How To File Form 1095 C Electronically

How To File Form 1095 C Electronically - Ale members that file 250 or more information returns must. Web employers typically have until the end of february to send them to the irs if filing paper forms, or until the end of march if filing electronically. Directions for filing can be found at the irs website. If choosing to submit your filing electronically, be sure to find an. Enter the employer / employee details step 3 : Web you do need your form 1095 to file your federal return if: Web how to file electronically. Complete, edit or print tax forms instantly. Web what is an information return? All applicable large employers (ales) reporting on 250+ employees however are.

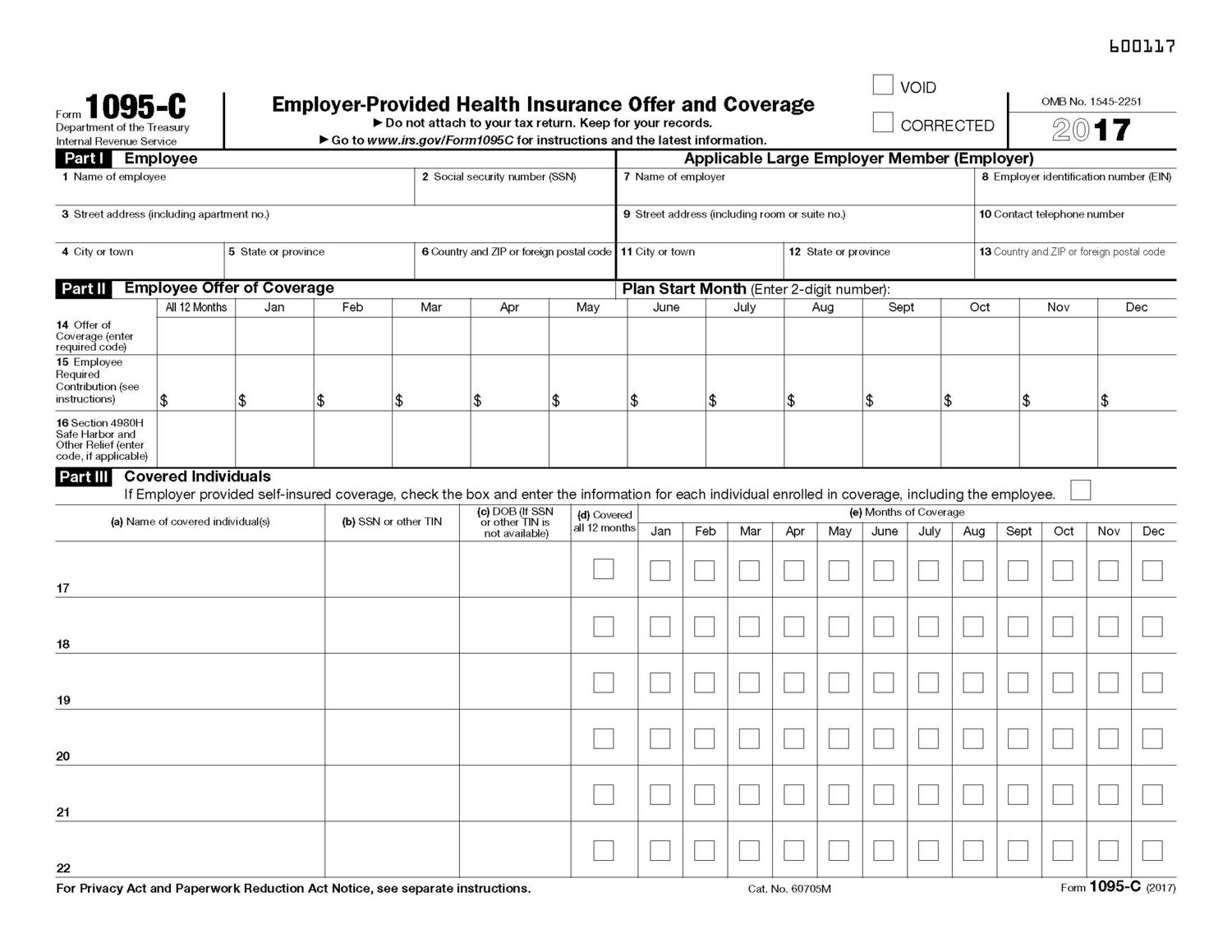

Part i, employee & ale. Ale members that file 250 or more information returns must. All applicable large employers (ales) reporting on 250+ employees however are. Complete, edit or print tax forms instantly. Web what is an information return? Enter the employer / employee details step 3 : If choosing to submit your filing electronically, be sure to find an. Directions for filing can be found at the irs website. Web employers typically have until the end of february to send them to the irs if filing paper forms, or until the end of march if filing electronically. Web you do need your form 1095 to file your federal return if:

Web what is an information return? Information returns are records other than tax returns that the irs requires to document certain financial transactions. Ale members that file 250 or more information returns must. You can efile data for any prior year from tax year 2015 to the present tax year. Part i, employee & ale. To receive a waiver, submit. Directions for filing can be found at the irs website. Web electronic filing with irs march 31, 2022. If choosing to submit your filing electronically, be sure to find an. Web employers typically have until the end of february to send them to the irs if filing paper forms, or until the end of march if filing electronically.

Efile ACA Form 1095C Online How to File 1095C for 2020

Complete, edit or print tax forms instantly. You can efile data for any prior year from tax year 2015 to the present tax year. The following forms may be. To receive a waiver, submit. Ale members that file 250 or more information returns must.

1095C Information Kum & Go

Information returns are records other than tax returns that the irs requires to document certain financial transactions. Web you do need your form 1095 to file your federal return if: Directions for filing can be found at the irs website. Part i, employee & ale. All applicable large employers (ales) reporting on 250+ employees however are.

how to file 1095c electronically Fill Online, Printable, Fillable

Enter the employer / employee details step 3 : Complete, edit or print tax forms instantly. Part i, employee & ale. You can efile data for any prior year from tax year 2015 to the present tax year. Web you do need your form 1095 to file your federal return if:

New Jersey ACA Reporting Requirements for 2021

Web electronic filing with irs march 31, 2022. Part i, employee & ale. Ale members that file 250 or more information returns must. If choosing to submit your filing electronically, be sure to find an. Enter the employer / employee details step 3 :

Efile ACA Form 1095C Online How to File 1095C for 2020

Web how to file electronically. Web what is an information return? You can efile data for any prior year from tax year 2015 to the present tax year. Complete, edit or print tax forms instantly. Directions for filing can be found at the irs website.

Efile IRS Form 1095 File 1095C or 1095B electronically.

To receive a waiver, submit. You can efile data for any prior year from tax year 2015 to the present tax year. Web electronic filing with irs march 31, 2022. Web you do need your form 1095 to file your federal return if: If choosing to submit your filing electronically, be sure to find an.

UPDATED HR's Guide to Filing and Distributing 1095Cs BerniePortal

Information returns are records other than tax returns that the irs requires to document certain financial transactions. You can efile data for any prior year from tax year 2015 to the present tax year. Directions for filing can be found at the irs website. Part i, employee & ale. Web electronic filing with irs march 31, 2022.

Efile ACA Form 1095C Online How to File 1095C for 2020

All applicable large employers (ales) reporting on 250+ employees however are. You can efile data for any prior year from tax year 2015 to the present tax year. Web how to file electronically. Web you do need your form 1095 to file your federal return if: Ale members that file 250 or more information returns must.

IRS Forms 1095C Still Required by Employers to File for 2017 — Shea

Part i, employee & ale. Ale members that file 250 or more information returns must. All applicable large employers (ales) reporting on 250+ employees however are. Web how to file electronically. If choosing to submit your filing electronically, be sure to find an.

Efile 2019 Form 1095C Online with TaxBandits YouTube

If choosing to submit your filing electronically, be sure to find an. To receive a waiver, submit. You can efile data for any prior year from tax year 2015 to the present tax year. Part i, employee & ale. Web you do need your form 1095 to file your federal return if:

You Can Efile Data For Any Prior Year From Tax Year 2015 To The Present Tax Year.

Ale members that file 250 or more information returns must. Complete, edit or print tax forms instantly. If choosing to submit your filing electronically, be sure to find an. Directions for filing can be found at the irs website.

The Following Forms May Be.

Web electronic filing with irs march 31, 2022. Web how to file electronically. Web you do need your form 1095 to file your federal return if: Part i, employee & ale.

To Receive A Waiver, Submit.

Web what is an information return? All applicable large employers (ales) reporting on 250+ employees however are. Information returns are records other than tax returns that the irs requires to document certain financial transactions. Web employers typically have until the end of february to send them to the irs if filing paper forms, or until the end of march if filing electronically.