How To Form A Nonprofit In Michigan

How To Form A Nonprofit In Michigan - Get exactly what you want at the best price. Web starting a 501c3 nonprofit in michigan is easy step 1: Get exactly what you want at the best price. Web to start a nonprofit in michigan, you must file nonprofit articles of incorporation with the michigan department of licensing and regulatory affairs. You can trust us to file your mi nonprofit! You should choose something that will resonate with. Choose who will be on the initial board of directors. Web michigan compliance checklist federal filing requirements 1. We'll help set up your nonprofit so you can focus on giving back to your community. Articles of incorporation for use by.

Articles of incorporation for use by. Web starting a 501c3 nonprofit in michigan is easy step 1: Click here for a sample articles of incorporation. Get exactly what you want at the best price. Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an michigan nonprofit. Web you must file your articles of incorporation with the michigan secretary of state. Select a name for your organization the name you choose for the michigan nonprofit must comply with michigan naming requirements and should also be easily searched by. Web michigan compliance checklist federal filing requirements 1. Web learn how to form a michigan nonprofit corporation. Web charities and nonprofits.

It is the first thing most people will learn about your. Your nonprofit corporation will come into existence as a separate legal entity when you file its articles of. Click here for a sample articles of incorporation. You should choose something that will resonate with. Form 3372, michigan sales and use. Name your organization the first step toward starting a nonprofit in michigan is choosing a name. Ad we've filed over 300,000 new businesses. Forming a michigan nonprofit organization is a complex process. Here are the steps you need to follow to form a nonprofit 501 (c) (3) corporation in michigan. The report can be filed online at www.michigan.gov/corpfileonline or mail the annual report with the $20.00 fee to p.o.

How to Start a Nonprofit in Michigan An Indepth 10Step Guide

Web charities and nonprofits. Below you will find information on initial filings required when starting a nonprofit. We'll help set up your nonprofit so you can focus on giving back to your community. Form 3372, michigan sales and use. Web michigan compliance checklist federal filing requirements 1.

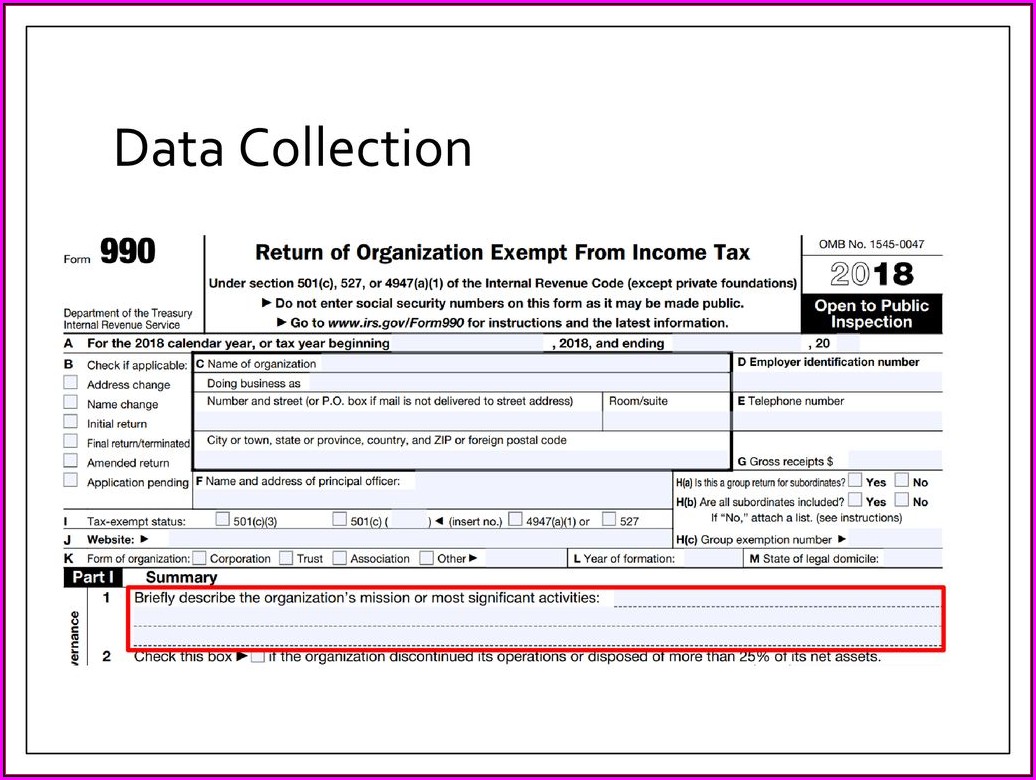

Irs Nonprofit Form 990 Form Resume Examples edV17Q09q6

You can file the articles in. Forming a michigan nonprofit organization is a complex process. It is the first thing most people will learn about your. Choose who will be on the initial board of directors. The filing fee is $20.

Nonprofit Donation Receipt Template Best Of Non Profit Donation Receipt

Web file the nonprofit's michigan articles of incorporation. It is the first thing most people will learn about your. Choose who will be on the initial board of directors. Box 30767 lansing mi 48909. The filing fee is $20.

Articles Of Organization Llc Texas godsgreatdesign

Web welcome to the registration and compliance page for michigan nonprofit organizations. Choose who will be on the initial board of directors. Form 3372, michigan sales and use. Get exactly what you want at the best price. You can file the articles in.

Michigan Nonprofit Form Form Resume Examples GM9OLwlYDL

Lifecycle of an exempt organization. Web michigan compliance checklist federal filing requirements 1. Choose who will be on the initial board of directors. Get exactly what you want at the best price. Select a name for your organization the name you choose for the michigan nonprofit must comply with michigan naming requirements and should also be easily searched by.

Michigan Nonprofit Association Jobs BOJSO

You can trust us to file your mi nonprofit! Be sure you know the procedures for forming a. You should choose something that will resonate with. We'll help set up your nonprofit so you can focus on giving back to your community. In michigan, your nonprofit corporation must have at least.

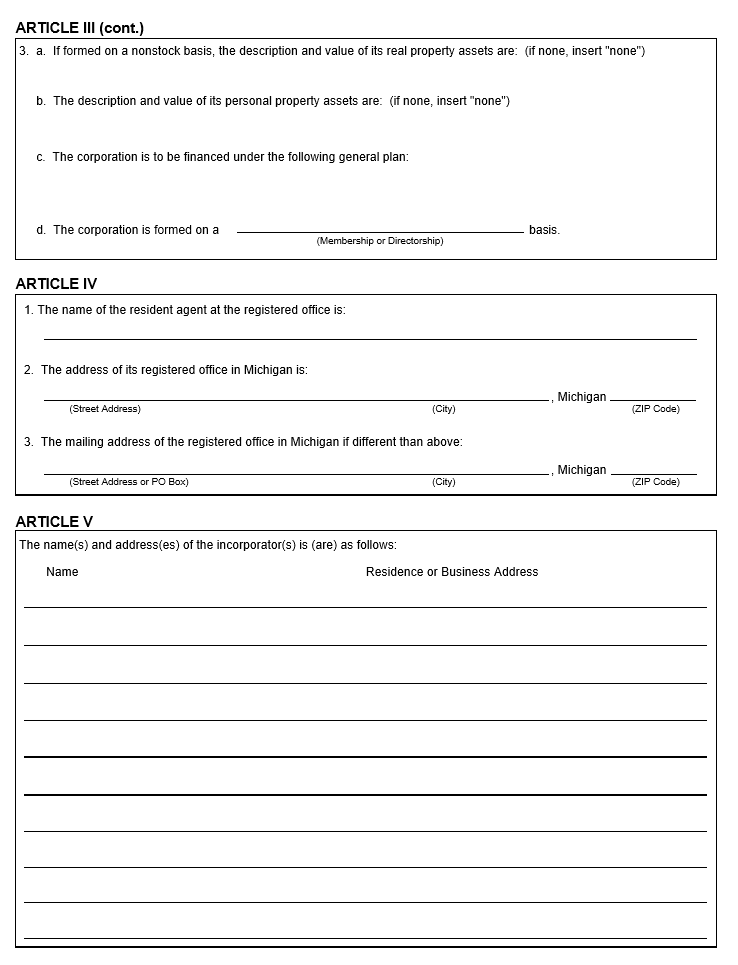

Free Michigan Articles of Incorporation For Use By A Nonprofit

Here are the steps you need to follow to form a nonprofit 501 (c) (3) corporation in michigan. Come up with your organization’s name this holds for any state in the u.s. You should choose something that will resonate with. Web to start a nonprofit in michigan, you must file nonprofit articles of incorporation with the michigan department of licensing.

Michigan Nonprofits Opt out of these unemployment tax increases

Form 3372, michigan sales and use. Select a name for your organization the name you choose for the michigan nonprofit must comply with michigan naming requirements and should also be easily searched by. Articles of incorporation for use by. Below you will find information on initial filings required when starting a nonprofit. Name your organization the first step toward starting.

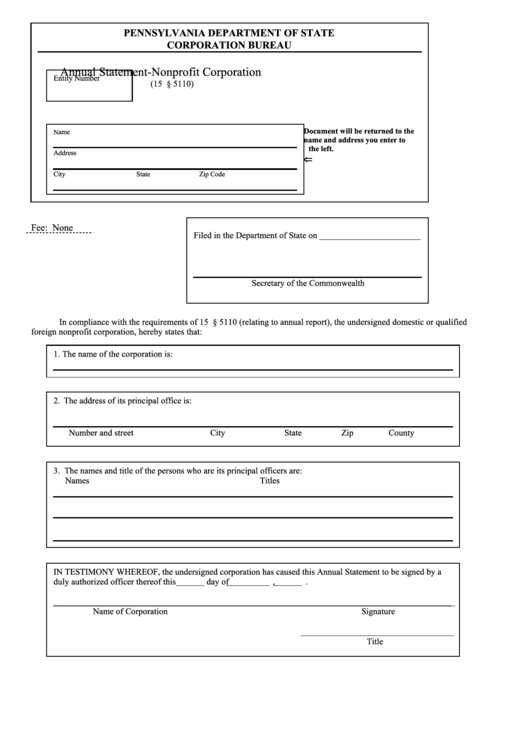

Fillable Annual StatementNonprofit Corporation Form printable pdf download

The report can be filed online at www.michigan.gov/corpfileonline or mail the annual report with the $20.00 fee to p.o. Web this guide covers each step you must take to fill out this document successfully and get on the right track to forming a michigan nonprofit. Web up to 25% cash back form your michigan nonprofit corporation 1. Select a name.

How to Form a Michigan Nonprofit Corporation in 2022

Here are the steps you need to follow to form a nonprofit 501 (c) (3) corporation in michigan. Register your nonprofit & get access to grants reserved just for nonprofits. Select a name for your organization the name you choose for the michigan nonprofit must comply with michigan naming requirements and should also be easily searched by. Name your michigan.

Box 30767 Lansing Mi 48909.

Web starting a 501c3 nonprofit in michigan is easy step 1: It is the first thing most people will learn about your. Form 3372, michigan sales and use. You can file the articles in.

Articles Of Incorporation For Use By.

In michigan, your nonprofit corporation must have at least. We'll help set up your nonprofit so you can focus on giving back to your community. Web up to 24% cash back in order to start and run a nonprofit in michigan, you must submit articles of incorporation to the state department of labor and economic growth, bureau of. Click here for a sample articles of incorporation.

Ad We've Filed Over 300,000 New Businesses.

Web up to 40% cash back below is an overview of the paperwork, cost, and time to start an michigan nonprofit. Web how to start a nonprofit in michigan. The filing fee is $20. The report can be filed online at www.michigan.gov/corpfileonline or mail the annual report with the $20.00 fee to p.o.

Name Your Michigan Nonprofit The Name You Select For Your Nonprofit Will Establish Its Brand.

Web to start a nonprofit in michigan, you must file nonprofit articles of incorporation with the michigan department of licensing and regulatory affairs. Web charities and nonprofits. Choose who will be on the initial board of directors. You should choose something that will resonate with.