Illinois Small Estate Affidavit Form 2022

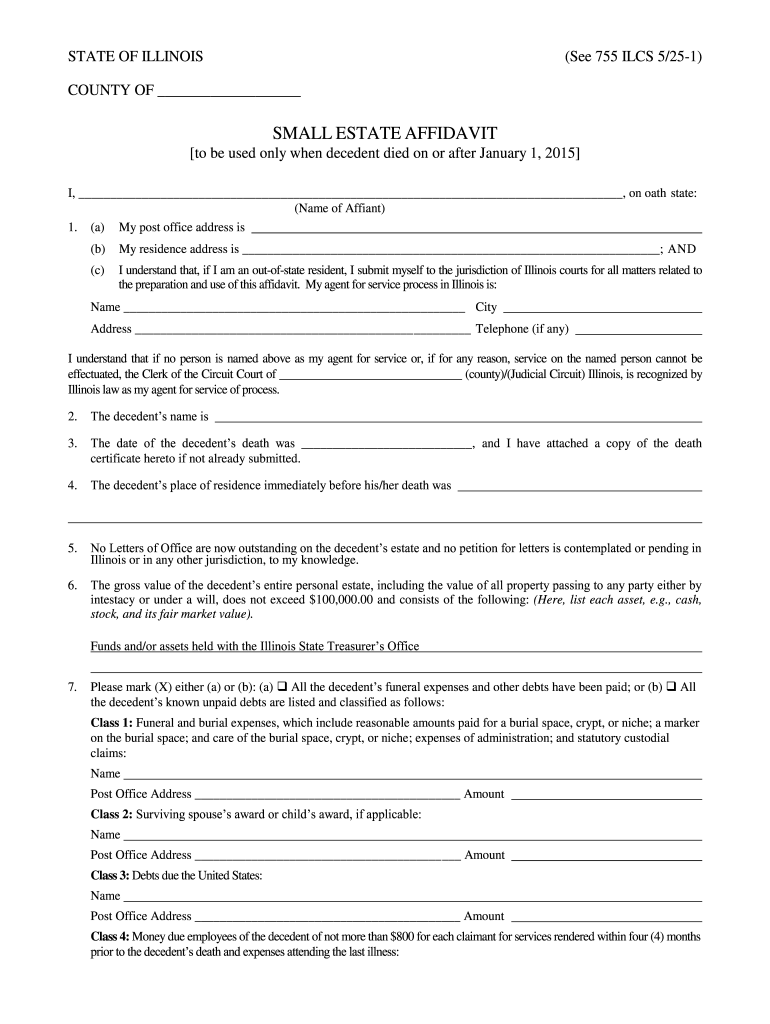

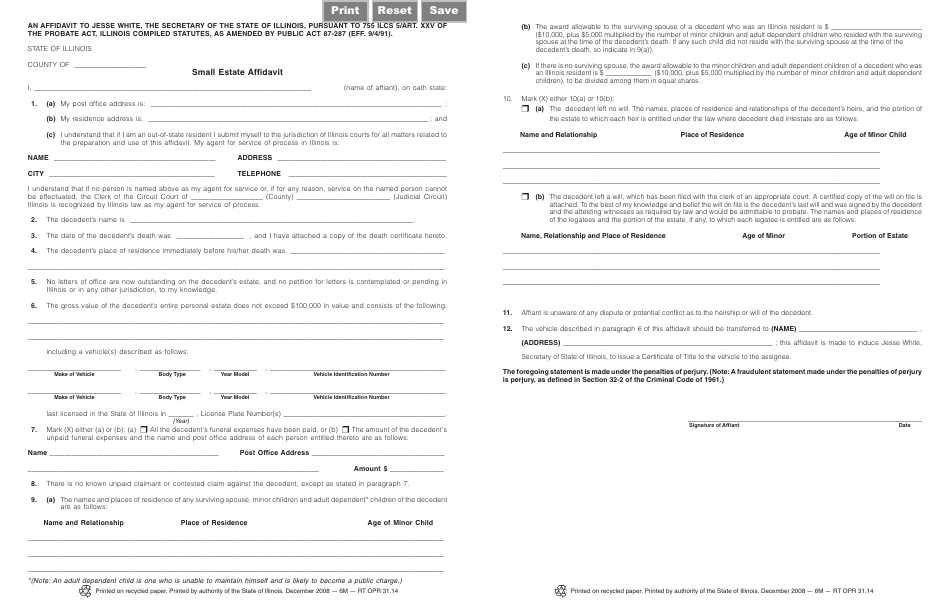

Illinois Small Estate Affidavit Form 2022 - No letters of office are now outstanding on the decedent’s estate and no petition for letters is contemplated or pending in illinois or in any other jurisdiction, to my. Mark (x) for either (a) or (b): Senior citizens and security fraud: Web illinois small estate affidavit form. Web property description fair market value $ $ $ 7. You can find the small estate affidavit form from the illinois secretary of state here. Illinois allows beneficiaries of small estates to file a small estate affidavit for easy. Web where to get a small estate affidavit in illinois? How to file a small estate affidavit in illinois. Ad il small estate affidavit & more fillable forms, register and subscribe now!

Ad il rt opr 31.16 & more fillable forms, register and subscribe now! Web estate planning basics; Web small estate if a decedent's estate is not being probated and the value of the personal estate does not exceed $100,000, the small estate affidavit procedure applies, and. Web property description fair market value $ $ $ 7. Most people can draft and complete the affidavit without help from an attorney. There are several ways to obtain a small estate affidavit illinois blank form. Mark (x) for either (a) or (b): Web illinois small estate affidavit form. To streamline the process and save your costs, you. The total amount of property in the estate is worth $100,000 or less;

Web to use this program, all of the following must be true: Web property description fair market value $ $ $ 7. Web to use a small estate affidavit, all of the following must be true: The total amount of personal property in the estate of the decedent (the person who died) is no more than $100,000, the. My post office address is: To streamline the process and save your costs, you. Web where to get a small estate affidavit in illinois? The county clerk where the. Mark (x) for either (a) or (b): Web small estate affidavit i, (name of affiant), on oath state:

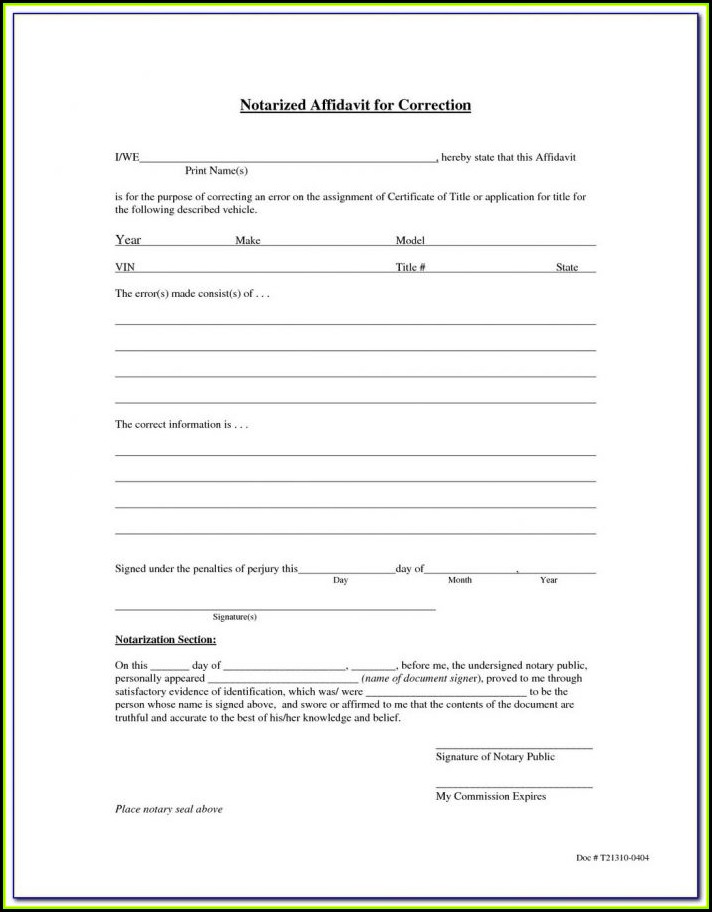

small estate affidavit illinois Fill out & sign online DocHub

Web estate planning basics; My post office address is: How to file a small estate affidavit in illinois. The person who died did not own any. The county clerk where the.

Small Estate Affidavit Form Illinois Free Download

Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないため、正しく表示. Web property description fair market value $ $ $ 7. Easily customize your affidavit of small estate. This file is just not submitted inside. Web where to get a small estate affidavit in illinois?

Illinois 2022 Small Estate Affidavit Form 2022

Web estate planning basics; How to file a small estate affidavit in illinois. No letters of office are now outstanding on the decedent’s estate and no petition for letters is contemplated or pending in illinois or in any other jurisdiction, to my. My post office address is: There are several ways to obtain a small estate affidavit illinois blank form.

Probate Form 13100 Affidavit For Small Estates Universal Network

Web property description fair market value $ $ $ 7. Web illinois small estate affidavit form. My post office address is: Easily customize your affidavit of small estate. The total amount of personal property in the estate of the decedent (the person who died) is no more than $100,000, the.

Power Of Attorney For Property Pdf

My post office address is: The total amount of property in the estate is worth $100,000 or less; This file is just not submitted inside. Most people can draft and complete the affidavit without help from an attorney. Web property description fair market value $ $ $ 7.

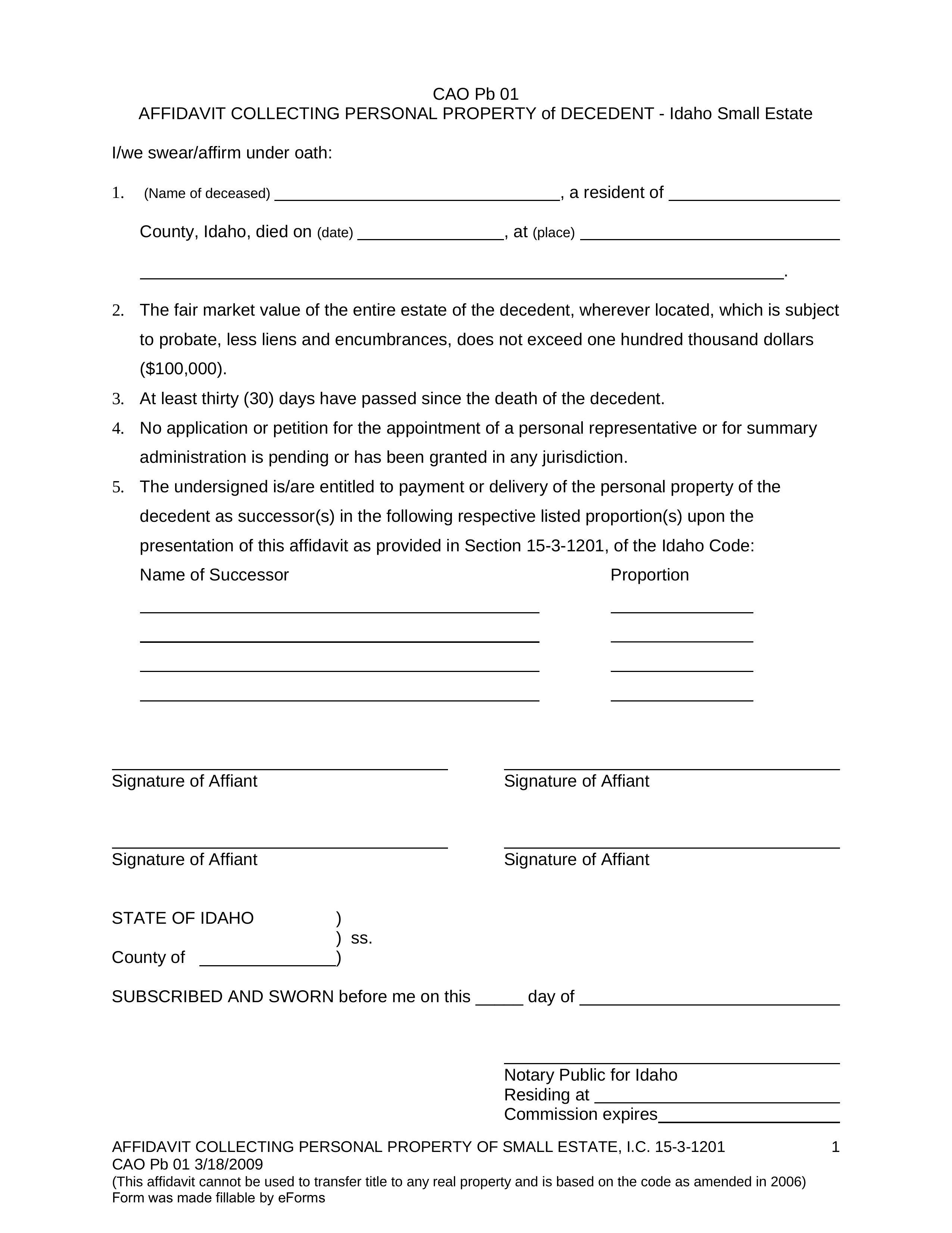

Free Idaho Small Estate Affidavit Form CAO Pb 01 PDF eForms

Web illinois lays out the requirements of a small estate affidavit on its legislative website. Ad answer simple questions to make an affidavit of small estate on any device in minutes. My post office address is: The person who died did not own any. How to file a small estate affidavit in illinois.

Illinois Estate Tax Waiver Form Form Resume Examples P32E5vg32J

Ad il rt opr 31.16 & more fillable forms, register and subscribe now! Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないため、正しく表示. The person who died did not own any. Web to use a small estate affidavit, all of the following must be true: The total amount of personal property in the estate of the decedent (the person who died) is.

Form RT OPR31.14 Download Fillable PDF or Fill Online Small Estate

Web to use this program, all of the following must be true: Web to use a small estate affidavit, all of the following must be true: Web small estate if a decedent's estate is not being probated and the value of the personal estate does not exceed $100,000, the small estate affidavit procedure applies, and. Web property description fair market.

Free Small Estate Affidavit Form Illinois Universal Network

The person who died did not own any. You can find the small estate affidavit form from the illinois secretary of state here. Mark (x) for either (a) or (b): Web estate planning basics; The county clerk where the.

Illinois Small Estate Affidavit for Estates under 100,000 Illinois

Web property description fair market value $ $ $ 7. Most people can draft and complete the affidavit without help from an attorney. Web small estate affidavit i, (name of affiant), on oath state: Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないため、正しく表示. No letters of office are now outstanding on the decedent’s estate and no petition for letters is contemplated.

Web To Use A Small Estate Affidavit, All Of The Following Must Be True:

To streamline the process and save your costs, you. Web to use this program, all of the following must be true: Web 2022/1/13をもって お客様がご利用中のブラウザ (internet explorer) のサポートを終了いたしました。 (詳細はこちら) クックパッドが推奨する環境ではないため、正しく表示. Senior citizens and security fraud:

(A) All Of The Decedent’s Funeral Expenses And Other Debts Have Been Paid, Or (B) All Of The.

This file is just not submitted inside. The county clerk where the. Web illinois small estate affidavit form. No letters of office are now outstanding on the decedent’s estate and no petition for letters is contemplated or pending in illinois or in any other jurisdiction, to my.

Web Property Description Fair Market Value $ $ $ 7.

The person who died did not own any. No letters of office are now outstanding on the decedent’s estate and no petition for letters is contemplated or pending in illinois or in any other jurisdiction, to my. How to file a small estate affidavit in illinois. Web where to get a small estate affidavit in illinois?

Mark (X) For Either (A) Or (B):

Web illinois lays out the requirements of a small estate affidavit on its legislative website. You can find the small estate affidavit form from the illinois secretary of state here. The total amount of property in the estate is worth $100,000 or less; The total amount of personal property in the estate of the decedent (the person who died) is no more than $100,000, the.