Instructions Form 5471

Instructions Form 5471 - Web when a us person has certain ownership or control over a foreign corporation, they may have a form 5471 filing requirement. With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. Citizens and residents with ownership in foreign corporations, such as shareholders, directors, or officers. However, in the case of schedule e (form 5471) filers, Item c—percentage of voting stock owned; For instructions and the latest information. Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. Section 898 specified foreign corporation (sfc). Web the instructions to form 5471 describes a category 5a filer as a u.s. Persons with respect to certain foreign corporations.

Form 5471 filers generally use the same category of filer codes used on form 1118. This way, the irs can prevent u.s. Residents from using foreign assets to evade u.s. Persons with respect to certain foreign corporations. Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. Web instead, form 5471 allows the internal revenue service (irs) to have a complete record of u.s. Shareholder of certain foreign corporations foreign corporation’s that file form 5471 use this schedule to report the ptep in the u.s. Item c—percentage of voting stock owned; Shareholder who doesn't qualify as either a category 5b or 5c filer. December 2021) department of the treasury internal revenue service.

This way, the irs can prevent u.s. Changes to separate schedule j (form 5471). Item c—percentage of voting stock owned; Citizens and residents with ownership in foreign corporations, such as shareholders, directors, or officers. Residents from using foreign assets to evade u.s. Form 5471 filers generally use the same December 2021) department of the treasury internal revenue service. Shareholder of certain foreign corporations foreign corporation’s that file form 5471 use this schedule to report the ptep in the u.s. Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. So, a 5a filer is an unrelated section 958(a) u.s.

Form 5471 Information Return of U.S. Persons with Respect to Certain

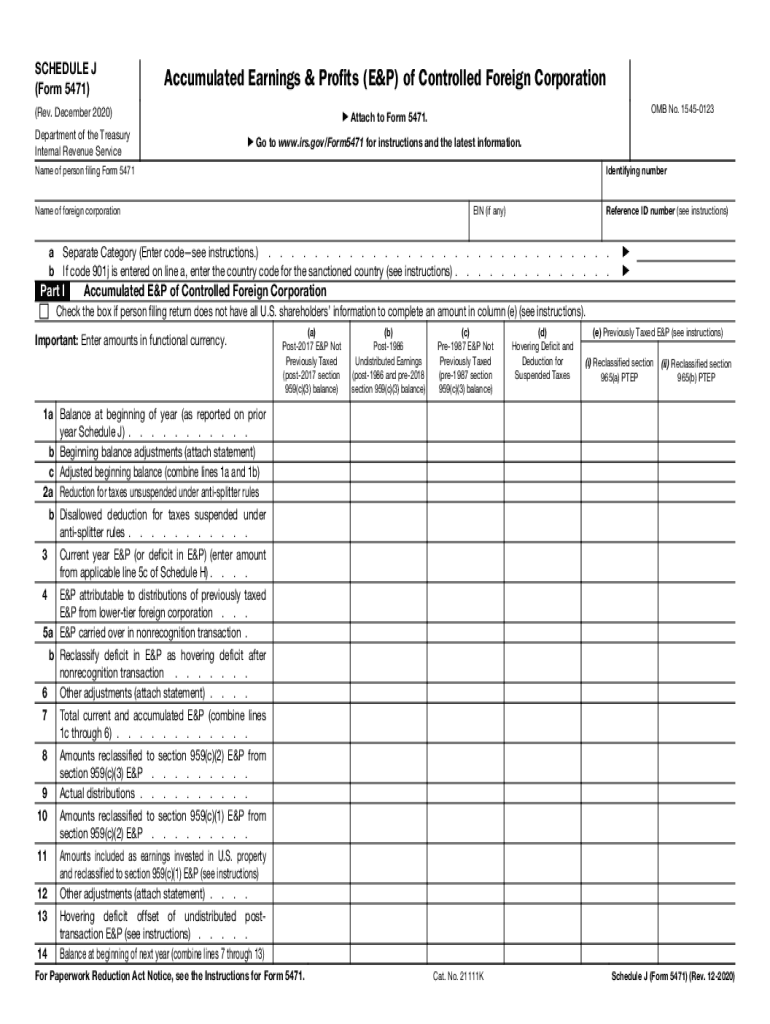

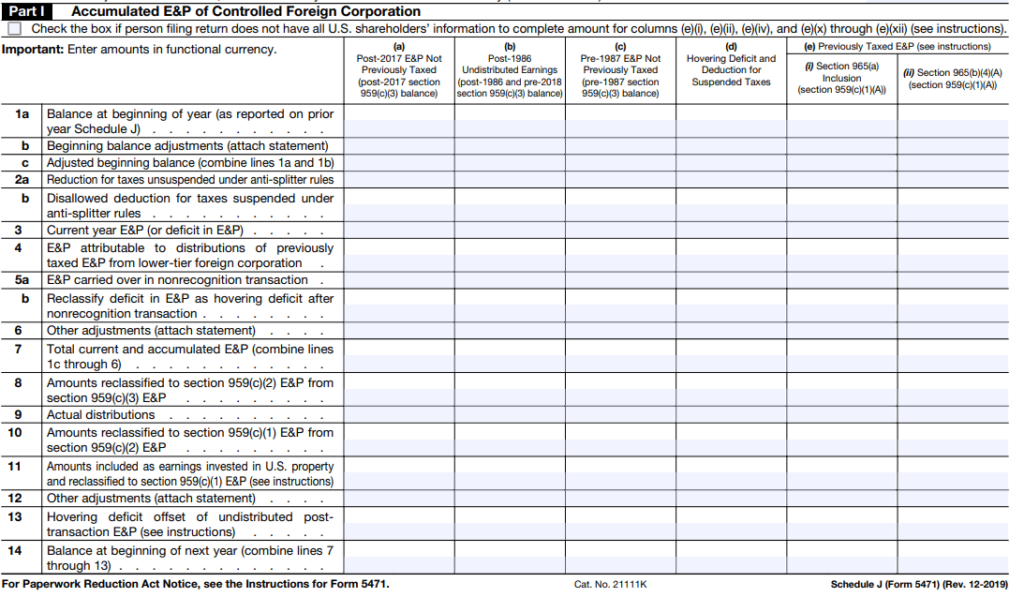

Form 5471 filers generally use the same category of filer codes used on form 1118. This way, the irs can prevent u.s. With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. Information furnished for the foreign corporation’s annual accounting.

IRS 5471 Schedule J 20202022 Fill out Tax Template Online US

For instructions and the latest information. Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. Shareholder, while a 5c filer is a related constructive u.s. This way, the irs can prevent u.s. Persons with respect to certain foreign corporations.

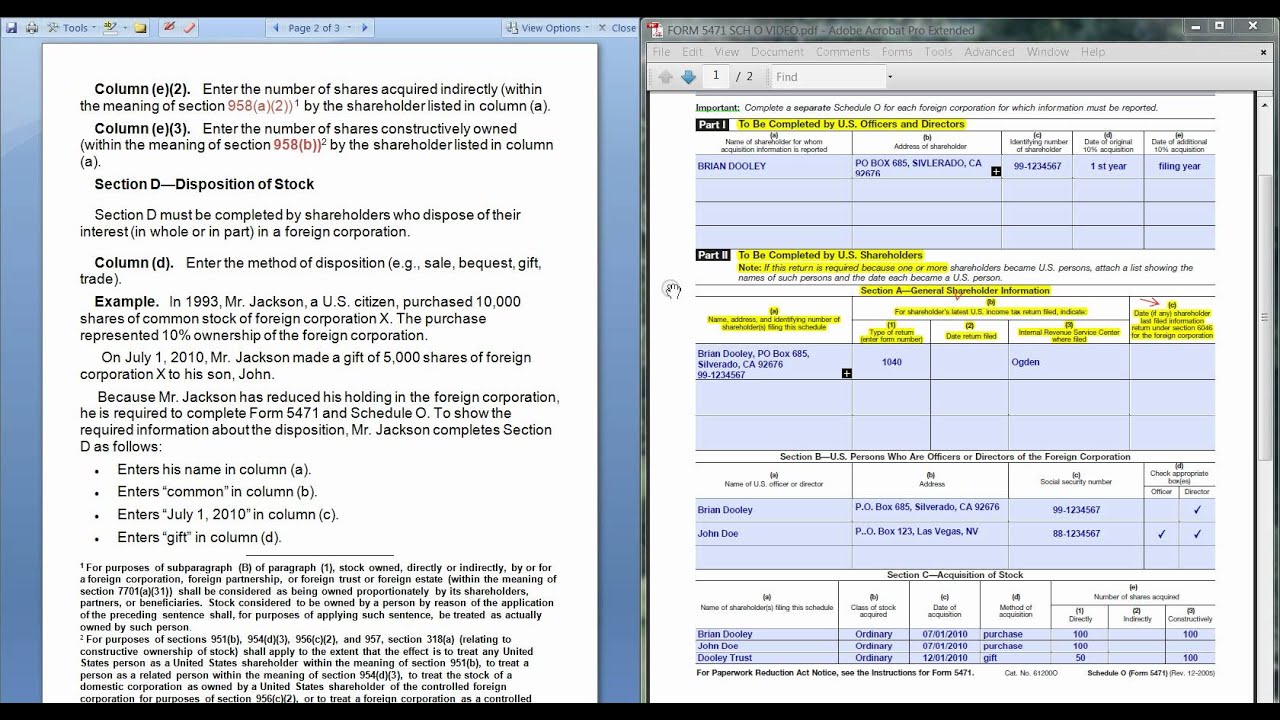

FORM 5471 SCHEDULE O CONTROLLED FOREIGN CORPORATION.avi YouTube

December 2021) department of the treasury internal revenue service. With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. However, in the case of schedule e (form 5471) filers, Form 5471 filers generally use the same Section 898 specified foreign.

IRS 3520A 2020 Fill out Tax Template Online US Legal Forms

Persons with respect to certain foreign corporations. Shareholder who doesn't qualify as either a category 5b or 5c filer. Form 5471 filers generally use the same category of filer codes used on form 1118. For instructions and the latest information. Web instead, form 5471 allows the internal revenue service (irs) to have a complete record of u.s.

Form 5471 Instructions 2016 Elegant Irs form Instructions Fs Federal

Shareholder of certain foreign corporations foreign corporation’s that file form 5471 use this schedule to report the ptep in the u.s. Form 5471 filers generally use the same Web when a us person has certain ownership or control over a foreign corporation, they may have a form 5471 filing requirement. Shareholder who doesn't qualify as either a category 5b or.

Instructions on Tax form 5471 TaxForm5471

Form 5471 filers generally use the same category of filer codes used on form 1118. Shareholder, while a 5c filer is a related constructive u.s. Web instead, form 5471 allows the internal revenue service (irs) to have a complete record of u.s. This way, the irs can prevent u.s. However, in the case of schedule e (form 5471) filers,

Form 5471 Schedule J Instructions 2019 cloudshareinfo

For instructions and the latest information. With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is required for schedule j filers in certain circumstances. This way, the irs can prevent u.s. Residents from using foreign assets to evade u.s. Section 898 specified foreign corporation (sfc).

Download Instructions for IRS Form 5471 Information Return of U.S

Use the december 2019 revision. Form 5471 filers generally use the same Section 898 specified foreign corporation (sfc). Citizens and residents with ownership in foreign corporations, such as shareholders, directors, or officers. Shareholder of certain foreign corporations foreign corporation’s that file form 5471 use this schedule to report the ptep in the u.s.

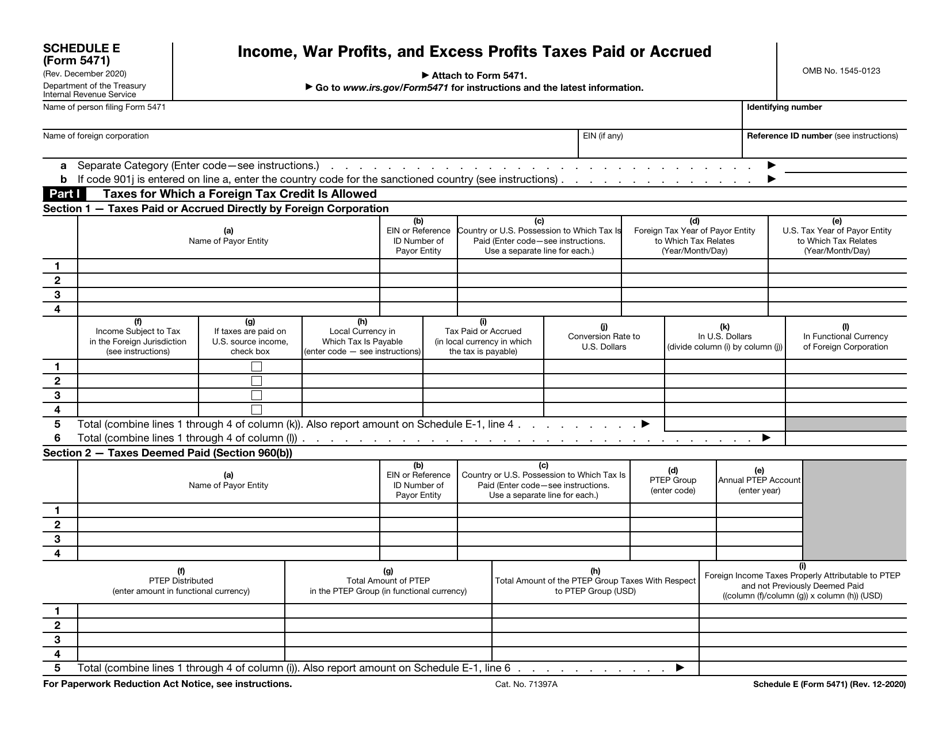

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web instead, form 5471 allows the internal revenue service (irs) to have a complete record of u.s. Shareholder of certain foreign corporations foreign corporation’s that file form 5471 use this schedule to report the ptep in the u.s. With respect to line a at the top of page 1 of schedule j, there is a new code “total” that is.

2012 form 5471 instructions Fill out & sign online DocHub

However, in the case of schedule e (form 5471) filers, Web when a us person has certain ownership or control over a foreign corporation, they may have a form 5471 filing requirement. Use the december 2019 revision. Changes to separate schedule j (form 5471). Name of person filing this return.

Residents From Using Foreign Assets To Evade U.s.

Name of person filing this return. Web instead, form 5471 allows the internal revenue service (irs) to have a complete record of u.s. For instructions and the latest information. Form 5471 filers generally use the same

Use The December 2019 Revision.

Changes to separate schedule j (form 5471). December 2021) department of the treasury internal revenue service. Web instructions for schedule o (form 5471) schedule p (form 5471), previously taxed earnings and profits of u.s. Citizens and residents with ownership in foreign corporations, such as shareholders, directors, or officers.

However, In The Case Of Schedule E (Form 5471) Filers,

Shareholder who doesn't qualify as either a category 5b or 5c filer. This way, the irs can prevent u.s. Shareholder of certain foreign corporations foreign corporation’s that file form 5471 use this schedule to report the ptep in the u.s. Web the instructions to form 5471 describes a category 5a filer as a u.s.

Shareholder, While A 5C Filer Is A Related Constructive U.s.

Persons with respect to certain foreign corporations. So, a 5a filer is an unrelated section 958(a) u.s. Item c—percentage of voting stock owned; Web corrections to form 5471;