How To File Form 8379

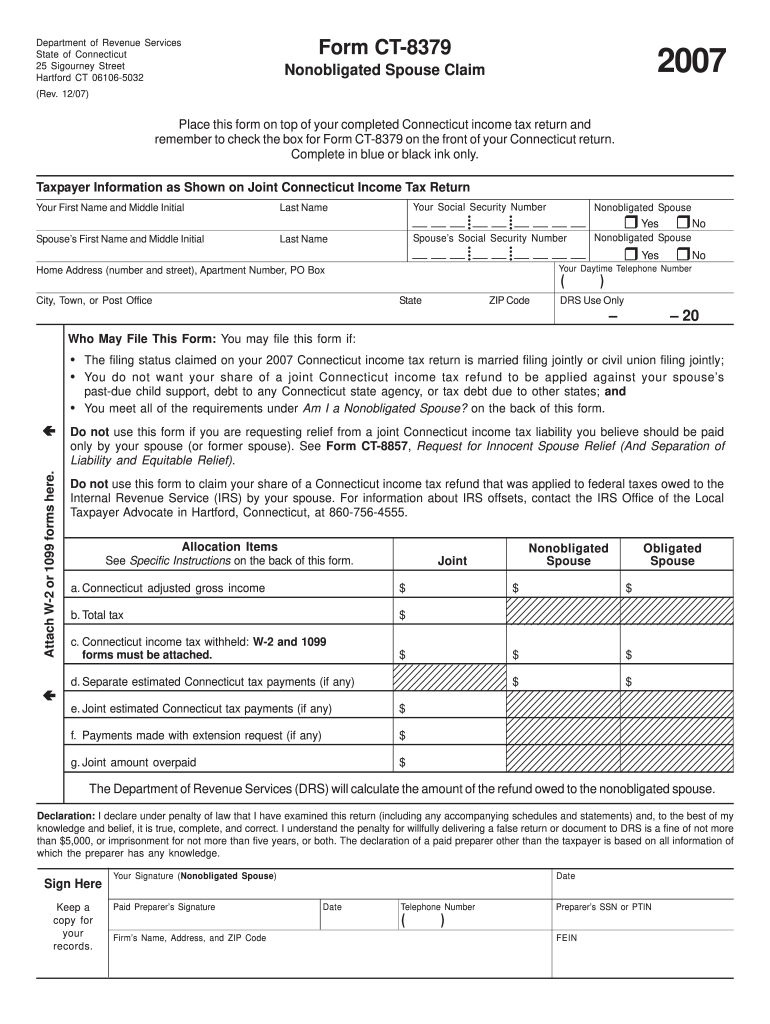

How To File Form 8379 - Upload, modify or create forms. Federal section miscellaneous forms injured spouse allocation, reported on form 8379 please. Complete, edit or print tax forms instantly. Web how do i file form 8379? Web a jointly filed tax return’s injured spouse has the option to file form 8379 in order to claim their share of a joint refund that was taken in order to satisfy the other. If you file form 8379 with a joint return electronically, the time needed to. An injured spouse form is only filed. Ad access irs tax forms. Continue with the interview process to enter all of the appropriate. If you are married filing jointly and you filed an injured spouse claim with your 2019 tax return (or.

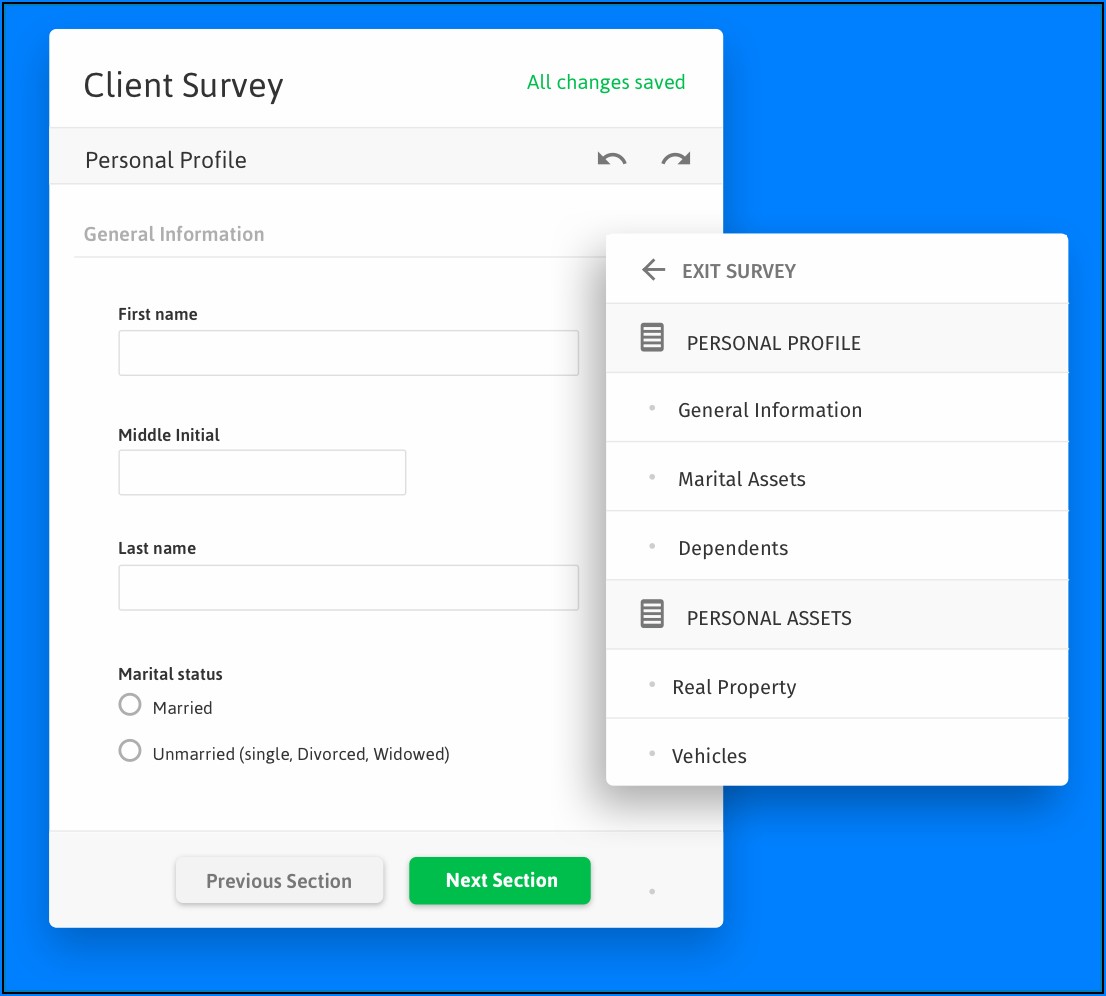

Continue with the interview process to enter all of the appropriate. An injured spouse form is only filed. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web click + add form 8379 to create a new copy of the form or click edit to review a form already created. Web to complete form 8379 in your taxact program: Complete, edit or print tax forms instantly. By itself, after filing your tax return. From within your taxact return ( online or desktop) click federal (on smaller devices, click in the top left corner of your screen,. Most state programs available in january;

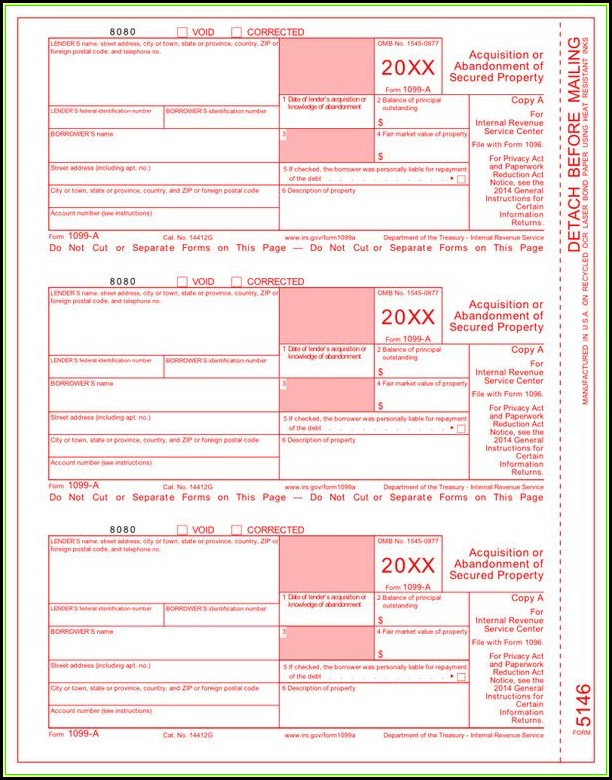

Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. Try it for free now! Federal section miscellaneous forms injured spouse allocation, reported on form 8379 please. Yes, you can file form 8379 electronically with your tax return. Form 8379 is used by injured. Web click + add form 8379 to create a new copy of the form or click edit to review a form already created. Web you may complete the injured spouse form, form 8379 within the program. Web 1 enter the tax year for which you are filing this form 2 did you (or will you) file a joint return? Ad access irs tax forms. Upload, modify or create forms.

Form 8379 E File Form Resume Examples 1ZV8aBeo23

Web how do i file form 8379? If you file form 8379 with a joint return electronically, the time needed to. Web to file as an injured spouse, you’ll need to complete form 8379: Yes, you can file form 8379 electronically with your tax return. Ad access irs tax forms.

Injured Spouse Form Fill Out and Sign Printable PDF Template signNow

Web instructions for form 8379. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. Web a jointly filed tax return’s injured spouse has the option to file form 8379 in order to claim their share of a joint refund that was taken in order to satisfy the other. Try it.

E File Form 7004 Turbotax Universal Network

Web instructions for form 8379. Yes, you can file form 8379 electronically with your tax return. Answer the following questions for that year. Complete, edit or print tax forms instantly. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file.

What Is Form 8379 Injured Spouse Allocation? Definition

Web open (continue) your return in turbotax online. Web you may complete the injured spouse form, form 8379 within the program. Web to complete form 8379 in your taxact program: If you file form 8379 with a joint return electronically, the time needed to. Yes, you can file form 8379 electronically with your tax return.

Form 8379 E File Form Resume Examples 1ZV8aBeo23

File form 8379 with form 1040x. An injured spouse form is only filed. Most state programs available in january; Try it for free now! Ad access irs tax forms.

Can File Form 8379 Electronically hqfilecloud

By itself, after filing your tax return. Upload, modify or create forms. Ad access irs tax forms. Try it for free now! If you file form 8379 with a joint return electronically, the time needed to.

File Isf Form Form Resume Examples Vj1yGL43yl

Complete, edit or print tax forms instantly. Web you may complete the injured spouse form, form 8379 within the program. Download or email irs 8379 & more fillable forms, register and subscribe now! Web a jointly filed tax return’s injured spouse has the option to file form 8379 in order to claim their share of a joint refund that was.

Fill Out Form 8379 Online easily airSlate

If you are married filing jointly and you filed an injured spouse claim with your 2019 tax return (or. Ad access irs tax forms. Web a jointly filed tax return’s injured spouse has the option to file form 8379 in order to claim their share of a joint refund that was taken in order to satisfy the other. If you’re.

How to stop child support from taking tax refund

To file your taxes as an injured spouse, follow the steps below: Web open (continue) your return in turbotax online. Complete, edit or print tax forms instantly. File form 8379 with form 1040x. Web to file as an injured spouse, you’ll need to complete form 8379:

Fill Free fillable form 8379 injured spouse allocation 2016 PDF form

Yes, you can file form 8379 electronically with your tax return. Form 8379 is used by injured. Web a jointly filed tax return’s injured spouse has the option to file form 8379 in order to claim their share of a joint refund that was taken in order to satisfy the other. If you’re filing with h&r block, you won’t need.

If You’re Filing With H&R Block, You Won’t Need To Complete This Form On Your.

Web open (continue) your return in turbotax online. Try it for free now! Continue with the interview process to enter all of the appropriate. By itself, after filing your tax return.

Try It For Free Now!

Form 8379 is used by injured. Web eligibility requirements to be eligible to file form 8370, the injured spouse must have reported their own income on the joint tax return that they filed with their. Injured spouse claim and allocation. Web to file as an injured spouse, you’ll need to complete form 8379:

Web Information About Form 8379, Injured Spouse Allocation, Including Recent Updates, Related Forms, And Instructions On How To File.

Yes, you can file form 8379 electronically with your tax return. To file your taxes as an injured spouse, follow the steps below: Web you may complete the injured spouse form, form 8379 within the program. Complete, edit or print tax forms instantly.

Ad Access Irs Tax Forms.

Web to complete form 8379 in your taxact program: Web a jointly filed tax return’s injured spouse has the option to file form 8379 in order to claim their share of a joint refund that was taken in order to satisfy the other. File form 8379 with form 1040x. Download or email irs 8379 & more fillable forms, register and subscribe now!

:max_bytes(150000):strip_icc()/8379InjuredSpouseAllocation-1-03b68023b499432fabbad2fdc66b4b5e.png)