Homestead Exemption Form Dallas County

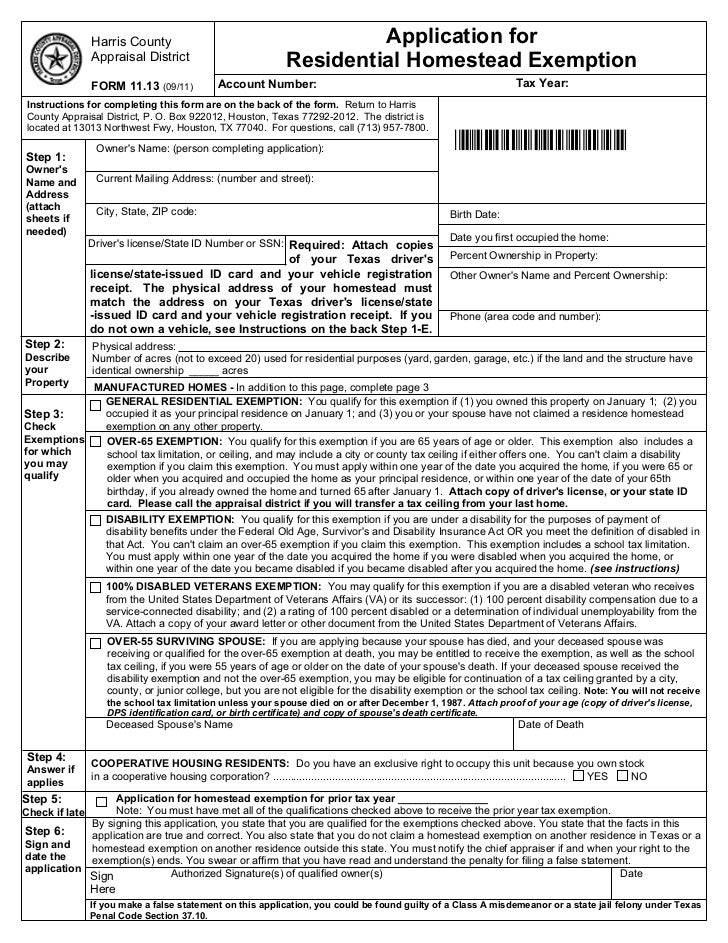

Homestead Exemption Form Dallas County - Web residence homestead exemption age 65 or older homestead exemption surviving spouse of person who received the 65 or older or disabled person exemption disabled person. As of the 2010 census, the population was 2,368,139. What is a residence homestead? 1 and april 30 of the. Web residence homestead exemption application. Yes no tag number(s) spouse's date of birth: Web you must apply with your county appraisal district to apply for a homestead exemption. What if my exemptions are wrong? Complete, edit or print tax forms instantly. Web there is a mandatory residential homestead exemption of $3,000 for counties and $25,000 for school districts.

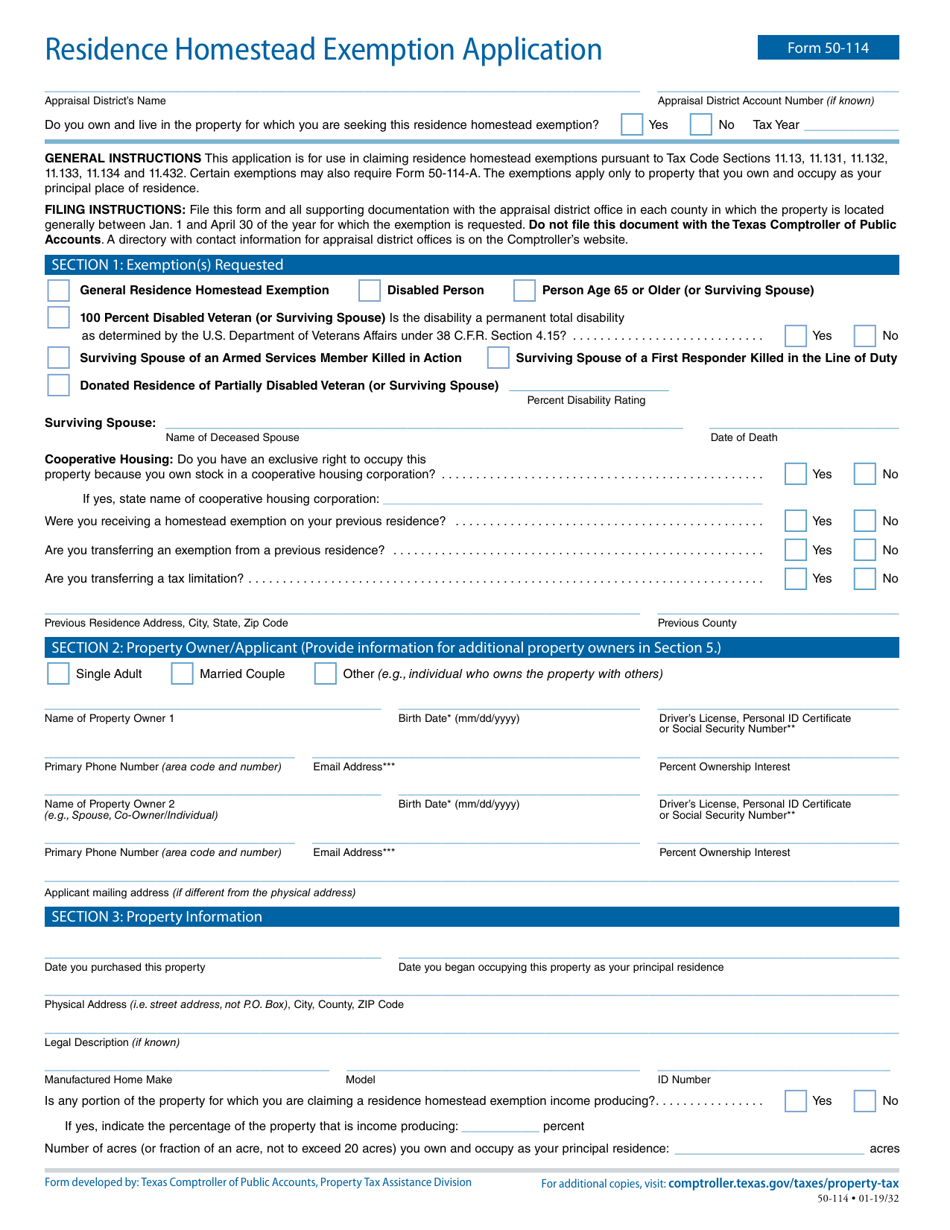

What is a residence homestead? Web residence homestead exemption application (includes age 65 or older, age 55 or older surviving spouse, and disabled person exemption) transfer request for tax ceiling. As of the 2010 census, the population was 2,368,139. What if my exemptions are wrong? Web homestead application general residence homestead application for step 5. Web check to apply for a homestead exemption. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. Web do i, as a homeowner, get a tax break from property taxes? Single do you claim homestead on other properties? Web the residence homestead exemption application form is available from the details page of your account.

Contact your local appraisal district. Web application for residence homestead exemption. Web there is a mandatory residential homestead exemption of $3,000 for counties and $25,000 for school districts. For filing with the appraisal district office in each county in which the property is located generally between jan. Yes no tag number(s) spouse's date of birth: Contact your local appraisal district. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. What is a residence homestead? Web how can i find out what my listed exemptions are? Your home could also be eligible for a discretionary.

Homestead Exemption 2020 How to File Homestead Collin, Denton

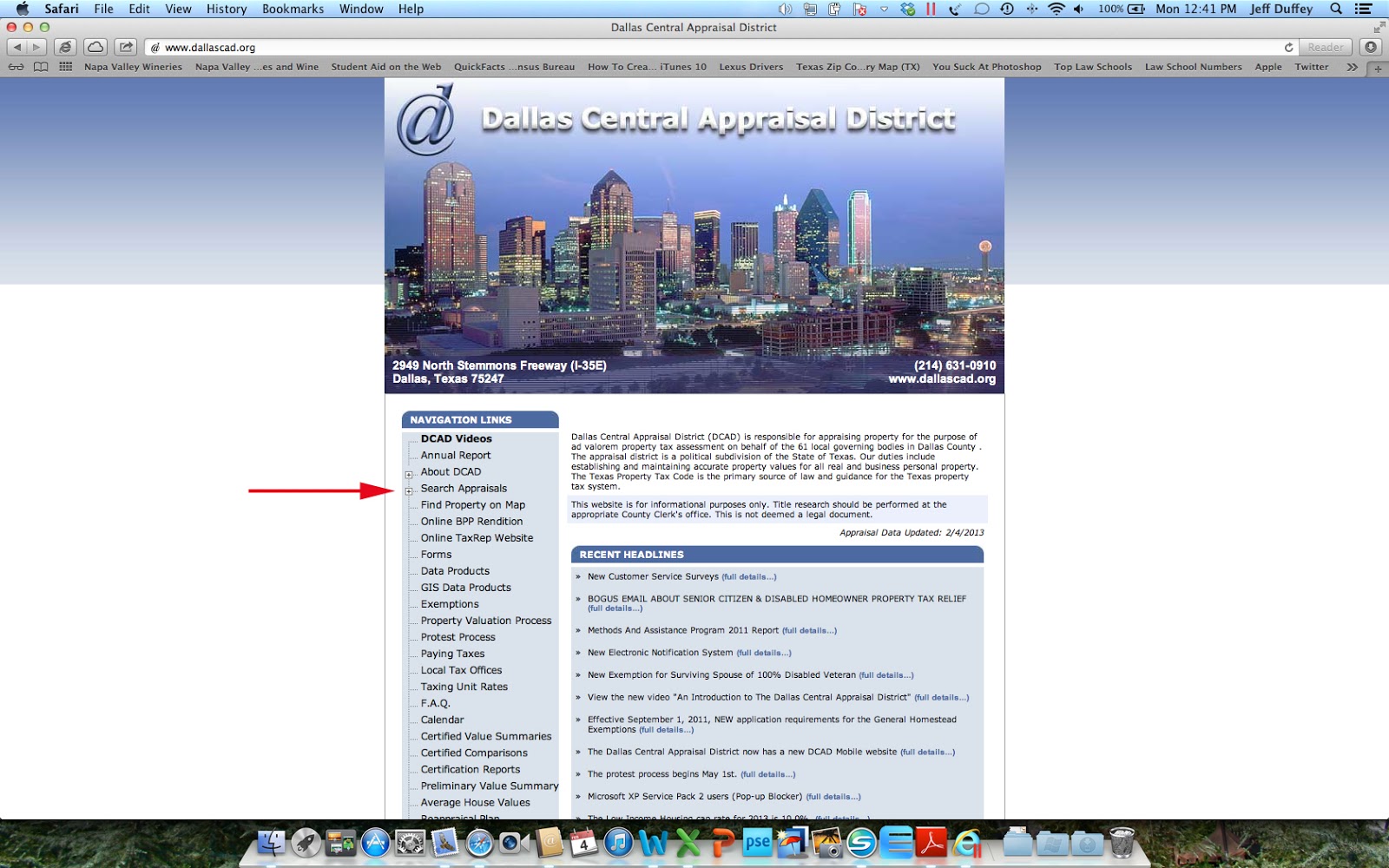

Counties are authorized to provide for local homestead section a:. As of the 2010 census, the population was 2,368,139. Web residence homestead exemption age 65 or older homestead exemption surviving spouse of person who received the 65 or older or disabled person exemption disabled person. See the explanation of exemptions for more information. Web the dallas central appraisal district (dcad).

Dallas Real Estate Blog How To File Your Homestead Exemption

Complete, edit or print tax forms instantly. 1 and april 30 of the. Counties are authorized to provide for local homestead section a:. For filing with the appraisal district office in each county in which the property is located generally between jan. You must own and occupy the.

Transfer homestead 2008 form Fill out & sign online DocHub

Web residence homestead exemption age 65 or older homestead exemption surviving spouse of person who received the 65 or older or disabled person exemption disabled person. See the explanation of exemptions for more information. You must own and occupy the. Web do i, as a homeowner, get a tax break from property taxes? Web the residence homestead exemption application form.

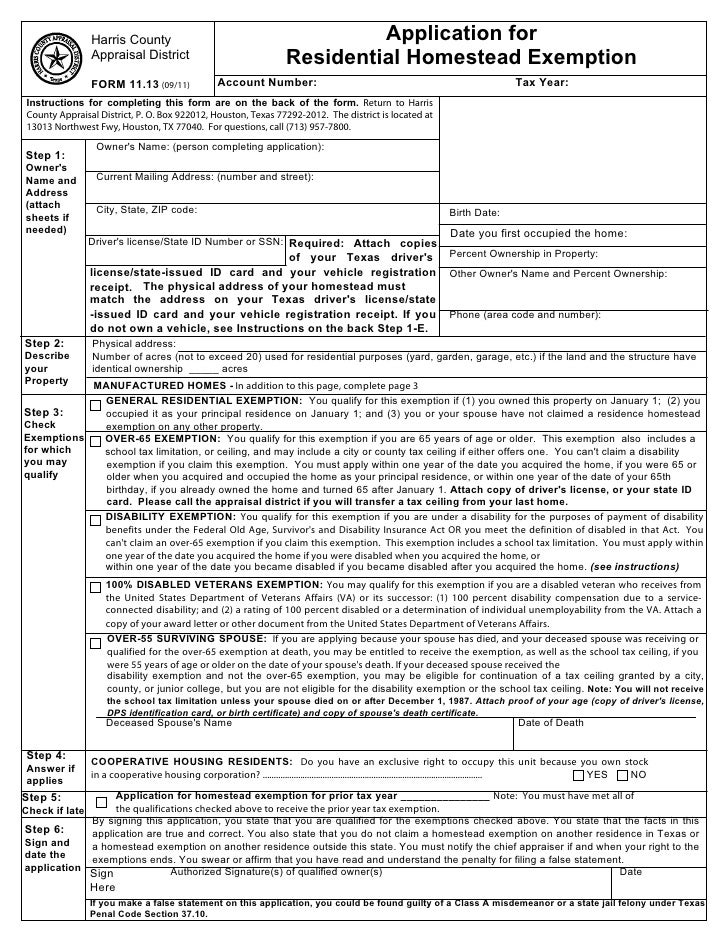

Harris Co TX Homestead Exemption

Web this form also allows for an exemption from the homestead being sold at foreclosure, up to a certain amount in value, as provided in the texas statutes. Web you must apply with your county appraisal district to apply for a homestead exemption. The form must be signed and. Contact your local appraisal district. Your home could also be eligible.

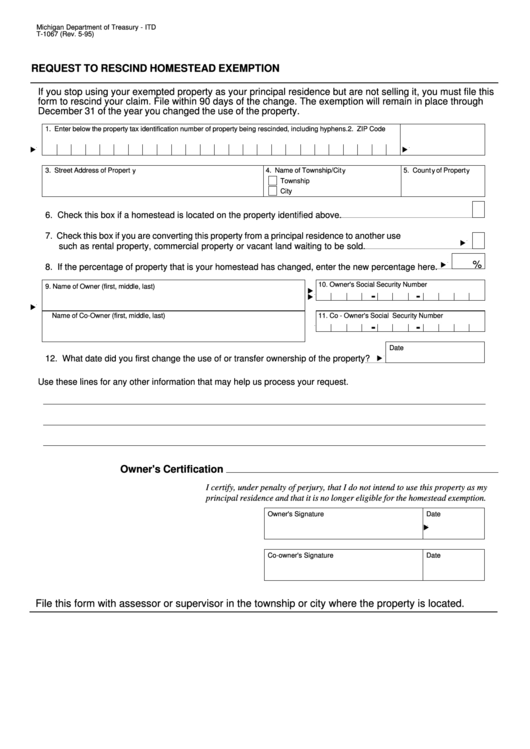

Fillable Form T1067 Request To Rescind Homestead Exemption 1995

Web check to apply for a homestead exemption. The form must be signed and. Yes no tag number(s) spouse's date of birth: Single do you claim homestead on other properties? Complete, edit or print tax forms instantly.

How to Fill Out Homestead Exemption Form Texas Homestead Exemption

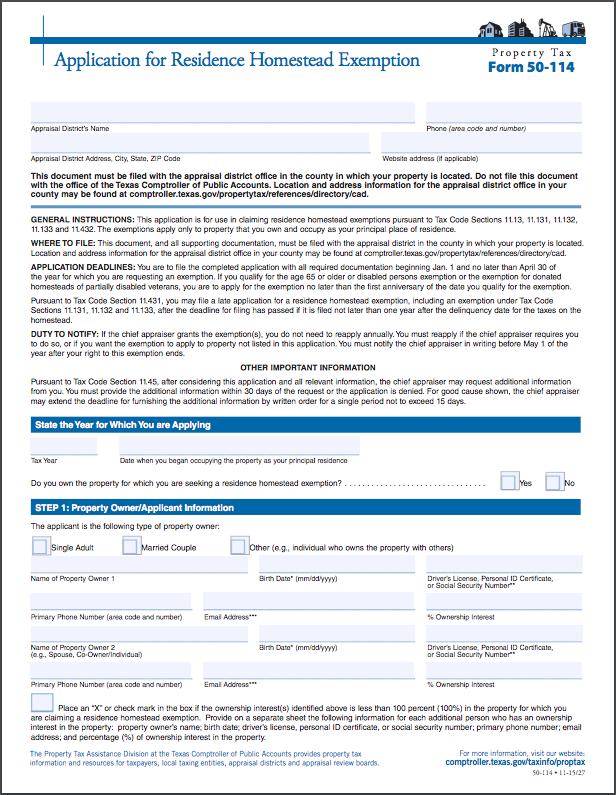

Web residence homestead exemption application (includes age 65 or older, age 55 or older surviving spouse, and disabled person exemption) transfer request for tax ceiling. You must own and occupy the. Web late filing benefits of exemptions heir property 11.35 disaster exemption other exemptions disabled veteran or survivors of a disabled veteran tax deferral for 65 or. Yes no tag.

2022 Update Houston Homestead Home Exemptions StepByStep Guide

Web the homestead exemptions provided for in this application form are those authorized by georgia law. Counties are authorized to provide for local homestead section a:. Yes no tag number(s) spouse's date of birth: You may search for your account by owner, by account or by address. Web dallas county is a county located in the u.s.

Form 50114 Download Fillable PDF or Fill Online Residence Homestead

Web the homestead exemptions provided for in this application form are those authorized by georgia law. Web the dallas central appraisal district (dcad) oversees property taxes and exemptions for homeowners in dallas county, including dallas, the city of irving, the city. Complete, edit or print tax forms instantly. Web how can i find out what my listed exemptions are? Web.

Form 11 13 Download Printable PDF Or Fill Online Application For

Web the residence homestead exemption application form is available from the details page of your account. What is a residence homestead? Web the dallas central appraisal district (dcad) oversees property taxes and exemptions for homeowners in dallas county, including dallas, the city of irving, the city. See the explanation of exemptions for more information. Web residence homestead exemption application (includes.

Homestead exemption form

What if my exemptions are wrong? Complete, edit or print tax forms instantly. Web the residence homestead exemption application form is available from the details page of your account. Single do you claim homestead on other properties? Web application for residence homestead exemption.

File The Completed Application And All Required Documents With The Appraisal District For The County In Which.

Web the dallas central appraisal district (dcad) oversees property taxes and exemptions for homeowners in dallas county, including dallas, the city of irving, the city. Complete, edit or print tax forms instantly. Web to qualify for a residence homestead exemption you must own and occupy as your principal residence on the date you request the exemption. Web new homestead exemption for disabled veterans we strongly advise applicants to consult with the county veterans services office prior to submitting all documents to the.

As Of The 2010 Census, The Population Was 2,368,139.

See the explanation of exemptions for more information. Web residence homestead exemption application. Web homestead application general residence homestead application for step 5. Web check to apply for a homestead exemption.

Counties Are Authorized To Provide For Local Homestead Section A:.

Web this form also allows for an exemption from the homestead being sold at foreclosure, up to a certain amount in value, as provided in the texas statutes. Single do you claim homestead on other properties? Applying is free and only needs to be filed once. Web residence homestead exemption application (includes age 65 or older, age 55 or older surviving spouse, and disabled person exemption) transfer request for tax ceiling.

Web Application For Residence Homestead Exemption.

Contact your local appraisal district. 1 and april 30 of the. Web there is a mandatory residential homestead exemption of $3,000 for counties and $25,000 for school districts. Web how can i find out what my listed exemptions are?