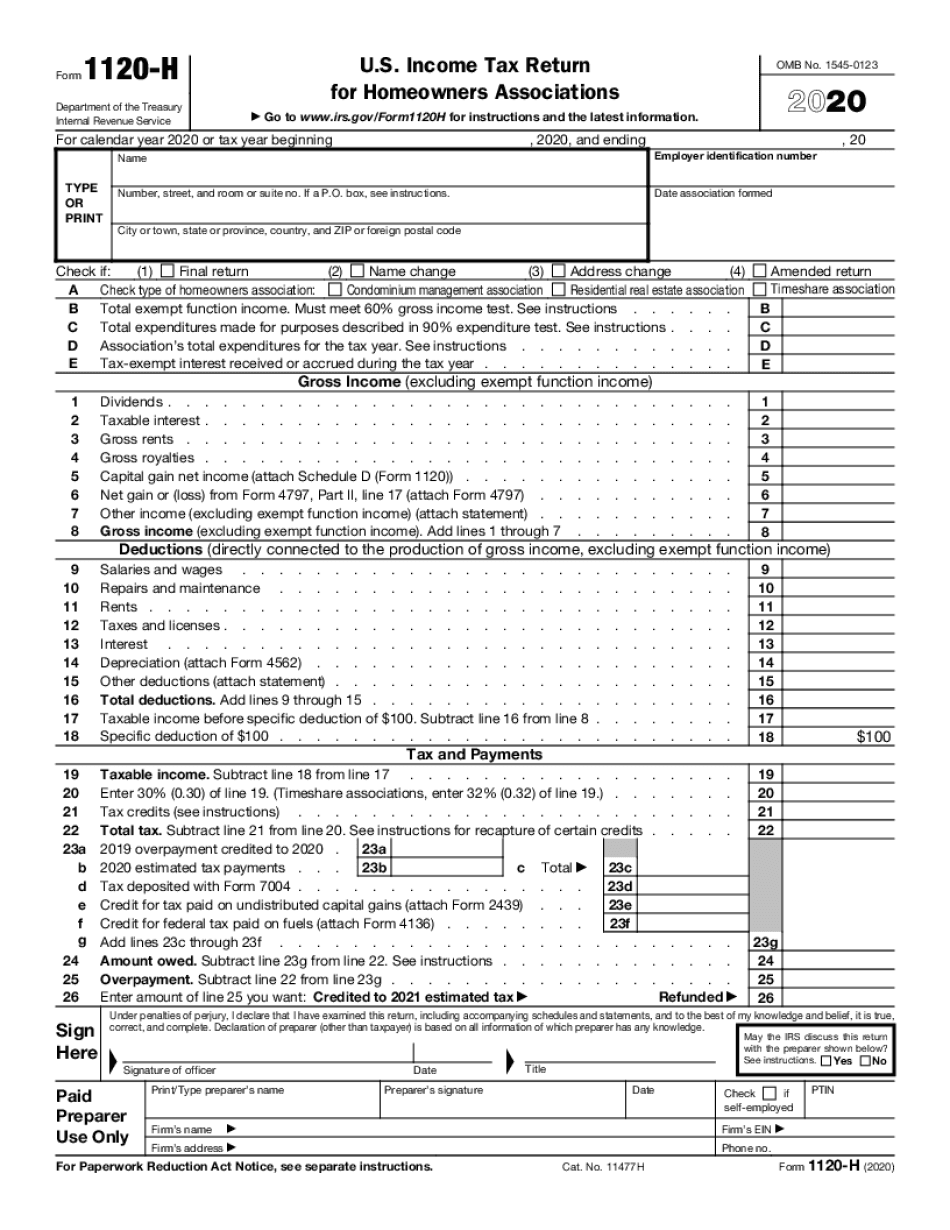

Instructions For Form 1120-H

Instructions For Form 1120-H - After completing the heading information, complete the rest of the return as needed. If you do not follow these instructions, your election will be. Web our online software proposes the key to make the process of completing irs docs as simple as possible. Income tax return for homeowners associations 2022 go to www.irs.gov/form1120h for instructions and. It details some of the basic information of the homeowners association. Top section the image above is the top section of the form. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Income tax return for homeowners associations department of the treasury internal revenue service section references are to the. Income tax return for homeowners associations department of the treasury internal revenue service section references are to the. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax.

Web our online software proposes the key to make the process of completing irs docs as simple as possible. If the association's principal business or office is located in. Organized and operated to acquire, build, • deductions under part viii of manage,. It details some of the basic information of the homeowners association. Income tax return for homeowners associations department of the treasury internal revenue service section references are to the. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax. If you do not follow these instructions, your election will be. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. Top section the image above is the top section of the form. Income tax return for homeowners associations department of the treasury internal revenue service section references are to the.

Web our online software proposes the key to make the process of completing irs docs as simple as possible. Organized and operated to acquire, build, • deductions under part viii of manage,. After completing the heading information, complete the rest of the return as needed. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. Instructions for form 1120 for details. If you do not follow these instructions, your election will be. It details some of the basic information of the homeowners association. If the association's principal business or office is located in. Use the following irs center address. Income tax return for homeowners associations department of the treasury internal revenue service section references are to the.

1120 h fillable form 2020 Fill Online, Printable, Fillable Blank

Web a condominium management association) (section 172). Instructions for form 1120 for details. Use the following irs center address. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax. Web your fein, the tax year of the return creating the overpayment, and the tax year you.

IRS 1120 2022 Form Printable Blank PDF Online

After completing the heading information, complete the rest of the return as needed. Use fill to complete blank online irs pdf. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. If the association's principal business or office is located in. It details some of the basic.

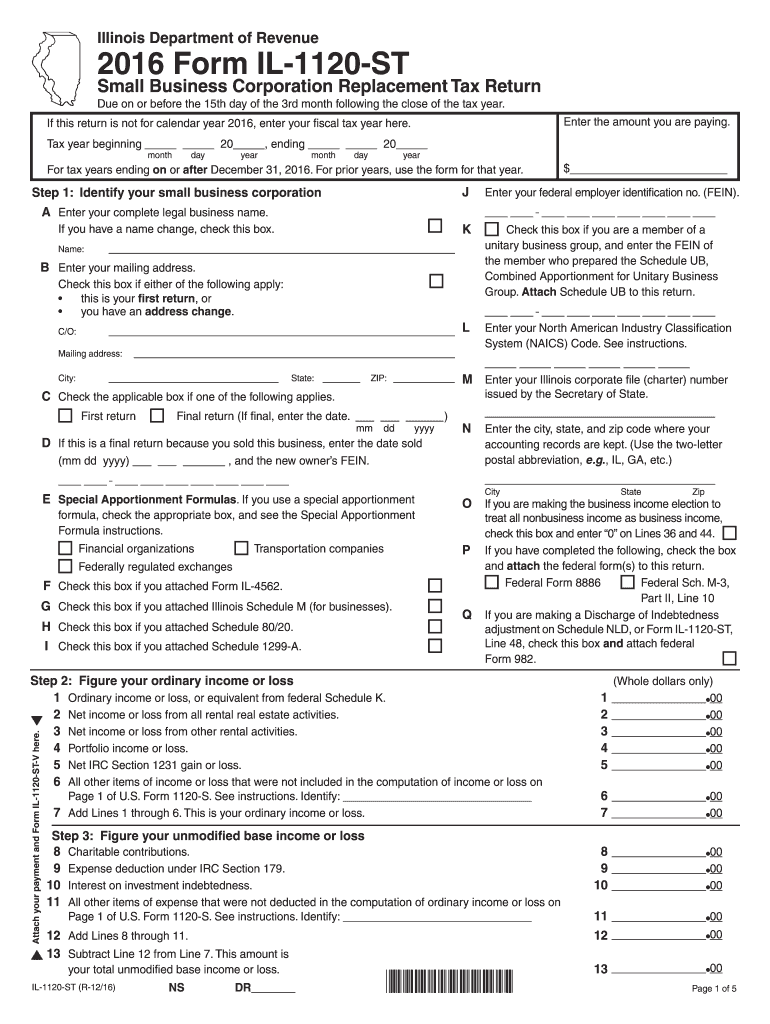

Form Il 1120 St Fill Out and Sign Printable PDF Template signNow

Top section the image above is the top section of the form. Income tax return for homeowners associations department of the treasury internal revenue service section references are to the. After completing the heading information, complete the rest of the return as needed. The election is made separately for each tax year and must generally be made by the due.

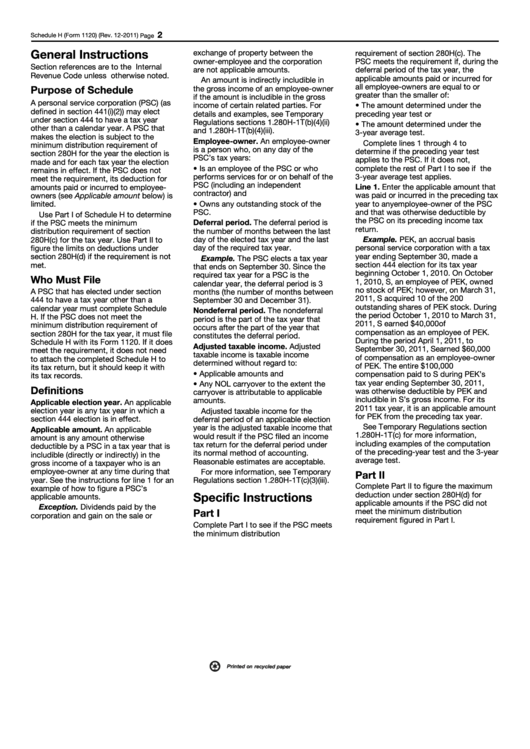

Form 1120 (Schedule H) Limitations for Personal Service Corporation

Top section the image above is the top section of the form. Instructions for form 1120 for details. Income tax return for homeowners associations department of the treasury internal revenue service section references are to the. Organized and operated to acquire, build, • deductions under part viii of manage,. Income tax return for homeowners associations 2022 go to www.irs.gov/form1120h for.

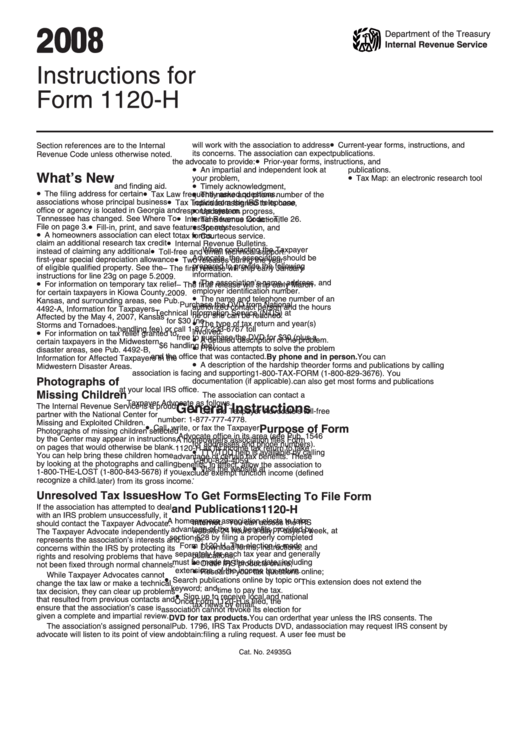

Instructions For Form 1120H 2008 printable pdf download

The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Income tax return for homeowners associations 2022 go to www.irs.gov/form1120h for instructions and. Use the following irs center address. Web our online software proposes the key to make the process of completing irs docs as.

IRS 1120W 2021 Fill out Tax Template Online US Legal Forms

Instructions for form 1120 for details. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax. Web our online software proposes the key to make the process of completing irs docs as simple as possible. Use fill to complete blank online irs pdf. Top section the.

Form 1120 Instructions Printable PDF Sample

Web our online software proposes the key to make the process of completing irs docs as simple as possible. It details some of the basic information of the homeowners association. Instructions for form 1120 for details. Organized and operated to acquire, build, • deductions under part viii of manage,. Use the following irs center address.

Instructions For Form 1120 Final Tax Return printable pdf download

Income tax return for homeowners associations department of the treasury internal revenue service section references are to the. If you do not follow these instructions, your election will be. If the association's principal business or office is located in. Income tax return for homeowners associations department of the treasury internal revenue service section references are to the. Instructions for form.

Form 1120F (Schedule H) Deductions Allocated to Effectively

After completing the heading information, complete the rest of the return as needed. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax..

Form 1120 Schedule H General Instructions printable pdf download

Income tax return for homeowners associations 2022 go to www.irs.gov/form1120h for instructions and. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. Income tax return for homeowners associations department of the treasury internal revenue service section references are to the. If you do not follow these.

Income Tax Return For Homeowners Associations Department Of The Treasury Internal Revenue Service Section References Are To The.

Income tax return for homeowners associations 2022 go to www.irs.gov/form1120h for instructions and. Web your fein, the tax year of the return creating the overpayment, and the tax year you wish to have the credit apply. Use fill to complete blank online irs pdf. Income tax return for homeowners associations department of the treasury internal revenue service section references are to the.

Instructions For Form 1120 For Details.

Top section the image above is the top section of the form. If the association's principal business or office is located in. Organized and operated to acquire, build, • deductions under part viii of manage,. After completing the heading information, complete the rest of the return as needed.

The Election Is Made Separately For Each Tax Year And Must Generally Be Made By The Due Date, Including Extensions, Of The Income Tax Return.

Web our online software proposes the key to make the process of completing irs docs as simple as possible. If you do not follow these instructions, your election will be. Web a condominium management association) (section 172). It details some of the basic information of the homeowners association.

Use The Following Irs Center Address.

The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax.