How To Fill Out Schedule Se Form 1040

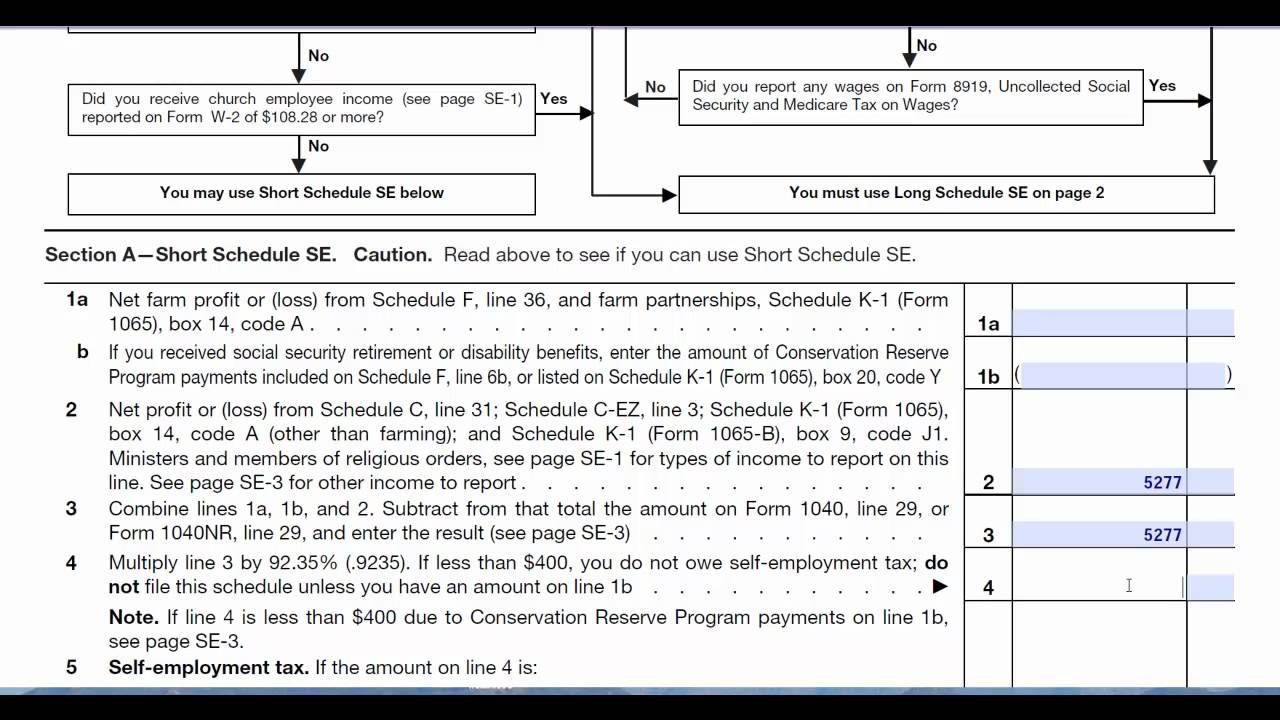

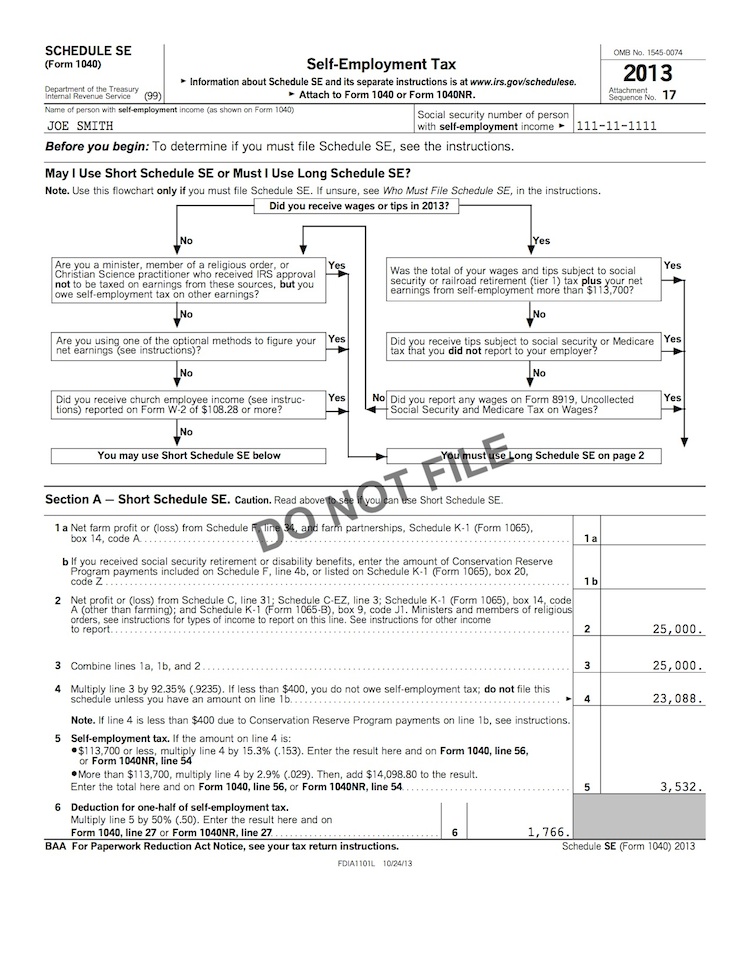

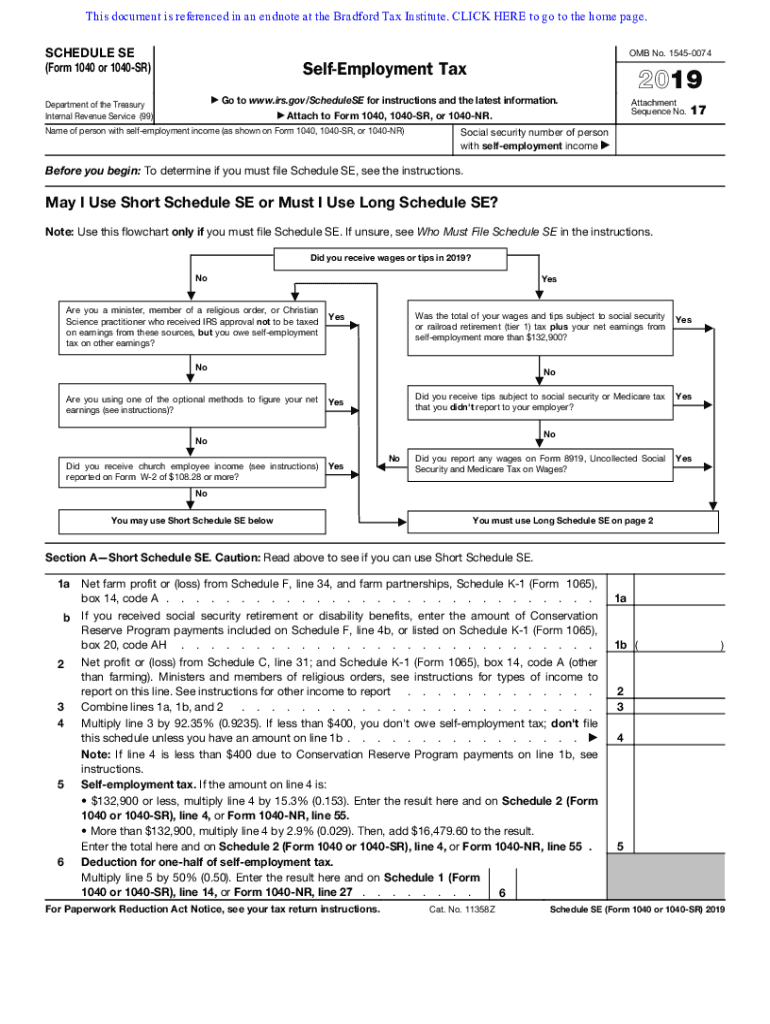

How To Fill Out Schedule Se Form 1040 - 2 even the smallest side hustle will top the $400 threshold pretty. Web the names of the two sections speak for themselves. Web get help with your taxes what is schedule se? Web if you received social security retirement or disability benefits, enter the amount of conservation reserve program payments included on schedule f, line 4b, or listed on. The irs has put together a flowchart to help you determine if you can fill out the shorter schedule se. If you’re running a side hustle or starting a full business, you need to start filling out irs form 1040 schedule se (self employed taxes). Web about these instructions these instructions are not official irs tax form instructions. Enter the amount from line 12 on schedule 2 (form 1040), line 4 to include. They explain how to use the most. Here’s a summary of how to fill out schedule se:

Web learn how to fill out schedule se in this video. Web get help with your taxes what is schedule se? The long schedule se is one full page and allows you. For those reporting their interest and dividend. Web methods for calculating schedule se. The social security administration uses the information from. The short schedule se is about half of a page long. Web the names of the two sections speak for themselves. Web about these instructions these instructions are not official irs tax form instructions. Here’s a summary of how to fill out schedule se:

If line 4c is zero, skip lines 18 through 20,. Web how to fill out the schedule se. Enter your name and social security number; Web the names of the two sections speak for themselves. If you’re running a side hustle or starting a full business, you need to start filling out irs form 1040 schedule se (self employed taxes). Web learn how to fill out schedule se in this video. The irs has put together a flowchart to help you determine if you can fill out the shorter schedule se. Web about these instructions these instructions are not official irs tax form instructions. For those who want to itemize their deductions and not claim the standard deduction schedule b: Web get help with your taxes what is schedule se?

Form 1040 (Schedule SE) SelfEmployment Tax Form (2015) Free Download

Web how to fill out the schedule se. Web the most common are: The social security administration uses the information from. Web if you received social security retirement or disability benefits, enter the amount of conservation reserve program payments included on schedule f, line 4b, or listed on. Web learn how to fill out schedule se in this video.

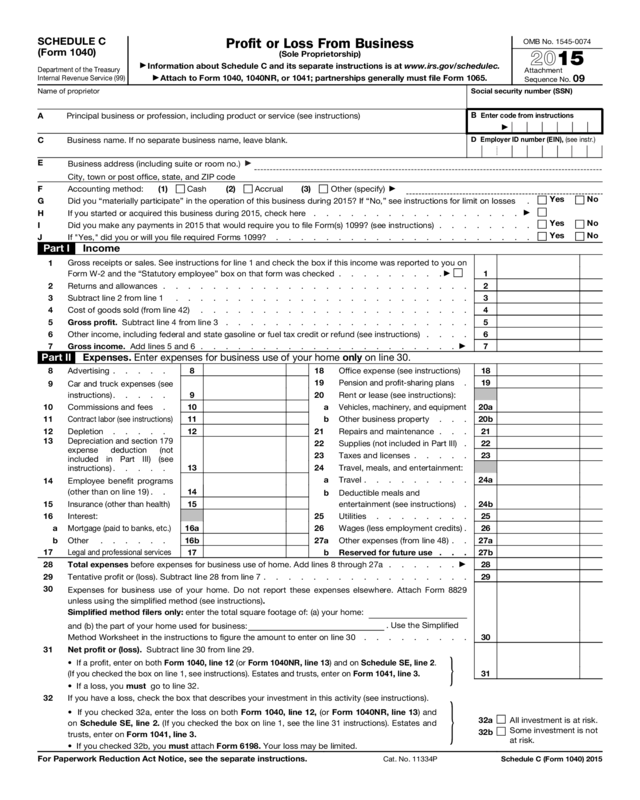

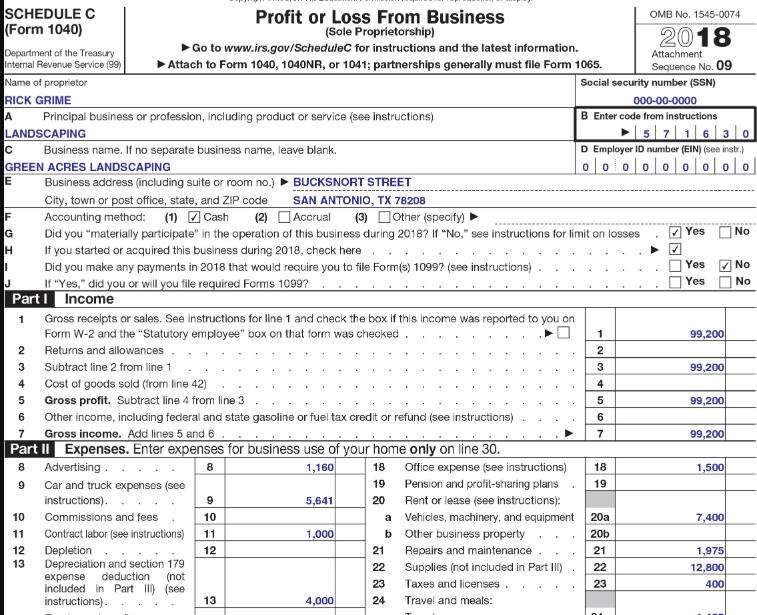

2015 Form 1040 (Schedule C) Edit, Fill, Sign Online Handypdf

The short schedule se is about half of a page long. The long schedule se is one full page and allows you. For those reporting their interest and dividend. Web how to fill out the schedule se. Web learn how to fill out schedule se in this video.

IRS Instructions 1040 (Schedule SE) 2019 Printable & Fillable Sample

Web schedule se (form 1040) 2020. Web if you received social security retirement or disability benefits, enter the amount of conservation reserve program payments included on schedule f, line 4b, or listed on. The short schedule se is about half of a page long. Web the most common are: For those who want to itemize their deductions and not claim.

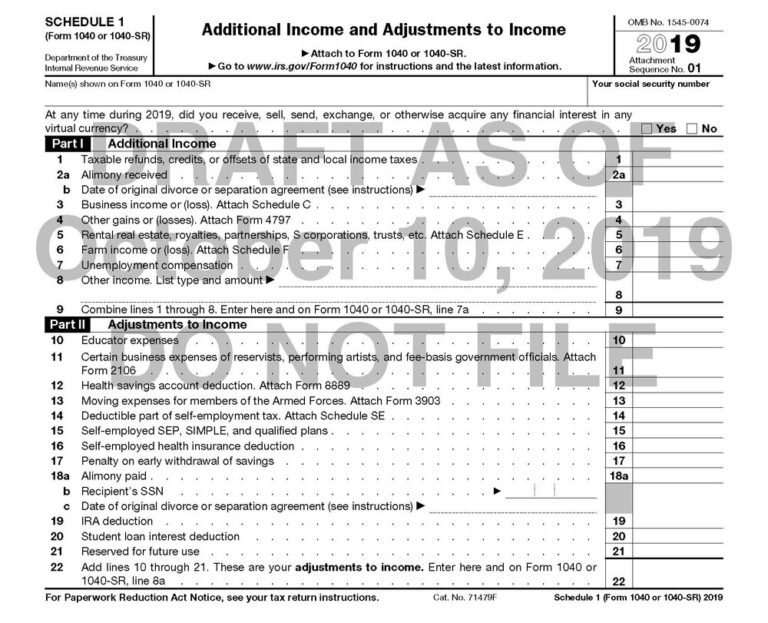

2019 Form 1040 Schedule 1 Will Ask Taxpayers If They Have 2021 Tax

You must file your return and pay any tax due by the. Web the most common are: For those reporting their interest and dividend. Web about these instructions these instructions are not official irs tax form instructions. The long schedule se is one full page and allows you.

Schedule SE SelfEmployment (Form 1040) Tax return preparation YouTube

Can you use the short schedule se? Schedule se (form 1040) is used. Web if you received social security retirement or disability benefits, enter the amount of conservation reserve program payments included on schedule f, line 4b, or listed on. Web schedule se (form 1040) 2020. Web where do i find schedule se?

New for 2019 taxes revised 1040 & only 3 schedules Don't Mess With Taxes

Enter your name and social security number; Web learn how to fill out schedule se in this video. Enter the amount from line 12 on schedule 2 (form 1040), line 4 to include. If you’re running a side hustle or starting a full business, you need to start filling out irs form 1040 schedule se (self employed taxes). Web the.

Book Form 1040 Schedule SE Tax Goddess Publishing

For those reporting their interest and dividend. They explain how to use the most. Web the most common are: The social security administration uses the information from. Can you use the short schedule se?

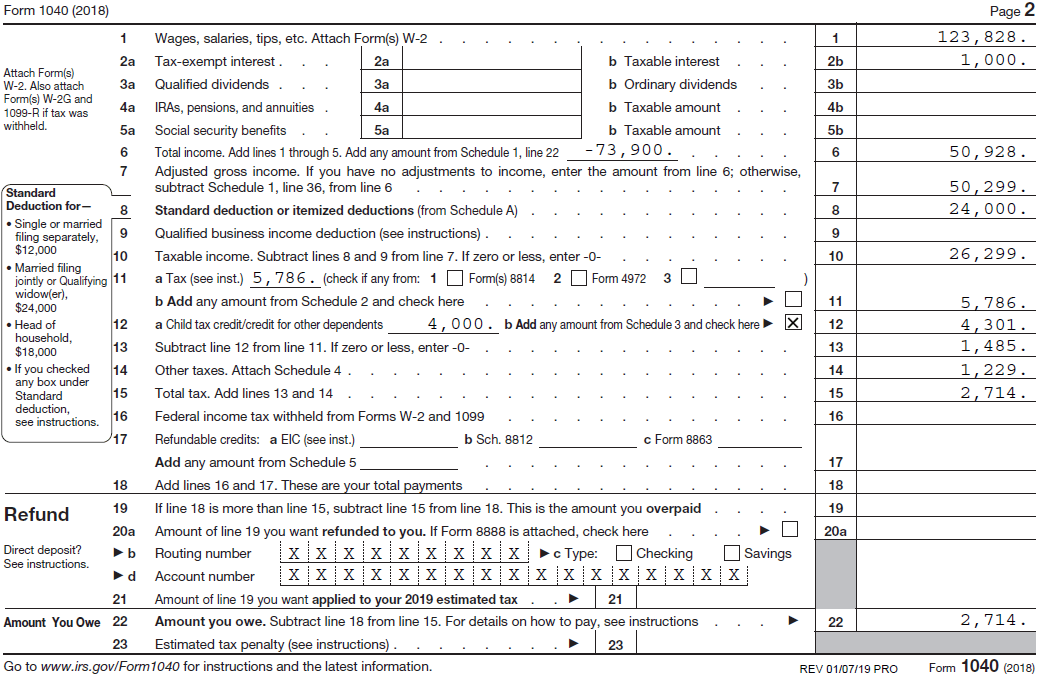

Completing Form 1040 With a US Expat 1040 Example

Web how to fill out the schedule se. The irs has put together a flowchart to help you determine if you can fill out the shorter schedule se. Web methods for calculating schedule se. Web about these instructions these instructions are not official irs tax form instructions. If you’re running a side hustle or starting a full business, you need.

How To Make A 1040 Schedule C 2020 Hampel Bloggen

The long schedule se is one full page and allows you. For those who want to itemize their deductions and not claim the standard deduction schedule b: The short schedule se is about half of a page long. They are for free file fillable forms only. This form will help you.

Schedule SE Form 1040. Self Employment Tax Fill and Sign Printable

Web if you received social security retirement or disability benefits, enter the amount of conservation reserve program payments included on schedule f, line 4b, or listed on. Web if you received social security retirement or disability benefits, enter the amount of conservation reserve program payments included on schedule f, line 4b, or listed on. The short schedule se is about.

Enter The Amount From Line 12 On Schedule 2 (Form 1040), Line 4 To Include.

Web if you received social security retirement or disability benefits, enter the amount of conservation reserve program payments included on schedule f, line 4b, or listed on. 2 even the smallest side hustle will top the $400 threshold pretty. This form will help you. Web the most common are:

Web Schedule Se (Form 1040) 2020.

You must file your return and pay any tax due by the. The irs has put together a flowchart to help you determine if you can fill out the shorter schedule se. Web get help with your taxes what is schedule se? Web about these instructions these instructions are not official irs tax form instructions.

Can You Use The Short Schedule Se?

They explain how to use the most. They are for free file fillable forms only. The social security administration uses the information from. Enter your name and social security number;

Web If You Received Social Security Retirement Or Disability Benefits, Enter The Amount Of Conservation Reserve Program Payments Included On Schedule F, Line 4B, Or Listed On.

Web the names of the two sections speak for themselves. If line 4c is zero, skip lines 18 through 20,. The short schedule se is about half of a page long. If you’re running a side hustle or starting a full business, you need to start filling out irs form 1040 schedule se (self employed taxes).