Georgia Form 600S Instructions 2021

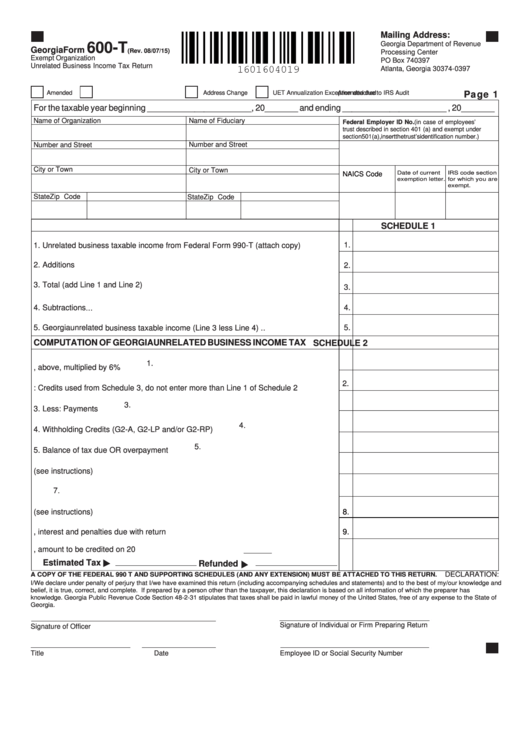

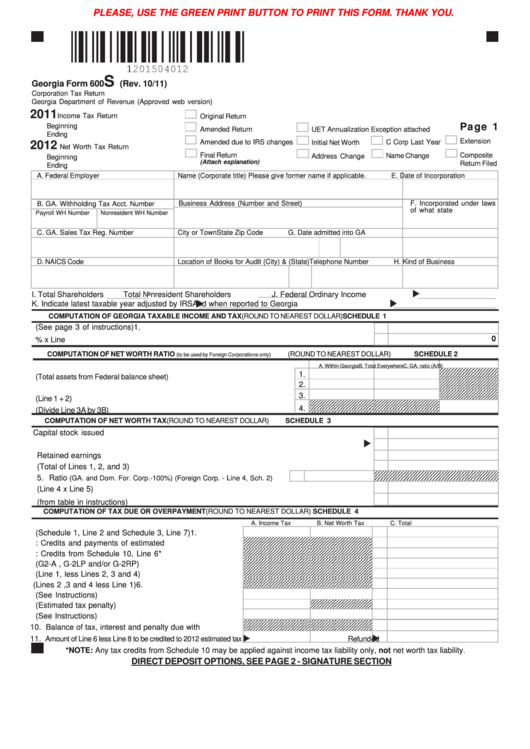

Georgia Form 600S Instructions 2021 - Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600s, fully updated for tax year 2022. Web file form 600s and pay the tax electronically. Visit our website dor.georgia.govfor more information. Web georgia form 600s (rev. Web complete georgia 600s instructions online with us legal forms. Please use the link below to. Upload, modify or create forms. You can download or print current or past. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet. Web corporation income tax general instructions booklet.

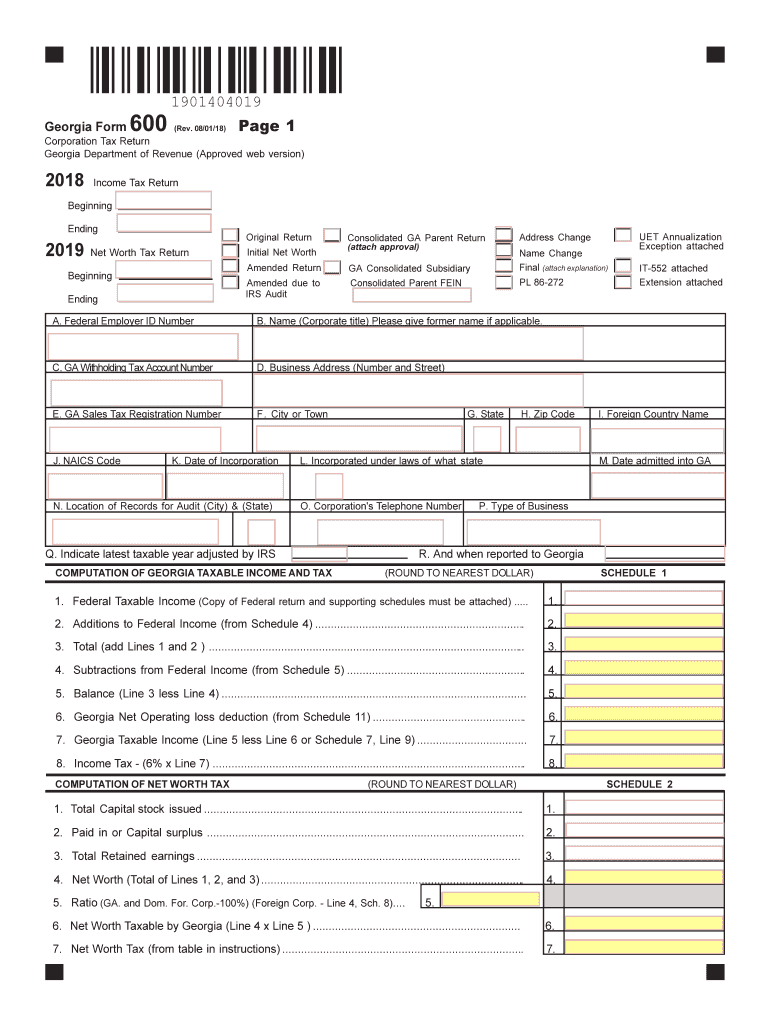

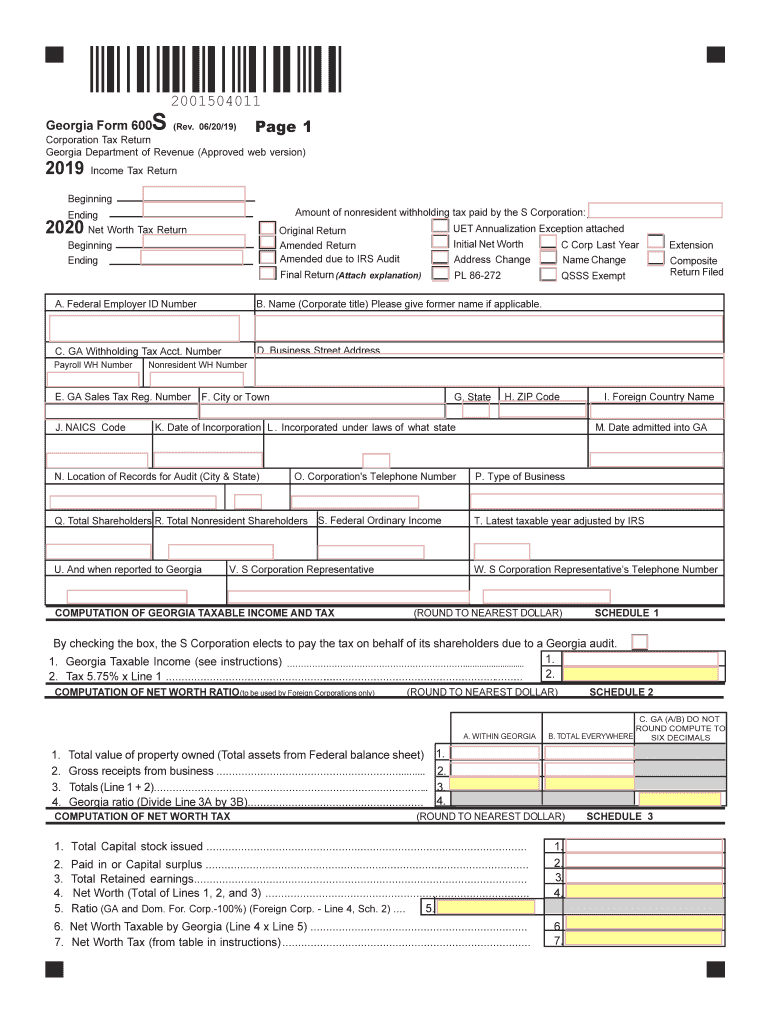

08/02/21) page 1 corporation tax return (approved web version) 2021 georgia department of revenue. Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. Upload, modify or create forms. Web file form 600s and pay the tax electronically. 06/20/20) page 1 corporation tax return georgia department of revenue 2020 income tax return beginning ending 2021 net worth tax return. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Visit our website dor.georgia.govfor more information. Complete, edit or print tax forms instantly. Please use the link below to. Accounts only) see booklet for further.

Please use the link below to. You can download or print current or past. Georgia form 600/2016 page 3 direct deposit options a. Web print blank form > georgia department of revenue print 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet. Web more about the georgia form 600s corporate income tax tax return ty 2022. As defined in the income tax laws of georgia, qualified only in cases of. The official 2023 gymnastics schedule for the university of georgia bulldogs. Web georgia form 600s (rev. Web complete georgia 600s instructions online with us legal forms.

Top 92 Tax Forms And Templates free to download in PDF

06/20/20) page 1 corporation tax return georgia department of revenue 2020 income tax return beginning ending 2021 net worth tax return. Web georgia form 600s (rev. Web file form 600s and pay the tax electronically. Web georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Complete, edit or print tax forms instantly.

2018 Form GA DoR 600 Fill Online, Printable, Fillable, Blank pdfFiller

You can download or print current or past. The official 2023 gymnastics schedule for the university of georgia bulldogs. We last updated the corporate tax return in january 2023, so this is the latest version of form. You can download or print current or past. Further, if the changes result in.

Fillable Form 600s Corporation Tax Return printable pdf download

Electronic filing the georgia department of revenue accepts visa,. Complete, edit or print tax forms instantly. Georgia form 600/2016 page 3 direct deposit options a. Accounts only) see booklet for further. As defined in the income tax laws of georgia, qualified only in cases of.

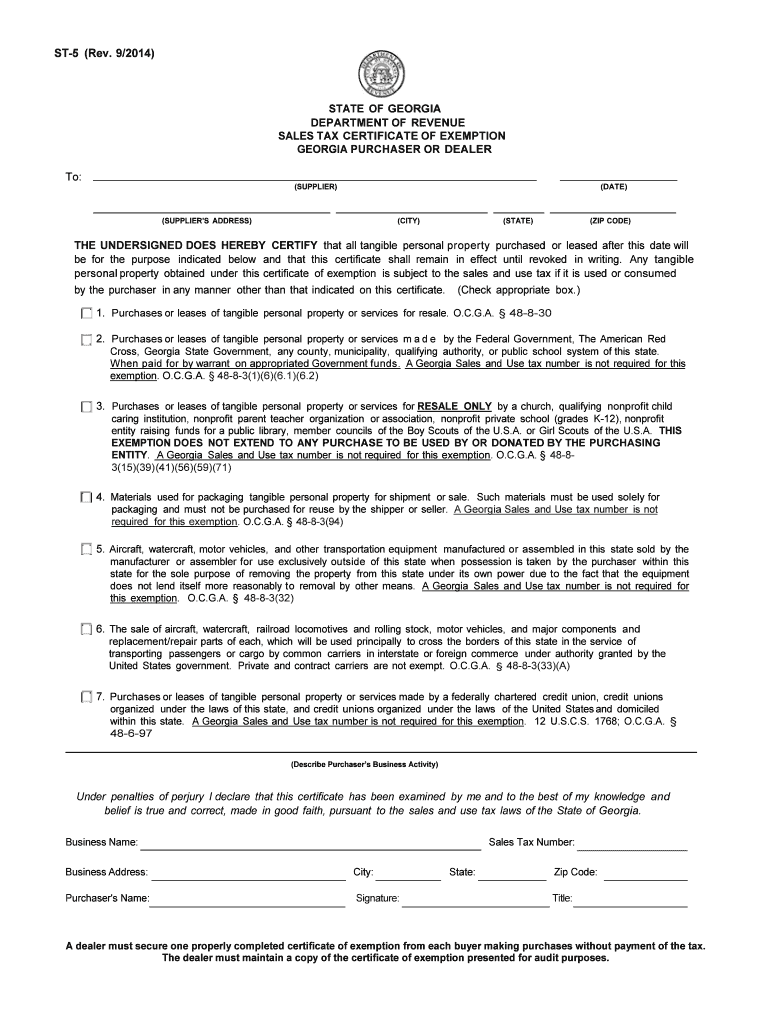

2014 Form GA DoR ST5 Fill Online, Printable, Fillable, Blank PDFfiller

08/02/21) corporation tax return page page 1 1 georgia department of revenue (approved web version) 2021 income tax return beginning. Electronically file or mail the return to: Web the official 2020 gymnastics schedule for the university of georgia bulldogs. Please use the link below to. As defined in the income tax laws of georgia, qualified only in cases of.

Printable State Of Tax Forms Printable Form 2022

Upload, modify or create forms. Web georgia law recognizes an election to file as an s corporation under the provisions of the i.r.c. Web more about the georgia form 600s corporate income tax tax return ty 2022. Web corporation income tax general instructions booklet. Save or instantly send your ready documents.

us japan tax treaty article 17 Be A Long Microblog Ajax

Visit our website dor.georgia.govfor more information. Web more about the georgia form 600s corporate income tax tax return ty 2022. You can download or print current or past. Save or instantly send your ready documents. Georgia form 600/2016 page 3 direct deposit options a.

2019 Form GA DoR 500NOL Fill Online, Printable, Fillable, Blank

Upload, modify or create forms. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet. You can download or print current or past. Web more about the georgia form 600s corporate income tax tax return ty 2022. Web the official 2023 gymnastics schedule for the university of georgia bulldogs.

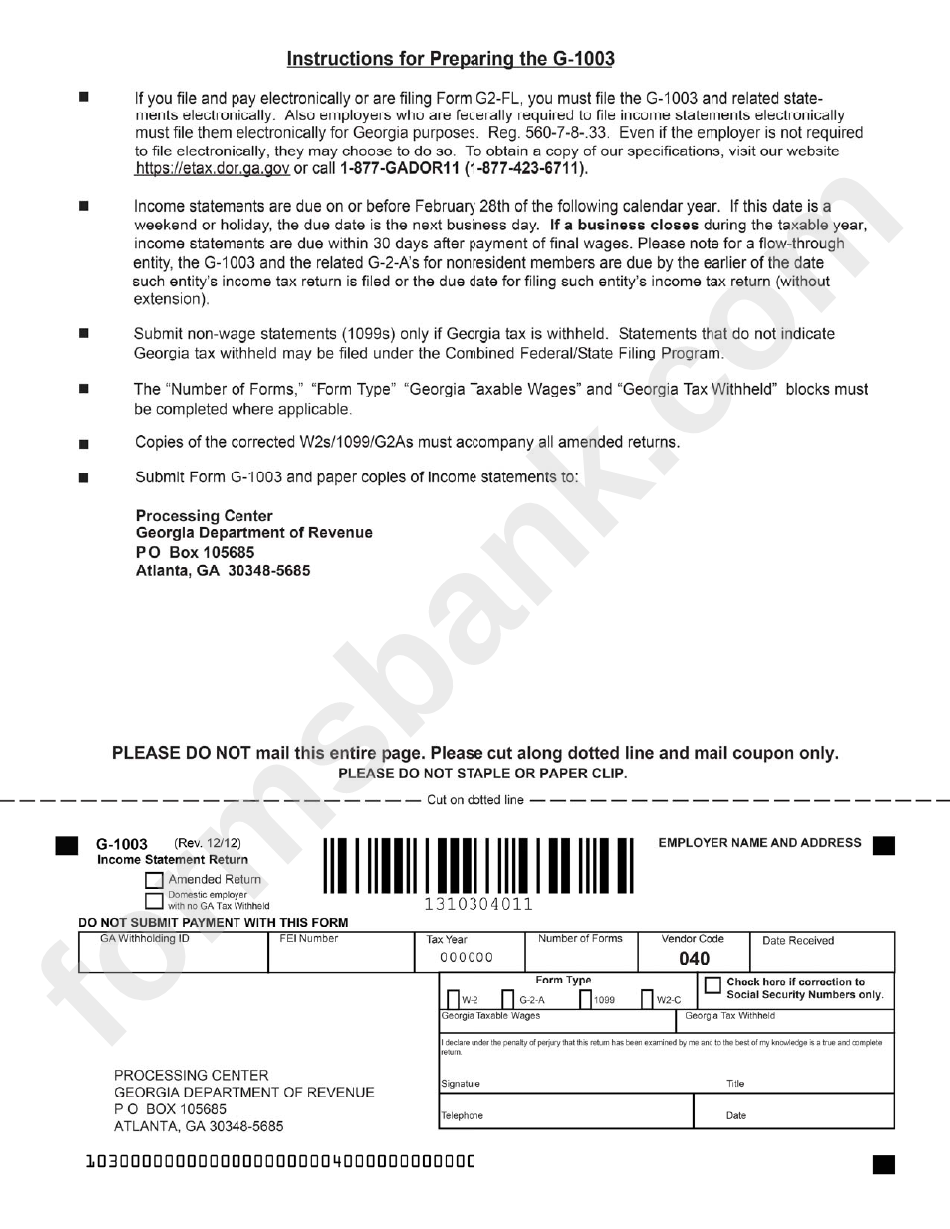

Form G1003 Statement Return Department Of Revenue

Web more about the georgia form 600s corporate income tax tax return ty 2022. Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600s, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april. Upload, modify or create.

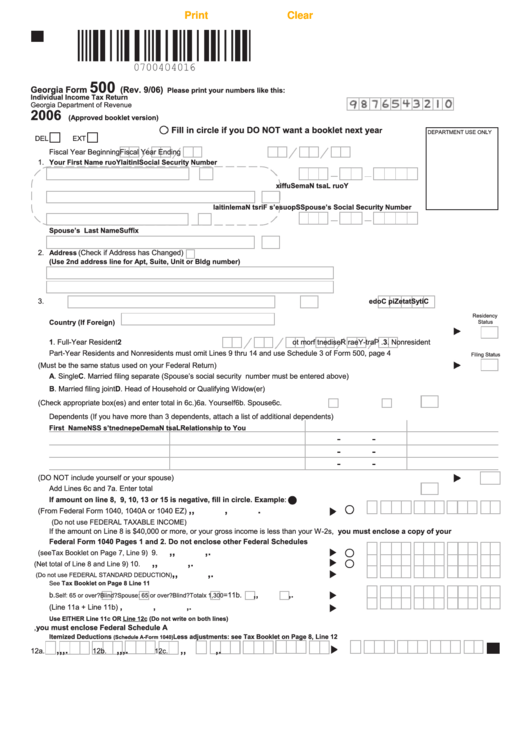

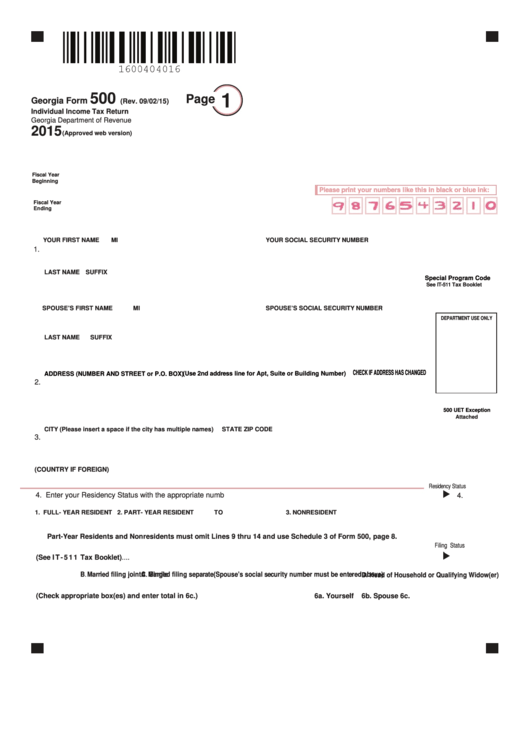

Fillable Form 500 Indvidual Tax Form

Save or instantly send your ready documents. 08/02/21) page 1 georgia form600 (rev. Web the official 2023 gymnastics schedule for the university of georgia bulldogs. This form is for income earned in tax year 2022, with tax returns due in april. You can download or print current or past.

GA DoR 600S 20192022 Fill out Tax Template Online US Legal Forms

Accounts only) see booklet for further. Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600s, fully updated for tax year 2022. 08/02/21) corporation tax return page page 1 1 georgia department of revenue (approved web version) 2021 income tax return beginning. Web georgia form 600s (rev. Easily fill out.

Try It For Free Now!

We last updated the corporate tax return in january 2023, so this is the latest version of form. This form is for income earned in tax year 2022, with tax returns due in april. Web the official 2020 gymnastics schedule for the university of georgia bulldogs. 06/20/20) page 1 corporation tax return georgia department of revenue 2020 income tax return beginning ending 2021 net worth tax return.

Web Complete Georgia 600S Instructions Online With Us Legal Forms.

You can download or print current or past. Upload, modify or create forms. Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. Web corporation income tax general instructions booklet.

Web More About The Georgia Form 600S Corporate Income Tax Tax Return Ty 2022.

07/20/22) corporation tax return page page 1 1 georgia department of revenue (approved web version) 2022 income tax return beginning. Web print blank form > georgia department of revenue print Complete, edit or print tax forms instantly. 08/02/21) page 1 georgia form600 (rev.

Web We Last Updated The Corporate Tax Return In January 2023, So This Is The Latest Version Of Form 600, Fully Updated For Tax Year 2022.

Georgia ratio (divide line 3a by 3b). Further, if the changes result in. Electronic filing the georgia department of revenue accepts visa,. Visit our website dor.georgia.govfor more information.