Indiana Tax Withholding Form

Indiana Tax Withholding Form - Underpayment of indiana withholding filing. Generally, employers are required to withhold both state and county taxes from employees’ wages. However, they have to register to withhold tax in indiana but must have an employer identification number issued by the federal government. Enter your indiana county of residence and county of principal employment as of january 1 of the current year. Register and file this tax online via intime. Your withholding is subject to review by the irs. Do not send this form to the department of revenue. Print or type your full name, social security number or itin and home address. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. You are still liable for any additional taxes due at the end of the tax year.

If the employer does withhold the additional amount, it should be submitted along with the regular state and county tax withholding. Register and file this tax online via intime. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. In addition, the employer should look at departmental notice #1 that details the withholding rates for each of indiana’s 92 counties. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. This forms part of indiana’s. Your withholding is subject to review by the irs. You are still liable for any additional taxes due at the end of the tax year. However, they have to register to withhold tax in indiana but must have an employer identification number issued by the federal government. The completed form should be returned to your employer.

In addition, the employer should look at departmental notice #1 that details the withholding rates for each of indiana’s 92 counties. Do not send this form to the department of revenue. Register and file this tax online via intime. Enter your indiana county of residence and county of principal employment as of january 1 of the current year. Underpayment of indiana withholding filing. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. Register and file this tax online via intime. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. This forms part of indiana’s. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax.

Worksheet A State Tax Withholding 2022 Pdf Tripmart

Register and file this tax online via intime. Register and file this tax online via intime. Do not send this form to the department of revenue. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. You are still liable for any additional taxes due at the end of the.

Employee's Withholding Exemption and County Status Certificate

In addition, the employer should look at departmental notice #1 that details the withholding rates for each of indiana’s 92 counties. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Your withholding is subject to review by the irs. Enter your indiana county of residence and county of principal.

Indiana Property Tax Due Dates 2016 Property Walls

In addition, the employer should look at departmental notice #1 that details the withholding rates for each of indiana’s 92 counties. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. However, they have to register to withhold tax in indiana but must have an employer identification number issued by the federal.

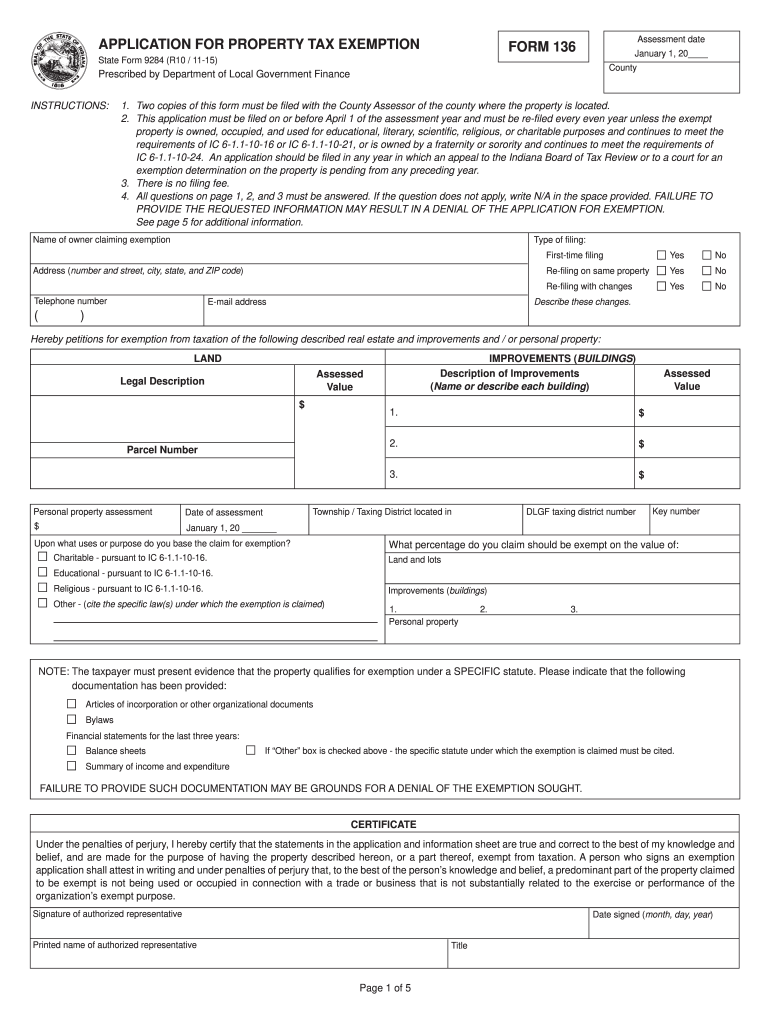

20152022 IN State Form 9284 Fill Online, Printable, Fillable, Blank

Web line does not obligate your employer to withhold the amount. Do not send this form to the department of revenue. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Generally, employers are required to withhold both state and county taxes from employees’ wages. You are still.

Employee's Withholding Exemption and County Status Certificate

In addition, the employer should look at departmental notice #1 that details the withholding rates for each of indiana’s 92 counties. If the employer does withhold the additional amount, it should be submitted along with the regular state and county tax withholding. Your withholding is subject to review by the irs. Underpayment of indiana withholding filing. However, they have to.

Indiana W4 Fill Out and Sign Printable PDF Template signNow

You are still liable for any additional taxes due at the end of the tax year. However, they have to register to withhold tax in indiana but must have an employer identification number issued by the federal government. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Register and.

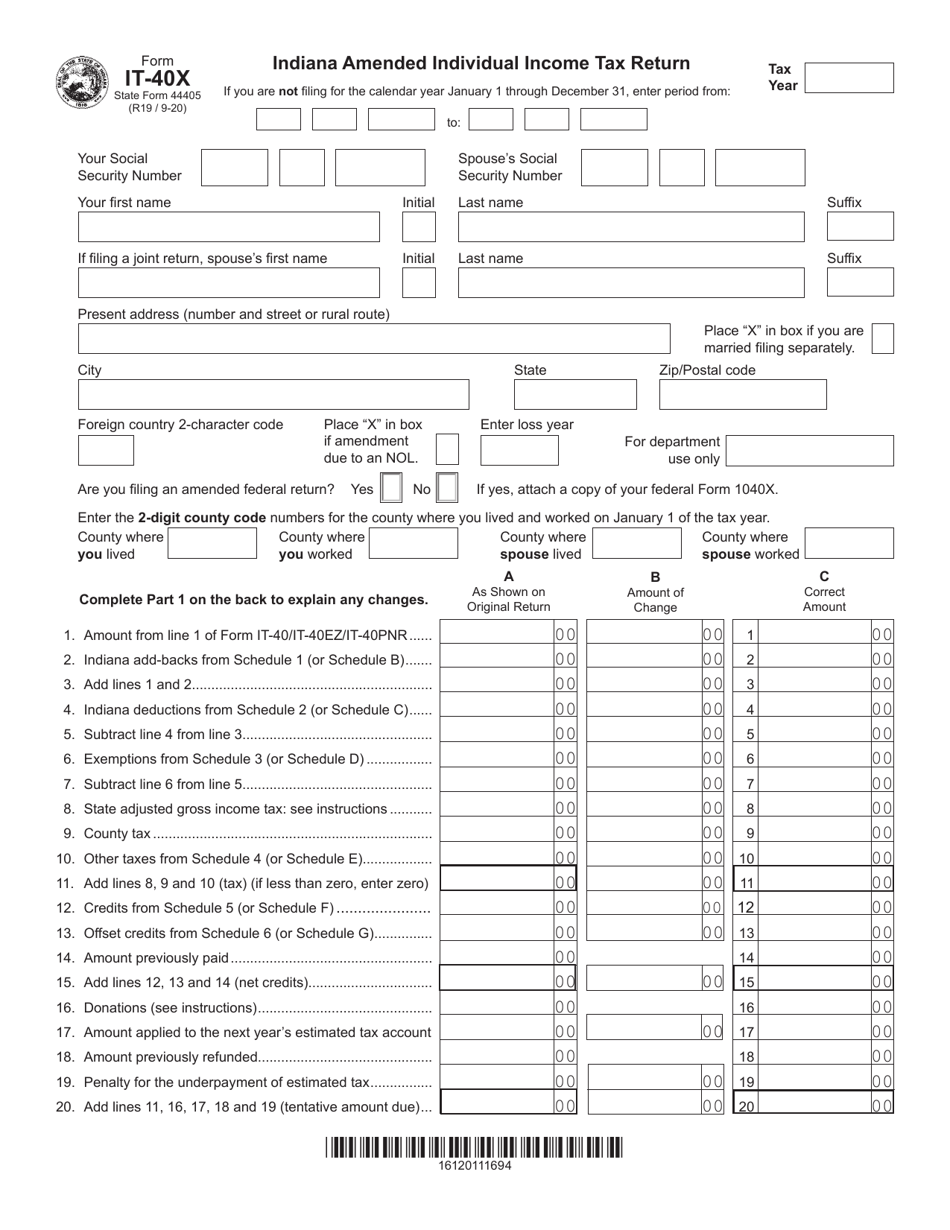

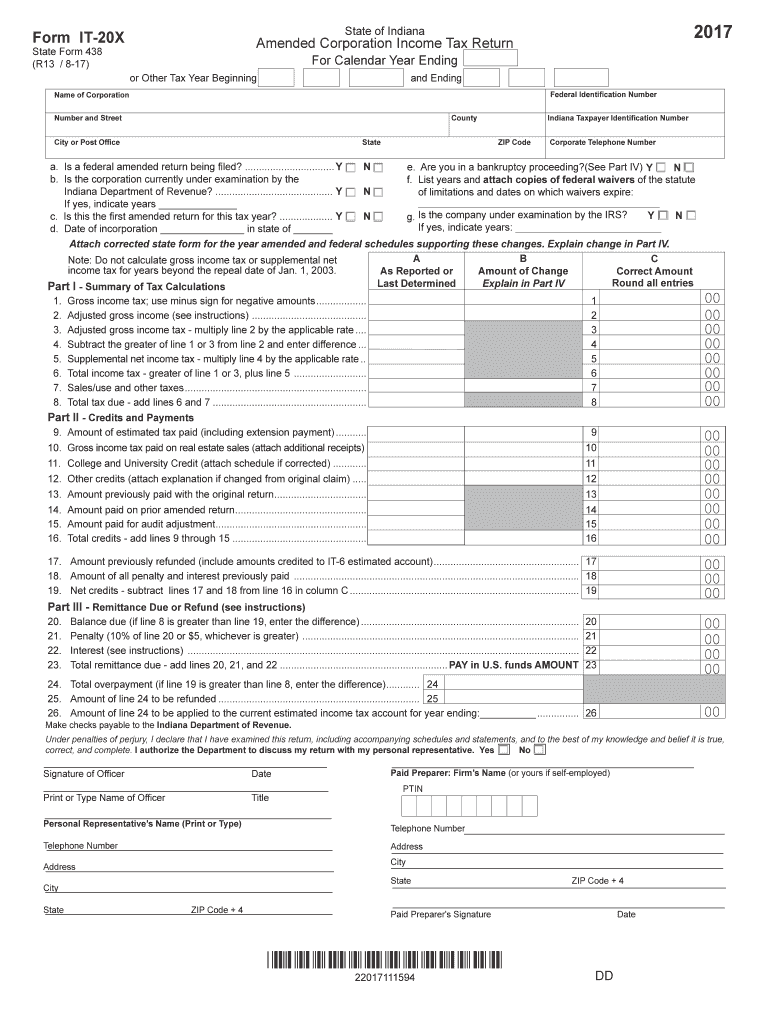

State Form 44405 (IT40X) Download Fillable PDF or Fill Online Indiana

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. This forms part of indiana’s. Register and file this tax online via intime. Do not send this form to the department of revenue. Web state of indiana employee’s withholding exemption and county status certificate this form is for.

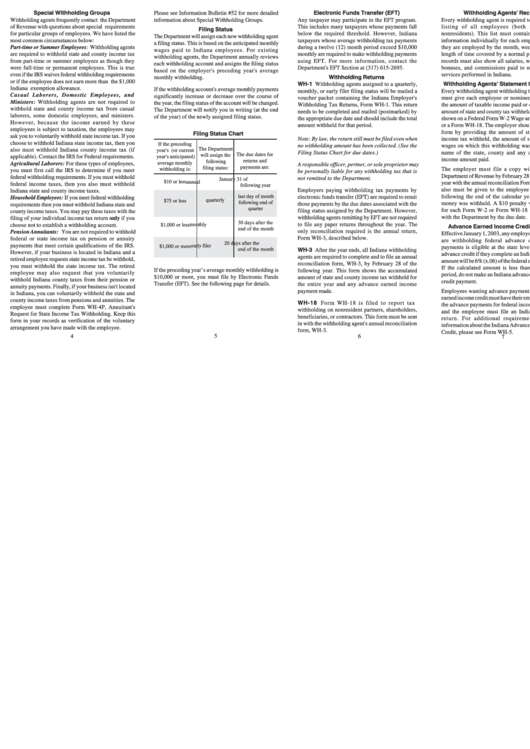

Form Wh13 Withholding Instructions For Indiana State And County

If the employer does withhold the additional amount, it should be submitted along with the regular state and county tax withholding. Your withholding is subject to review by the irs. However, they have to register to withhold tax in indiana but must have an employer identification number issued by the federal government. Do not send this form to the department.

Indiana Form It 20x Fill Out and Sign Printable PDF Template signNow

Do not send this form to the department of revenue. Register and file this tax online via intime. Underpayment of indiana withholding filing. Register and file this tax online via intime. Enter your indiana county of residence and county of principal employment as of january 1 of the current year.

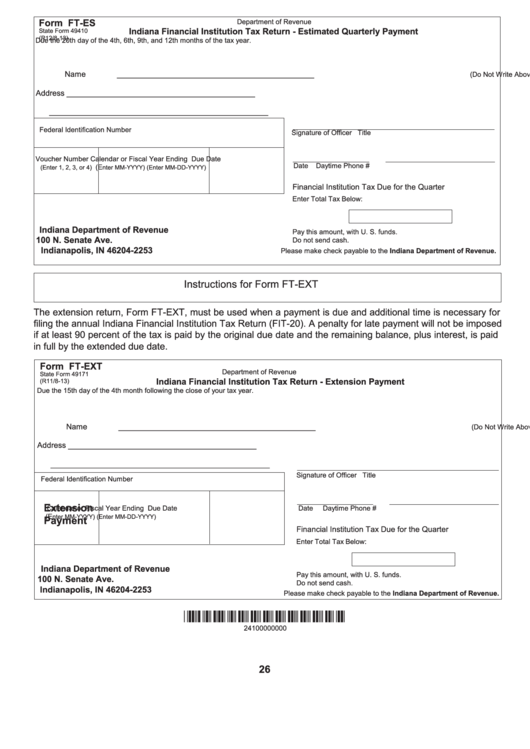

Form FtEs Indiana Financial Institution Tax Return Estimated

Do not send this form to the department of revenue. If the employer does withhold the additional amount, it should be submitted along with the regular state and county tax withholding. Print or type your full name, social security number or itin and home address. Underpayment of indiana withholding filing. Web this form should be completed by all resident and.

In Addition, The Employer Should Look At Departmental Notice #1 That Details The Withholding Rates For Each Of Indiana’s 92 Counties.

Web line does not obligate your employer to withhold the amount. Register and file this tax online via intime. Generally, employers are required to withhold both state and county taxes from employees’ wages. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records.

The Completed Form Should Be Returned To Your Employer.

Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Your withholding is subject to review by the irs. Register and file this tax online via intime. Your withholding is subject to review by the irs.

Underpayment Of Indiana Withholding Filing.

This forms part of indiana’s. Do not send this form to the department of revenue. If the employer does withhold the additional amount, it should be submitted along with the regular state and county tax withholding. Enter your indiana county of residence and county of principal employment as of january 1 of the current year.

Register And File This Tax Online Via Intime.

However, they have to register to withhold tax in indiana but must have an employer identification number issued by the federal government. Print or type your full name, social security number or itin and home address. You are still liable for any additional taxes due at the end of the tax year. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax.