Instructions Form 8938

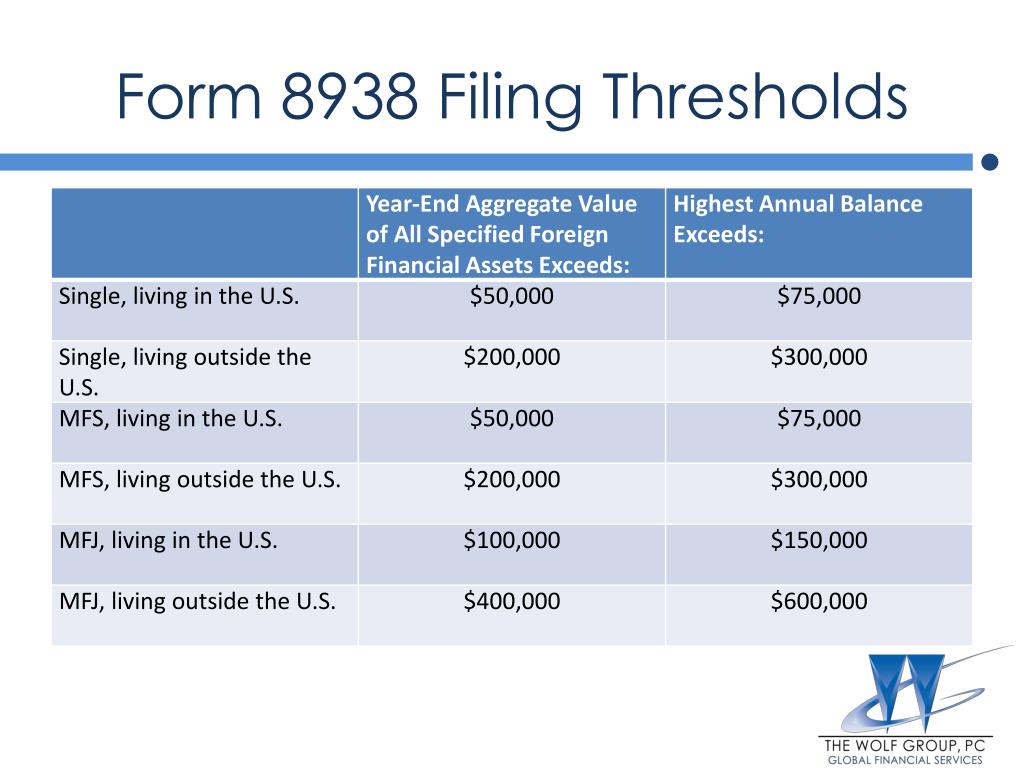

Instructions Form 8938 - You are a specified person (either a specified individual or a specified domestic entity). Attach to your tax return. You must file form 8938 if: Web filing form 8938 is only available to those using turbotax deluxe or higher. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Web form 8938 each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose this information on internal revenue service form 8938 — in addition to filing a us tax return — to comply with fatca. Filing form 8938 does not !relieve you of the requirement See types of reporting thresholds, later. Web the irs requires u.s. Or tax year beginning, 20, and ending.

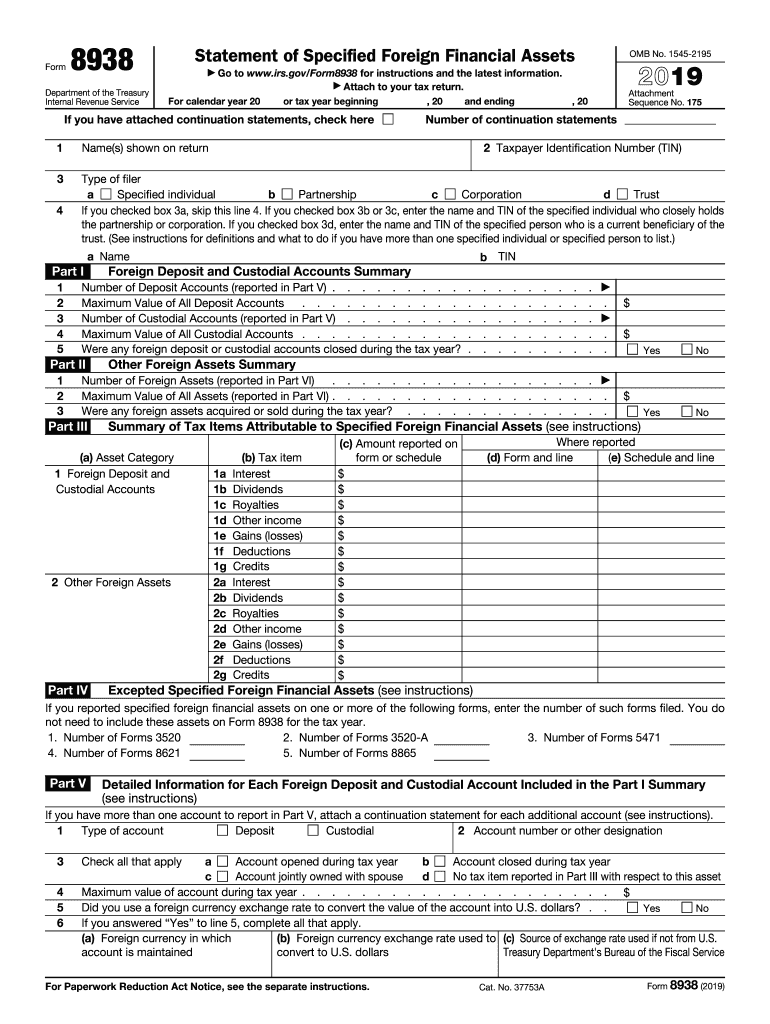

Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Web the irs requires u.s. See types of reporting thresholds, later. When living and working abroad, it’s common for americans to acquire different types of foreign financial assets — having a foreign pension plan or shares of a foreign company. To get to the 8938 section in turbotax, refer to the following instructions: Web filing form 8938 is only available to those using turbotax deluxe or higher. Attach to your tax return. November 2021) statement of specified foreign financial assets department of the treasury internal revenue service go to www.irs.gov/form8938 for instructions and the latest information. You must file form 8938 if:

Web refer to form 8938 instructions for more information on assets that do not have to be reported. Filing form 8938 does not !relieve you of the requirement Attach to your tax return. When living and working abroad, it’s common for americans to acquire different types of foreign financial assets — having a foreign pension plan or shares of a foreign company. Web foreign stock or securities, if you hold them outside of a financial account, must be reported on form 8938, provided the value of your specified foreign financial assets is greater than the reporting threshold that applies to you. See reporting thresholds applying to specified individuals, later. You are a specified person (either a specified individual or a specified domestic entity). Or tax year beginning, 20, and ending. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Search for 8938 and select the jump to link at the top of the search results

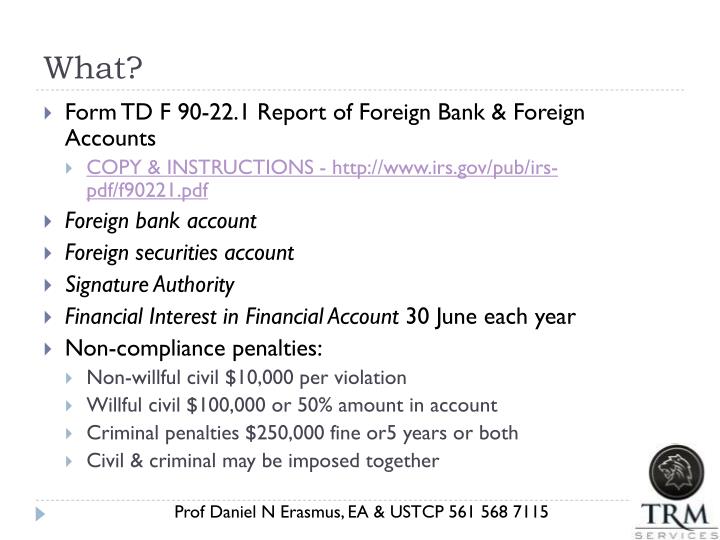

Comparison of Form 8938 and FBAR Requirements

Search for 8938 and select the jump to link at the top of the search results Web the irs requires u.s. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. See types of reporting thresholds, later. Web foreign stock or securities,.

Form 8938 Meadows Urquhart Acree and Cook, LLP

Web filing form 8938 is only available to those using turbotax deluxe or higher. See types of reporting thresholds, later. Web foreign stock or securities, if you hold them outside of a financial account, must be reported on form 8938, provided the value of your specified foreign financial assets is greater than the reporting threshold that applies to you. Web.

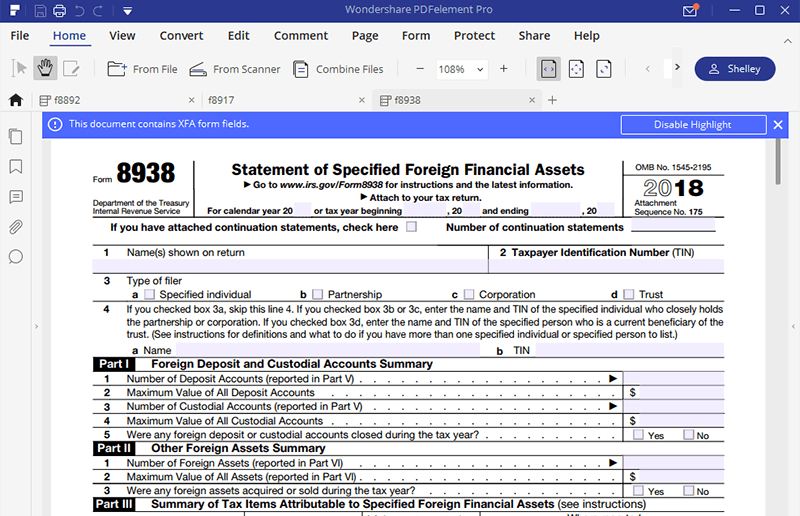

Form 8938 Statement of Specified Foreign Financial Assets 2018 DocHub

You are a specified person (either a specified individual or a specified domestic entity). Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Or tax year beginning, 20, and ending. Web the irs requires u.s..

PPT 1818 Society Form 8938 and Other I mportant R eporting I ssues

Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Or tax year beginning, 20, and ending. Search for 8938 and select the jump to link at the top of the search results Web filing.

Form Td F 90 22.1 Instructions

Web foreign stock or securities, if you hold them outside of a financial account, must be reported on form 8938, provided the value of your specified foreign financial assets is greater than the reporting threshold that applies to you. Attach to your tax return. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms.

USCs and LPRs Who Are Having Their NonU.S. Accounts Closed Is it hype

Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you.

IRS Form 8938 How to Fill it with the Best Form Filler

Web the irs requires u.s. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. You are a specified person (either a specified individual or a specified domestic entity). Or tax year beginning, 20, and.

IRS Instructions 8938 2018 2019 Fillable and Editable PDF Template

Web refer to form 8938 instructions for more information on assets that do not have to be reported. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Taxpayers to report specified foreign financial assets each year on a form 8938. Web.

2020 8938 Instructions Form Fill Out and Sign Printable PDF Template

To get to the 8938 section in turbotax, refer to the following instructions: Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Search for 8938 and select the jump to link at the top.

Ir's 8938 Instructions Form Fill Out and Sign Printable PDF Template

Filing form 8938 does not !relieve you of the requirement Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Web foreign stock or securities, if you hold them outside of a financial account, must be.

Web Filing Form 8938 Is Only Available To Those Using Turbotax Deluxe Or Higher.

Web form 8938 each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose this information on internal revenue service form 8938 — in addition to filing a us tax return — to comply with fatca. Filing form 8938 does not !relieve you of the requirement To get to the 8938 section in turbotax, refer to the following instructions: Web the irs requires u.s.

Or Tax Year Beginning, 20, And Ending.

Search for 8938 and select the jump to link at the top of the search results Web foreign stock or securities, if you hold them outside of a financial account, must be reported on form 8938, provided the value of your specified foreign financial assets is greater than the reporting threshold that applies to you. Web officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Taxpayers to report specified foreign financial assets each year on a form 8938.

You Must File Form 8938 If:

Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold.

Web Refer To Form 8938 Instructions For More Information On Assets That Do Not Have To Be Reported.

When living and working abroad, it’s common for americans to acquire different types of foreign financial assets — having a foreign pension plan or shares of a foreign company. See reporting thresholds applying to specified individuals, later. See types of reporting thresholds, later. Attach to your tax return.