Innocent Spouse Tax Form

Innocent Spouse Tax Form - Important things you should know • do not file this form with your tax return. If you are requesting relief for more than 6 tax years, you must file an additional form 8857. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. In the event the request for innocent spouse relief is denied, a requesting spouse is entitled to an administrative. If income is missing from your tax return, it should be income your spouse received, not you. Form 8857 covers innocent spouse relief, separation of liability and equitable relief. (see community property laws, later). A request can also be made as part of a u.s. You may be allowed innocent spouse relief only if all of the following apply. If we denied relief, you both remain responsible for the taxes, penalties and interest.

Web to request relief of any of the types discussed above, use form 8857, request for innocent spouse relief. The letter explains the reason for our decision. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. Web 8857 request for innocent spouse relief. Web you must request innocent spouse relief within 2 years of receiving an irs notice of an audit or taxes due because of an error on your return. Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. If income is missing from your tax return, it should be income your spouse received, not you. Web you must file form 8857 no later than 6 months before the expiration of the period of limitations on assessment (including extensions) against your spouse or former spouse for the tax year for which you are requesting relief. The irs will review your form 8857 and let you know if you qualify. June 2021) department of the treasury internal revenue service (99) request for innocent spouse relief.

Web give your spouse relief; To request relief, file form 8857, request for innocent spouse relief. Web 8857 request for innocent spouse relief. Web you must request innocent spouse relief within 2 years of receiving an irs notice of an audit or taxes due because of an error on your return. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. A request can also be made as part of a u.s. We send a preliminary determination letter to both spouses after we review form 8857, request for innocent spouse relief pdf. In the event the request for innocent spouse relief is denied, a requesting spouse is entitled to an administrative. Form 8857 covers innocent spouse relief, separation of liability and equitable relief. Important things you should know • do not file this form with your tax return.

Your Guide To Filing Form 8857 Request For Innocent Spouse Relief

A request can also be made as part of a u.s. The letter explains the reason for our decision. Relief from liability for tax attributable to an item of community income. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse..

Form 8857 Request for Innocent Spouse Relief (2014) Free Download

Form 8857 covers innocent spouse relief, separation of liability and equitable relief. We send a preliminary determination letter to both spouses after we review form 8857, request for innocent spouse relief pdf. Relief from liability for tax attributable to an item of community income. You may be allowed innocent spouse relief only if all of the following apply. The letter.

Form 8857 Request for Innocent Spouse Relief (2014) Free Download

(see community property laws, later). If you are requesting relief for more than 6 tax years, you must file an additional form 8857. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. June 2021) department of the treasury internal revenue service (99) request for innocent spouse relief. Web information about form.

Form 8857Request for Innocent Spouse Relief

The letter explains the reason for our decision. When to file form 8857 Web 8857 request for innocent spouse relief. A request can also be made as part of a u.s. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse.

Innocent Spouse Tax Liability Relief Roger Rossmeisl, CPA

You may be allowed innocent spouse relief only if all of the following apply. Tax court petition under the taxpayer first act, p.l. (see community property laws, later). In the event the request for innocent spouse relief is denied, a requesting spouse is entitled to an administrative. The letter explains the reason for our decision.

Innocent Spouse Podcast CT Attorneys Discuss Tax Relief

Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Form 8857 covers innocent spouse relief, separation of liability and equitable relief. You may be allowed innocent spouse relief only if all of the following apply. The irs will review your form 8857 and let you know if you.

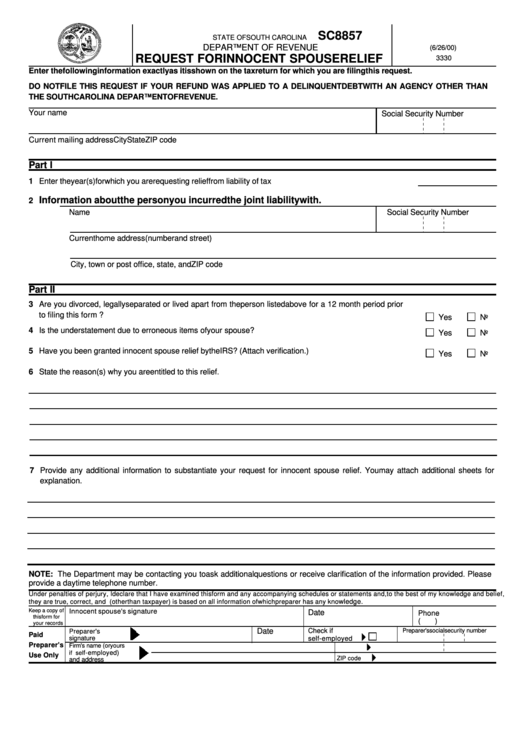

Form Sc8857 Request For Innocent Spouse Relief printable pdf download

You may be allowed innocent spouse relief only if all of the following apply. Web give your spouse relief; Web 8857 request for innocent spouse relief. A request can also be made as part of a u.s. For instructions and the latest information.

Innocent Spouse Relief Tax Attorney San Diego Milikowsky Law

You may be allowed innocent spouse relief only if all of the following apply. Important things you should know • do not file this form with your tax return. (see community property laws, later). The irs will review your form 8857 and let you know if you qualify. If income is missing from your tax return, it should be income.

Should I file an innocent spouse form?

In the event the request for innocent spouse relief is denied, a requesting spouse is entitled to an administrative. For instructions and the latest information. A request can also be made as part of a u.s. To request relief, file form 8857, request for innocent spouse relief. The irs will review your form 8857 and let you know if you.

Your Guide To Filing Form 8857 Request For Innocent Spouse Relief

Web information about form 8857, request for innocent spouse relief, including recent updates, related forms, and instructions on how to file. Important things you should know • do not file this form with your tax return. If income is missing from your tax return, it should be income your spouse received, not you. June 2021) department of the treasury internal.

Web Give Your Spouse Relief;

If you are requesting relief for more than 6 tax years, you must file an additional form 8857. Form 8857 covers innocent spouse relief, separation of liability and equitable relief. For instructions and the latest information. You may be allowed innocent spouse relief only if all of the following apply.

Tax Court Petition Under The Taxpayer First Act, P.l.

Form 8857 is used to request relief from tax liability when a spouse or former spouse should be. Web to request relief of any of the types discussed above, use form 8857, request for innocent spouse relief. Web you must request innocent spouse relief within 2 years of receiving an irs notice of an audit or taxes due because of an error on your return. If income is missing from your tax return, it should be income your spouse received, not you.

If We Denied Relief, You Both Remain Responsible For The Taxes, Penalties And Interest.

Web 8857 request for innocent spouse relief. Request for innocent spouse relief is an internal revenue service (irs) tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. When to file form 8857 Web you must file form 8857 no later than 6 months before the expiration of the period of limitations on assessment (including extensions) against your spouse or former spouse for the tax year for which you are requesting relief.

A Request Can Also Be Made As Part Of A U.s.

In the event the request for innocent spouse relief is denied, a requesting spouse is entitled to an administrative. (see community property laws, later). Relief from liability for tax attributable to an item of community income. To request relief, file form 8857, request for innocent spouse relief.