How Do I File Form 8868 Electronically

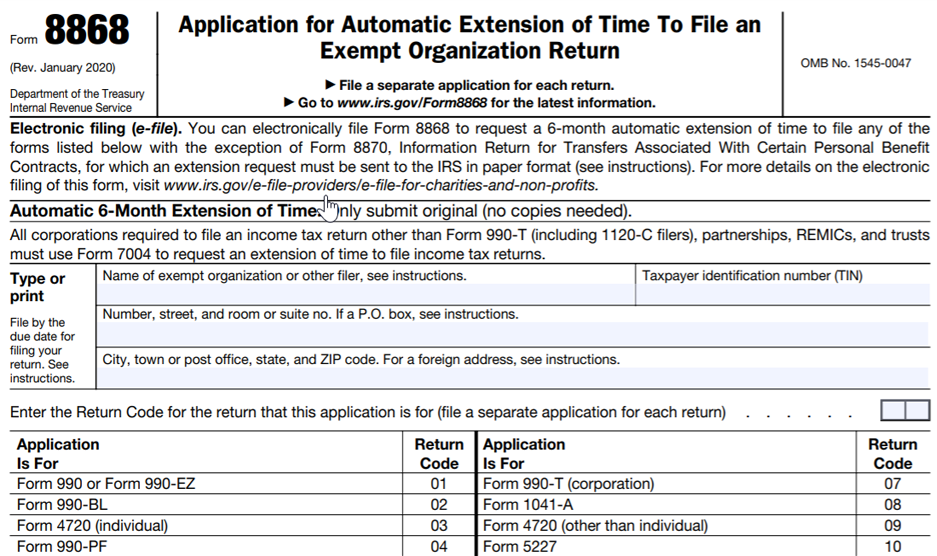

How Do I File Form 8868 Electronically - Web how to file irs form 8868 (+ instructions) 1. What is the purpose of irs form 8868? Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically? Ad download or email irs 8868 & more fillable forms, register and subscribe now! Who can file form 8868? Web there are several ways to request an automatic extension of time to file your return. Click start new return for the organization. Type or print application is for return code application is for return code 1 2 3a b c 3a 3b 3c $ $ $ balance due. Use form 8868, application for extension of time to file an exempt organization return pdf, to. Web to create and electronically file form 8868 in your tax990 account , follow these steps:

Web there are several ways to request an automatic extension of time to file your return. Click start new return for the organization. *file from any device and get up to 6 months extension. Web table of contents 1. Web extension of time to file exempt organization returns. If both form 7004 and form 8868 are present in the return, the return is only able to electronically file one at a time. However, they are not part of, nor do they have any special relationship with the internal revenue. Get your extension approved or money back*. Use form 8868, application for extension of time to file an exempt organization return pdf, to. Options to pay taxes due.

Click start new return for the organization. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. What is the purpose of irs form 8868? Web write your ssn, daytime phone number, and 2014 form 4868 on your check or money order. Do not staple or attach your payment to form 4868. Use form 8868, application for extension of time to file an exempt organization return pdf, to. Web 1 add organization details 2 choose tax year 3 enter form details 4 review the form summary 5 transmit to the irs need more time to file your 990 form? Web there are several ways to submit form 4868. Options to pay taxes due. Sign in to your tax 990 account.

Form 8868 Fillable and Editable PDF Template

Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically? Ad download or email irs 8868 & more fillable forms, register and subscribe now! Click start new return for the organization. Who can file form 8868? You can electronically.

Form 8868 Application for Extension of Time to File an Exempt

Web extension of time to file exempt organization returns. Who can file form 8868? Web answer yes, electronic filing is supported for form 8868. If both form 7004 and form 8868 are present in the return, the return is only able to electronically file one at a time. Type or print application is for return code application is for return.

If You Filed a Form 8868 Extension in May, it’s Time to File Your

Web to generate a form 4868 for individual: However, there are a few things you should remember when doing this. Ad download or email irs 8868 & more fillable forms, register and subscribe now! Web write your ssn, daytime phone number, and 2014 form 4868 on your check or money order. Options to pay taxes due.

Form 8868 Edit, Fill, Sign Online Handypdf

You can electronically file form. Ad download or email irs 8868 & more fillable forms, register and subscribe now! Web how to file irs form 8868 (+ instructions) 1. Sign in to your tax 990 account. Ad download or email irs 8868 & more fillable forms, register and subscribe now!

Filing a 990 series return? Here's Some LastMinute Filing Tips!

Web there are several ways to submit form 4868. Electronically file or mail an form 4868, application for automatic extension of. Web answer yes, electronic filing is supported for form 8868. Ad download or email irs 8868 & more fillable forms, register and subscribe now! Use form 8868, application for extension of time to file an exempt organization return pdf,.

File Form 8868 Online Efile 990 Extension with the IRS

Type or print application is for return code application is for return code 1 2 3a b c 3a 3b 3c $ $ $ balance due. Get your extension approved or money back*. However, they are not part of, nor do they have any special relationship with the internal revenue. Do not staple or attach your payment to form 4868..

Form 8868 Extension ExpressTaxExempt YouTube

Web extension of time to file exempt organization returns. Use form 8868, application for extension of time to file an exempt organization return pdf, to. Electronically file or mail an form 4868, application for automatic extension of. Get your extension approved or money back*. Web 1 enter your organization details 2 select the appropriate tax form to file an extension.

How to File For an Extension Using Form 8868

When is the deadline to file form 8868? Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web answer yes, electronic filing is supported for form 8868. Electronically file or mail an form 4868, application for automatic extension of. Web to create and electronically file form 8868 in your tax990.

How to File A LastMinute 990 Extension With Form 8868

What is the purpose of irs form 8868? Ad download or email irs 8868 & more fillable forms, register and subscribe now! Web write your ssn, daytime phone number, and 2014 form 4868 on your check or money order. Sign in to your tax 990 account. Get your extension approved or money back*.

Form 8868 Edit, Fill, Sign Online Handypdf

Options to pay taxes due. You can electronically file form. What is the purpose of irs form 8868? Type or print application is for return code application is for return code 1 2 3a b c 3a 3b 3c $ $ $ balance due. Web answer yes, electronic filing is supported for form 8868.

Web There Are Several Ways To Request An Automatic Extension Of Time To File Your Return.

However, there are a few things you should remember when doing this. Ad download or email irs 8868 & more fillable forms, register and subscribe now! *file from any device and get up to 6 months extension. Type or print application is for return code application is for return code 1 2 3a b c 3a 3b 3c $ $ $ balance due.

Instructions To Complete Form 8868 5.

Use form 8868, application for extension of time to file an exempt organization return pdf, to. Ad download or email irs 8868 & more fillable forms, try for free now! Do not staple or attach your payment to form 4868. Click start new return for the organization.

Web To Create And Electronically File Form 8868 In Your Tax990 Account , Follow These Steps:

Web how to file irs form 8868 (+ instructions) 1. Web extension of time to file exempt organization returns. Web 1 add organization details 2 choose tax year 3 enter form details 4 review the form summary 5 transmit to the irs need more time to file your 990 form? Web write your ssn, daytime phone number, and 2014 form 4868 on your check or money order.

Electronically File Or Mail An Form 4868, Application For Automatic Extension Of.

Web answer yes, electronic filing is supported for form 8868. Sign in to your tax 990 account. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. What is the purpose of irs form 8868?