic institution during the year should report the one they. Go to www.irs.gov/form8843 for the latest information. The form 8843 instructions can be complex. This guide has been created to assist you in completing the form 8843. If your status has changed, also enter date of change and previous. Enter the name, address, and telephone number of the academic institution you attended during 2022.

31, 2022, you are obligated to send one form, form 8843, to the u.s. Students complete parts i and iii of form 8843. You must file this form to remain in compliance with the law. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. You may also be required to file a tax return for every state you earned income in during 2022. Arizona and/or other state requirements: In f or j status anytime between jan. Web where can i submit irs form 8843? The form is different than form 8840, which is used to. The irs also has additional guidance on.

The irs allows some foreigners who meet the substantial presence test (spt) to claim an exemption to u.s. I got an email from issc that i have to fill it out until april, but they didn't tell me about where to submit it. If you want to apply for permanent residence at a later date, you may be asked. Arizona and/or other state requirements: The irs also has additional guidance on. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. Students who attend more than one academic institution during the year should report the one they. In f or j status anytime between jan. This lesson is designed to teach tax preparers how to complete form 8843, statement for exempt individuals and individuals with a medical condition, for students and scholars you may be assisting. Tax agency irs, even if you had no income.

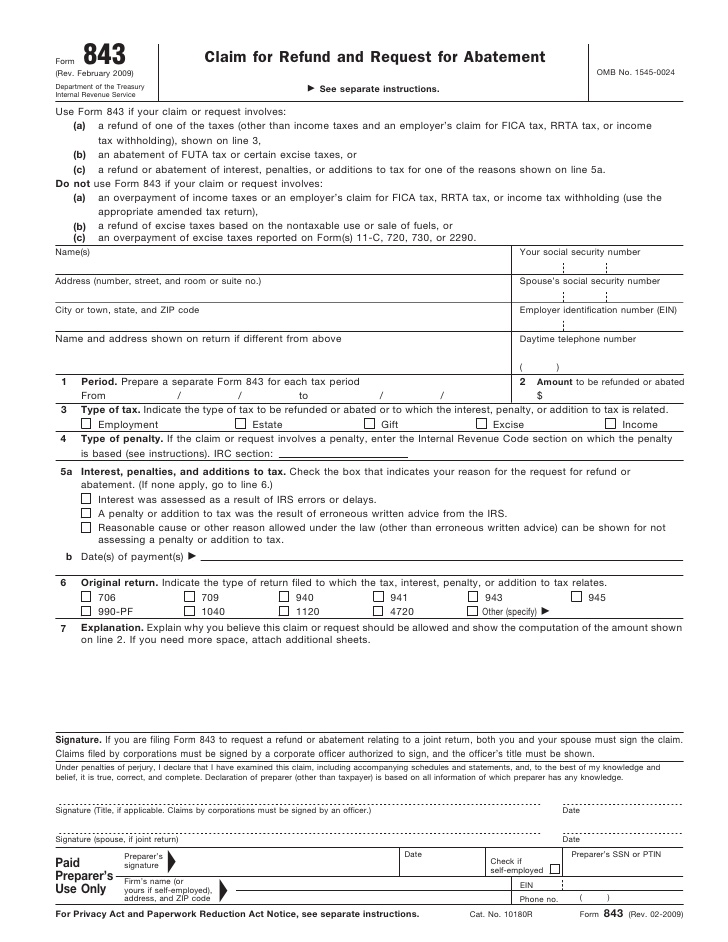

Form 843 amulette

The irs also has additional guidance on. Tax agency irs, even if you had no income. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. This guide has been created to assist you in completing the form 8843. Enter the name, address, and telephone number of.

[2016 버전] 미국 유학생 텍스 리턴 3편 (Form 8843 작성법) Bluemoneyzone

It is a simplified version of the irs instructions found on pp. Filers who complete parts iv and v should be referred to a professional tax preparer. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. Students complete parts i and iii. Web.

IRS Form 8843 Editable and Printable Statement to Fill out

Web when filling out form 8843, tax preparers must obtain information on why the student or scholar is in this country and information about the student's educational institution. If you want to apply for permanent residence at a later date, you may be asked. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals.

2023 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Scholars (teachers and trainees) complete. Students complete parts i and iii of form 8843. If your status has changed, also enter date of change and previous. How do i complete form 8843? Alien individuals use form 8843 to explain excluded days of presence in the u.s.

Unofficial UWaterloo Intern USA Tax Guide

How do i complete form 8843? Web form 8843 & instructions 2020: You may also be required to file a tax return for every state you earned income in during 2022. For the year january 1—december 31,. The irs allows some foreigners who meet the substantial presence test (spt) to claim an exemption to u.s.

Download Instructions for IRS Form 8843 Statement for Exempt

If you want to apply for permanent residence at a later date, you may be asked. Filers who complete parts iv and v should be referred to a professional tax preparer. 31, 2022, you are obligated to send one form, form 8843, to the u.s. For the year january 1—december 31,. Who is required to file form 8843?

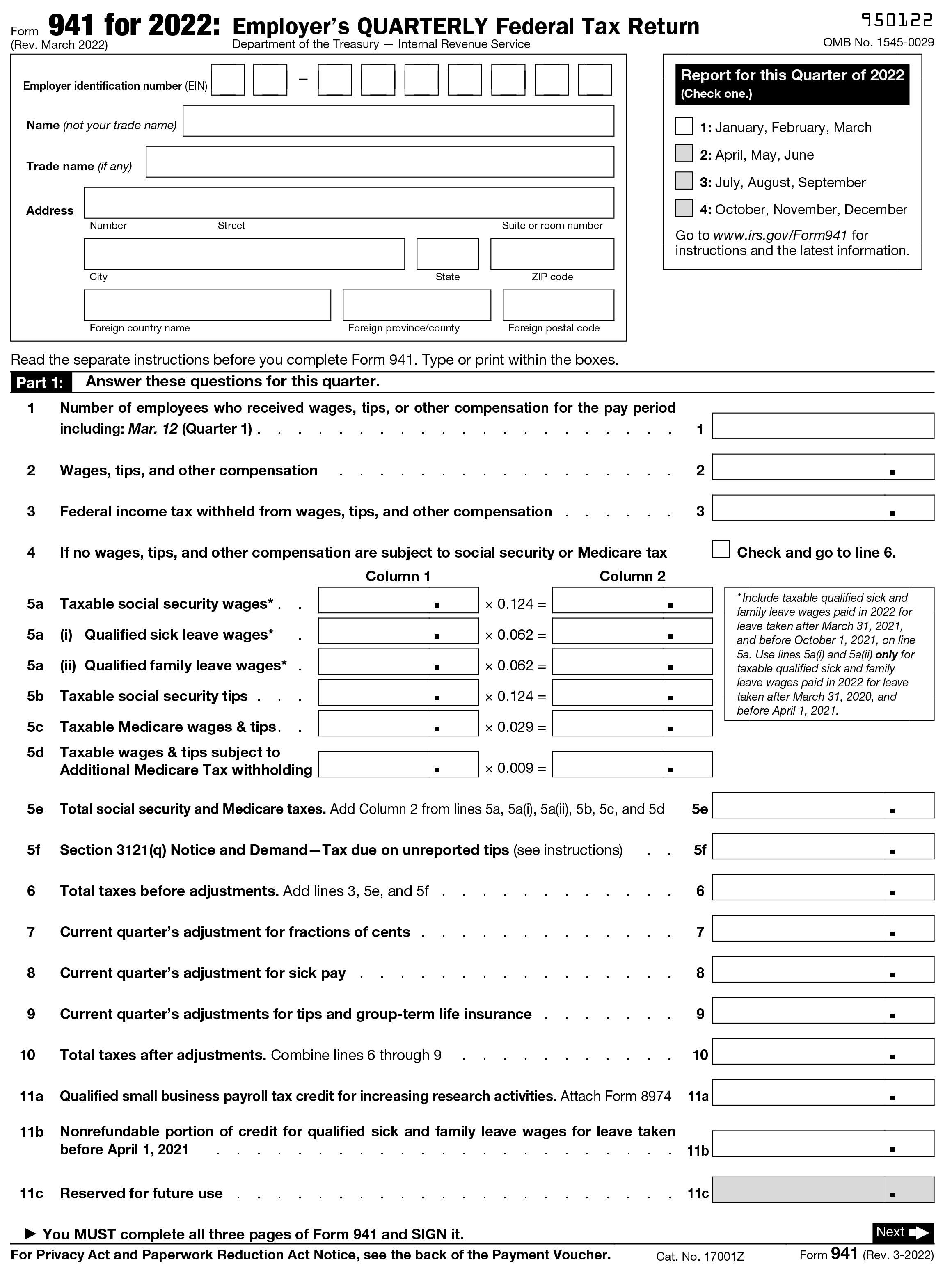

2022 IRS Form 941 filing instructions and informations

You may also be required to file a tax return for every state you earned income in during 2022. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. Go to www.irs.gov/form8843 for the latest information. Web if you are required to file a.

Irs Form 1098 T Instructions 2017 Universal Network

Arizona and/or other state requirements: This guide has been created to assist you in completing the form 8843. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including.

Fillable Form 8843 Statement For Exempt Individuals And Individuals

Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. The form 8843 instructions can be complex. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. Filers who complete parts.

8843 Form Tutorial YouTube

Students complete parts i and iii of form 8843. The form 8843 instructions can be complex. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. You must file this form to remain in compliance with the law. It is a simplified version of.

Web When Filling Out Form 8843, Tax Preparers Must Obtain Information On Why The Student Or Scholar Is In This Country And Information About The Student's Educational Institution.

It is a simplified version of the irs instructions found on pp. Students who attend more than one academic institution during the year should report the one they. Visa (for example, f, j, m, q, etc.) and date you entered the united states: Arizona and/or other state requirements:

Web Form 8843 Department Of The Treasury Internal Revenue Service Statement For Exempt Individuals And Individuals With A Medical Condition For Use By Alien Individuals Only.

Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. Alien individuals use form 8843 to explain excluded days of presence in the u.s. Go to www.irs.gov/form8843 for the latest information. The form 8843 instructions can be complex.

31, 2022, You Are Obligated To Send One Form, Form 8843, To The U.s.

I got an email from issc that i have to fill it out until april, but they didn't tell me about where to submit it. Web use these tips when completing part iii of form 8843 for students. Web if you were physically in the u.s. Students, scholars, and dependents who are at indiana university in f or j status must file form 8843 every year.

Additional Forms Will Be Required Based On Your Status As A Resident Or.

Enter the name, address, and telephone number of the academic institution you attended during 2022. Web statement for exempt individuals and individuals with a medical condition 1a type of u.s. Scholars (teachers and trainees) complete. Web form 8843 & instructions 2020:

![[2016 버전] 미국 유학생 텍스 리턴 3편 (Form 8843 작성법) Bluemoneyzone](https://img1.daumcdn.net/thumb/R800x0/?scode=mtistory2&fname=https:%2F%2Ft1.daumcdn.net%2Fcfile%2Ftistory%2F2638E83958C218ED0B)