Insurance Proof Of Loss Form

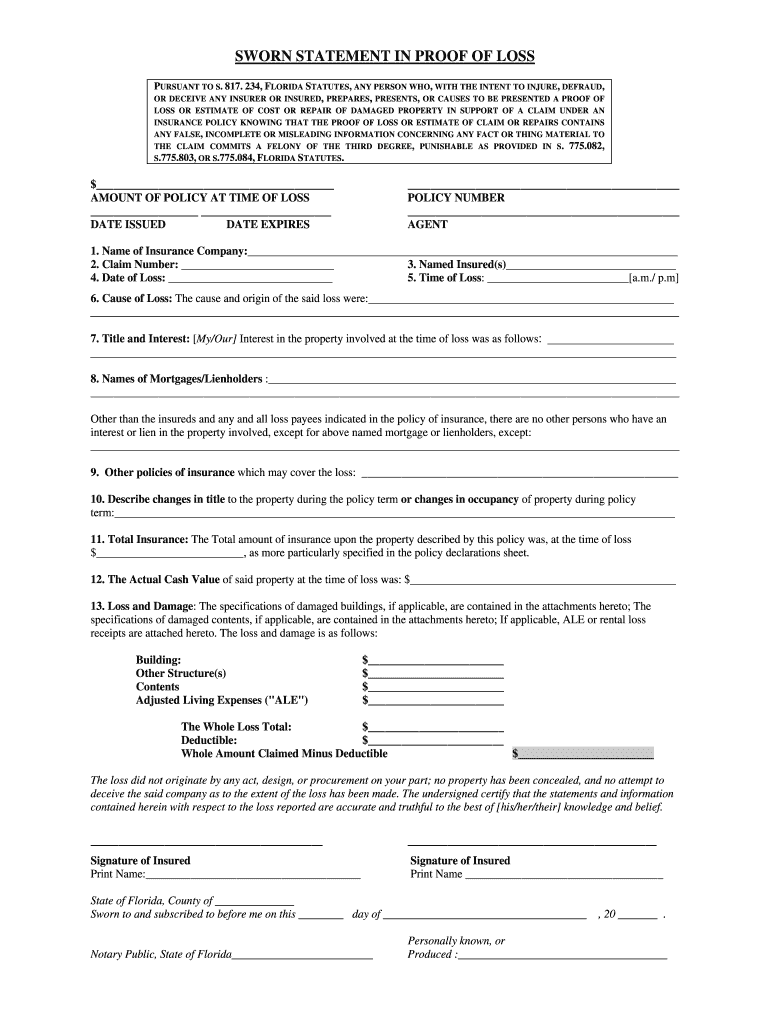

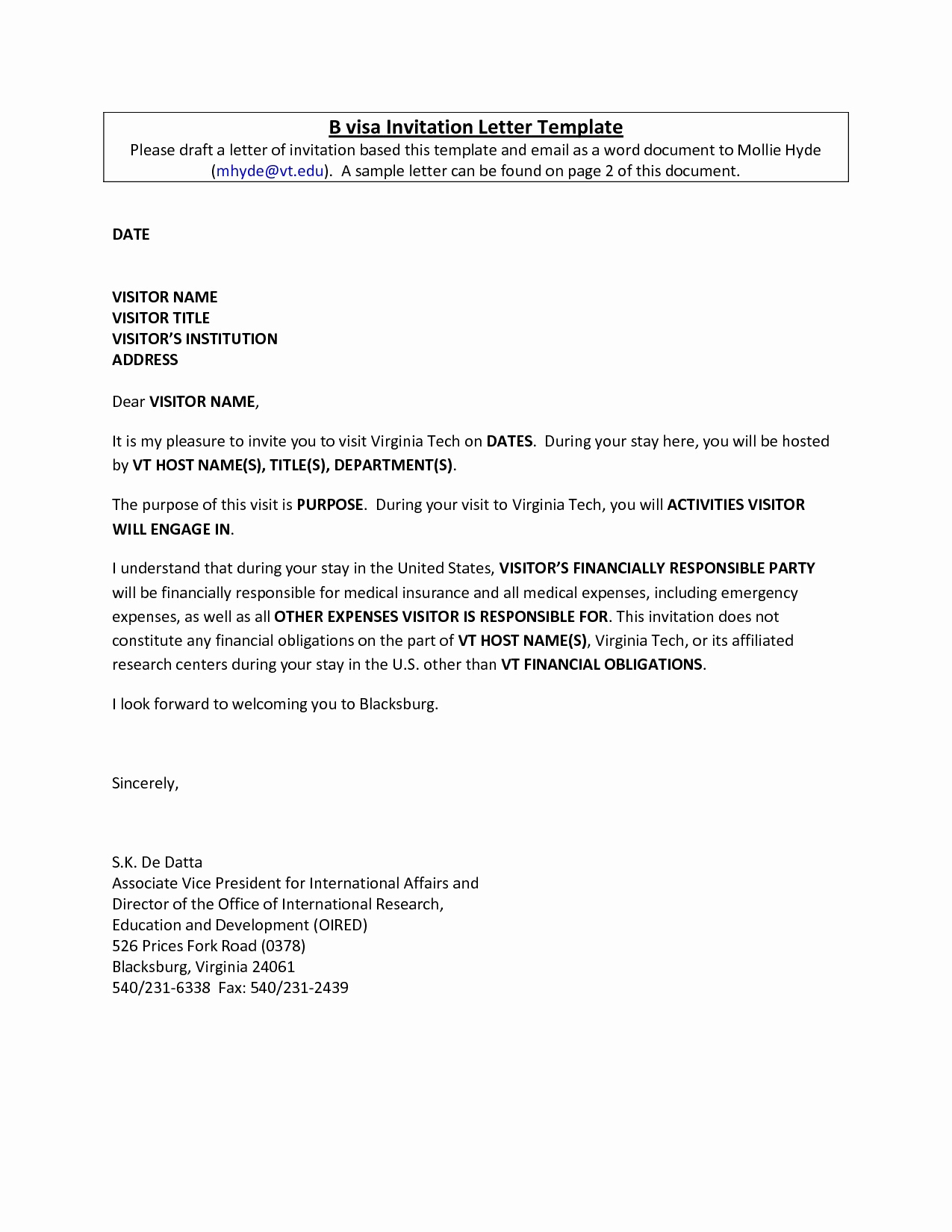

Insurance Proof Of Loss Form - Choose the get form key to open it and move to editing. Web practically all insurance companies will require you to submit the proof of loss statement form when you have had a loss occur. After a thorough review of pricing and coverage, the college of medicine is recommending enrollment in the. Homeowners, condo and renters insurance can typically help cover personal property. Texas title insurance proof of sec. Initial additional name(s) of insured: Web october 5, 2020 baton rouge, la. Web baton rouge, la. The kind your policy requires. Web a proof of loss is a formal, legal document that states the amount of money the policyholder is requesting from the insurance carrier.

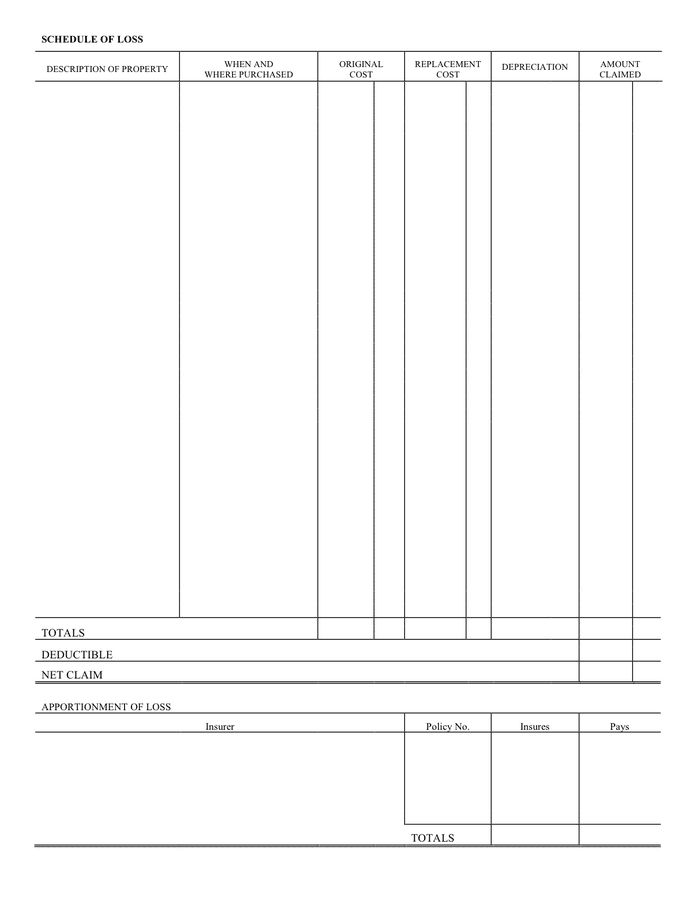

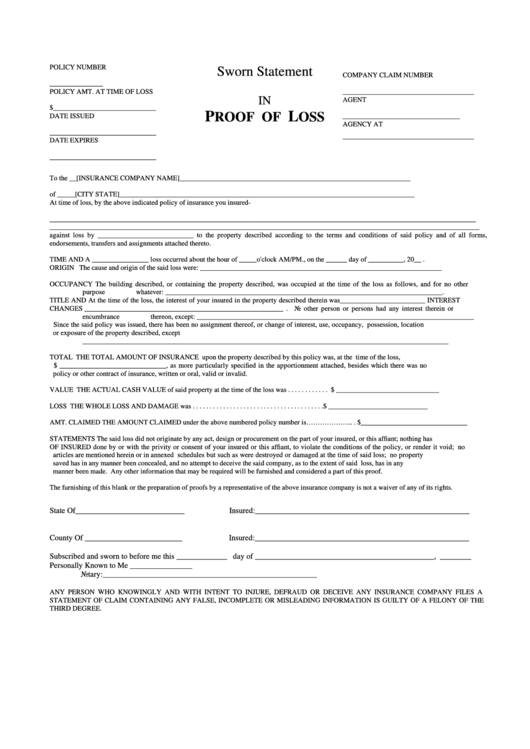

Abide by time requirements your insurance policy will state how long you have to fill out and submit a proof. In the insurance policy, under the. Date & time of loss: Web three important items to remember when filling out a proof of loss form: Select the document you want to sign and click upload. Web tech jobs (coders, computer programmers, software engineers, data analysts) coders, software developers, and data analysts could be displaced by ai, an expert says. All students enrolled in the m.d. Web the total amount of insurance upon the property described by this policy was, at the time of the loss, $ ______________________________, as more particularly specified in the apportionment attached, besides which there was no policy or other contract of insurance, written or oral, valid or invalid. Failure to fill out this form accurately can lead to underpayment,. The kind your policy requires.

A typed, drawn or uploaded signature. Insurance company insured name and address claim number policy number vehicle make and model year serial number date purchased place price loss or damage goods and services tax/harmonized sales tax After a thorough review of pricing and coverage, the college of medicine is recommending enrollment in the. Is there a mortgage interest or additional interest in the property: This form can be used when the adjuster prepares the proof of loss as a courtesy to the policyholder, who then reviews and verifies the accuracy of the information and amounts. Failure to fill out this form accurately can lead to underpayment,. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Abide by time requirements your insurance policy will state how long you have to fill out and submit a proof. This form supports calculations to determine the amount of insurance benefits for mitigation activities. You will need to provide supporting.

Proof Of Loss Fill Out and Sign Printable PDF Template signNow

It provides the insurance company with detailed information regarding the formal claim of damages. Web complete proof of loss form in just several moments by following the instructions listed below: Web proof of loss is a formal, official, certified, and sworn statement of the claim an individual makes and submits it to the insurance company about the degree of property.

Proof Of Auto Insurance Template Free Template Business

Vii loss form texas title insurance proof of loss form. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web baton rouge, la. Web proof of disability insurance form. Total amount of coverage for the dwelling at the time of loss 2.

Proof of loss template in Word and Pdf formats page 2 of 2

Failure to fill out this form accurately can lead to underpayment,. Web proof of disability insurance form. Insurance policy number policy amt. Web baton rouge, la. This helps to document the circumstances, as you have told it, to the insurance company and will be used as part of the overall record for your total insurance claim.

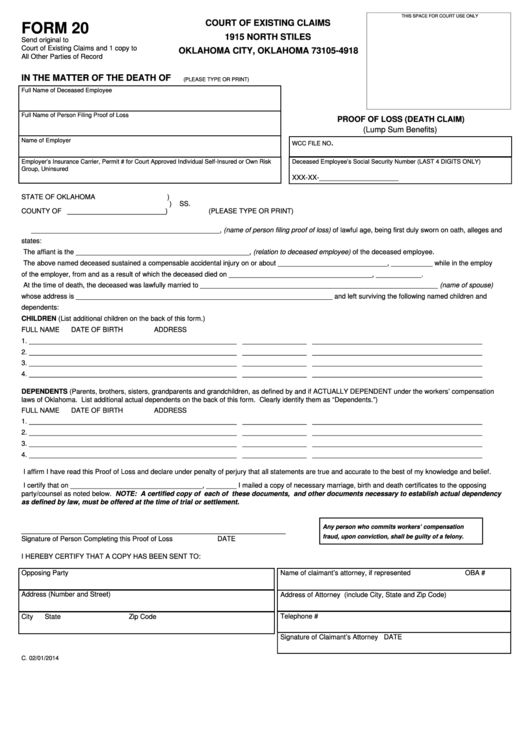

Fillable Form 20 Proof Of Loss (Death Claim) printable pdf download

Most but not all insurance companies require this document after an insurance claim has been filed. Initial additional name(s) of insured: Web proof of loss is a legal document that explains what’s been damaged or stolen and how much money you’re claiming. Your insurer may have you fill one out, depending on the loss. Once you’ve signed the form, you.

Sworn Statement In Proof Of Loss printable pdf download

Date & time of loss: Homeowners, condo and renters insurance can typically help cover personal property. Which has a $200,000 payout and has. Web practically all insurance companies will require you to submit the proof of loss statement form when you have had a loss occur. Fill out the form accurately and truthfully if you do not fill out this.

Loss S Proof Fill Online, Printable, Fillable, Blank pdfFiller

Web a proof of loss form is typically a notarized, sworn statement detailing the losses you suffered and the amount you’re claiming after an insured event. Web follow these steps to fill out your proof of loss form policy number: Web a proof of loss is a formal, legal document that states the amount of money the policyholder is requesting.

Proof Of Loss Of Coverage Letter Template Samples Letter Template

Choose the get form key to open it and move to editing. Find the document template you will need in the library of legal form samples. Web tech jobs (coders, computer programmers, software engineers, data analysts) coders, software developers, and data analysts could be displaced by ai, an expert says. The insurance company then investigates the claim and allows the.

Taking a Look at a Common Proof of Loss Form Property Insurance

It provides the insurance company with detailed information regarding the formal claim of damages. Find the document template you will need in the library of legal form samples. In the insurance policy, under the. 2.) abide by time requirements. Your insurer may have you fill one out, depending on the loss.

Proof Of Auto Insurance Template Free Template Business

Name of your insurance company 7. Web follow these steps to fill out your proof of loss form policy number: The insurance company then investigates the claim and allows the individual to protect its interests. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. With that final touch, your document becomes.

Proof of Loss Homeowners Insurance

Total amount of coverage for the dwelling at the time of loss 2. Your insurer may have you fill one out, depending on the loss. This form supports calculations to determine the amount of insurance benefits for mitigation activities. 2.) abide by time requirements. Name of your insurance company 7.

Web A Proof Of Loss Is A Formal, Legal Document That States The Amount Of Money The Policyholder Is Requesting From The Insurance Carrier.

Abide by time requirements your insurance policy will state how long you have to fill out and submit a proof. Initial additional name(s) of insured: Program of the college of medicine are required to have disability insurance. Texas title insurance proof of sec.

1.) Fill Out The Form Accurately And Truthfully.

Web complete proof of loss form in just several moments by following the instructions listed below: You will need to provide supporting. Web tech jobs (coders, computer programmers, software engineers, data analysts) coders, software developers, and data analysts could be displaced by ai, an expert says. Delay in return of this form may

Find The Document Template You Will Need In The Library Of Legal Form Samples.

Web three important items to remember when filling out a proof of loss form: The total amount of insurance held on the property at the time of the loss date issued/expires: Name of your insurance company 7. Insurance company insured name and address claim number policy number vehicle make and model year serial number date purchased place price loss or damage goods and services tax/harmonized sales tax

Web Baton Rouge, La.

Web follow these steps to fill out your proof of loss form policy number: 2.) abide by time requirements. Please complete all items to the best of your knowledge and return this form to us within 91 days. Web this form is provided to comply with the insurance act, and without prejudice to the liability of the insurer.