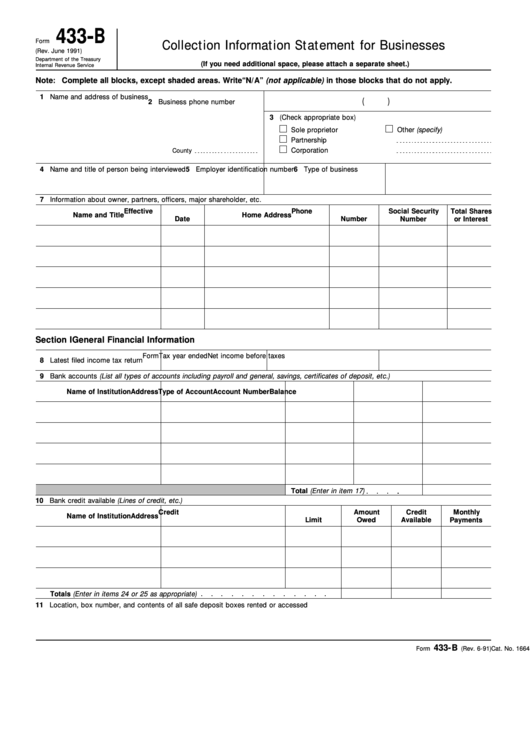

Irs Form 433 B

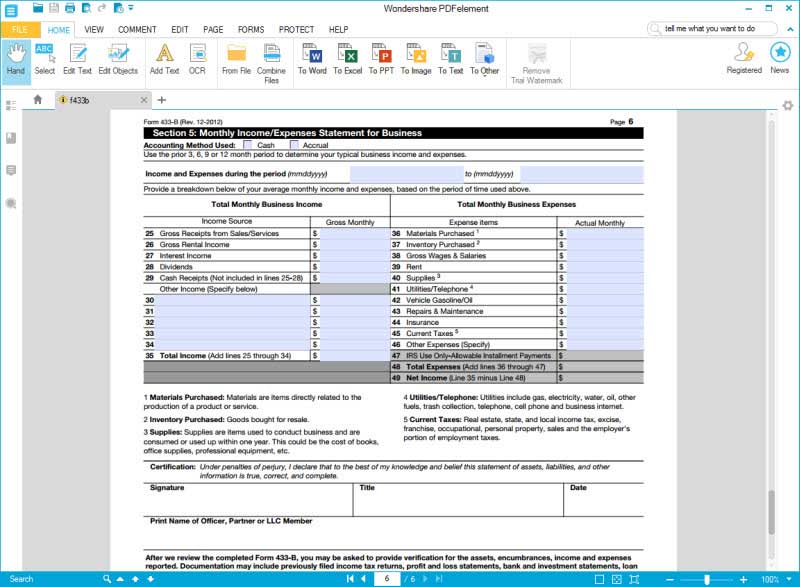

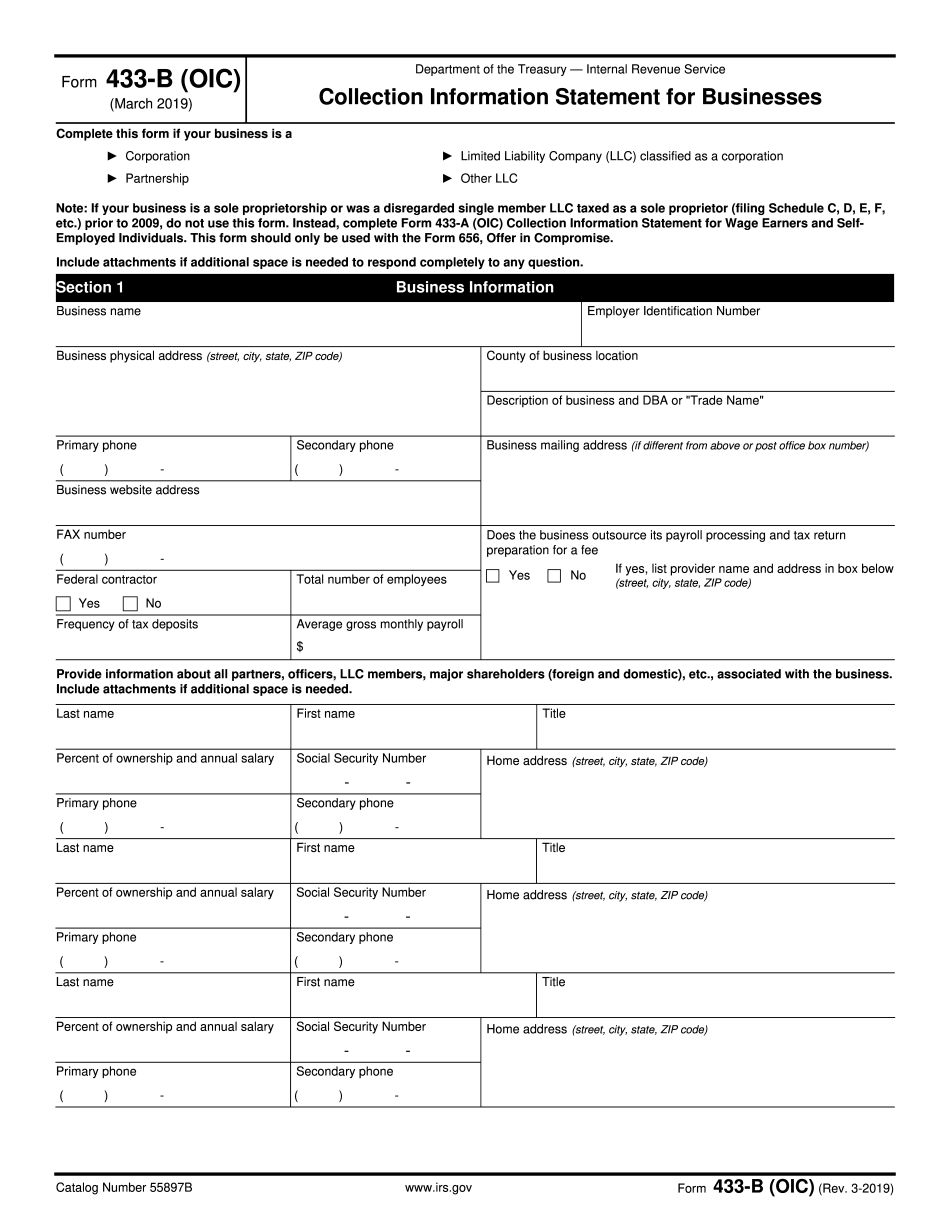

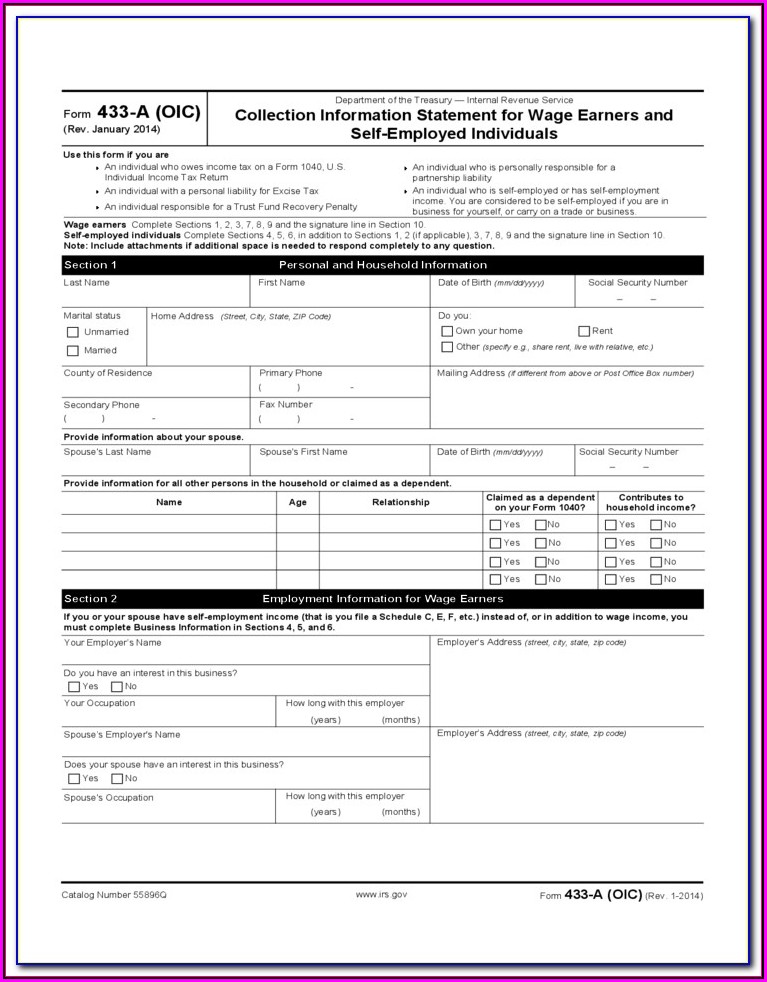

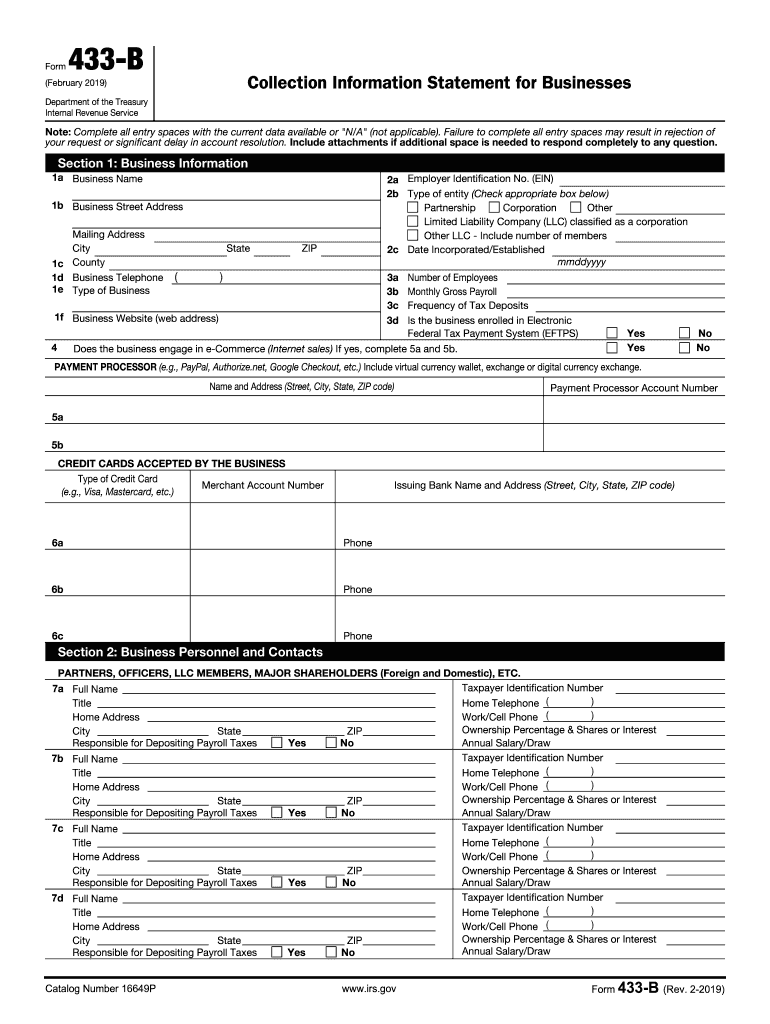

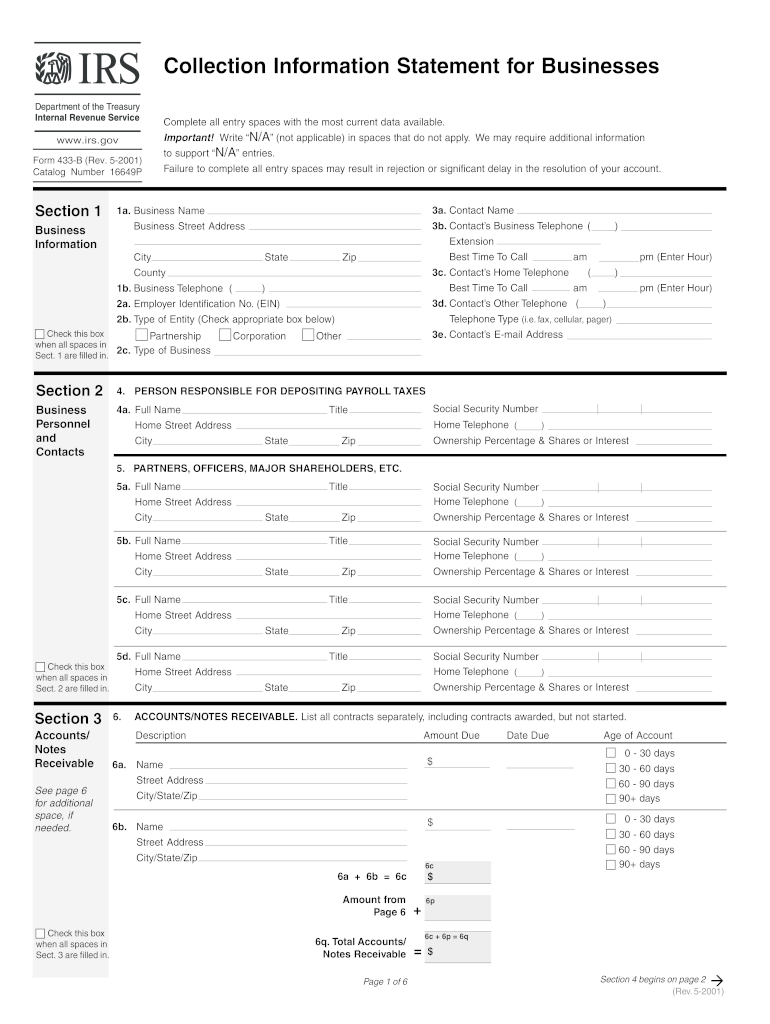

Irs Form 433 B - Failure to complete all entry spaces may result in rejection of It is a form that the irs uses to learn about a business’s income, assets, expenses, and liabilities. This figure is the amount from page 6, line 89. If the net business income is. Complete this form if your business is a corporation partnership limited liability company (llc) classified as a corporation other llc. This is the amount earned after ordinary and necessary monthly business expenses are paid. Web net income from business: Collection information statement for businesses. • partnerships • corporations • exempt organizations The form should be completed as accurately as possible.

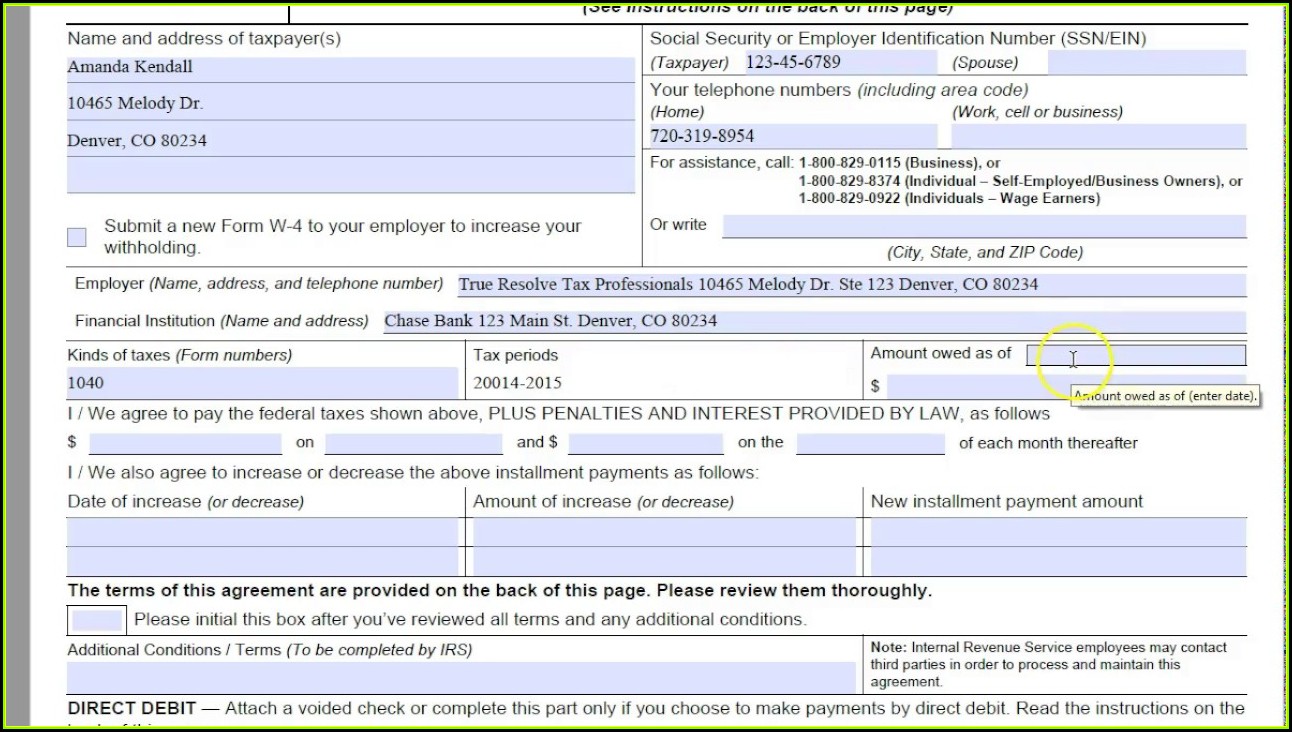

Collection information statement for businesses. This figure is the amount from page 6, line 89. Collection information statement for businesses. Failure to complete all entry spaces may result in rejection of Walking through them step by step will help you understand your tax obligations and avoid feeling overwhelmed. Web net income from business: If a business cannot afford to pay its tax bill, the irs may approve a form of tax relief such as a temporary delay in collection, an offer in compromise, or an. Complete all entry spaces with the current data available or n/a (not applicable). The irs uses this information to determine if businesses qualify for payment plans, hardship status, tax settlements, or other types of tax relief. It is a form that the irs uses to learn about a business’s income, assets, expenses, and liabilities.

The irs uses this information to determine if businesses qualify for payment plans, hardship status, tax settlements, or other types of tax relief. Failure to complete all entry spaces may result in rejection of • partnerships • corporations • exempt organizations Web net income from business: If the net business income is. Collection information statement for businesses. Enter monthly net business income. This is the amount earned after ordinary and necessary monthly business expenses are paid. This figure is the amount from page 6, line 89. It is a form that the irs uses to learn about a business’s income, assets, expenses, and liabilities.

IRS Form 433B Fill it Right the First Time

This is the amount earned after ordinary and necessary monthly business expenses are paid. If the net business income is. Enter monthly net business income. Walking through them step by step will help you understand your tax obligations and avoid feeling overwhelmed. Collection information statement for businesses.

irs form 433b 2019 2020 Fill Online, Printable, Fillable Blank

Complete all entry spaces with the current data available or n/a (not applicable). Walking through them step by step will help you understand your tax obligations and avoid feeling overwhelmed. This is the amount earned after ordinary and necessary monthly business expenses are paid. It is a form that the irs uses to learn about a business’s income, assets, expenses,.

Va Form 21 4138 Instructions Form Resume Examples GM9Ow6k9DL

Enter monthly net business income. If the net business income is. Collection information statement for businesses. The form should be completed as accurately as possible. This figure is the amount from page 6, line 89.

Form 433B Edit, Fill, Sign Online Handypdf

Web net income from business: The form should be completed as accurately as possible. If the net business income is. It is a form that the irs uses to learn about a business’s income, assets, expenses, and liabilities. If your business is a sole proprietorship do not use this form.

IRS Solutions Form 656 offer in compromise software

If a business cannot afford to pay its tax bill, the irs may approve a form of tax relief such as a temporary delay in collection, an offer in compromise, or an. Collection information statement for businesses. • partnerships • corporations • exempt organizations Complete this form if your business is a corporation partnership limited liability company (llc) classified as.

Irs Form 433 B Oic Form Resume Examples 3q9JMJ32Ar

This figure is the amount from page 6, line 89. This post is based on the 2022 form and is part of our free comprehensive tax help guide. Complete all entry spaces with the current data available or n/a (not applicable). It is a form that the irs uses to learn about a business’s income, assets, expenses, and liabilities. If.

20192022 Form IRS 433B Fill Online, Printable, Fillable, Blank

Failure to complete all entry spaces may result in rejection of Enter monthly net business income. This post is based on the 2022 form and is part of our free comprehensive tax help guide. The irs uses this information to determine if businesses qualify for payment plans, hardship status, tax settlements, or other types of tax relief. Collection information statement.

IRS Form 433B Collection Info for Businesses PDF FormSwift

The form should be completed as accurately as possible. If the net business income is. This figure is the amount from page 6, line 89. Collection information statement for businesses. • partnerships • corporations • exempt organizations

Irs Form 433 B Fill Out and Sign Printable PDF Template signNow

This post is based on the 2022 form and is part of our free comprehensive tax help guide. Walking through them step by step will help you understand your tax obligations and avoid feeling overwhelmed. This figure is the amount from page 6, line 89. This is the amount earned after ordinary and necessary monthly business expenses are paid. Complete.

Form 433B (Rev. June 1991) printable pdf download

Collection information statement for businesses. This figure is the amount from page 6, line 89. If your business is a sole proprietorship do not use this form. • partnerships • corporations • exempt organizations This post is based on the 2022 form and is part of our free comprehensive tax help guide.

Collection Information Statement For Businesses.

The form should be completed as accurately as possible. Collection information statement for businesses. This is the amount earned after ordinary and necessary monthly business expenses are paid. Enter monthly net business income.

This Post Is Based On The 2022 Form And Is Part Of Our Free Comprehensive Tax Help Guide.

Failure to complete all entry spaces may result in rejection of Web net income from business: This figure is the amount from page 6, line 89. If a business cannot afford to pay its tax bill, the irs may approve a form of tax relief such as a temporary delay in collection, an offer in compromise, or an.

If The Net Business Income Is.

It is a form that the irs uses to learn about a business’s income, assets, expenses, and liabilities. If your business is a sole proprietorship do not use this form. The irs uses this information to determine if businesses qualify for payment plans, hardship status, tax settlements, or other types of tax relief. Walking through them step by step will help you understand your tax obligations and avoid feeling overwhelmed.

Complete This Form If Your Business Is A Corporation Partnership Limited Liability Company (Llc) Classified As A Corporation Other Llc.

Complete all entry spaces with the current data available or n/a (not applicable). • partnerships • corporations • exempt organizations