How To Complete Form 1116

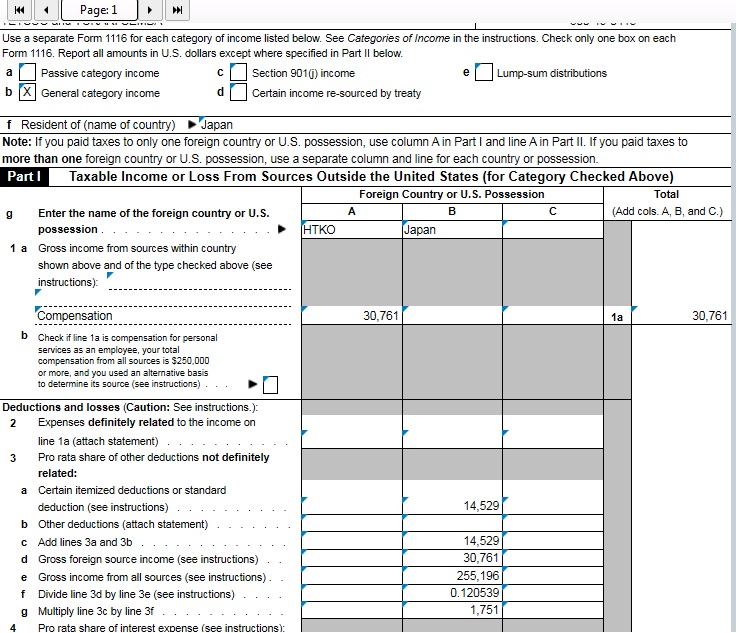

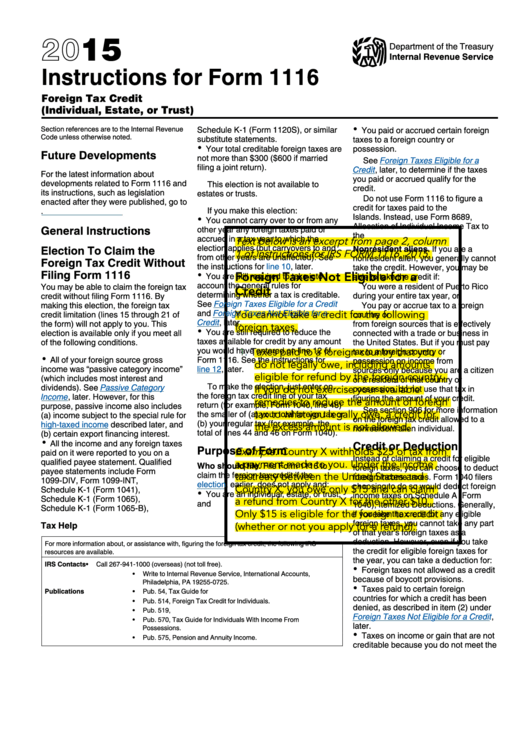

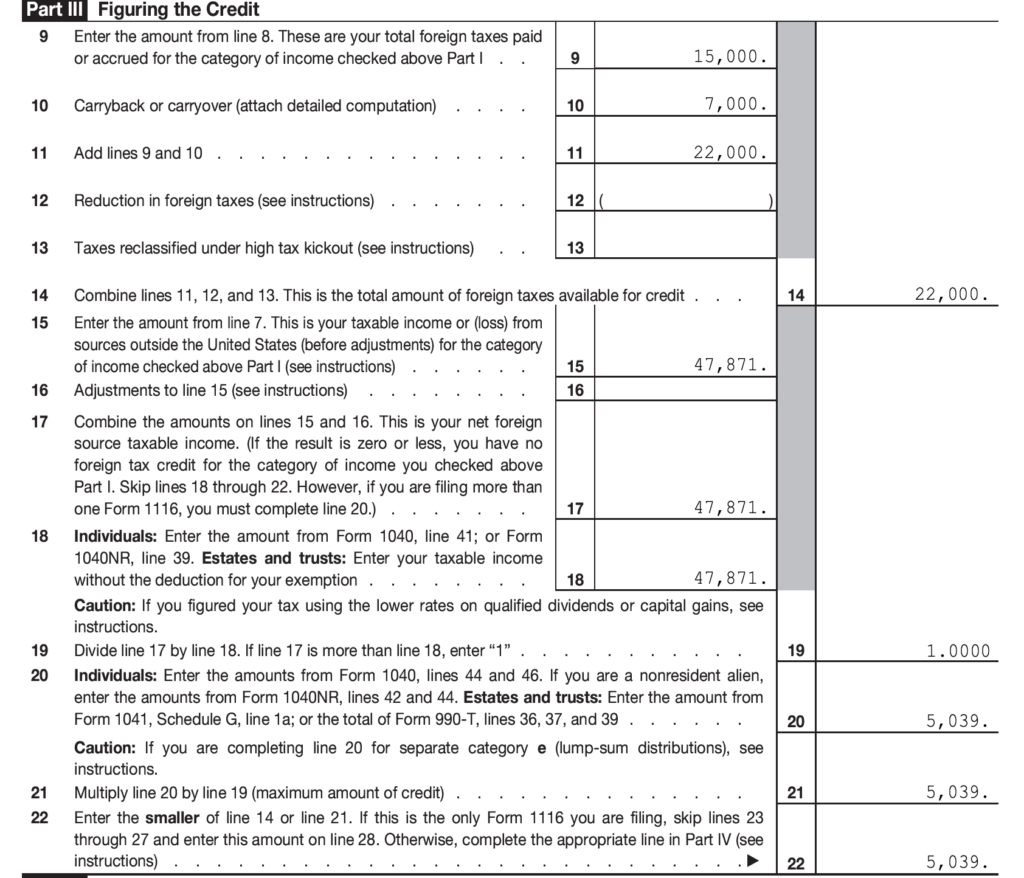

How To Complete Form 1116 - Web 1 best answer fangxial expert alumni try the following steps to resolve your issue: Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Web what do i need? Check only one box on each form. Web you file form 1116 if you are an individual, estate, or trust, and you paid or accrued certain foreign taxes to a foreign country or u.s. Web this video describes form 1116, which is the form that us expats need to use to claim the foreign tax credit. Web use a separate form 1116 for each category of income listed below. Go to tax tools > tools to open the tools center. Web use a separate form 1116 for each category of income listed below. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116.

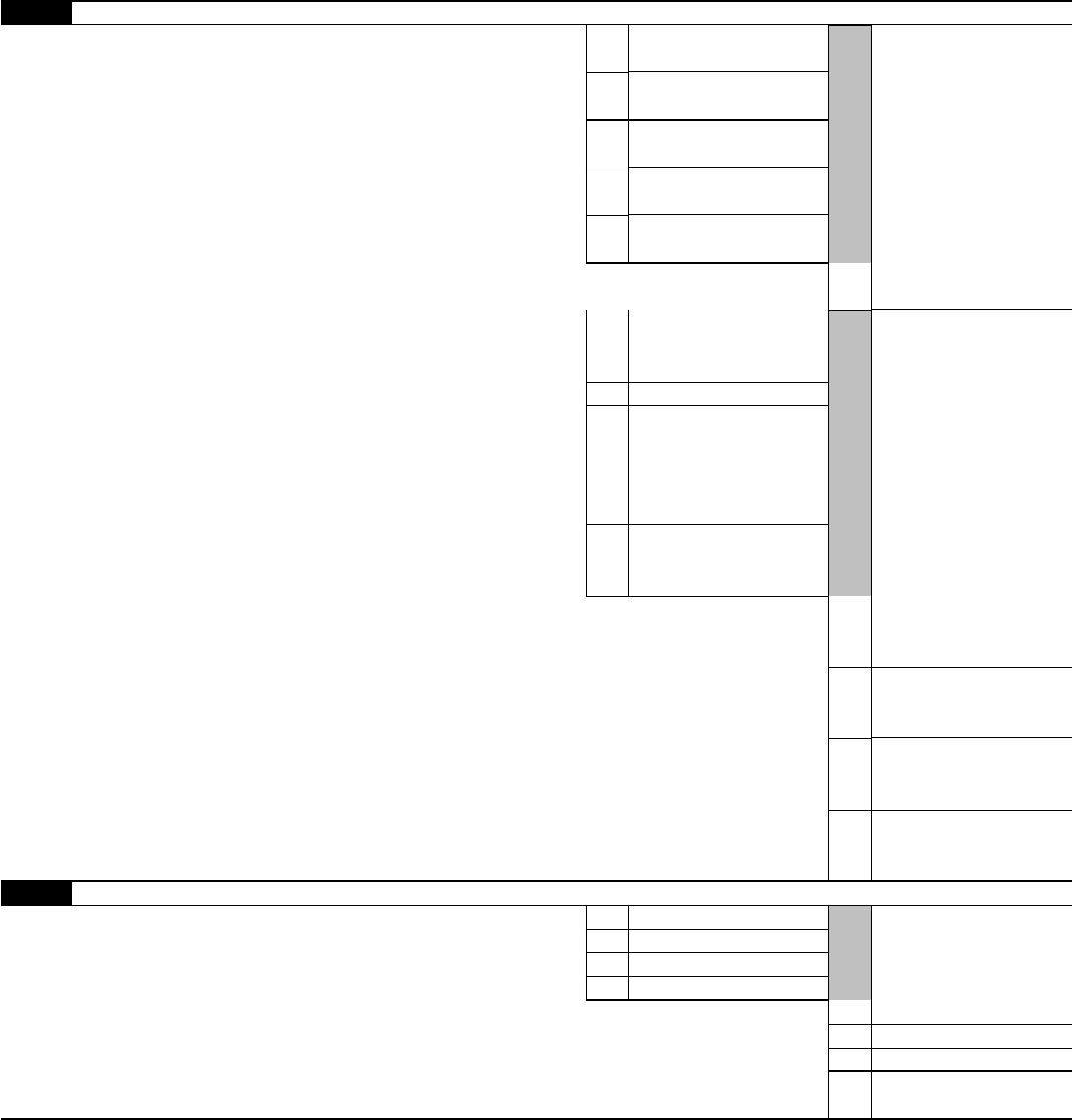

Web 1 best answer fangxial expert alumni try the following steps to resolve your issue: Within your federal tax return: The foreign tax credit is essentially a dollar for. Web use a separate form 1116 for each category of income listed below. 19 name identifying number as shown on page 1 of. Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Web what do i need? Check only one box on each form. One form 1116, you must. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover.

Web 1 best answer fangxial expert alumni try the following steps to resolve your issue: Check only one box on each. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web this video describes form 1116, which is the form that us expats need to use to claim the foreign tax credit. At the end of this lesson, using your resource materials, you will be able to: Web use a separate form 1116 for each category of income listed below. Web you file form 1116 if you are an individual, estate, or trust, and you paid or accrued certain foreign taxes to a foreign country or u.s. Web form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Web use a separate form 1116 for each category of income listed below.

2014 USCIS M1116 Form I9 Fill Online, Printable, Fillable, Blank

Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. 19 name identifying number as shown on page 1 of. Web 1 best answer fangxial expert alumni try the following steps to resolve your issue: Go to tax tools > tools to open the tools.

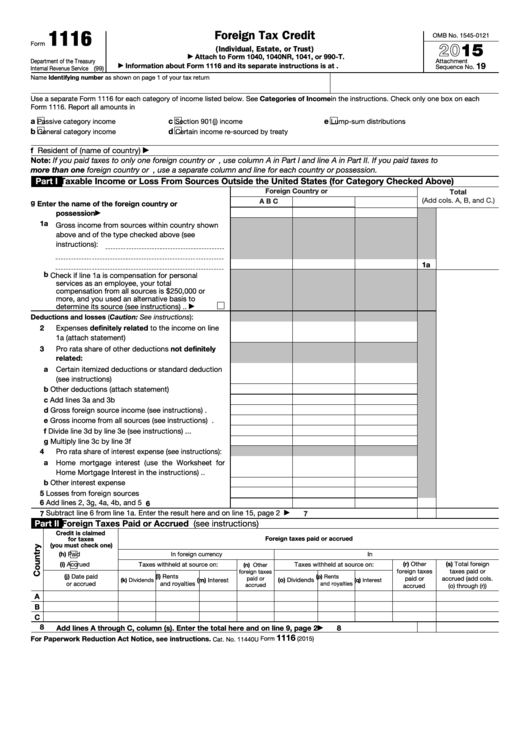

Form 1116 Instructions 2022 2023 IRS Forms Zrivo

Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Go to tax tools > tools to open the tools center. Web what do i need? Web use a separate form 1116 for each category of income listed below. Web you file form.

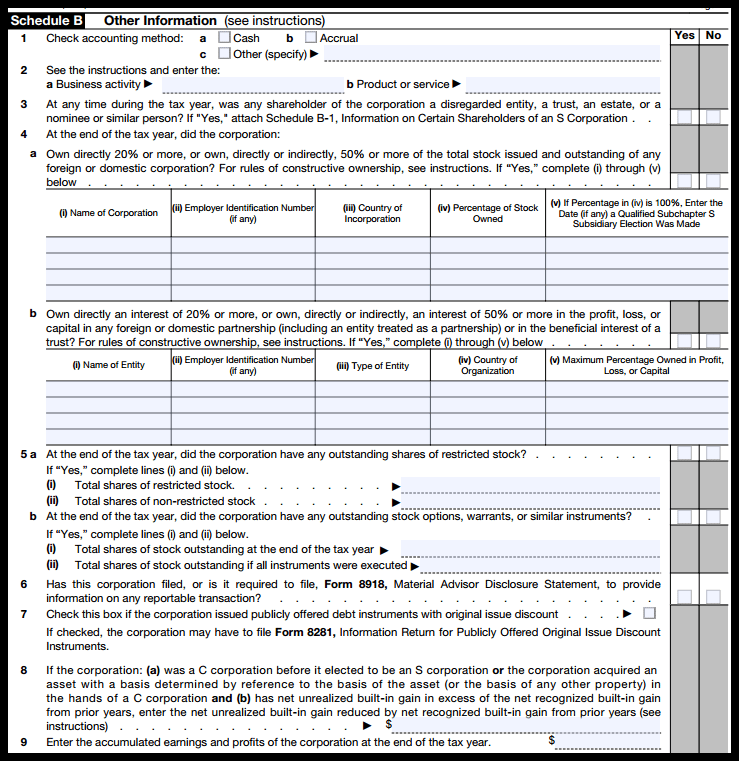

How to Complete Form 1120S Tax Return for an S Corp

The foreign tax credit is essentially a dollar for. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Web use a separate form 1116 for each category of income listed below. At the end of this lesson, using your resource materials, you will be.

Form 1116 part 1 instructions

19 name identifying number as shown on page 1 of. Check only one box on each. At the end of this lesson, using your resource materials, you will be able to: Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web what.

How can I add Form 1116? General Chat ATX Community

At the end of this lesson, using your resource materials, you will be able to: Check only one box on each form. Check only one box on each. The foreign tax credit is essentially a dollar for. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current.

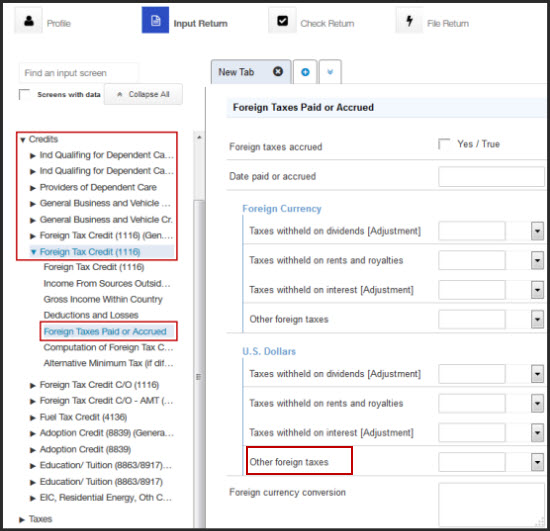

How do I generate Form 1116 Foreign Tax Credit in ProConnect Tax

Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Go to tax tools > tools to open the tools center. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your.

2015 Instructions For Form 1116 printable pdf download

The foreign tax credit is essentially a dollar for. Check only one box on each. Web use a separate form 1116 for each category of income listed below. Web this video describes form 1116, which is the form that us expats need to use to claim the foreign tax credit. Web 1 best answer fangxial expert alumni try the following.

Form 1116 Edit, Fill, Sign Online Handypdf

Web form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid. One form 1116, you must. Go to tax tools > tools to open the tools center. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile.

Foreign Tax Credit & IRS Form 1116 Explained Greenback Expat Taxes

Within your federal tax return: Web you file form 1116 if you are an individual, estate, or trust, and you paid or accrued certain foreign taxes to a foreign country or u.s. Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return).

Fillable Form 1116 Foreign Tax Credit printable pdf download

Web use a separate form 1116 for each category of income listed below. The foreign tax credit is essentially a dollar for. At the end of this lesson, using your resource materials, you will be able to: Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if.

Web General Instructions Purpose Of Schedule Schedule B (Form 1116) Is Used To Reconcile Your Prior Year Foreign Tax Carryover With Your Current Year Foreign Tax Carryover.

Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Go to tax tools > tools to open the tools center. Check only one box on each. Web you file form 1116 if you are an individual, estate, or trust, and you paid or accrued certain foreign taxes to a foreign country or u.s.

Web Schedule C (Form 1116) Is Used To Identify Foreign Tax Redeterminations That Occur In The Current Tax Year In Each Separate Category, The Years To Which They Relate,.

Web this video describes form 1116, which is the form that us expats need to use to claim the foreign tax credit. Check only one box on each form. Web use a separate form 1116 for each category of income listed below. One form 1116, you must.

Web 1 Best Answer Fangxial Expert Alumni Try The Following Steps To Resolve Your Issue:

Within your federal tax return: The foreign tax credit is essentially a dollar for. Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Web form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid.

Web What Do I Need?

At the end of this lesson, using your resource materials, you will be able to: Web use a separate form 1116 for each category of income listed below. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. 19 name identifying number as shown on page 1 of.