Ira Excess Contribution Removal Form

Ira Excess Contribution Removal Form - Web 403(b), or governmental 457(b) plan is reported on irs form 1099r using code g. Web if your total ira contributions (both traditional and roth combined) are greater than your allowed amount for the year, and you haven't withdrawn the excess contributions,. Will report the excess contribution on irs form 5498. Web complete this form to request the removal of an excess contribution from your ira or to recharacterize a contribution. Web carry forward timely remove excess before the tax filing deadline — the excess or unwanted ira contribution amount, plus the net gain or loss, will need to be removed. Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Web any additional tax you may owe due to an excess ira contribution. In january following this calendar year, td ameritrade clearing, inc. • consult your tax advisor for more information prior to completing this form. Web use code “j” with code “p” or “8” for a roth ira excess contribution, and do not mark the ira/sep/simple box.

This page contains fillable form pdfs that may not be supported in chrome or firefox. Removing excesses after the deadline. Web to avoid the excise tax, you should withdraw the excess contribution from your ira and any income earned on the excess contribution by the due date of your individual. Web carry forward timely remove excess before the tax filing deadline — the excess or unwanted ira contribution amount, plus the net gain or loss, will need to be removed. If you have made an excess contribution to. Web if you remove the excess contribution and earnings and file an amended return by the october extension deadline, you could avoid the 6% penalty. Web use code “j” with code “p” or “8” for a roth ira excess contribution, and do not mark the ira/sep/simple box. Web complete this form to request the removal of an excess contribution from your ira or to recharacterize a contribution. Web excess contributions to an ira are subject to a 6% excise tax, which applies to the excess contributions each year until they are removed or eliminated from the. • if you would like to remove.

Web any additional tax you may owe due to an excess ira contribution. Web if you remove the excess contribution and earnings and file an amended return by the october extension deadline, you could avoid the 6% penalty. In january following this calendar year, td ameritrade clearing, inc. Web and you are requesting your excess to be removed by the later of (1) your tax filing deadline or (2) the date six months following your tax filing deadline (generally october 15). Web use code “j” with code “p” or “8” for a roth ira excess contribution, and do not mark the ira/sep/simple box. Tips for viewing and using fillable form pdfs:. Will report the excess contribution on irs form 5498. Web if you miss the deadline to fix your excess, then the 6% penalty applies every year until the excess is corrected. Web use this form to recharacterize contributions made to a roth ira or traditional ira, or remove an excess traditional ira or roth ira contribution. Plus, you may also owe a 10% penalty on the.

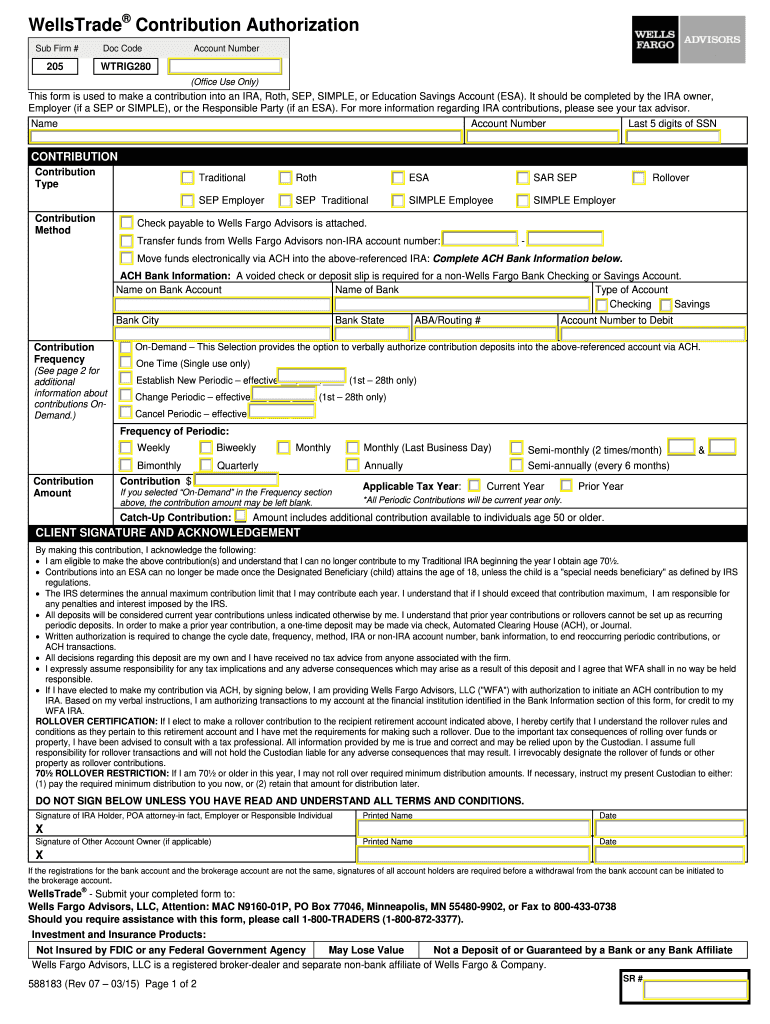

Wells Fargo Sep Ira Contribution Form Fill Out and Sign Printable PDF

Tips for viewing and using fillable form pdfs:. Web if you miss the deadline to fix your excess, then the 6% penalty applies every year until the excess is corrected. Web 403(b), or governmental 457(b) plan is reported on irs form 1099r using code g. Web if your total ira contributions (both traditional and roth combined) are greater than your.

Ira withdrawal authorization form Fill out & sign online DocHub

Web if your total ira contributions (both traditional and roth combined) are greater than your allowed amount for the year, and you haven't withdrawn the excess contributions,. Web excess contributions to an ira are subject to a 6% excise tax, which applies to the excess contributions each year until they are removed or eliminated from the. Tips for viewing and.

What Do I Need to Do to Calculate and Correct an Excess IRA

Web and you are requesting your excess to be removed by the later of (1) your tax filing deadline or (2) the date six months following your tax filing deadline (generally october 15). In january following this calendar year, td ameritrade clearing, inc. • consult your tax advisor for more information prior to completing this form. Web use this form.

Fidelity Advisor IRA Return of Excess Contribution [PDF Document]

Web use code “j” with code “p” or “8” for a roth ira excess contribution, and do not mark the ira/sep/simple box. Web 403(b), or governmental 457(b) plan is reported on irs form 1099r using code g. • consult your tax advisor for more information prior to completing this form. Web the contributions for 2022 to your traditional iras, roth.

Requesting an IRA excess removal Common questions Vanguard

This page contains fillable form pdfs that may not be supported in chrome or firefox. Web 403(b), or governmental 457(b) plan is reported on irs form 1099r using code g. Web if you remove the excess contribution and earnings and file an amended return by the october extension deadline, you could avoid the 6% penalty. Web and you are requesting.

Deadline for Correcting 2021 IRA Excess Contributions is October 17, 2022

This page contains fillable form pdfs that may not be supported in chrome or firefox. In january following this calendar year, td ameritrade clearing, inc. Will report the excess contribution on irs form 5498. Web and you are requesting your excess to be removed by the later of (1) your tax filing deadline or (2) the date six months following.

Excess Contributions to an IRA The FI Tax Guy

Removing excesses after the deadline. In january following this calendar year, td ameritrade clearing, inc. Web complete this form to request the removal of an excess contribution from your ira or to recharacterize a contribution. Web 403(b), or governmental 457(b) plan is reported on irs form 1099r using code g. Web to avoid the excise tax, you should withdraw the.

Removing excess contributions from your IRA Vanguard

For more information regarding an. In january following this calendar year, td ameritrade clearing, inc. Tips for viewing and using fillable form pdfs:. Web td ameritrade clearing, inc. Web complete this form to request the removal of an excess contribution from your ira or to recharacterize a contribution.

The Deadline For Correcting IRA Excesses Has Passed—Now What? — Ascensus

Web and you are requesting your excess to be removed by the later of (1) your tax filing deadline or (2) the date six months following your tax filing deadline (generally october 15). For more information regarding an. If you have made an excess contribution to. Web excess contributions to an ira are subject to a 6% excise tax, which.

ira contribution Archives Midland Trust

This page contains fillable form pdfs that may not be supported in chrome or firefox. Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Web complete this form to request the removal of an excess contribution from your ira or to.

Web The Contributions For 2022 To Your Traditional Iras, Roth Iras, Coverdell Esas, Archer Msas, Hsas, Or Able Accounts Exceed Your Maximum Contribution Limit, Or You Had A.

Web if you remove the excess contribution and earnings and file an amended return by the october extension deadline, you could avoid the 6% penalty. Plus, you may also owe a 10% penalty on the. For more information regarding an. Web any additional tax you may owe due to an excess ira contribution.

Web Carry Forward Timely Remove Excess Before The Tax Filing Deadline — The Excess Or Unwanted Ira Contribution Amount, Plus The Net Gain Or Loss, Will Need To Be Removed.

If you have made an excess contribution to. Web 403(b), or governmental 457(b) plan is reported on irs form 1099r using code g. This page contains fillable form pdfs that may not be supported in chrome or firefox. Tips for viewing and using fillable form pdfs:.

Web Use This Form To Recharacterize Contributions Made To A Roth Ira Or Traditional Ira, Or Remove An Excess Traditional Ira Or Roth Ira Contribution.

Will report the excess contribution on irs form 5498. • if you would like to remove. Web use code “j” with code “p” or “8” for a roth ira excess contribution, and do not mark the ira/sep/simple box. Web if your total ira contributions (both traditional and roth combined) are greater than your allowed amount for the year, and you haven't withdrawn the excess contributions,.

Web To Avoid The Excise Tax, You Should Withdraw The Excess Contribution From Your Ira And Any Income Earned On The Excess Contribution By The Due Date Of Your Individual.

Web excess contributions to an ira are subject to a 6% excise tax, which applies to the excess contributions each year until they are removed or eliminated from the. Web td ameritrade clearing, inc. • consult your tax advisor for more information prior to completing this form. In january following this calendar year, td ameritrade clearing, inc.

![Fidelity Advisor IRA Return of Excess Contribution [PDF Document]](https://cdn.vdocuments.net/doc/1200x630/6182a6deeddd7b24247094d9/fidelity-advisor-ira-return-of-excess-contribution.jpg?t=1676542746)