How Long Does It Take To File Chapter 7

How Long Does It Take To File Chapter 7 - Web a chapter 7 bankruptcy will stay on your credit report for 10 years, while a chapter 13 bankruptcy will fall off after seven years. Web individuals may file chapter 7 or chapter 13 bankruptcy, depending on the specifics of their situation. This is called the automatic stay. See if you qualify to save monthly on your debt. Once you file and the automatic stay takes effect, your creditors are not allowed to take. Consolidate your debt to save with one lower monthly payment. Consolidate your debt to save with one lower monthly payment. Web declaring bankruptcy does not alter the original delinquency date or extend the time the account remains on the credit report. Web after discharge in chapter 7. Also, where you file will depend on how long.

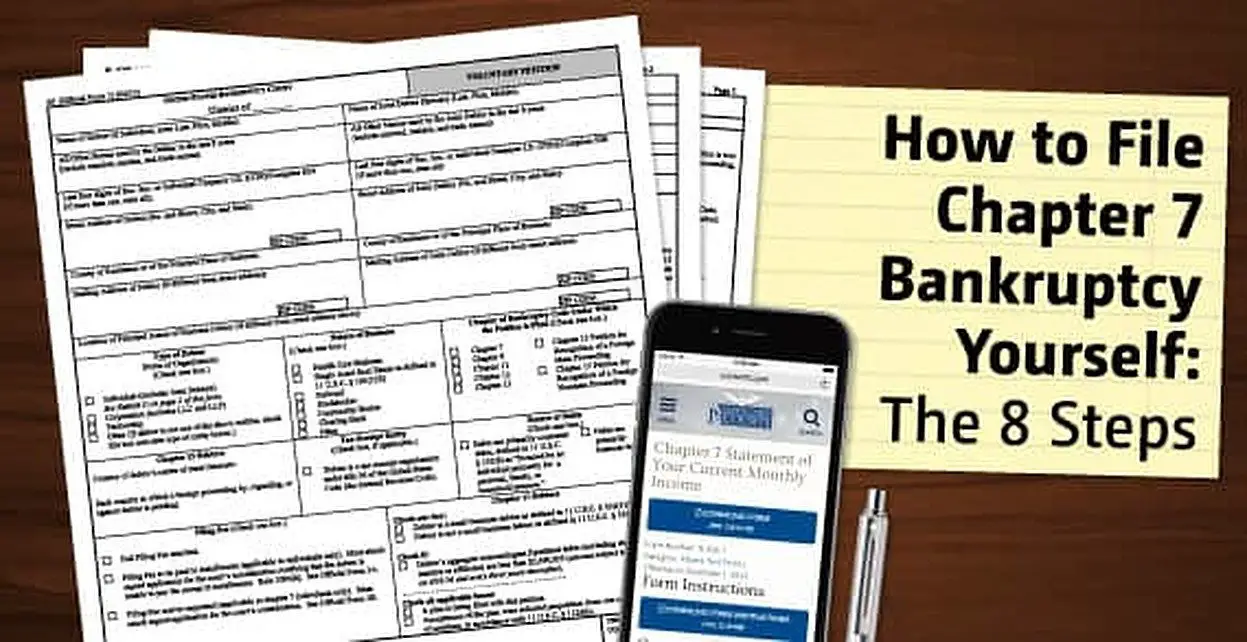

Compare top 5 consolidation options. If you received a discharge in chapter 7, you can’t file chapter 7 again until eight years from the date you filed the previous chapter 7. Web an individual cannot file under chapter 7 or any other chapter, however, if during the preceding 180 days a prior bankruptcy petition was dismissed due to the debtor's willful failure to appear before the court or. If the account was never late prior to being included in bankruptcy, it will be removed seven years. Nancy is admitted to practice in kansas and missouri. See if you qualify to save monthly on your debt. Consolidate your debt to save with one lower monthly payment. Web the chapter 7 bankruptcy process typically takes between four to five months from the time you file to when you receive a final discharge. You will have to take care of some tasks before you file. You’re not required to hire an attorney, but it is recommended that you go through this process with professional guidance from an attorney.

Web the process of filing chapter 7 bankruptcy generally takes 80 to 100 days from filing to when your debts are discharged. Web individuals filing for chapter 7 bankruptcy must complete a course before filing or, in highly unusual cases, shortly after. However, bankruptcy can also save you from accruing more debt. Web if your previous bankruptcy case was chapter 7 and you’re seeking to file for chapter 13 bankruptcy, you typically must wait at least four years after the chapter 7 bankruptcy was filed. Compare top 5 consolidation options. You will have to take care of some tasks before you file. Web we would like to show you a description here but the site won’t allow us. Municipalities—cities, towns, villages, taxing districts, municipal utilities, and school districts may file under chapter. Chapter 7 bankruptcy, also known as “liquidation” or. Consolidate your debt to save with one lower monthly payment.

How Long Does It Take To File Chapter 7 Bankruptcy in Philadelphia

Consolidate your debt to save with one lower monthly payment. See if you qualify to save monthly on your debt. Also, where you file will depend on how long. Ad don't file for bankruptcy. Here are some of the things you should be prepared to do during a chapter 7.

How Long Does It Take To Learn To Sail? Best Boat Report

You’re not required to hire an attorney, but it is recommended that you go through this process with professional guidance from an attorney. Web chapter 7 will remain on your credit report for up to 10 years, while chapter 13 will remain for up to seven years. Here are some of the things you should be prepared to do during.

How Long Does Bankruptcy Chapter 7 Last

Web we would like to show you a description here but the site won’t allow us. Chapter 13 bankruptcy may be a solution. Web for instance, you can't use chapter 7 bankruptcy if you received a previous bankruptcy discharge in the last six to eight years. Here are some of the things you should be prepared to do during a.

How Long Does it Take to File Chapter 7 Bankruptcy in Las Vegas

This will enable you to also receive a discharge in the new chapter 7, which is one of the primary goals of filing bankruptcy. Web a chapter 7 bankruptcy will stay on your credit report for 10 years, while a chapter 13 bankruptcy will fall off after seven years. Web after discharge in chapter 7. Web chapter 7 will remain.

37+ Can I File Chapter 7 Before 8 Years KhamShunji

Web if your previous bankruptcy case was chapter 7 and you’re seeking to file for chapter 13 bankruptcy, you typically must wait at least four years after the chapter 7 bankruptcy was filed. Web we would like to show you a description here but the site won’t allow us. Various factors shape how long it takes to complete your bankruptcy.

How Long Does It Take To File Chapter 7 Bankruptcy in Philadelphia

Web chapter 7 will remain on your credit report for up to 10 years, while chapter 13 will remain for up to seven years. Web an individual cannot file under chapter 7 or any other chapter, however, if during the preceding 180 days a prior bankruptcy petition was dismissed due to the debtor's willful failure to appear before the court.

How Long Does It Take To File Chapter 7 Bankruptcy in Philadelphia

Nancy is admitted to practice in kansas and missouri. Various factors shape how long it takes to complete your bankruptcy case. Web after discharge in chapter 7. See if you qualify to save monthly on your debt. If the account was never late prior to being included in bankruptcy, it will be removed seven years.

How To File Bankruptcy Chapter 7 Yourself In Nj

If the account was never late prior to being included in bankruptcy, it will be removed seven years. Web protection from your creditors begins immediately after filing for chapter 7 or chapter 13 bankruptcy. Web a chapter 13 bankruptcy stays on your credit reports for up to seven years. However, bankruptcy can also save you from accruing more debt. Ad.

How Long Does It Take To File Chapter 7 Bankruptcy in Philadelphia

Web for instance, you can't use chapter 7 bankruptcy if you received a previous bankruptcy discharge in the last six to eight years. Here are some of the things you should be prepared to do during a chapter 7. Municipalities—cities, towns, villages, taxing districts, municipal utilities, and school districts may file under chapter. Also, where you file will depend on.

How Often Can Someone File Chapter 7 Bankruptcy

The waiting period depends on whether the previous filing was a chapter 7 or 13 bankruptcy. Web individuals may file chapter 7 or chapter 13 bankruptcy, depending on the specifics of their situation. Consolidate your debt to save with one lower monthly payment. Web for instance, you can't use chapter 7 bankruptcy if you received a previous bankruptcy discharge in.

Web Bankruptcy Stays On Your Credit Report For Either Seven Or 10 Years, Depending On Whether You File For Chapter 7 Or Chapter 13 Bankruptcy.

Web the chapter 7 bankruptcy process typically takes between four to five months from the time you file to when you receive a final discharge. Web we would like to show you a description here but the site won’t allow us. Consolidate your debt to save with one lower monthly payment. Web an individual cannot file under chapter 7 or any other chapter, however, if during the preceding 180 days a prior bankruptcy petition was dismissed due to the debtor's willful failure to appear before the court or.

Web Protection From Your Creditors Begins Immediately After Filing For Chapter 7 Or Chapter 13 Bankruptcy.

Web individuals may file chapter 7 or chapter 13 bankruptcy, depending on the specifics of their situation. Web the process of filing chapter 7 bankruptcy generally takes 80 to 100 days from filing to when your debts are discharged. The waiting period depends on whether the previous filing was a chapter 7 or 13 bankruptcy. Also, where you file will depend on how long.

Municipalities—Cities, Towns, Villages, Taxing Districts, Municipal Utilities, And School Districts May File Under Chapter.

However, bankruptcy can also save you from accruing more debt. Chapter 13 bankruptcy may be a solution. Web a chapter 7 bankruptcy will stay on your credit report for 10 years, while a chapter 13 bankruptcy will fall off after seven years. Consolidate your debt to save with one lower monthly payment.

You’re Not Required To Hire An Attorney, But It Is Recommended That You Go Through This Process With Professional Guidance From An Attorney.

Web chapter 7 will remain on your credit report for up to 10 years, while chapter 13 will remain for up to seven years. If the account was never late prior to being included in bankruptcy, it will be removed seven years. Web a chapter 13 bankruptcy stays on your credit reports for up to seven years. Various factors shape how long it takes to complete your bankruptcy case.