How To Get My Crypto.com Tax Form

How To Get My Crypto.com Tax Form - Web you need to report your taxable crypto transactions on your us individual tax return (irs form 1040 and its state equivalents, where applicable). As mentioned above, us users who earn $600 or more in rewards from crypto.com from staking, earn,. Web you can also chose among common cost basis methods used for tax calculation: Web how are cryptocurrencies taxed? Web this is done in just seconds and at no cost. Web it really doesn’t matter since you’re taxed on gains not transactions but generally yes, just holding a coin means 0 transactions and 0 gains to report so it’s “simpler” but doesn’t. Web jan 26, 2022. Log in to the app and go to ‘ accounts ‘. Straightforward ui which you get your crypto taxes done in seconds. We’re excited to share that u.s.

Web this is done in just seconds and at no cost. Log in to the app and go to ‘ accounts ‘. This tax treatment leads to taxable events each. We’re excited to share that u.s. You need to know your capital gains, losses, income and expenses. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Select the tax settings you’d like to generate your tax reports. Web jan 26, 2022. Web how are cryptocurrencies taxed? What’s more, this detailed crypto tax report includes the user’s transaction history and full record of capital gains and.

Straightforward ui which you get your crypto taxes done in seconds. Person who has earned usd $600 or more in rewards from crypto.com. As mentioned above, us users who earn $600 or more in rewards from crypto.com from staking, earn,. Web yes, crypto.com does report crypto activity to the irs. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Web jan 26, 2022. Log in to the app and go to ‘ accounts ‘. Web this is done in just seconds and at no cost. Web calculate your crypto tax. This tax treatment leads to taxable events each.

Crypto Tax Calculator Free Crypto Com Tax Get Your Crypto Taxes Done

You need to know your capital gains, losses, income and expenses. Web calculate your crypto tax. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. Log in to the app and go to ‘ accounts ‘. Web jan 26, 2022.

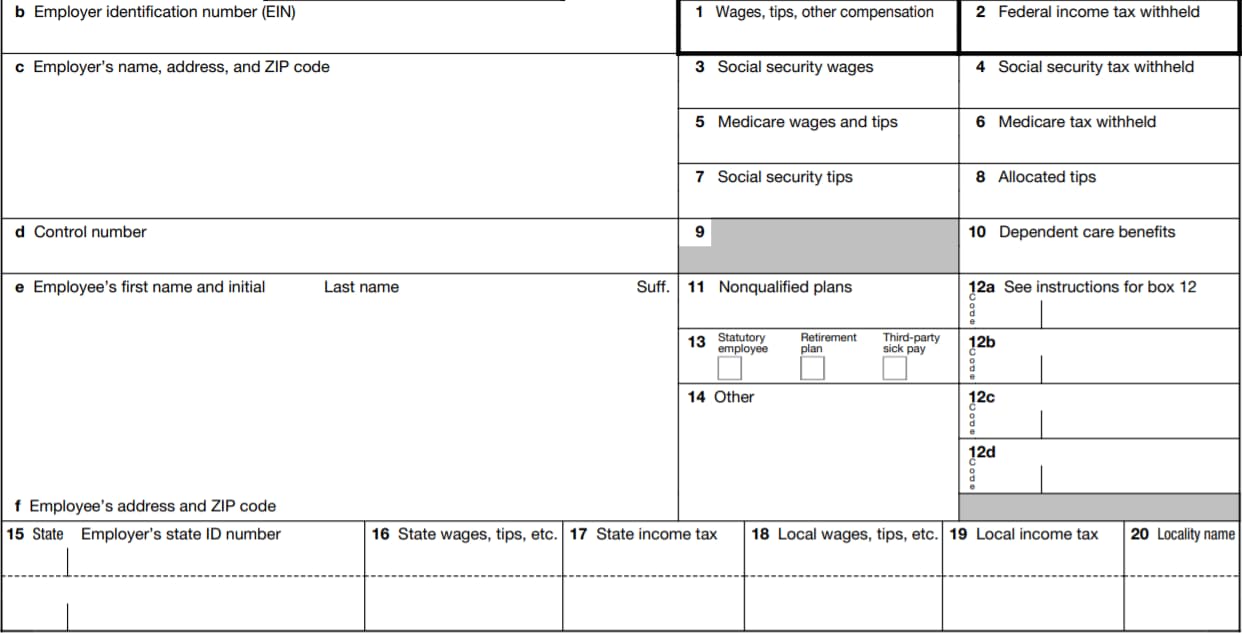

W2 Form 2022 Fillable PDF

Straightforward ui which you get your crypto taxes done in seconds. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. You need to know your capital gains, losses, income and expenses. Once you know your capital gains and losses, complete the tax form for. Web it really doesn’t matter since.

What you Should know about Crypto Tax Evasion CTR

The platform is entirely free of. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Web how to connect crypto.com app with csv. Once you know your capital gains and losses, complete the tax form for. Straightforward ui which you get your crypto taxes done in seconds.

When You Pay Your Taxes, You Love Your Neighbor Good Faith Media

You might need any of these crypto. Web you need to report your taxable crypto transactions on your us individual tax return (irs form 1040 and its state equivalents, where applicable). Web yes, crypto.com does report crypto activity to the irs. Web it really doesn’t matter since you’re taxed on gains not transactions but generally yes, just holding a coin.

Beginners Guide How To Make Money With Crypto Arbitrage in 2020

This tax treatment leads to taxable events each. Register your account in crypto.com tax step 2: Web crypto.com tax offers the best free crypto tax calculator for bitcoin tax reporting and other crypto tax solutions. Web how to connect crypto.com app with csv. You need to know your capital gains, losses, income and expenses.

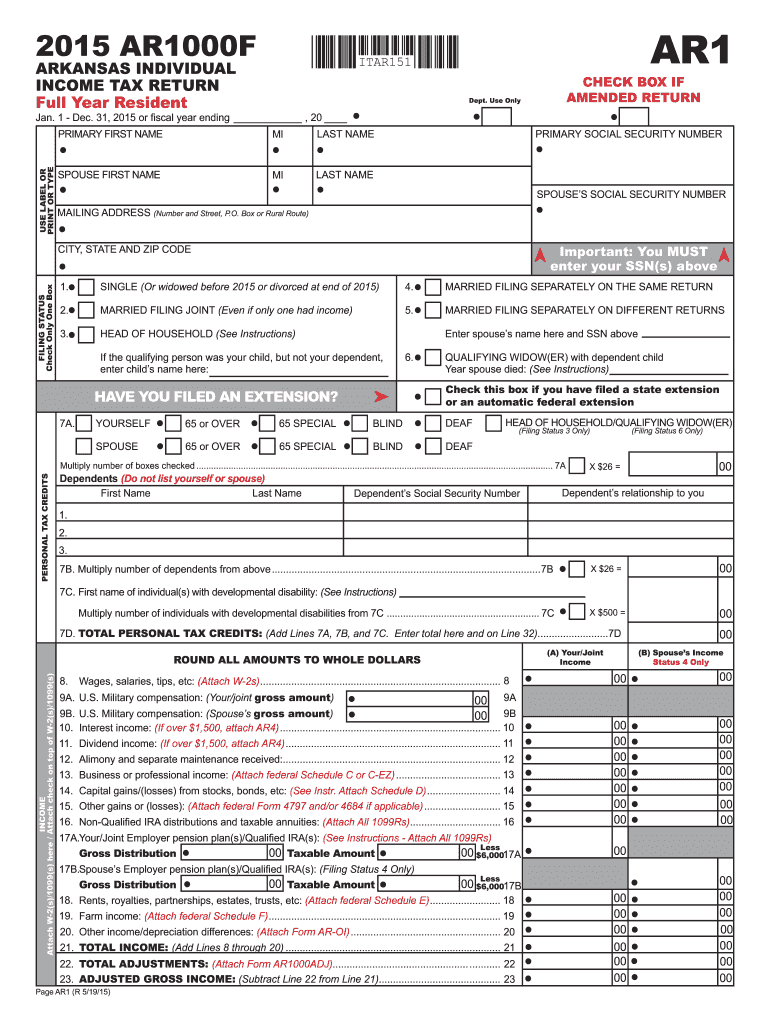

Tax Form Ar Fill Out and Sign Printable PDF Template signNow

What’s more, this detailed crypto tax report includes the user’s transaction history and full record of capital gains and. Web crypto.com tax offers the best free crypto tax calculator for bitcoin tax reporting and other crypto tax solutions. Web jan 26, 2022. We’re excited to share that u.s. If you held on to your virtual.

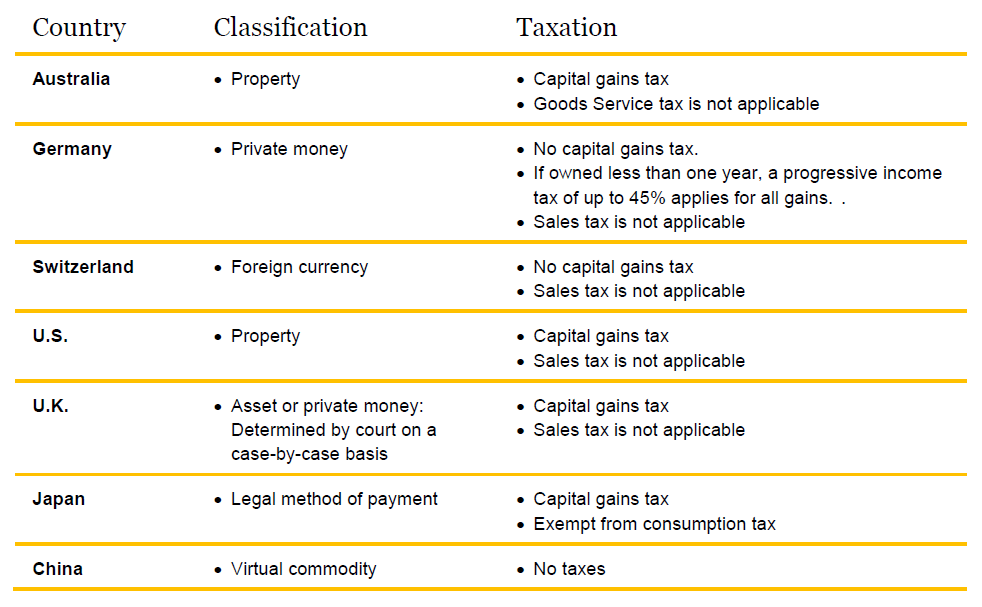

Best Country For Crypto Tax Vincendes

This tax treatment leads to taxable events each. The platform is entirely free of. Web yes, crypto.com does report crypto activity to the irs. Select the tax settings you’d like to generate your tax reports. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to.

Tax Introduces New Features

This tax treatment leads to taxable events each. Web you need to report your taxable crypto transactions on your us individual tax return (irs form 1040 and its state equivalents, where applicable). Web this is done in just seconds and at no cost. Web the 1040 form is the official tax return that taxpayers have to file with the irs.

How To Get Tax Forms 🔴 YouTube

The platform is entirely free of. Web calculate your crypto tax. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Once you know your capital gains and losses, complete the tax form for. Web here’s how to report crypto purchases on your tax form.

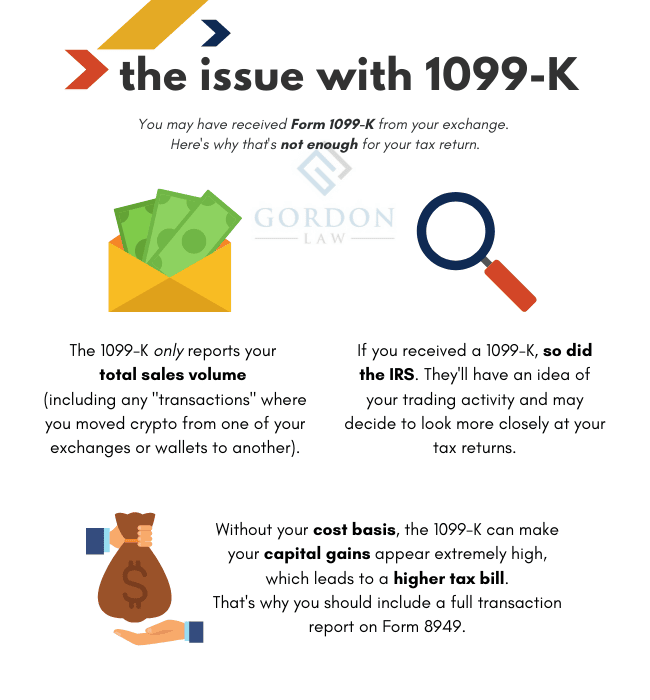

Your Crypto Tax Questions Answered by a Tax Attorney & CPA

You might need any of these crypto. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. You may refer to this section on how to set up your tax. As mentioned above, us users who earn $600 or more in rewards from crypto.com from staking, earn,. Web calculate your crypto.

Once You Know Your Capital Gains And Losses, Complete The Tax Form For.

What’s more, this detailed crypto tax report includes the user’s transaction history and full record of capital gains and. Web calculate your crypto tax. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. Log in to the app and go to ‘ accounts ‘.

Straightforward Ui Which You Get Your Crypto Taxes Done In Seconds.

Web this is done in just seconds and at no cost. You need to know your capital gains, losses, income and expenses. Select the tax settings you’d like to generate your tax reports. Web jan 26, 2022.

As Mentioned Above, Us Users Who Earn $600 Or More In Rewards From Crypto.com From Staking, Earn,.

Web for your individual tax return, you will have to file form 8949 to report your cryptocurrency and nft gains and losses, per forbes. Web how are cryptocurrencies taxed? You may refer to this section on how to set up your tax. Web crypto.com tax offers the best free crypto tax calculator for bitcoin tax reporting and other crypto tax solutions.

Web The 1040 Form Is The Official Tax Return That Taxpayers Have To File With The Irs Each Year To Report Taxable Income And Calculate Their Taxes Due.

Web how to connect crypto.com app with csv. Web yes, crypto.com does report crypto activity to the irs. Web you can also chose among common cost basis methods used for tax calculation: Register your account in crypto.com tax step 2: