Indiana Form It-65 Instructions 2021

Indiana Form It-65 Instructions 2021 - Find federal tax forms (e.g. Web indiana current year tax forms forms downloaded and printed from this page may be used to file taxes unless otherwise specified. Prior year tax forms can be. To download a form, click on the form name in the left column in the tables below. (a) taxpayer (b) disregarded entity (c) disregarded. If you don’t expect to be able to file your. Web here's what you need to know: Web 2021 individual income tax forms see individual tax forms for 2022. Web file now with turbotax we last updated indiana income tax instructions in february 2023 from the indiana department of revenue. This form is for income earned in tax year 2022, with tax returns due in april.

(a) taxpayer (b) disregarded entity (c) disregarded. Web 2021 individual income tax forms see individual tax forms for 2022. To download a form, click on the form name in the left column in the tables below. Prior year tax forms can be. Web here's what you need to know: This form is for income earned in tax year 2022, with tax returns due in. Web we last updated the apportionment of income for indiana in february 2023, so this is the latest version of schedule e, fully updated for tax year 2022. Web dor tax professionals nonresident withholding faq find answers to frequently asked questions about nonresident withholding below. This form is for income earned in tax year 2022, with tax returns due in april. 2023 due date the due date to file your 2022 indiana individual income tax return is april 18, 2023.

Web 2021 individual income tax forms see individual tax forms for 2022. 2023 due date the due date to file your 2022 indiana individual income tax return is april 18, 2023. Web indiana current year tax forms forms downloaded and printed from this page may be used to file taxes unless otherwise specified. Prior year tax forms can be. This form is for income earned in tax year 2022, with tax returns due in april. Find federal tax forms (e.g. You can download or print. Partnership return of income, form 1065 or 1065b. This form is for income earned in tax. If you don’t expect to be able to file your.

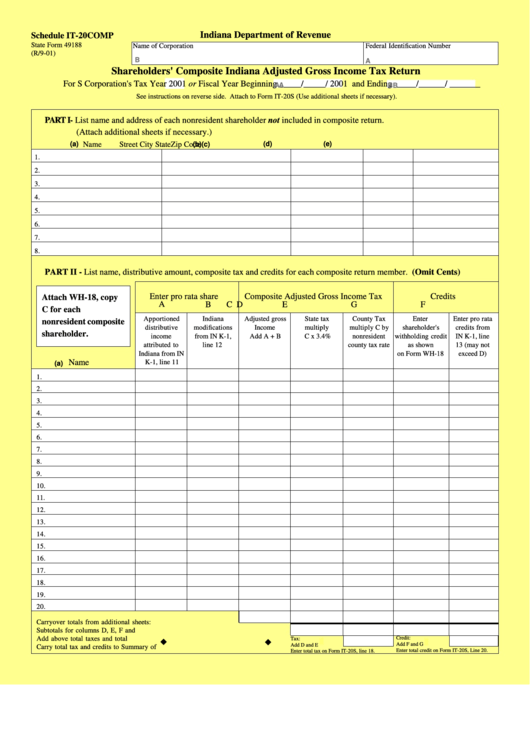

State Form 49188 Schedule Shareholders' Composite Indiana

This form is for income earned in tax year 2022, with tax returns due in april. 2023 due date the due date to file your 2022 indiana individual income tax return is april 18, 2023. Web 2021 individual income tax forms see individual tax forms for 2022. (a) taxpayer (b) disregarded entity (c) disregarded. This form is for income earned.

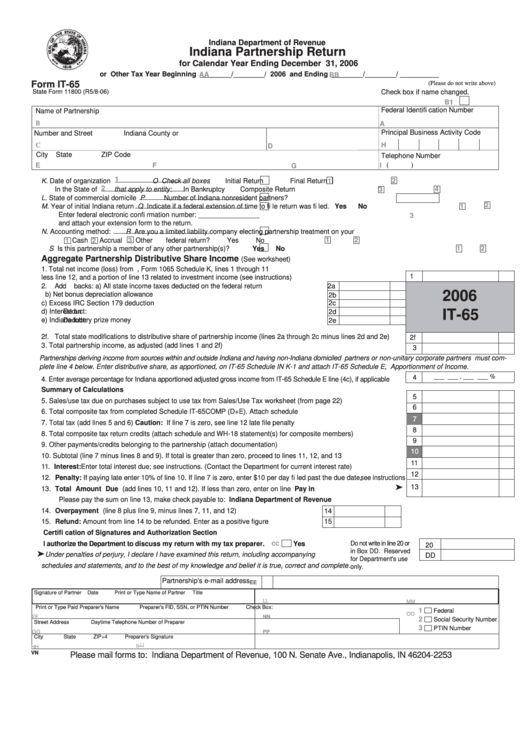

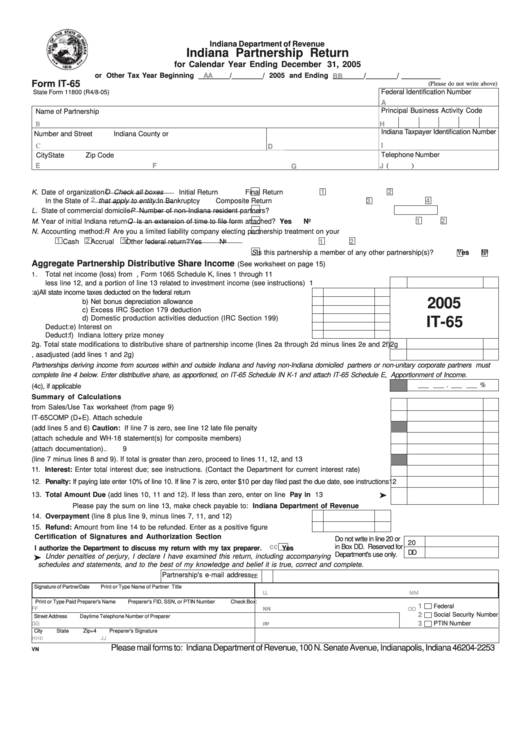

Form It65 Indiana Partnership Return 2006 printable pdf download

Web file now with turbotax we last updated indiana income tax instructions in february 2023 from the indiana department of revenue. Prior year tax forms can be. Partnership return of income, form 1065 or 1065b. Web dor tax professionals nonresident withholding faq find answers to frequently asked questions about nonresident withholding below. (a) taxpayer (b) disregarded entity (c) disregarded.

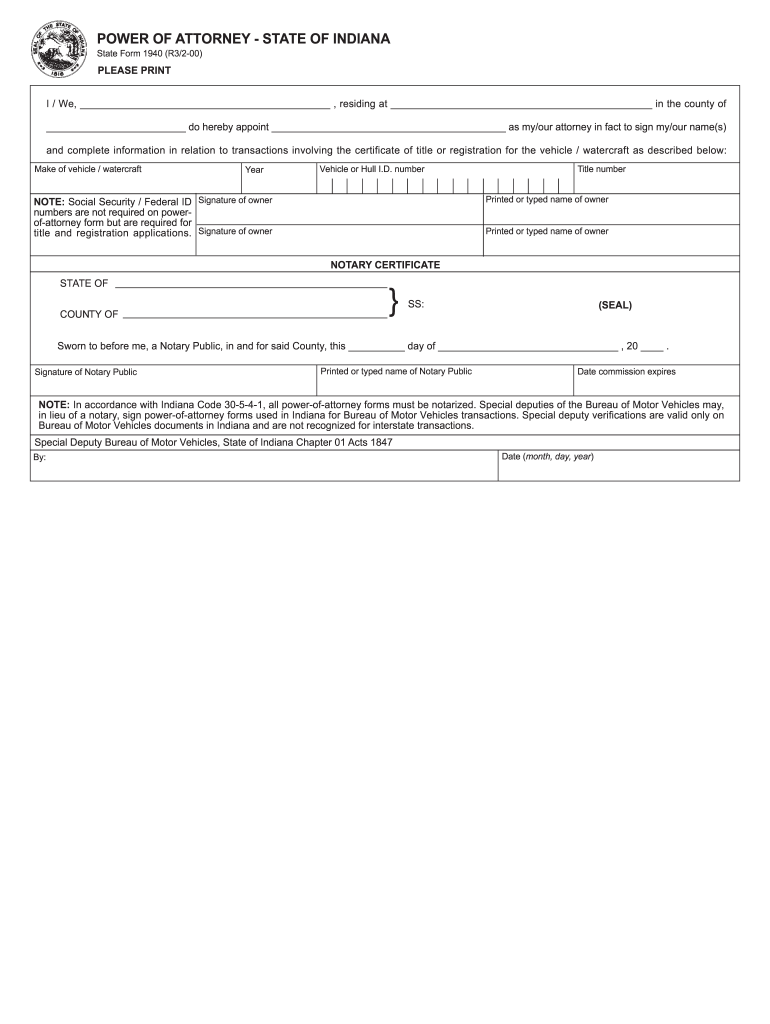

Indiana Form 1940 Fill Out and Sign Printable PDF Template signNow

Web dor tax professionals nonresident withholding faq find answers to frequently asked questions about nonresident withholding below. This form is for income earned in tax year 2022, with tax returns due in. Find federal tax forms (e.g. This form is for income earned in tax year 2022, with tax returns due in april. Web indiana department of revenue indiana partnership.

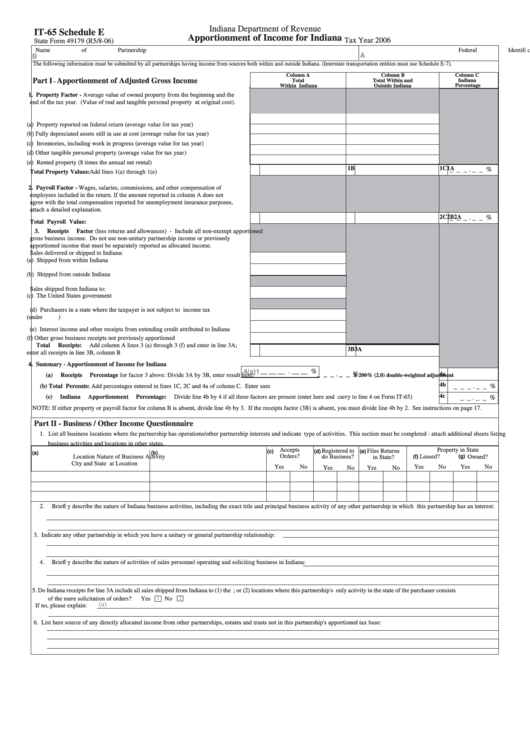

Form It65 Schedule E Apportionment Of For Indiana printable

2023 due date the due date to file your 2022 indiana individual income tax return is april 18, 2023. (a) taxpayer (b) disregarded entity (c) disregarded. You can download or print. Web we last updated the apportionment of income for indiana in february 2023, so this is the latest version of schedule e, fully updated for tax year 2022. Web.

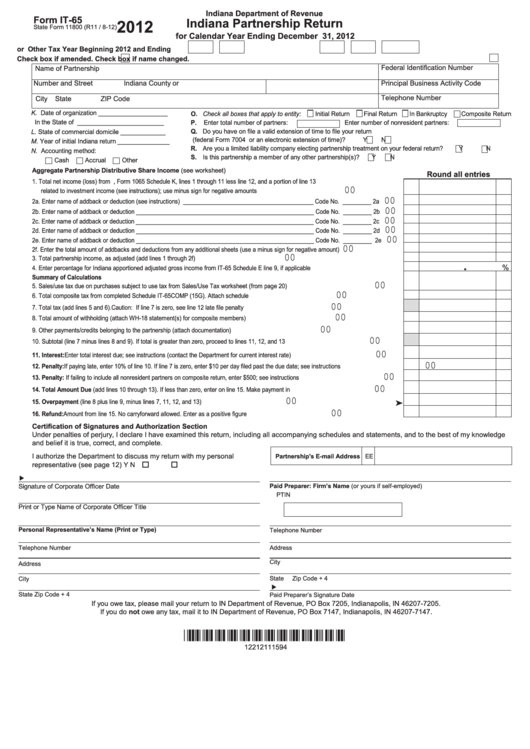

Form It65 Indiana Partnership Return 2012 printable pdf download

Web we last updated the apportionment of income for indiana in february 2023, so this is the latest version of schedule e, fully updated for tax year 2022. Web dor tax professionals nonresident withholding faq find answers to frequently asked questions about nonresident withholding below. This form is for income earned in tax year 2022, with tax returns due in..

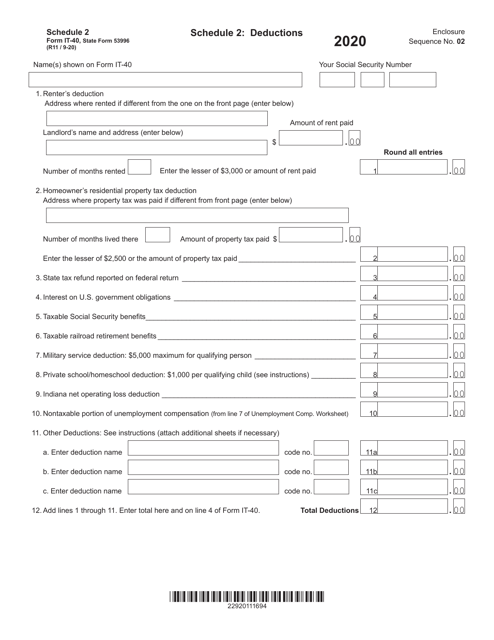

Form IT40 (State Form 53996) Schedule 2 Download Fillable PDF or Fill

Find federal tax forms (e.g. Web file now with turbotax we last updated indiana income tax instructions in february 2023 from the indiana department of revenue. Web indiana current year tax forms forms downloaded and printed from this page may be used to file taxes unless otherwise specified. Web dor tax professionals nonresident withholding faq find answers to frequently asked.

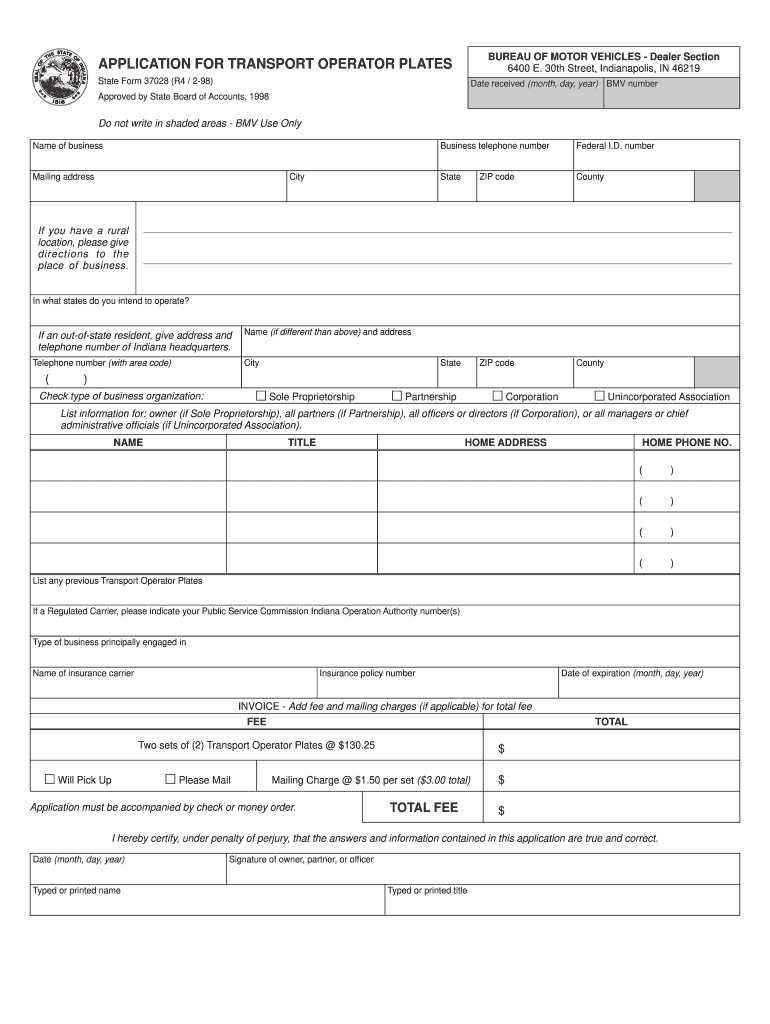

1996 IN Form 46800 Fill Online, Printable, Fillable, Blank pdfFiller

Prior year tax forms can be. Web indiana department of revenue indiana partnership return for calendar year ending december 31, 2010 or other tax year beginning 2010 and ending check box if. Find federal tax forms (e.g. This form is for income earned in tax year 2022, with tax returns due in. This form is for income earned in tax.

Printable Temporary License Plate Indiana 20202022 Fill and Sign

Find federal tax forms (e.g. This form is for income earned in tax year 2022, with tax returns due in april. Web indiana current year tax forms forms downloaded and printed from this page may be used to file taxes unless otherwise specified. Web file now with turbotax we last updated indiana income tax instructions in february 2023 from the.

Form It65 Indiana Partnership Return printable pdf download

You can download or print. Web here's what you need to know: (a) taxpayer (b) disregarded entity (c) disregarded. Web file now with turbotax we last updated indiana income tax instructions in february 2023 from the indiana department of revenue. Prior year tax forms can be.

Download Instructions for Form IT65, State Form 11800 Indiana

Web here's what you need to know: Web dor tax professionals nonresident withholding faq find answers to frequently asked questions about nonresident withholding below. If you don’t expect to be able to file your. Web we last updated the apportionment of income for indiana in february 2023, so this is the latest version of schedule e, fully updated for tax.

To Download A Form, Click On The Form Name In The Left Column In The Tables Below.

Find federal tax forms (e.g. Web indiana department of revenue indiana partnership return for calendar year ending december 31, 2010 or other tax year beginning 2010 and ending check box if. Web dor tax professionals nonresident withholding faq find answers to frequently asked questions about nonresident withholding below. Web we last updated the apportionment of income for indiana in february 2023, so this is the latest version of schedule e, fully updated for tax year 2022.

You Can Download Or Print.

Web file now with turbotax we last updated indiana income tax instructions in february 2023 from the indiana department of revenue. If you don’t expect to be able to file your. This form is for income earned in tax year 2022, with tax returns due in april. Web indiana current year tax forms forms downloaded and printed from this page may be used to file taxes unless otherwise specified.

Partnership Return Of Income, Form 1065 Or 1065B.

Web here's what you need to know: This form is for income earned in tax year 2022, with tax returns due in. Web 2021 individual income tax forms see individual tax forms for 2022. This form is for income earned in tax.

(A) Taxpayer (B) Disregarded Entity (C) Disregarded.

Prior year tax forms can be. 2023 due date the due date to file your 2022 indiana individual income tax return is april 18, 2023.