Irs Form 7004 Due Date

Irs Form 7004 Due Date - In the case of s corporations and partnerships, the tax returns are due by march 15th. Fill in your business's name, address, and employer identification. Web 1 select your business entity type that the irs elected you. Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to request an extension. Web due dates for form 7004. Web the irs tax form 7004 should be filed on or before the due date of the applicable tax returns. The extension that this form brings is automatic when properly. Web the table below shows the deadline for filing form 7004 for business tax returns. Web us based support due date to file business tax extension form 7004 businesses seeking an extension for the tax returns 1120, 1120s, 1065, 1041 and more. Web in part i, indicate the business entity you are filing for, such as a corporation, partnership, nonprofit, or trust.

Web 1 select your business entity type that the irs elected you. February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021. The extension that this form brings is automatic when properly. This determines which income tax return you need to file. Web us based support due date to file business tax extension form 7004 businesses seeking an extension for the tax returns 1120, 1120s, 1065, 1041 and more. Web for example, if your business tax return is due on march 15, you must submit a fillable form 7004 or printable by that date to receive an extension. Generally, form 7004 must be filed on or before the due date of the applicable tax return. Partnerships, llcs, and corporations that need extra time to file certain tax documents. 2 choose your business tax return that you are required to file.

The approval process is automatic, so you won’t receive a confirmation if your. January 6, 2022 | last updated: 2 choose your business tax return that you are required to file. Web 1 select your business entity type that the irs elected you. The due dates of the returns can be found in. Generally, payment of any balance due on part ii, line 8, is required by the due date of the return. Web for example, if your business tax return is due on march 15, you must submit a fillable form 7004 or printable by that date to receive an extension. Partnerships, llcs, and corporations that need extra time to file certain tax documents. By the tax filing due date (april 15th for most businesses) who needs to file: Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to request an extension.

Irs Form 7004 amulette

Web the table below shows the deadline for filing form 7004 for business tax returns. Partnerships, llcs, and corporations that need extra time to file certain tax documents. Web the irs tax form 7004 should be filed on or before the due date of the applicable tax returns. Web the irs has extended the filing and payment deadlines for businesses.

Online Form How to Fill 7004 Form App Blog

Web in part i, indicate the business entity you are filing for, such as a corporation, partnership, nonprofit, or trust. And for the tax returns such as 1120, 1041 and others. 2 choose your business tax return that you are required to file. By the tax filing due date (april 15th for most businesses) who needs to file: In the.

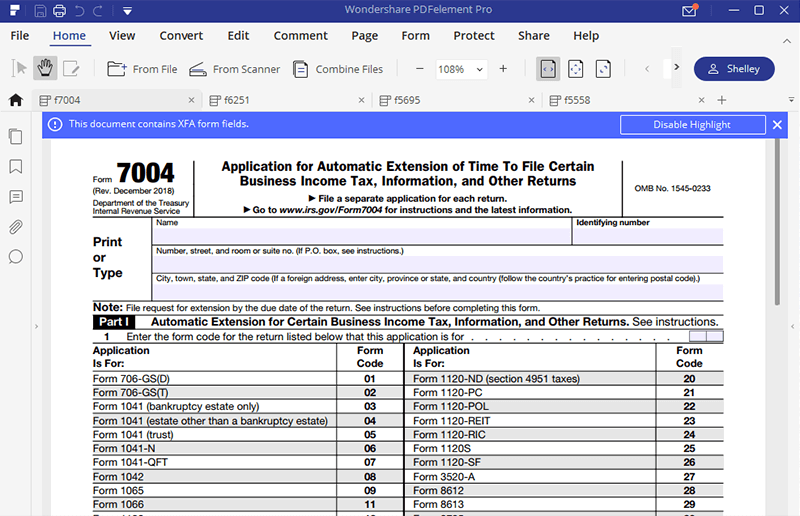

Irs Fillable Form 7004 Fill online, Printable, Fillable Blank

February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. The extension that this form brings is automatic when properly. Web the table below shows the deadline for filing form 7004 for business tax returns. Web if the year ends on december 31st, taxes must be filed and paid.

When is Tax Extension Form 7004 Due? Tax Extension Online

Generally, form 7004 must be filed on or before the due date of the applicable tax return. January 6, 2022 | last updated: Generally, payment of any balance due on part ii, line 8, is required by the due date of the return. Partnerships, llcs, and corporations that need extra time to file certain tax documents. Web payment of tax.

The IRS Delays The Deadline to File Personal Taxes Until May 17

The approval process is automatic, so you won’t receive a confirmation if your. Web due dates for form 7004. Web us based support due date to file business tax extension form 7004 businesses seeking an extension for the tax returns 1120, 1120s, 1065, 1041 and more. Web in part i, indicate the business entity you are filing for, such as.

extension form 7004 for 2022 IRS Authorized

Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to request an extension. Web the irs tax form 7004 should be filed on or before the due date of the applicable tax returns. The approval process is automatic, so you won’t.

IRS Tax Extension Form 7004 and Form 4868 are Due this April 15

Generally, payment of any balance due on part ii, line 8, is required by the due date of the return. Web if the year ends on december 31st, taxes must be filed and paid by april 15th. January 6, 2022 | last updated: 2 choose your business tax return that you are required to file. Web you’ll need to file.

for How to Fill in IRS Form 7004

February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. Web the table below shows the deadline for filing form 7004 for business tax returns. Web in part i, indicate the business entity you are filing for, such as a corporation, partnership, nonprofit, or trust. Web you’ll need to.

Form 7004 Automatically Extend Your 1120 Filing Due date IRSForm7004

Web in part i, indicate the business entity you are filing for, such as a corporation, partnership, nonprofit, or trust. And for the tax returns such as 1120, 1041 and others. The due dates of the returns can be found in. In the case of s corporations and partnerships, the tax returns are due by march 15th. This determines which.

Irs Form 7004 amulette

Web 1 select your business entity type that the irs elected you. Web us based support due date to file business tax extension form 7004 businesses seeking an extension for the tax returns 1120, 1120s, 1065, 1041 and more. By the tax filing due date (april 15th for most businesses) who needs to file: Web you’ll need to file 7004.

Fill In Your Business's Name, Address, And Employer Identification.

Web if the year ends on december 31st, taxes must be filed and paid by april 15th. In the case of s corporations and partnerships, the tax returns are due by march 15th. Generally, payment of any balance due on part ii, line 8, is required by the due date of the return. Web the entity must file form 7004 by the due date of the return (the 15th day of the 6th month following the close of the tax year) to request an extension.

2 Choose Your Business Tax Return That You Are Required To File.

Partnerships, llcs, and corporations that need extra time to file certain tax documents. And for the tax returns such as 1120, 1041 and others. The approval process is automatic, so you won’t receive a confirmation if your. Web the irs tax form 7004 should be filed on or before the due date of the applicable tax returns.

Web The Table Below Shows The Deadline For Filing Form 7004 For Business Tax Returns.

January 6, 2022 | last updated: Web for example, if your business tax return is due on march 15, you must submit a fillable form 7004 or printable by that date to receive an extension. Web us based support due date to file business tax extension form 7004 businesses seeking an extension for the tax returns 1120, 1120s, 1065, 1041 and more. Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021.

Web 1 Select Your Business Entity Type That The Irs Elected You.

The extension that this form brings is automatic when properly. Web in part i, indicate the business entity you are filing for, such as a corporation, partnership, nonprofit, or trust. Generally, form 7004 must be filed on or before the due date of the applicable tax return. The due dates of the returns can be found in.