Idaho State Tax Form 2023

Idaho State Tax Form 2023 - Use the information on the back to calculate your idaho allowances and any additional amount you need withheld from each paycheck. Sales and use tax forms. Sales and use tax forms; Idaho income tax calculator how to use this calculator you can use our free idaho income tax calculator to get a good estimate of what your tax liability will be come april. Web individual income tax forms; This form is for income earned in tax year 2022, with tax returns due in april 2023. Sign the form and give it to your employer. Web individual income tax forms (current) individual income tax forms (archive) property tax forms. This edition features articles about new tax laws, taxable sales for recreation and. Idaho income tax table learn how marginal tax brackets work 2.

Sign the form and give it to your employer. Be sure to verify that the form you are downloading is for the correct year. Idaho income tax table learn how marginal tax brackets work 2. Web eligible residents have until may 1, 2023, to apply. Use the information on the back to calculate your idaho allowances and any additional amount you need withheld from each paycheck. This form is for income earned in tax year 2022, with tax returns due in april 2023. Travel & convention tax forms; The deadline to file your 2022 income taxes is april 18, 2023. Sales and use tax forms. Web individual income tax forms;

Web summer 2023 tax update now available. This edition features articles about new tax laws, taxable sales for recreation and. Sales and use tax forms. The deadline to file your 2022 income taxes is april 18, 2023. Travel & convention tax forms; Idaho income tax table learn how marginal tax brackets work 2. Use the information on the back to calculate your idaho allowances and any additional amount you need withheld from each paycheck. Web individual income tax forms; Web eligible residents have until may 1, 2023, to apply. Be sure to verify that the form you are downloading is for the correct year.

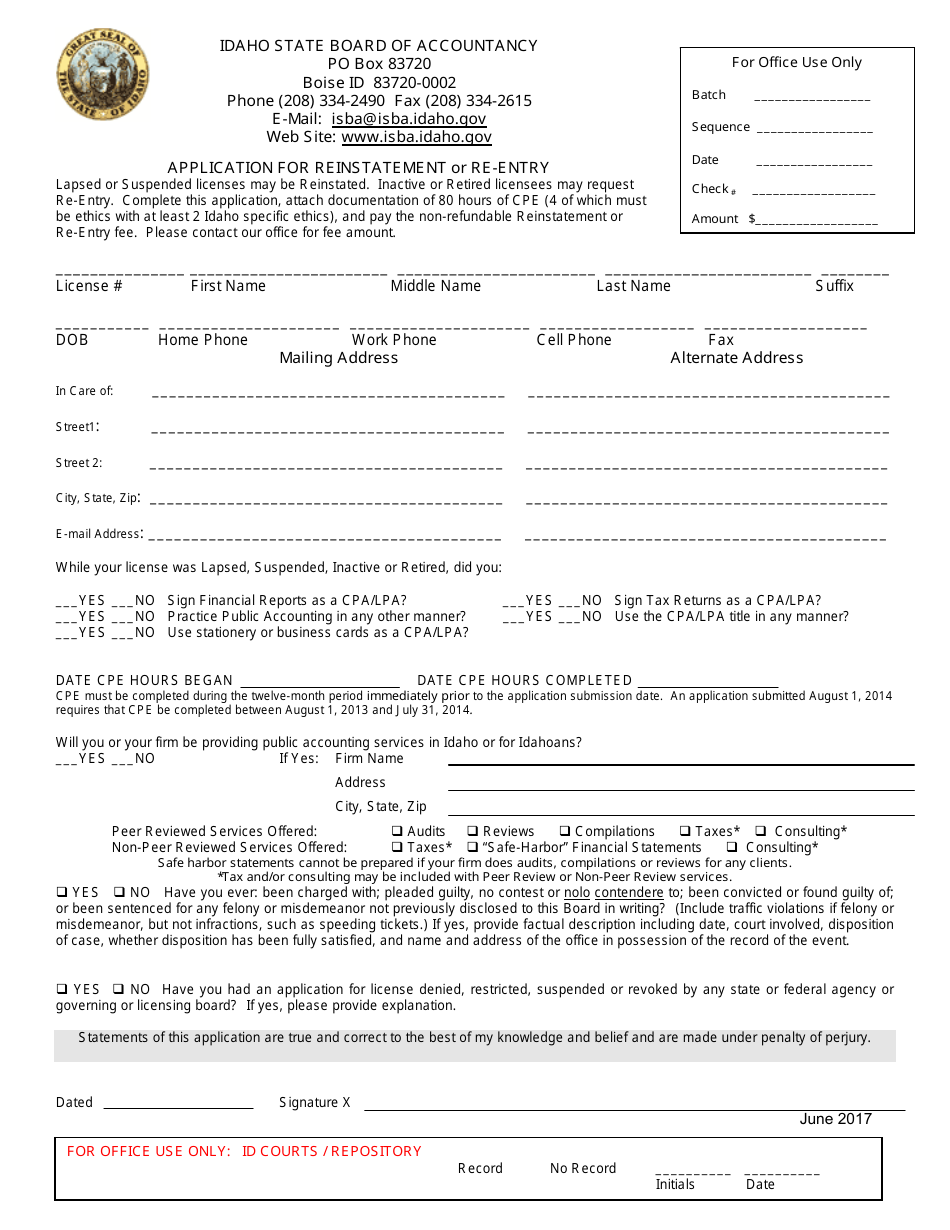

Idaho Application for Reinstatement or Reentry Download Printable PDF

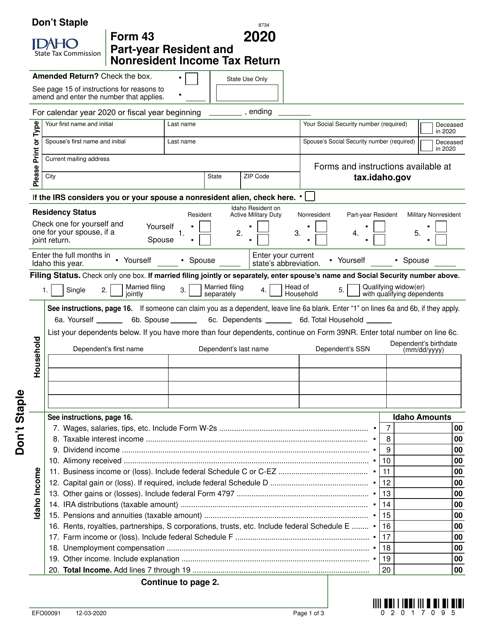

Web we last updated idaho form 43 in february 2023 from the idaho state tax commission. Travel & convention tax forms; Read the summer 2023 tax update, our newsletter for the business community. The deadline to file your 2022 income taxes is april 18, 2023. This form is for income earned in tax year 2022, with tax returns due in.

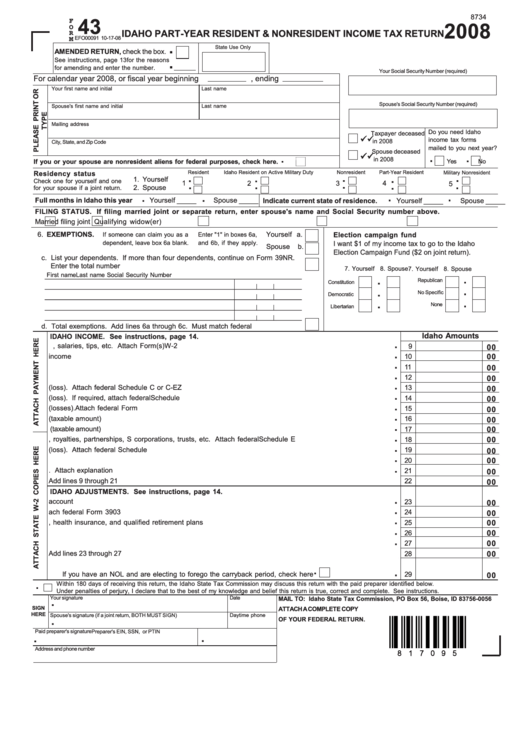

Fillable Form 43 Idaho PartYear Resident & Nonresident Tax

Travel & convention tax forms; Idaho income tax table learn how marginal tax brackets work 2. Web summer 2023 tax update now available. Web eligible residents have until may 1, 2023, to apply. We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government.

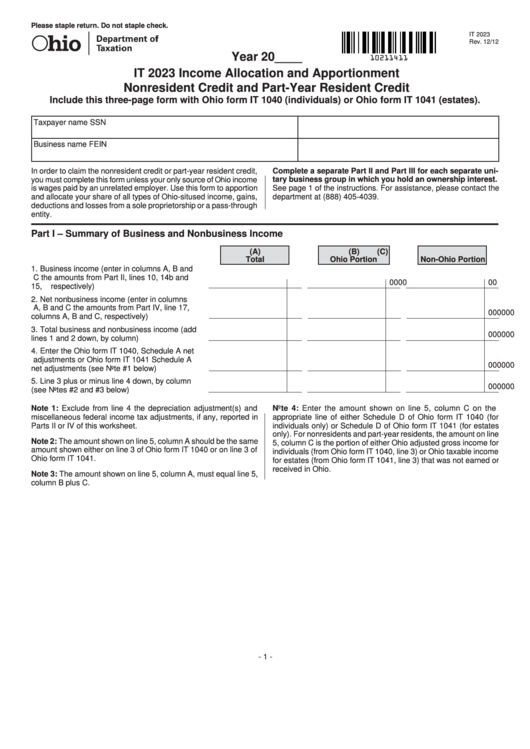

Fillable Form It 2023 Allocation And Apportionment Nonresident

Use the information on the back to calculate your idaho allowances and any additional amount you need withheld from each paycheck. Read the summer 2023 tax update, our newsletter for the business community. Web eligible residents have until may 1, 2023, to apply. Web we last updated idaho form 43 in february 2023 from the idaho state tax commission. Web.

Form 43 (EFO00091) Download Fillable PDF or Fill Online PartYear

This edition features articles about new tax laws, taxable sales for recreation and. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Sales and use tax forms; Web we last updated idaho form 43 in february 2023 from the idaho state tax commission. Fuels taxes and fees forms;

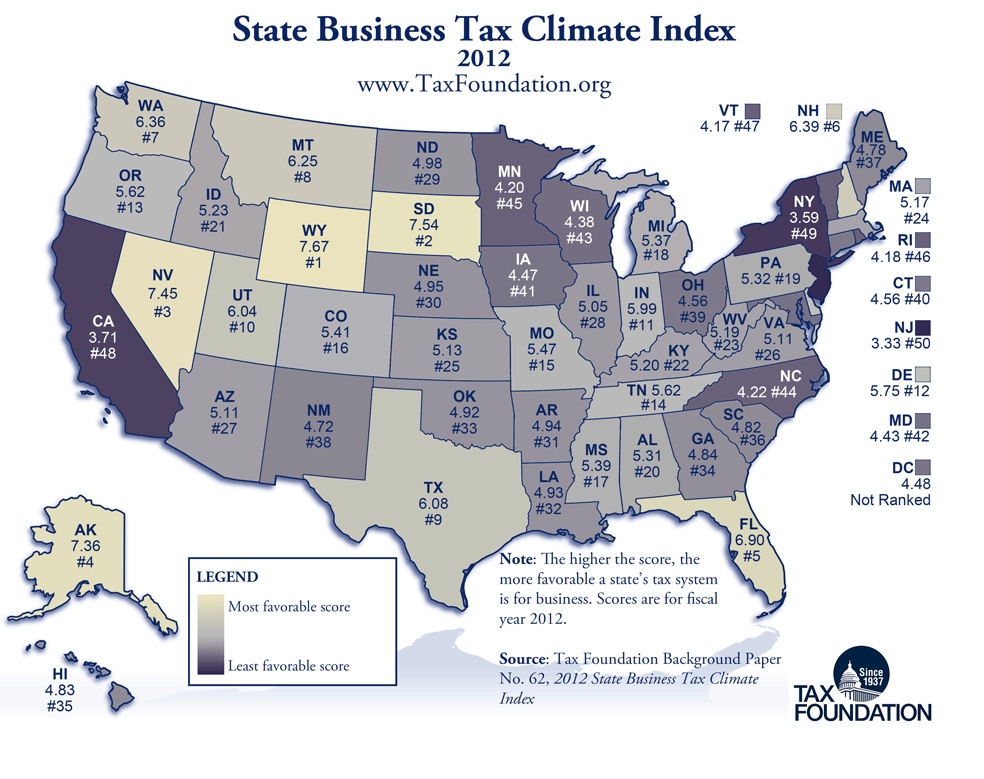

Idaho Ranks 21st in the Annual State Business Tax Climate Index

Read the summer 2023 tax update, our newsletter for the business community. This edition features articles about new tax laws, taxable sales for recreation and. Fuels taxes and fees forms; Web summer 2023 tax update now available. Web individual income tax forms;

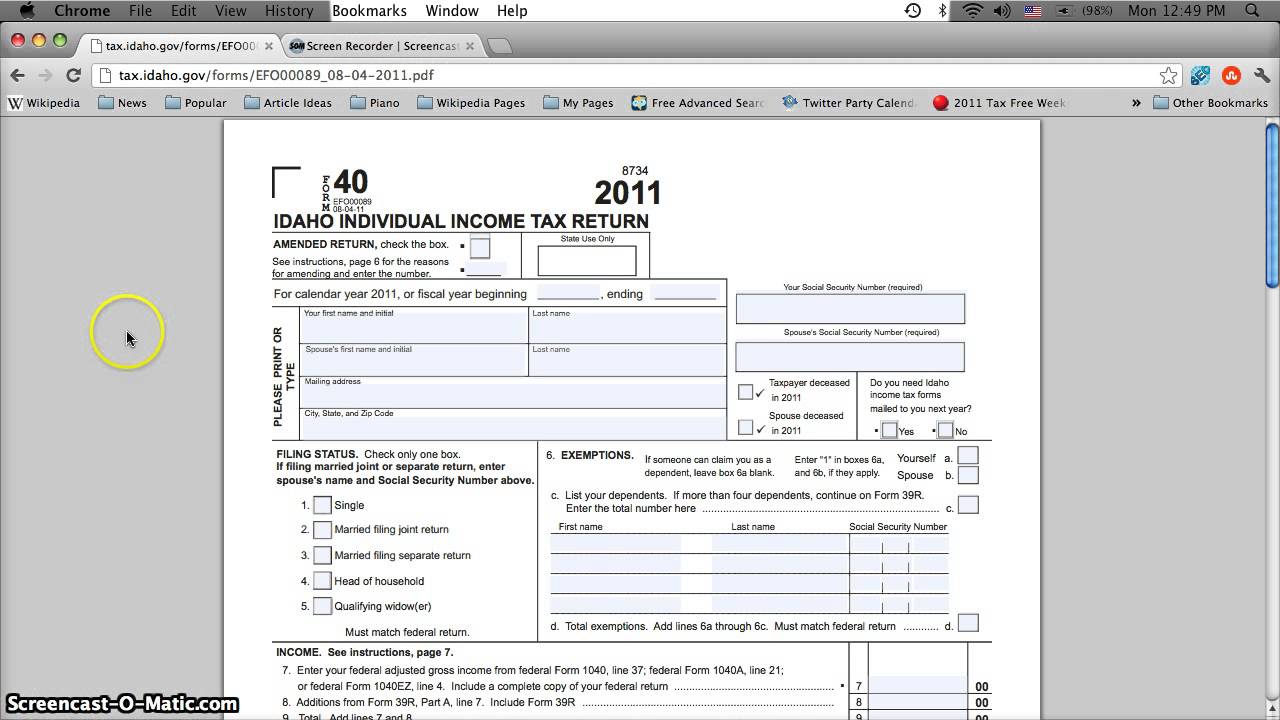

Idaho Printable Tax Forms 2012 Individual Tax Return Form 40

Keep in mind that some states will not update their tax forms for 2023 until january 2024. Sales and use tax forms; Fuels taxes and fees forms; This form is for income earned in tax year 2022, with tax returns due in april 2023. Idaho income tax calculator how to use this calculator you can use our free idaho income.

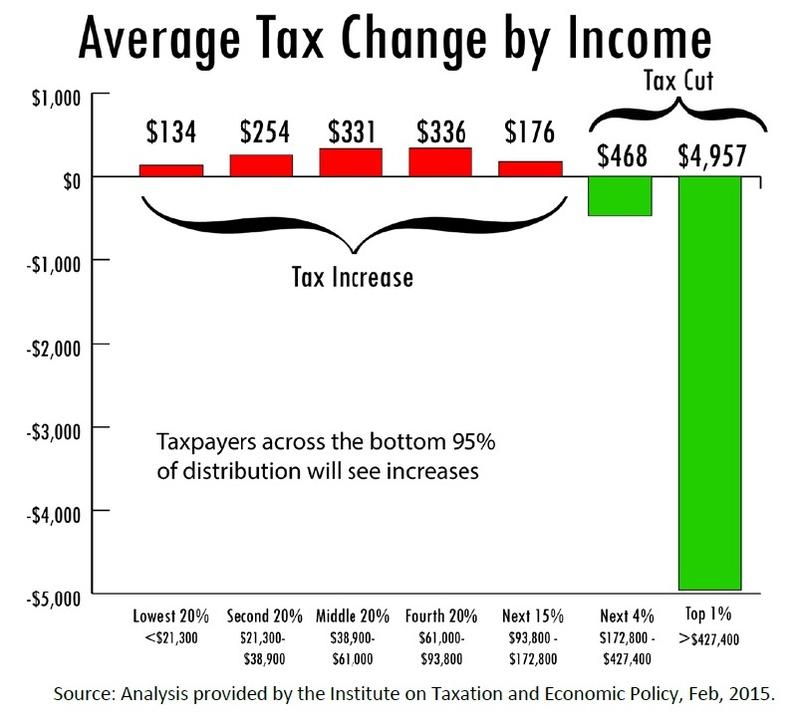

Idaho state and local taxburden > manufacturing, educational services

Travel & convention tax forms; Sign the form and give it to your employer. Web we last updated idaho form 43 in february 2023 from the idaho state tax commission. Be sure to verify that the form you are downloading is for the correct year. Idaho income tax calculator how to use this calculator you can use our free idaho.

How Idaho’s Taxes Compare To Other States In The Region Boise State

Web individual income tax forms; Keep in mind that some states will not update their tax forms for 2023 until january 2024. Read the summer 2023 tax update, our newsletter for the business community. Use the information on the back to calculate your idaho allowances and any additional amount you need withheld from each paycheck. Web eligible residents have until.

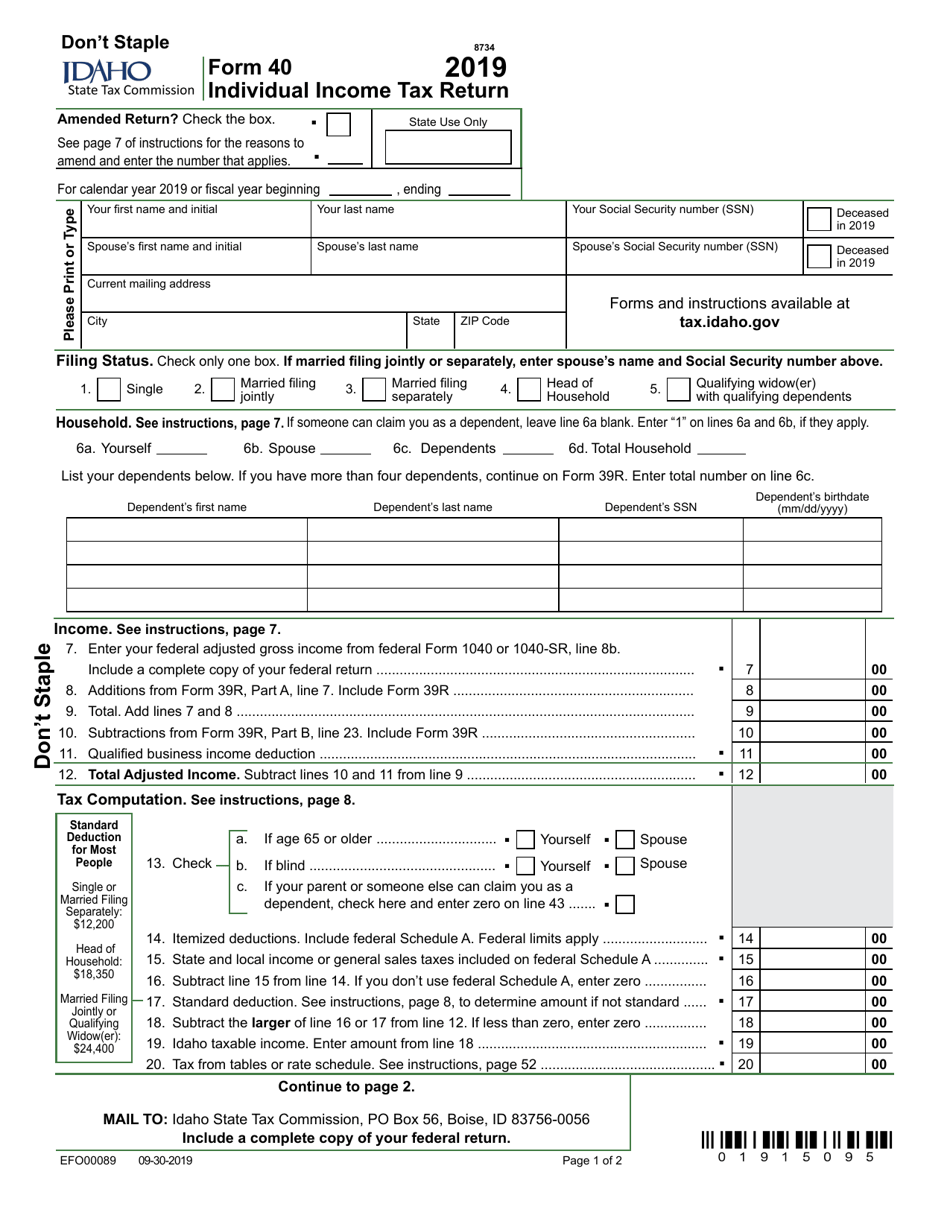

Form 40 Download Fillable PDF or Fill Online Individual Tax

Idaho income tax table learn how marginal tax brackets work 2. Read the summer 2023 tax update, our newsletter for the business community. Web eligible residents have until may 1, 2023, to apply. This form is for income earned in tax year 2022, with tax returns due in april 2023. Sales and use tax forms.

Web Individual Income Tax Forms;

Be sure to verify that the form you are downloading is for the correct year. This edition features articles about new tax laws, taxable sales for recreation and. Web we last updated idaho form 43 in february 2023 from the idaho state tax commission. Idaho income tax table learn how marginal tax brackets work 2.

Web Summer 2023 Tax Update Now Available.

Web individual income tax forms (current) individual income tax forms (archive) property tax forms. Idaho income tax calculator how to use this calculator you can use our free idaho income tax calculator to get a good estimate of what your tax liability will be come april. The deadline to file your 2022 income taxes is april 18, 2023. Sign the form and give it to your employer.

Sales And Use Tax Forms.

Fuels taxes and fees forms; Travel & convention tax forms; This form is for income earned in tax year 2022, with tax returns due in april 2023. Sales and use tax forms;

Read The Summer 2023 Tax Update, Our Newsletter For The Business Community.

We will update this page with a new version of the form for 2024 as soon as it is made available by the idaho government. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Web eligible residents have until may 1, 2023, to apply. Use the information on the back to calculate your idaho allowances and any additional amount you need withheld from each paycheck.