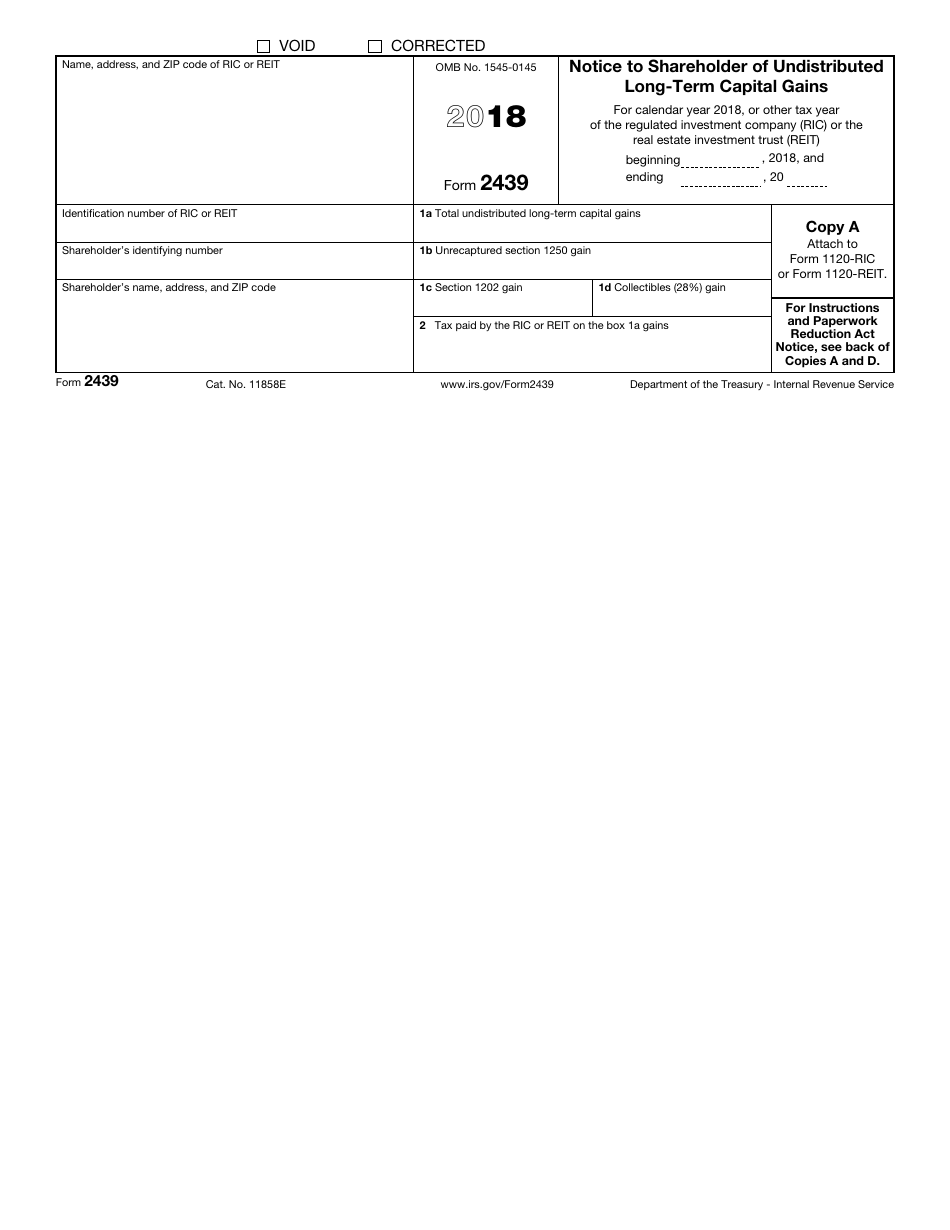

Irs Form 2439

Irs Form 2439 - Deletion should solve the problem. If you’re using the average basis method to determine your basis, the basis adjustment is easy. Web you can see it form 2439 (rev. Web form 2439 is an irs tax form required to be issued by rics, mutual funds, etfs, & reits. Form 1120 2018 uncertain tax position statement. Foreign tax carryover reconciliation schedule k 1118. Regulated investment companies must report any gains they do not distribute to their shareholders. However, a mutual fund might keep some. Web complete copies a, b, c, and d of form 2439 for each owner. The amounts entered in boxes 1b, 1c, and 1d and the tax shown in box 2 on the form 2439 for each owner must agree with the amounts on copy b that you received from the ric or reit.

Regulated investment companies must report any gains they do not distribute to their shareholders. Form 1120 2018 uncertain tax position statement. The amounts entered in boxes 1b, 1c, and 1d and the tax shown in box 2 on the form 2439 for each owner must agree with the amounts on copy b that you received from the ric or reit. However, a mutual fund might keep some. Web you can see it form 2439 (rev. Your basis allocation is $158. If you’re using the average basis method to determine your basis, the basis adjustment is easy. A mutual fund usually distributes all its capital gains to its shareholders. When the fund company decides to retain these gains, it must pay taxes on behalf of shareholders and report these transactions on form 2439. Form 2439 says you’ve received a capital gain allocation of $200, and the mutual fund paid $42 of tax on this amount.

The amounts entered in boxes 1b, 1c, and 1d and the tax shown in box 2 on the form 2439 for each owner must agree with the amounts on copy b that you received from the ric or reit. A mutual fund usually distributes all its capital gains to its shareholders. When the fund company decides to retain these gains, it must pay taxes on behalf of shareholders and report these transactions on form 2439. Web undistributed capital gains tax return 2438. Simply add this amount to your total basis in the shares. Your basis allocation is $158. Form 2439 says you’ve received a capital gain allocation of $200, and the mutual fund paid $42 of tax on this amount. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. Web form 2439 is an irs tax form required to be issued by rics, mutual funds, etfs, & reits. Deletion should solve the problem.

IRS Form 2439 Download Fillable PDF or Fill Online Notice to

However, a mutual fund might keep some. No, it does not sound like it makes sense on your return. Web complete copies a, b, c, and d of form 2439 for each owner. Form 2439 says you’ve received a capital gain allocation of $200, and the mutual fund paid $42 of tax on this amount. Regulated investment companies must report.

Fill Free fillable IRS PDF forms

Web you can see it form 2439 (rev. A mutual fund usually distributes all its capital gains to its shareholders. Simply add this amount to your total basis in the shares. The amounts entered in boxes 1b, 1c, and 1d and the tax shown in box 2 on the form 2439 for each owner must agree with the amounts on.

1040 Schedule 3 (Drake18 and Drake19) (Schedule3)

Deletion should solve the problem. Foreign tax carryover reconciliation schedule k 1118. The amounts entered in boxes 1b, 1c, and 1d and the tax shown in box 2 on the form 2439 for each owner must agree with the amounts on copy b that you received from the ric or reit. No, it does not sound like it makes sense.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Form 1120 2018 uncertain tax position statement. Your basis allocation is $158. The amounts entered in boxes 1b, 1c, and 1d and the tax shown in box 2 on the form 2439 for each owner must agree with the amounts on copy b that you received from the ric or reit. Web complete copies a, b, c, and d of.

Fill Free fillable IRS PDF forms

If you’re using the average basis method to determine your basis, the basis adjustment is easy. Foreign tax carryover reconciliation schedule k 1118. A mutual fund usually distributes all its capital gains to its shareholders. Web undistributed capital gains tax return 2438. Web complete copies a, b, c, and d of form 2439 for each owner.

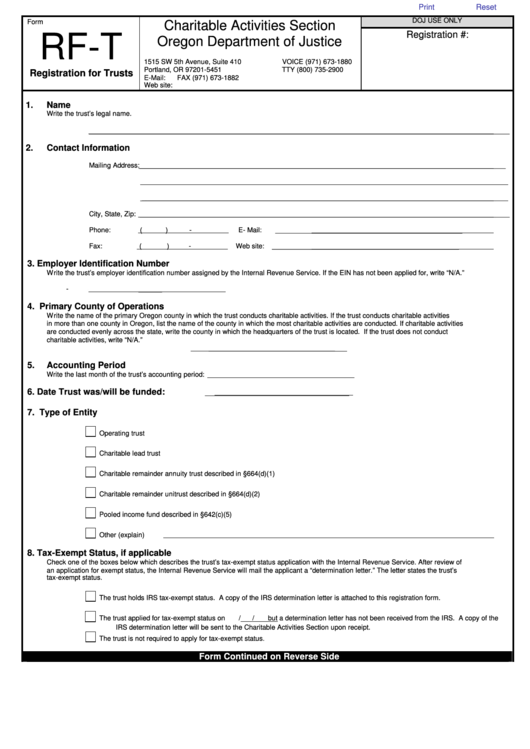

Fillable Form RfT Registration For Trusts printable pdf download

Web form 2439 is an irs tax form required to be issued by rics, mutual funds, etfs, & reits. Web you can see it form 2439 (rev. A mutual fund usually distributes all its capital gains to its shareholders. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439.

Ssurvivor Form 2439 Statements

However, a mutual fund might keep some. When the fund company decides to retain these gains, it must pay taxes on behalf of shareholders and report these transactions on form 2439. Web complete copies a, b, c, and d of form 2439 for each owner. Web you can see it form 2439 (rev. Deletion should solve the problem.

Publication 908 (10/2012), Bankruptcy Tax Guide Internal Revenue Service

Your basis allocation is $158. If you’re using the average basis method to determine your basis, the basis adjustment is easy. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. The amounts entered in.

The Dangers Of Deemed Dividends

However, a mutual fund might keep some. Form 1120 2018 uncertain tax position statement. If you’re using the average basis method to determine your basis, the basis adjustment is easy. Form 2439 says you’ve received a capital gain allocation of $200, and the mutual fund paid $42 of tax on this amount. Deletion should solve the problem.

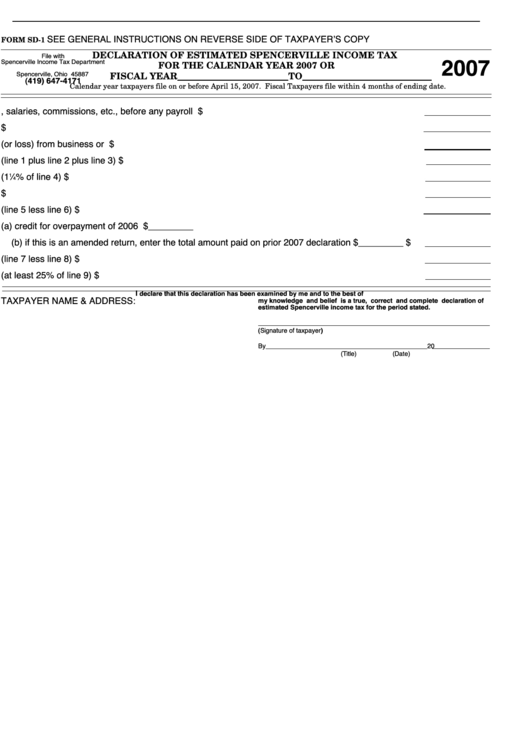

Form Sd1 Declaration Of Estimated Spencerville Tax 2007

The amounts entered in boxes 1b, 1c, and 1d and the tax shown in box 2 on the form 2439 for each owner must agree with the amounts on copy b that you received from the ric or reit. Deletion should solve the problem. If you’re using the average basis method to determine your basis, the basis adjustment is easy..

Regulated Investment Companies Must Report Any Gains They Do Not Distribute To Their Shareholders.

Foreign tax carryover reconciliation schedule k 1118. If you’re using the average basis method to determine your basis, the basis adjustment is easy. Form 1120 2018 uncertain tax position statement. Form 2439 says you’ve received a capital gain allocation of $200, and the mutual fund paid $42 of tax on this amount.

Web Form 2439 Is An Irs Tax Form Required To Be Issued By Rics, Mutual Funds, Etfs, & Reits.

Web undistributed capital gains tax return 2438. The amounts entered in boxes 1b, 1c, and 1d and the tax shown in box 2 on the form 2439 for each owner must agree with the amounts on copy b that you received from the ric or reit. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. A mutual fund usually distributes all its capital gains to its shareholders.

Web Complete Copies A, B, C, And D Of Form 2439 For Each Owner.

When the fund company decides to retain these gains, it must pay taxes on behalf of shareholders and report these transactions on form 2439. Simply add this amount to your total basis in the shares. No, it does not sound like it makes sense on your return. Web you can see it form 2439 (rev.

Your Basis Allocation Is $158.

However, a mutual fund might keep some. Deletion should solve the problem.