Irs 4972 Form

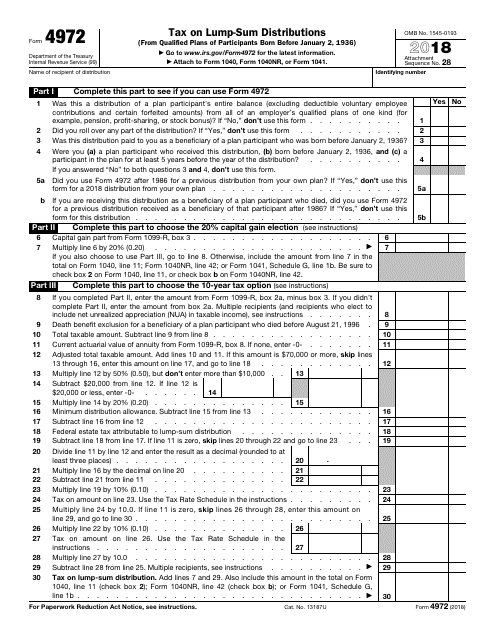

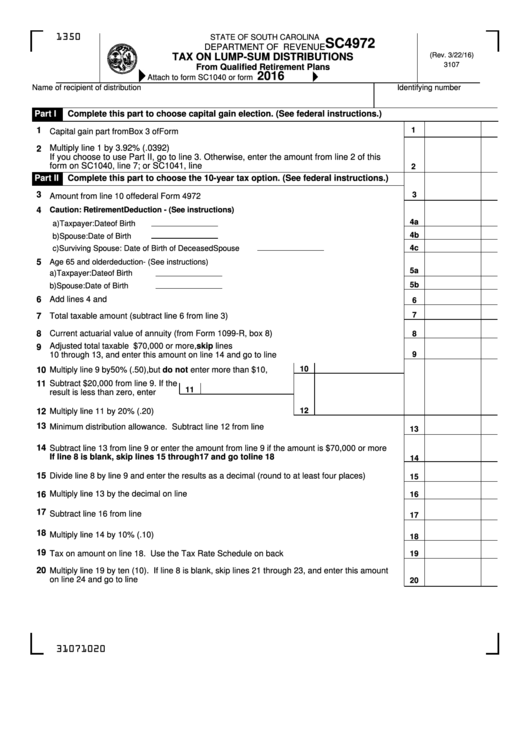

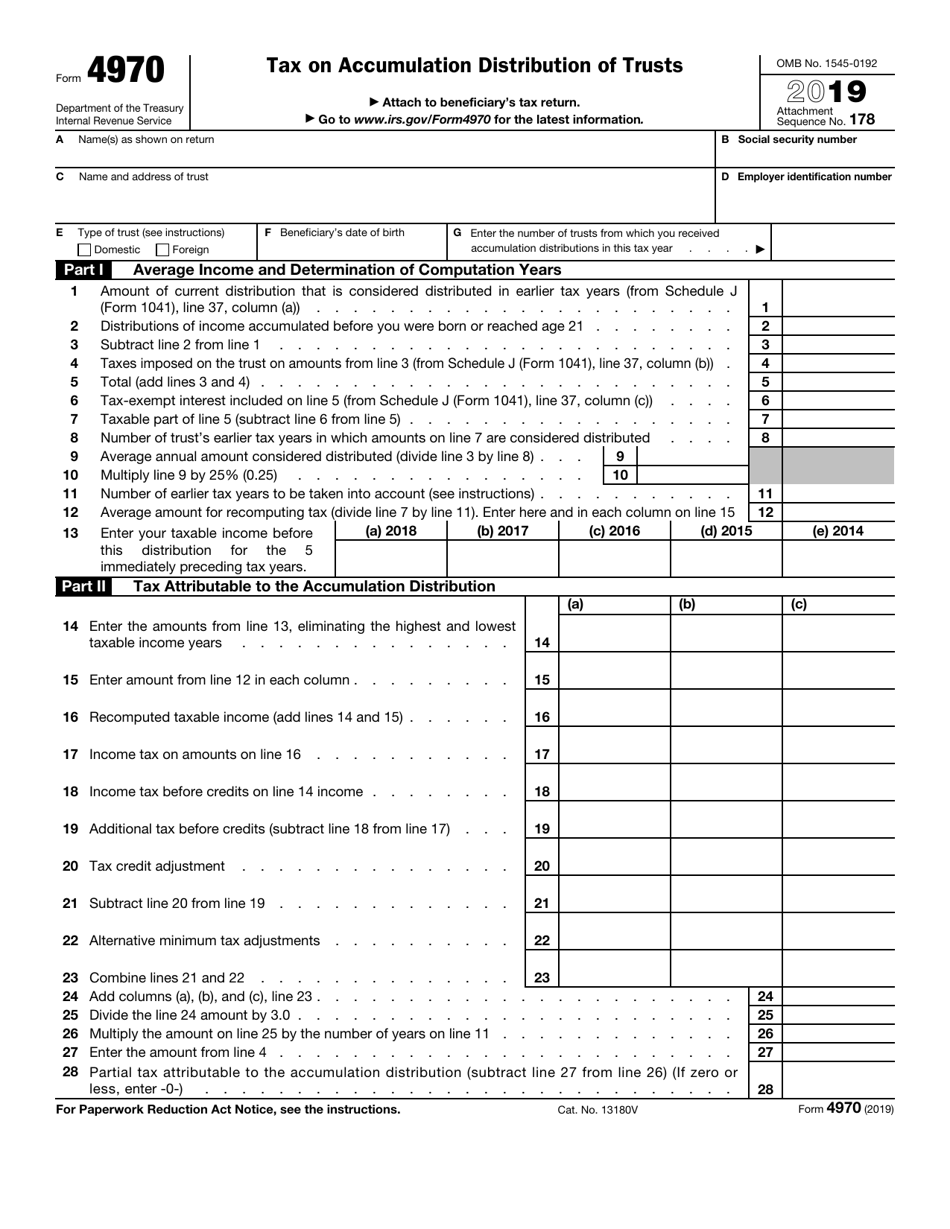

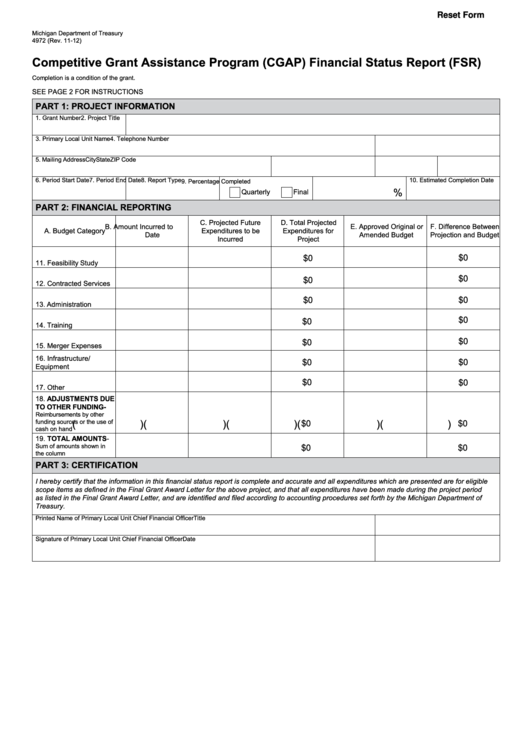

Irs 4972 Form - It allows beneficiaries to receive their entire benefit in. Web 1 was this a distribution of a plan participant’s entire balance (excluding deductible voluntary employee contributions and certain forfeited amounts) from all of an employer’s qualified. Code notes prev | next (a) tax imposed in the case of any qualified employer plan, there. Web department of the treasury—internal revenue service u.s. § 4972 (a) tax imposed — in the case of any qualified employer plan, there. C if you choose not to use any part of form 4972, report the. To claim these benefits, you must file irs. If you aren?t associated with document administration and law procedures, submitting irs docs can be quite tiring. Web chapter 43 § 4972 sec. Follow these steps to generate form 4972 in the.

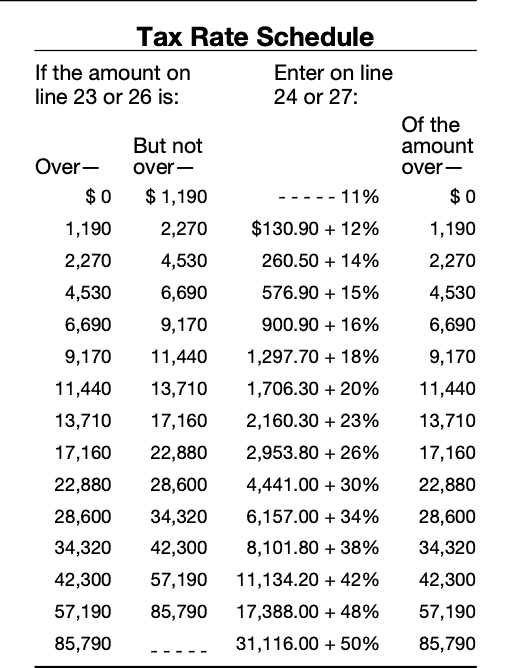

Web chapter 43 § 4972 sec. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Code notes prev | next (a) tax imposed in the case of any qualified employer plan, there. Use this form to figure the. Nonresident alien income tax return (99) 2021 omb no. Tax on nondeductible contributions to qualified employer plans i.r.c. Web department of the treasury—internal revenue service u.s. It allows beneficiaries to receive their entire benefit in. Web what is irs form 4972:

You can download or print current. Nonresident alien income tax return (99) 2021 omb no. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Web chapter 43 § 4972 sec. Tax on nondeductible contributions to qualified employer plans i.r.c. To claim these benefits, you must file irs. Use this form to figure the. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Code notes prev | next (a) tax imposed in the case of any qualified employer plan, there. Web follow the simple instructions below:

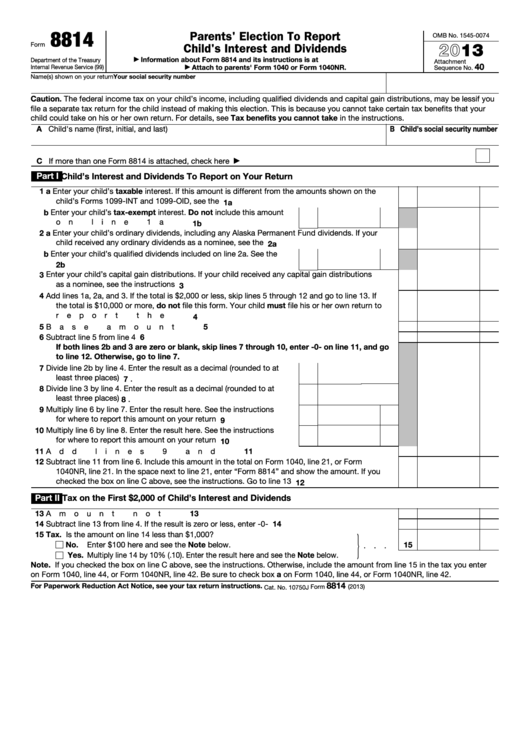

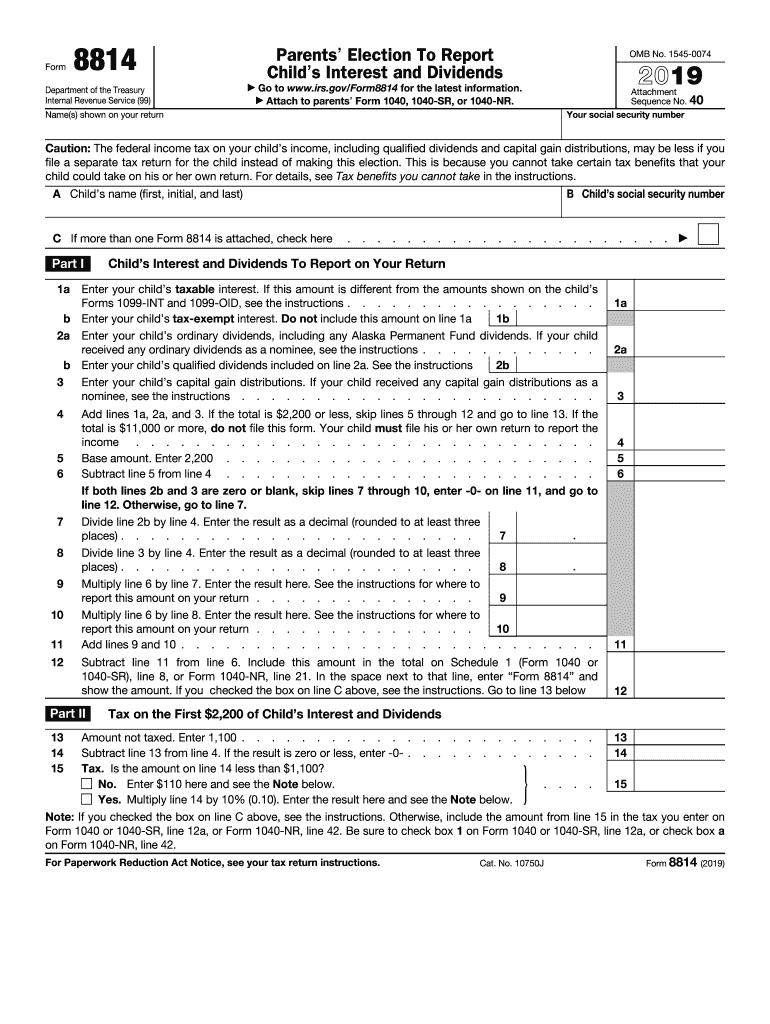

Fillable Form 8814 Parents' Election To Report Child'S Interest And

View more information about using irs forms, instructions, publications and other item files. Follow these steps to generate form 4972 in the. To see if you qualify, you must first determine if your distribution is a qualified lump sum. Complete, edit or print tax forms instantly. Web what is irs form 4972:

2019 IRS Form 4972 Fill Out Digital PDF Sample

Use this form to figure the. It allows beneficiaries to receive their entire benefit in. To claim these benefits, you must file irs. Follow these steps to generate form 4972 in the. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file.

8814 Fill Out and Sign Printable PDF Template signNow

Web what is irs form 4972: It allows beneficiaries to receive their entire benefit in. Use this form to figure the. Code notes prev | next (a) tax imposed in the case of any qualified employer plan, there. Web the latest versions of irs forms, instructions, and publications.

IRS Form 4972 Download Fillable PDF or Fill Online Tax on LumpSum

Tax on nondeductible contributions to qualified employer plans i.r.c. C if you choose not to use any part of form 4972, report the. Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this form. Use this form to figure the. To see if you qualify, you must first determine.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

It allows beneficiaries to receive their entire benefit in. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Follow these steps to generate form 4972 in the. Web department of the treasury—internal revenue service u.s. View more information about using irs forms, instructions, publications and other item files.

Form 4972 Turbotax Fill Out and Sign Printable PDF Template signNow

Tax on nondeductible contributions to qualified employer plans i.r.c. Web department of the treasury—internal revenue service u.s. View more information about using irs forms, instructions, publications and other item files. C if you choose not to use any part of form 4972, report the. Web 1 was this a distribution of a plan participant’s entire balance (excluding deductible voluntary employee.

IRS Form 4972A Guide to Tax on LumpSum Distributions

Follow these steps to generate form 4972 in the. Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this form. Tax on nondeductible contributions to qualified employer plans i.r.c. To see if you qualify, you must first determine if your distribution is a qualified lump sum. Complete, edit or.

Sc4972 Tax On Lump Sum Distributions printable pdf download

To claim these benefits, you must file irs. Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this form. View more information about using irs forms, instructions, publications and other item files. You can download or print current. Web what is irs form 4972:

IRS Form 4970 Download Fillable PDF or Fill Online Tax on Accumulation

§ 4972 (a) tax imposed — in the case of any qualified employer plan, there. Use this form to figure the. To see if you qualify, you must first determine if your distribution is a qualified lump sum. Tax on nondeductible contributions to qualified employer plans i.r.c. Nonresident alien income tax return (99) 2021 omb no.

Fillable Form 4972 Competitive Grant Assistance Program Cgap

If you aren?t associated with document administration and law procedures, submitting irs docs can be quite tiring. Use this form to figure the. Complete, edit or print tax forms instantly. Code notes prev | next (a) tax imposed in the case of any qualified employer plan, there. Web department of the treasury—internal revenue service u.s.

§ 4972 (A) Tax Imposed — In The Case Of Any Qualified Employer Plan, There.

C if you choose not to use any part of form 4972, report the. Web follow the simple instructions below: Code notes prev | next (a) tax imposed in the case of any qualified employer plan, there. Nonresident alien income tax return (99) 2021 omb no.

Tax On Nondeductible Contributions To Qualified Employer Plans I.r.c.

Web department of the treasury—internal revenue service u.s. To claim these benefits, you must file irs. If you aren?t associated with document administration and law procedures, submitting irs docs can be quite tiring. Use this form to figure the.

Complete, Edit Or Print Tax Forms Instantly.

Web the latest versions of irs forms, instructions, and publications. Web what is irs form 4972: Ad download or email irs 4972 & more fillable forms, register and subscribe now! Follow these steps to generate form 4972 in the.

To See If You Qualify, You Must First Determine If Your Distribution Is A Qualified Lump Sum.

View more information about using irs forms, instructions, publications and other item files. Web see the irs instructions for form 4792 for all of the limitations on what's considered a qualified distribution for this form. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Web 1 was this a distribution of a plan participant’s entire balance (excluding deductible voluntary employee contributions and certain forfeited amounts) from all of an employer’s qualified.