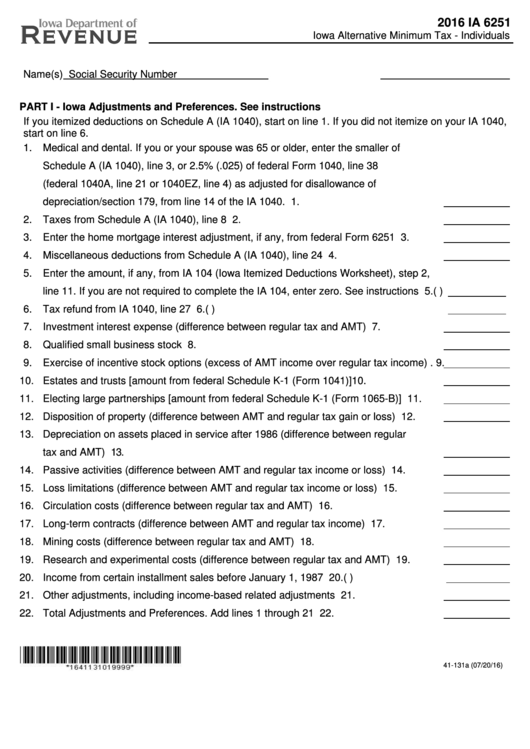

Iowa Form 6251

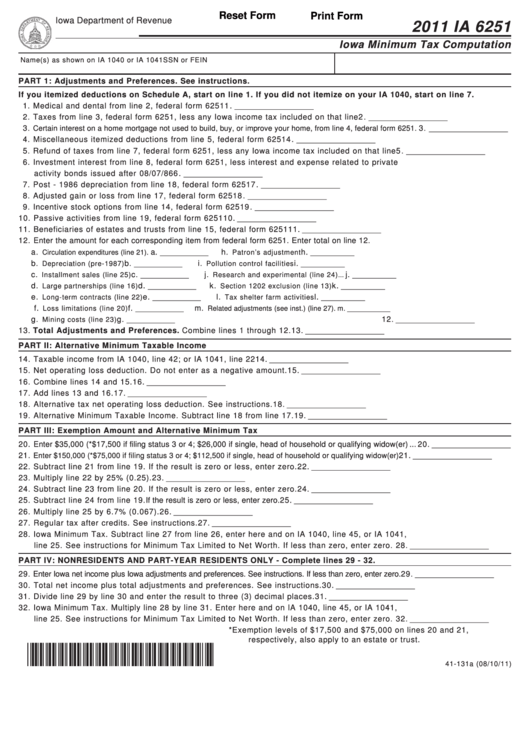

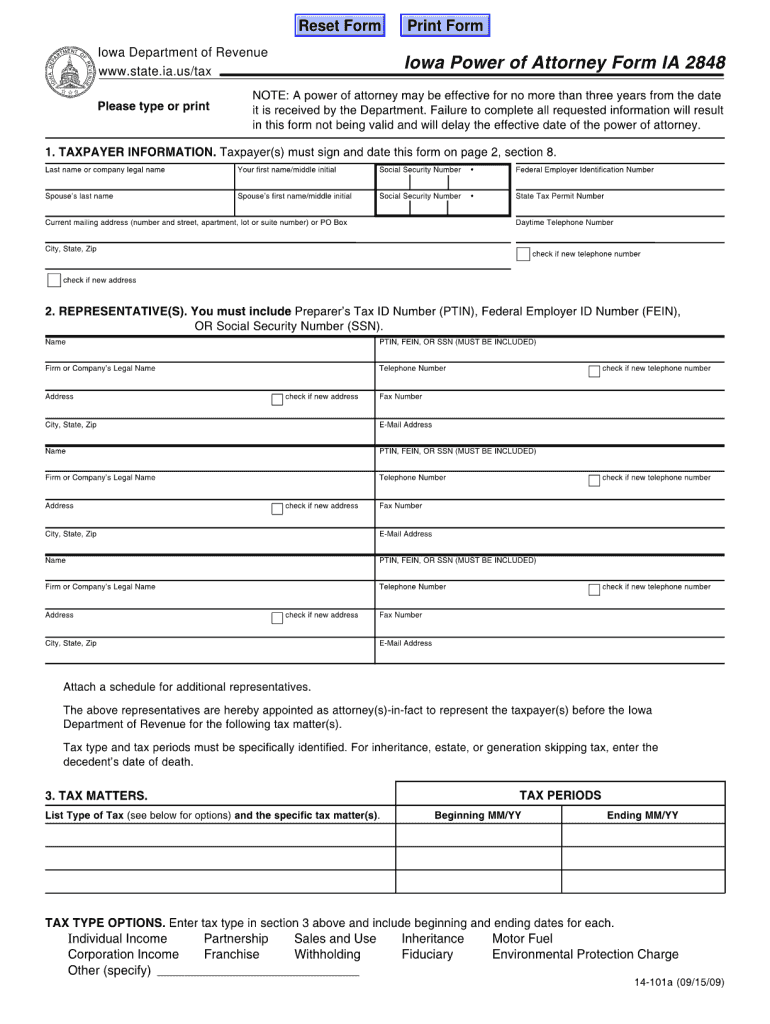

Iowa Form 6251 - Sign it in a few clicks draw your signature, type it,. Estates and trusts must use form ia 1041 schedule i to calculate alternative. Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Save or instantly send your ready documents. Sign it in a few clicks. Recalculate this amount by using the iowa depreciation deduction amounts shown on this year’s ia 4562a, and follow the federal. Web credits section and indicate “the originally filed iowa return overstated the alternative minimum tax because of an incorrect calculation on line 35 of the form ia 6251. You can download or print. Web all individuals, estates and trusts that had one or more of the adjustments or preferences in part i must complete form ia 6251 to see if they owe iowa minimum tax. Edit your ia 6251 online type text, add images, blackout confidential details, add comments, highlights and more.

Iowa tax credits schedule : Web ia 6251bbalance sheet/statement of net worth tax.iowa.gov this form can be used for any tax year. Edit your ia 6251 online type text, add images, blackout confidential details, add comments, highlights and more. Web federal form 6251 to adjust for the iowa amount. The amt is a separate tax that is imposed in addition to your regular tax. Sign it in a few clicks draw your signature, type it,. Sign it in a few clicks. Save or instantly send your ready documents. Recalculate this amount by using the iowa depreciation deduction amounts shown on this year’s ia 4562a, and follow the federal. Recalculate this amount by using the iowa depreciation deduction amounts shown on this year’s ia 4562a, or other nonconformity.

Web we last updated iowa form ia 6251 in february 2023 from the iowa department of revenue. These tax benefits can significantly. Who must file ia 6251? Recalculate this amount by using the iowa depreciation deduction amounts shown on this year’s ia 4562a, or other nonconformity. You can download or print. Edit your ia 6251 online type text, add images, blackout confidential details, add comments, highlights and more. Web it applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. Type text, add images, blackout confidential details, add comments, highlights and more. The amt is a separate tax that is imposed in addition to your regular tax. Married separate filers (including status 4):.

Iowa 8453 Pe Fill Online, Printable, Fillable, Blank pdfFiller

Iowa tax credits schedule : Web ia 6251bbalance sheet/statement of net worth tax.iowa.gov this form can be used for any tax year. Sign it in a few clicks draw your signature, type it,. The amt is a separate tax that is imposed in addition to your regular tax. Sign it in a few clicks.

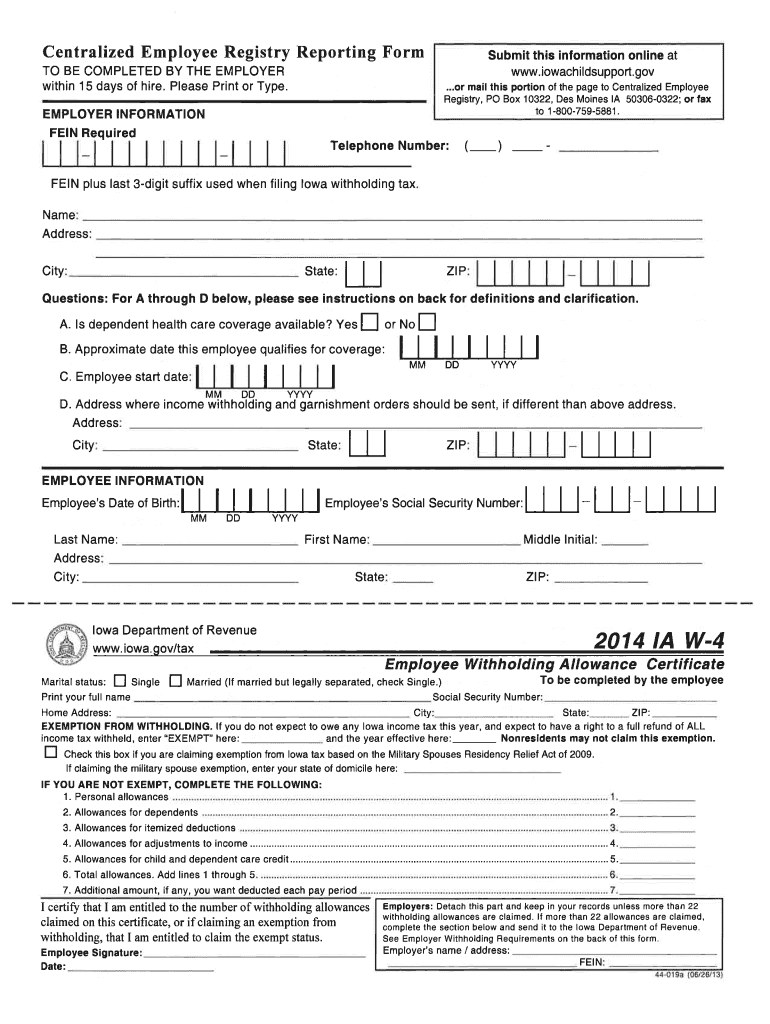

Iowa W 4 2021 Printable 2022 W4 Form

Sign it in a few clicks draw your signature, type it,. Get ready for tax season deadlines by completing any required tax forms today. Recalculate this amount by using the iowa depreciation deduction amounts shown on this year’s ia 4562a, or other nonconformity. The amt is a separate tax that is imposed in addition to your regular tax. Web credits.

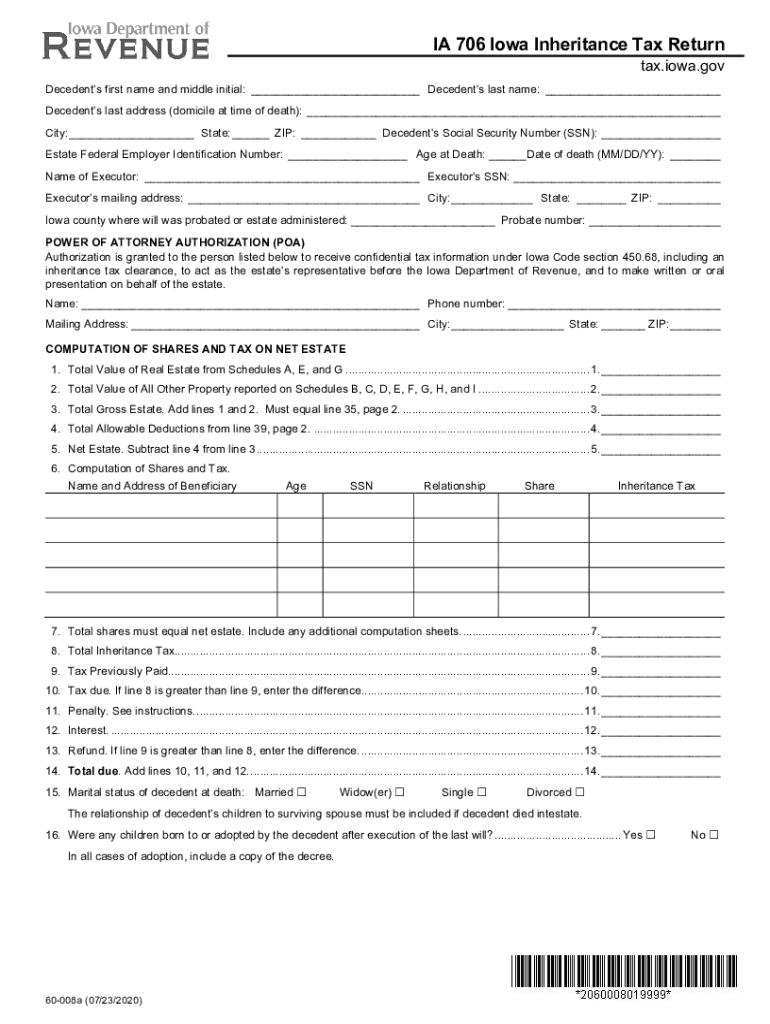

Iowa Form 706 Fill Out and Sign Printable PDF Template signNow

Edit your ia 6251 online. The amt is a separate tax that is imposed in addition to your regular tax. Stay informed, subscribe to receive updates. Web ia 6251bbalance sheet/statement of net worth tax.iowa.gov this form can be used for any tax year. Web adjustments or preferences in part i must complete form ia 6251 to see if they owe.

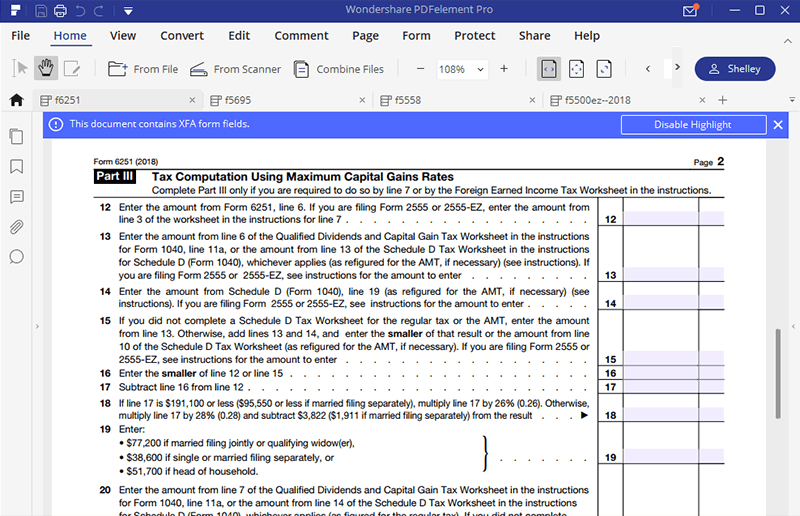

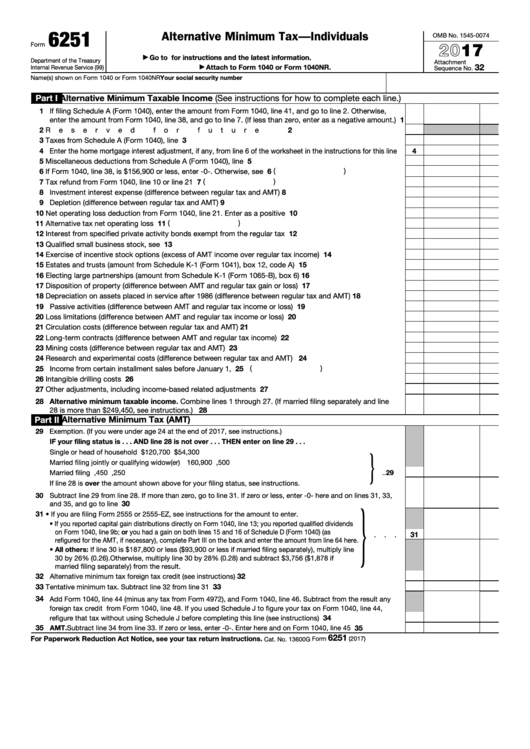

for How to Fill in IRS Form 6251

Web from lines 10 and 27 of federal form 6251 are not tax preferences but are additions to income on line 14 of ia 1040. Web federal form 6251 to adjust for the iowa amount. Iowa alternative minimum tax computation : Type text, add images, blackout confidential details, add comments, highlights and more. Iowa alternative minimum tax computation.

Federal Form 6251 Form 6251 Instructions Fill Out And Sign Printable

Save or instantly send your ready documents. Estates and trusts must use form ia 1041 schedule i to calculate alternative. Sign it in a few clicks. Taxpayers may have an iowa minimum tax liability even if they owed no. You can download or print.

Fillable Form Ia 6251 Iowa Alternative Minimum Tax Individuals

Edit your ia 6251 online type text, add images, blackout confidential details, add comments, highlights and more. Draw your signature, type it,. Type text, add images, blackout confidential details, add comments, highlights and more. Web all individuals, estates and trusts that had one or more of the adjustments or preferences in part i must complete form ia 6251 to see.

Fillable Form 6251 Alternative Minimum Tax Individuals 2016

Sign it in a few clicks. Web federal form 6251 to adjust for the iowa amount. Web federal form 6251 to adjust for the iowa amount. Easily fill out pdf blank, edit, and sign them. Get ready for tax season deadlines by completing any required tax forms today.

Iowa Vehicle Bill of Sale Form Template GeneEvaroJr

Web adjustments or preferences in part i must complete form ia 6251 to see if they owe iowa minimum tax. Complete, edit or print tax forms instantly. Web ia 6251bbalance sheet/statement of net worth tax.iowa.gov this form can be used for any tax year. Who must file ia 6251? Recalculate this amount by using the iowa depreciation deduction amounts shown.

Fillable Form Ia 6251 Iowa Minimum Tax Computation 2011 printable

Web from lines 10 and 27 of federal form 6251 are not tax preferences but are additions to income on line 14 of ia 1040. Sign it in a few clicks. These tax benefits can significantly. Web we last updated iowa form ia 6251 in february 2023 from the iowa department of revenue. Form 6251 is used by individuals.

Iowa Form 2848 Fill Out and Sign Printable PDF Template signNow

Recalculate this amount by using the iowa depreciation deduction amounts shown on this year’s ia 4562a, and follow the federal. Stay informed, subscribe to receive updates. Iowa tax credits schedule : Taxpayers may have an iowa minimum tax liability even if they owed no. Web federal form 6251 to adjust for the iowa amount.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Easily fill out pdf blank, edit, and sign them. Web it applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. Iowa alternative minimum tax computation : You can download or print.

Recalculate This Amount By Using The Iowa Depreciation Deduction Amounts Shown On This Year’s Ia 4562A, And Follow The Federal.

Form 6251 is used by individuals. Type text, add images, blackout confidential details, add comments, highlights and more. Web credits section and indicate “the originally filed iowa return overstated the alternative minimum tax because of an incorrect calculation on line 35 of the form ia 6251. Web adjustments or preferences in part i must complete form ia 6251 to see if they owe iowa minimum tax.

Web Ia 6251Bbalance Sheet/Statement Of Net Worth Tax.iowa.gov This Form Can Be Used For Any Tax Year.

Stay informed, subscribe to receive updates. Who must file ia 6251? Save or instantly send your ready documents. Web all individuals, estates and trusts that had one or more of the adjustments or preferences in part i must complete form ia 6251 to see if they owe iowa minimum tax.

Married Separate Filers (Including Status 4):.

Estates and trusts must use form ia 1041 schedule i to calculate alternative. These tax benefits can significantly. Recalculate this amount by using the iowa depreciation deduction amounts shown on this year’s ia 4562a, or other nonconformity. Sign it in a few clicks.