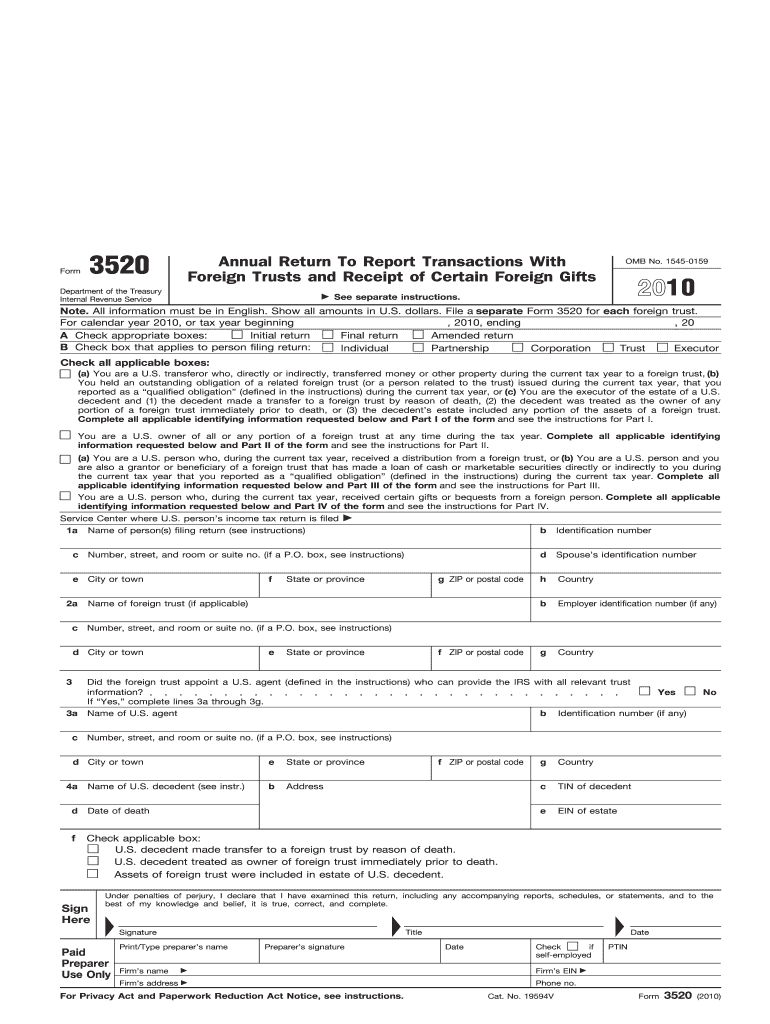

How To Fill Out Form 3520

How To Fill Out Form 3520 - Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Send form 3520 to the. If you are involved with or owned one or more foreign trusts or you have received bequests or gifts. Ad access irs tax forms. Here is the direct download. Enter the initial and final returns. Web press the blue button above to get a fillable form template and conveniently complete it online. Person who owns a foreign trust or has received a foreign gift in the past tax year. Person meets the 3520 threshold requirements for filing, they may have to report one or more transactions. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable.

Enter the initial and final returns. Generally, the deadline for filling out irs. Web press the blue button above to get a fillable form template and conveniently complete it online. Try it for free now! Generally speaking, if you have received a gift of over $100,000 in value from a. Here is the direct download. Person who, during the current tax year,. Upload, modify or create forms. Web form 3520 filing requirements form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt of certain foreign gifts. See the instructions for part i.

Web this form must be submitted to u.s. Web this form must be submitted to the u.s. Complete, edit or print tax forms instantly. You need to have the irs form 3520 on your computer hence you need to download it. Ad access irs tax forms. Here is the direct download. Box 409101, ogden, ut 84409, by the 15th day. Person meets the 3520 threshold requirements for filing, they may have to report one or more transactions. Web the form is due when a person’s tax return is due to be filed. Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to.

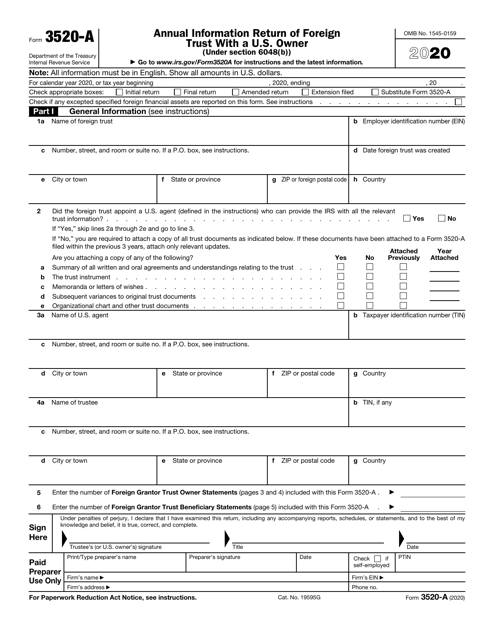

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Here is the direct download. Person who owns a foreign trust or has received a foreign gift in the past tax year. Web complete the identifying information on page 1 of the form and the relevant portions of part.

Form 3520 Blank Sample to Fill out Online in PDF

Try it for free now! Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. Web complete the identifying information on page 1 of the form and the relevant portions of part i. Person who, during the current tax year,..

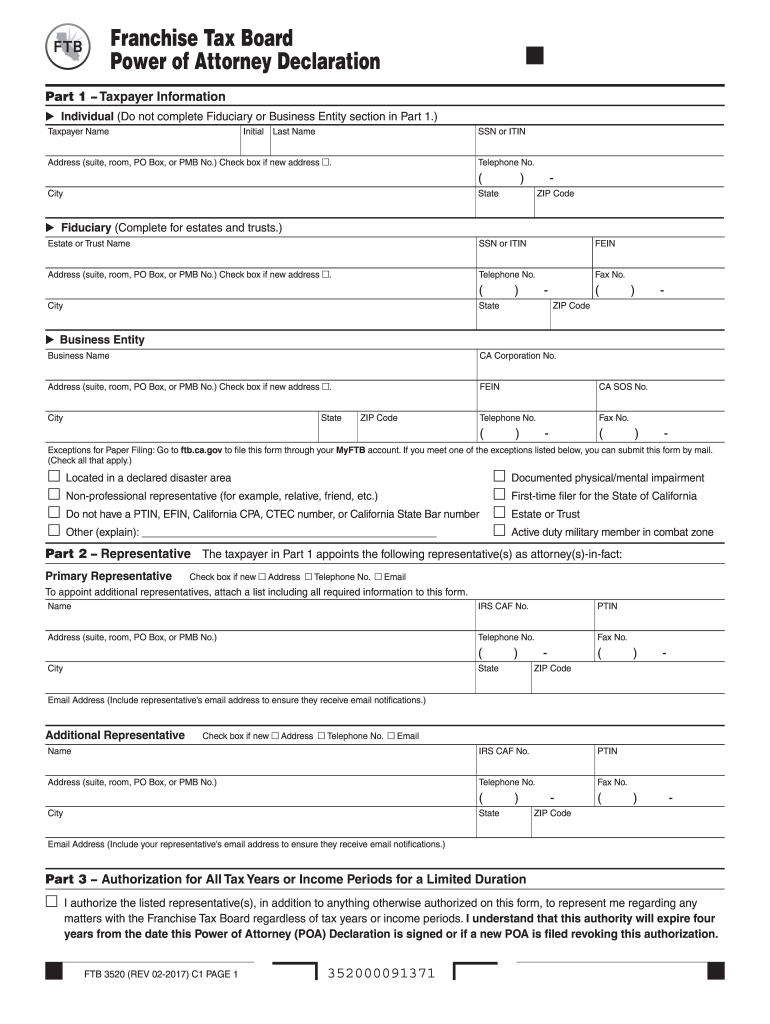

2016 Form CA FTB 3520 Fill Online, Printable, Fillable, Blank pdfFiller

Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. Send form 3520 to the. Ad access irs tax forms. See the instructions for part i. Next is to download the.

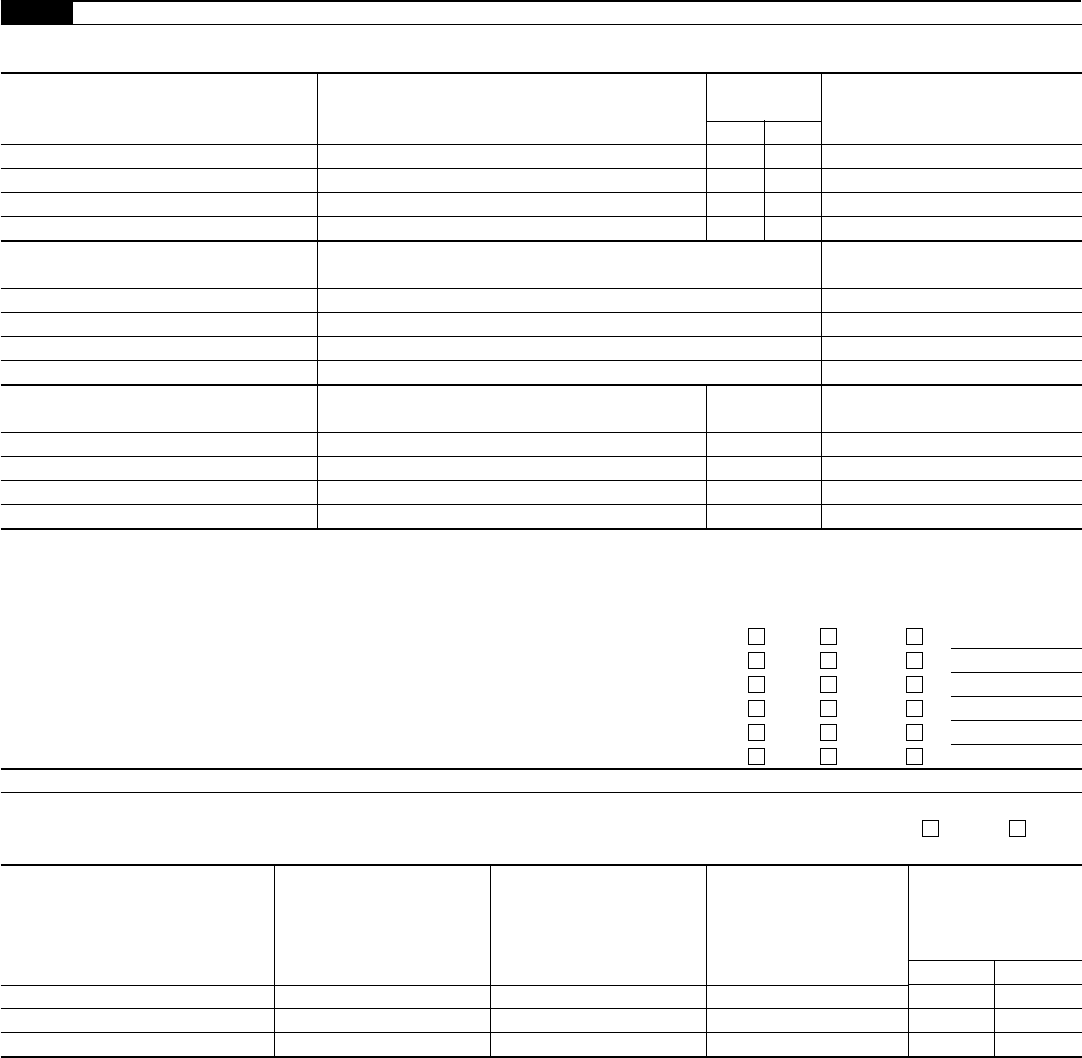

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Web form 3520 how to report foreign trusts and certain foreign gifts. Web press the blue button above to get a fillable form template and conveniently complete it online. Web this form must be submitted to u.s. Web you must separately identify each gift and the identity of the donor. Send form 3520 to the.

Forex trading irs

Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. Web press the blue button above to get a fillable form template and conveniently complete it online. Note that the irs may recharacterize purported gifts from foreign corporations or foreign.

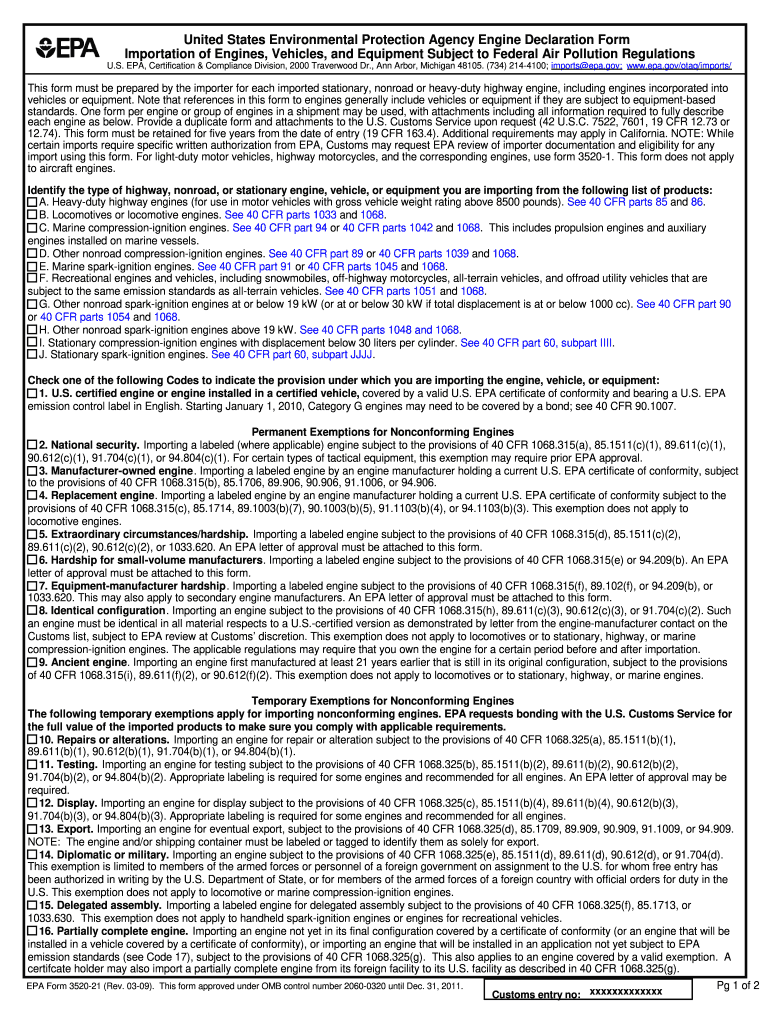

Epa 3520 21 2009 form Fill out & sign online DocHub

If you are involved with or owned one or more foreign trusts or you have received bequests or gifts. Web this form must be submitted to the u.s. Web you’ll have to complete form 3520 if you’re a u.s. Web you must separately identify each gift and the identity of the donor. Generally, the deadline for filling out irs.

Form 3520 Fill Out and Sign Printable PDF Template signNow

Try it for free now! Person who owns a foreign trust or has received a foreign gift in the past tax year. Generally speaking, if you have received a gift of over $100,000 in value from a. Web you’ll have to complete form 3520 if you’re a u.s. Web complete the identifying information on page 1 of the form and.

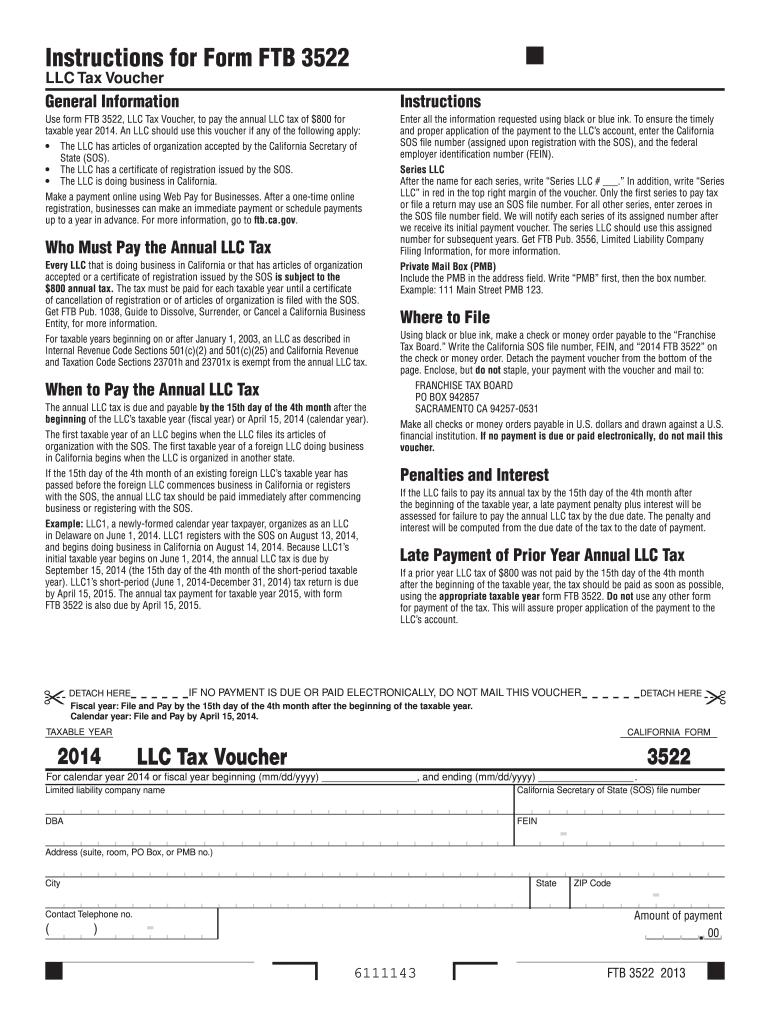

Form 3522 California 2020 Fill Online, Printable, Fillable, Blank

Complete, edit or print tax forms instantly. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Box 409101, ogden, ut 84409, by the 15th day. Generally speaking, if you have received a gift of over $100,000 in value from a. If.

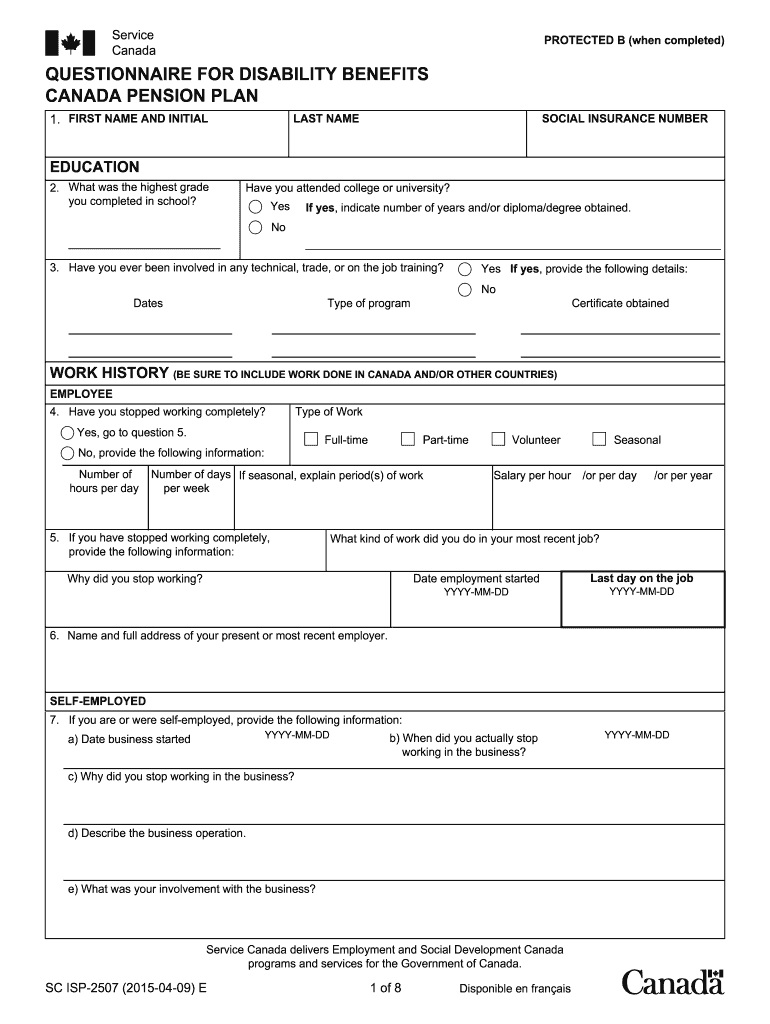

Sc Isp Fill Out and Sign Printable PDF Template signNow

Try it for free now! Ad access irs tax forms. Next is to download the. Web this form must be submitted to the u.s. Here is the direct download.

Form 3520 Fill out & sign online DocHub

If you are involved with or owned one or more foreign trusts or you have received bequests or gifts. Box 409101, ogden, ut 84409, by the 15th day. You need to have the irs form 3520 on your computer hence you need to download it. Web you’ll have to complete form 3520 if you’re a u.s. Web the form is.

Web You Must Separately Identify Each Gift And The Identity Of The Donor.

Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to. Generally speaking, if you have received a gift of over $100,000 in value from a. Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Person who, during the current tax year,.

Person Who Owns A Foreign Trust Or Has Received A Foreign Gift In The Past Tax Year.

Web you’ll have to complete form 3520 if you’re a u.s. Web figuring out when and how to notify the irs of a foreign inheritance can be a nuanced process. Send form 3520 to the. Next is to download the.

Try It For Free Now!

Web complete the identifying information on page 1 of the form and the relevant portions of part i. Ad access irs tax forms. Person meets the 3520 threshold requirements for filing, they may have to report one or more transactions. Web the form is due when a person’s tax return is due to be filed.

Enter The Initial And Final Returns.

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Generally, the deadline for filling out irs. Put down the tax year. Web form 3520 how to report foreign trusts and certain foreign gifts.