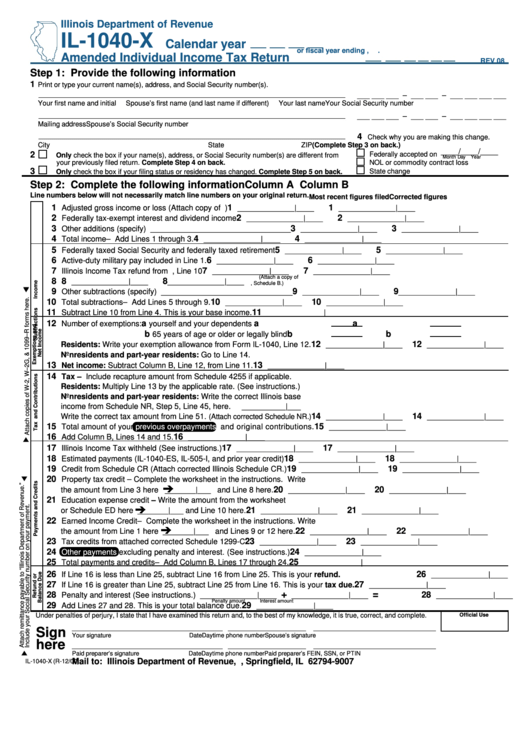

Il-1040-X Form

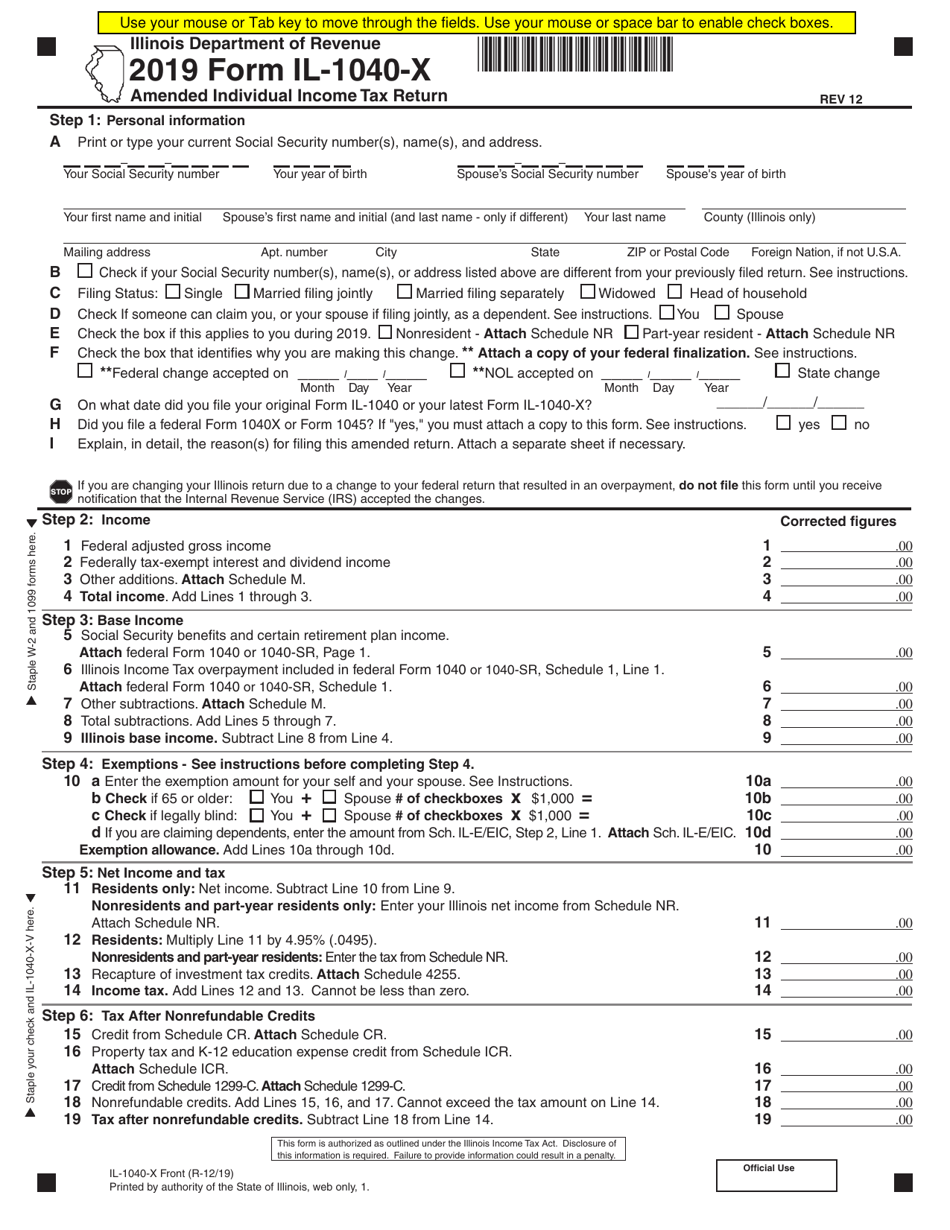

Il-1040-X Form - Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Personal information print or type your current social security number(s), name(s), and address. You earned enough taxable income from illinois sources to have a tax liability (i.e., your illinois base income from. Web individual income tax return. Personal information *61512211w* rev 12 step 2: You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. Make certain elections after the deadline. July 2021) department of the treasury—internal revenue service amended u.s. This form is for income earned in tax year 2022, with.

You earned enough taxable income from illinois sources to have a tax liability (i.e., your illinois base income from. 2023 estimated income tax payments for individuals. July 2021) department of the treasury—internal revenue service amended u.s. Personal information *61512211w* rev 12 step 2: You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically. Personal information print or type your current social security number(s), name(s), and address. Individual income tax return use this revision to amend 2019 or later tax returns. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. Web individual income tax return. This form is for income earned in tax year 2022, with.

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically. July 2021) department of the treasury—internal revenue service amended u.s. This form is for income earned in tax year 2022, with. Without proper attachments, il may partially or totally deny your claim. Personal information *61512211w* rev 12 step 2: You earned enough taxable income from illinois sources to have a tax liability (i.e., your illinois base income from. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. Make certain elections after the deadline. 2023 estimated income tax payments for individuals.

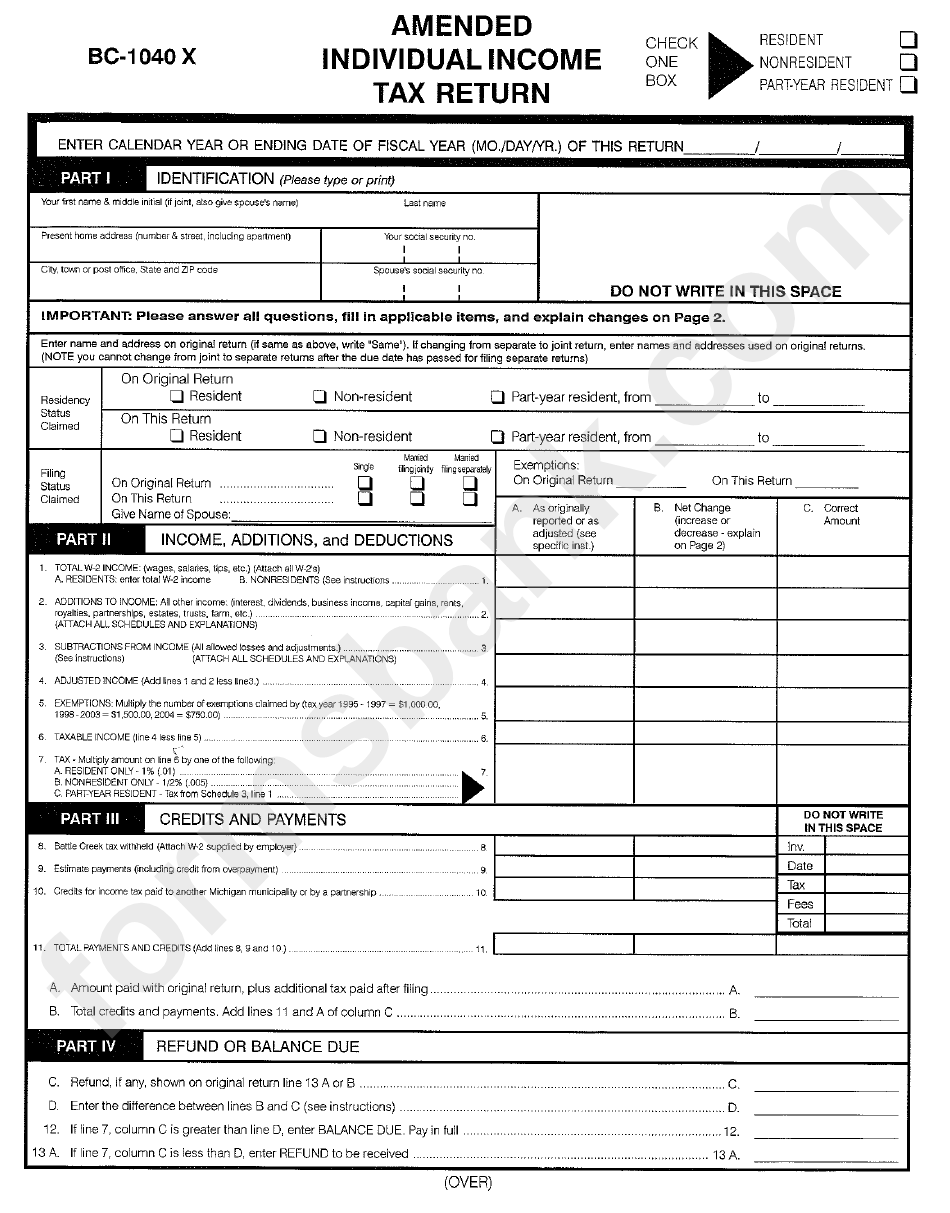

Form Bc1040X Amended Individual Tax Return printable pdf

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. This form is for income earned in tax year 2022, with. July 2021) department of the treasury—internal revenue service amended u.s. Make certain elections after the deadline. Personal information *61512211w* rev 12 step 2:

The IRS Is Taking Going Digital to the Next Level Electronic Filing

2023 estimated income tax payments for individuals. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web individual income tax return. You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically. Personal information *61512201w* rev 12 print or type your current social security number(s),.

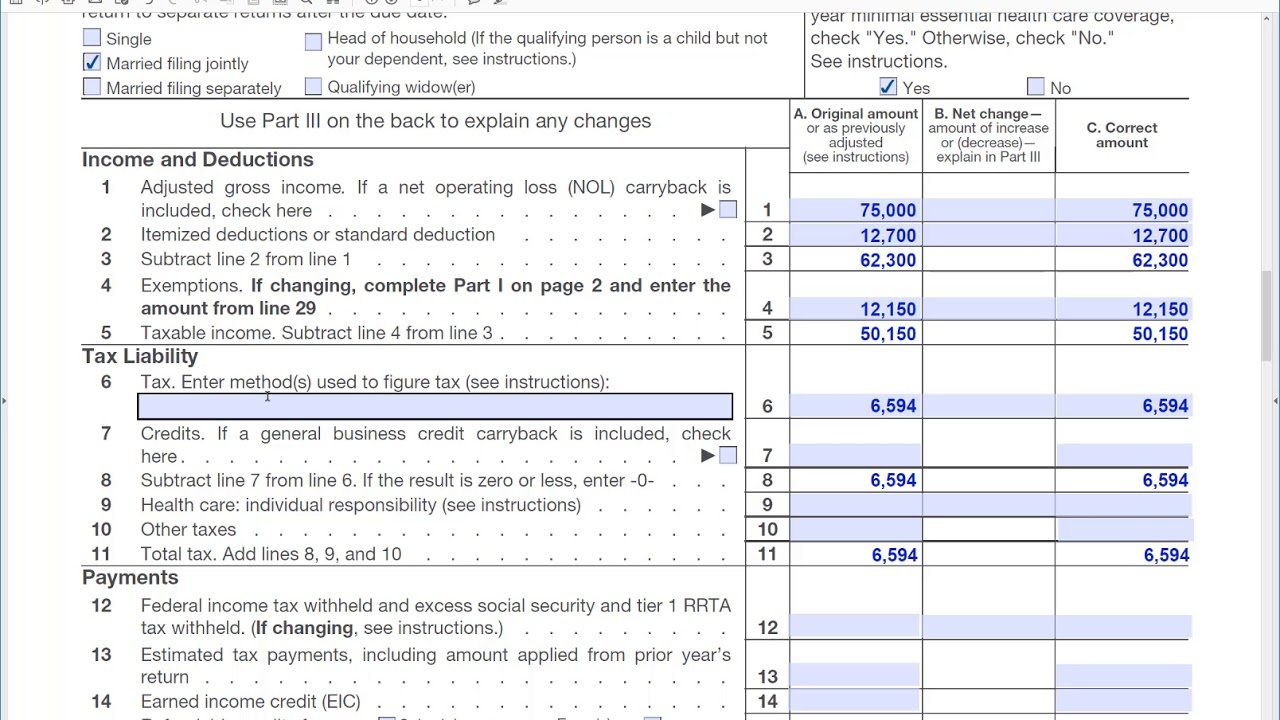

1040 X Form 1040 Form Printable

Make certain elections after the deadline. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. 2023 estimated income tax payments for individuals. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. Web individual income tax return.

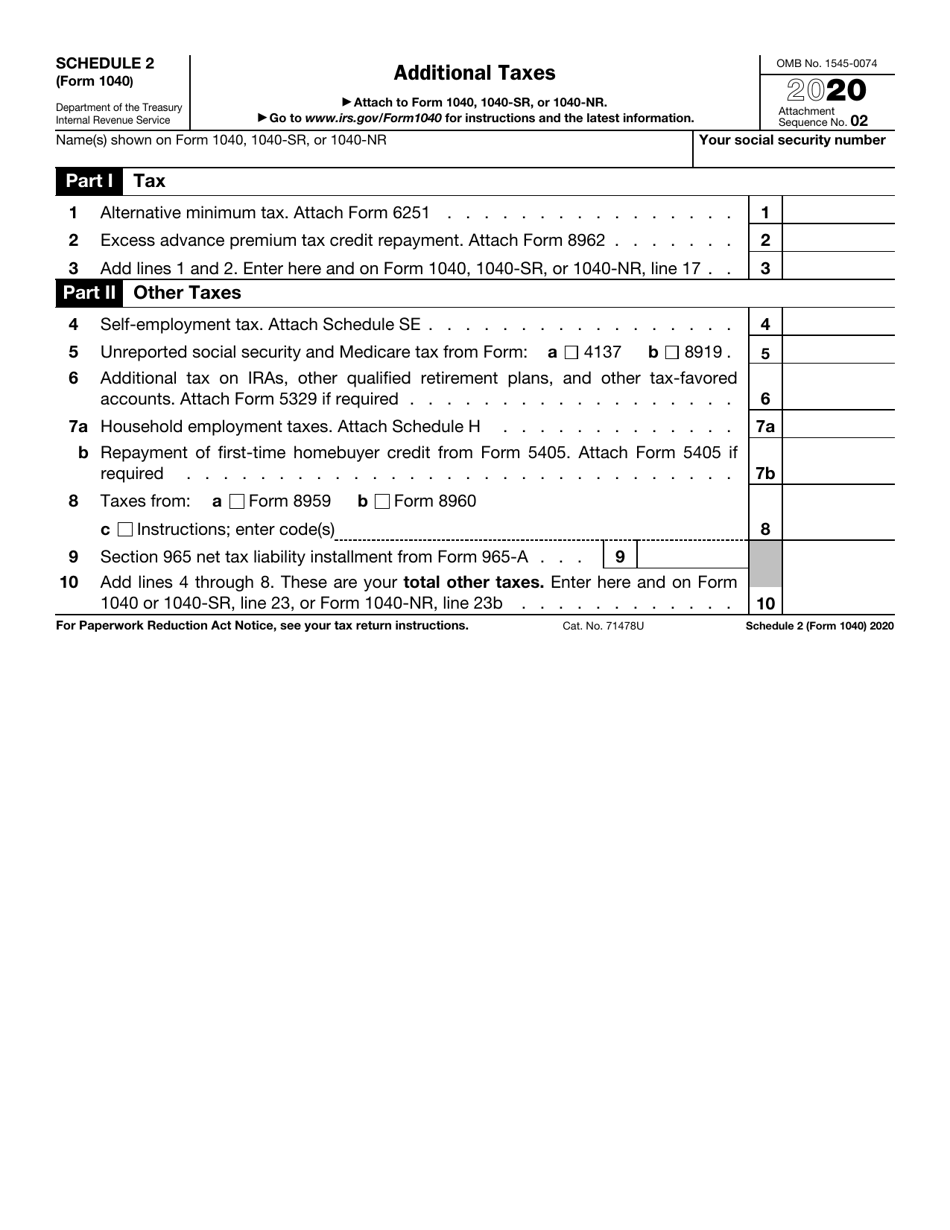

IRS Form 1040 Schedule 2 Download Fillable PDF or Fill Online

This form is for income earned in tax year 2022, with. Web individual income tax return. 2023 estimated income tax payments for individuals. You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically. Personal information print or type your current social security number(s), name(s), and address.

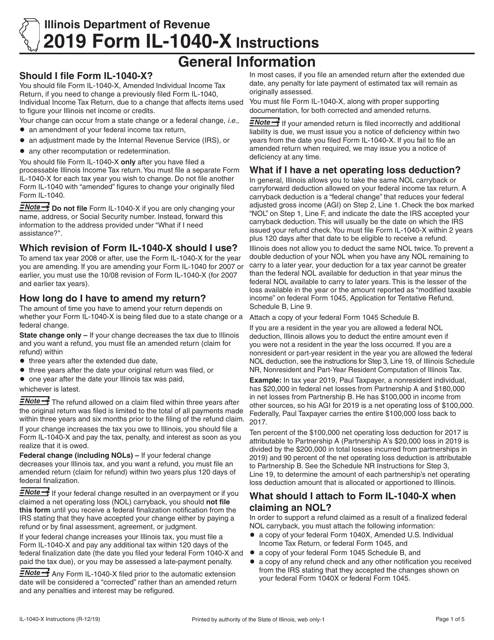

Download Instructions for Form IL1040X Amended Individual Tax

Personal information print or type your current social security number(s), name(s), and address. You earned enough taxable income from illinois sources to have a tax liability (i.e., your illinois base income from. You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically. Without proper attachments, il may partially or totally deny your claim. Individual.

2015 Form IL1040X Instructions

You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically. Web individual income tax return. Personal information print or type your current social security number(s), name(s), and address. Make certain elections after the deadline. Individual income tax return use this revision to amend 2019 or later tax returns.

IRS Instruction 1040X Blank PDF Forms to Download

You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. Personal information print or type your current social security number(s), name(s), and address. This form is for income earned in tax year 2022, with. Use this form for.

2018 Form IL DoR IL1040X Fill Online, Printable, Fillable, Blank

Make certain elections after the deadline. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. Individual income tax return use this revision to amend 2019 or later tax returns. July 2021) department of the treasury—internal revenue service amended u.s. Use this form for payments that are due on april 18, 2023, june 15,.

Form Il1040X Amended Individual Tax Return 2000 printable

Make certain elections after the deadline. This form is for income earned in tax year 2022, with. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. 2023 estimated income tax payments for individuals.

Form IL1040X Download Fillable PDF or Fill Online Amended Individual

You can prepare a 2022 illinois tax amendment on efile.com, however you cannot submit it electronically. Personal information *61512211w* rev 12 step 2: Make certain elections after the deadline. Without proper attachments, il may partially or totally deny your claim. This form is for income earned in tax year 2022, with.

This Form Is For Income Earned In Tax Year 2022, With.

Personal information print or type your current social security number(s), name(s), and address. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Personal information *61512201w* rev 12 print or type your current social security number(s), name(s), and address. Personal information *61512211w* rev 12 step 2:

You Can Prepare A 2022 Illinois Tax Amendment On Efile.com, However You Cannot Submit It Electronically.

Individual income tax return use this revision to amend 2019 or later tax returns. Web individual income tax return. Make certain elections after the deadline. You earned enough taxable income from illinois sources to have a tax liability (i.e., your illinois base income from.

July 2021) Department Of The Treasury—Internal Revenue Service Amended U.s.

Without proper attachments, il may partially or totally deny your claim. 2023 estimated income tax payments for individuals.