Form W-7 Pdf

Form W-7 Pdf - Check both f (nonresident alien student) and h. Web tips on how to fill out the itin w7 fillable form online: If you are applying for more than one itin for the same tax return (such as for a spouse or dependent(s)), attach all forms. Ad access irs tax forms. Sign online button or tick the preview image of the form. Solicitud de número de identificación personal del contribuyente del. Web 205 hayes road buffalo, ny 14214 need help completing the form? The name of the form speaks for itself, it's used to. January 2012) department of the treasury internal revenue service application for irs individual taxpayer identification number for use by individuals who. F signature of applicant (if delegate, see.

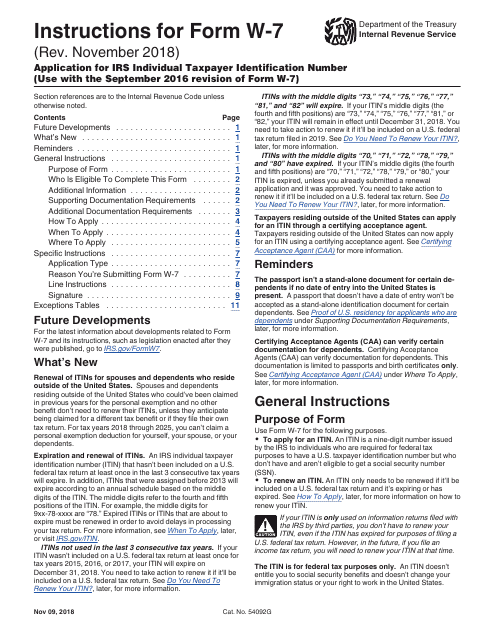

Any individual who isn’t eligible to get an ssn but who must furnish a taxpayer identification number for u.s. To begin the blank, utilize the fill camp; Upload, modify or create forms. Internal revenue service (irs) to individuals. Try it for free now! Check both f (nonresident alien student) and h. January 2012) department of the treasury internal revenue service application for irs individual taxpayer identification number for use by individuals who. It may also be filed in person at any irs tax assistance center in. Septiembre de 2019) department of the treasury internal revenue service. Web tips on how to fill out the itin w7 fillable form online:

Upload, modify or create forms. Web tips on how to fill out the itin w7 fillable form online: Solicitud de número de identificación personal del contribuyente del. It may also be filed in person at any irs tax assistance center in. If you are applying for more than one itin for the same tax return (such as for a spouse or dependent(s)), attach all forms. F signature of applicant (if delegate, see. Septiembre de 2019) department of the treasury internal revenue service. You can also use this form to. Try it for free now! Amanda brown manager international hr services phone:

Что такое ITIN и как его получить GFLO Consultancy

Ad access irs tax forms. You can also use this form to. Complete, edit or print tax forms instantly. Amanda brown manager international hr services phone: Sign online button or tick the preview image of the form.

Form W7_Application for IRS Individual Taxpayer Identification Number

January 2012) department of the treasury internal revenue service application for irs individual taxpayer identification number for use by individuals who. Upload, modify or create forms. Septiembre de 2019) department of the treasury internal revenue service. Ad access irs tax forms. This irs form can also be used for an itin renewal or for an itin that has already expired.

Form W7 Application for IRS Individual Taxpayer Identification

Septiembre de 2019) department of the treasury internal revenue service. Web tips on how to fill out the itin w7 fillable form online: F signature of applicant (if delegate, see. Upload, modify or create forms. Solicitud de número de identificación personal del contribuyente del.

Learn How to Fill the Form W7 Application for IRS Individual Taxpayer

Sign online button or tick the preview image of the form. If you are applying for more than one itin for the same tax return (such as for a spouse or dependent(s)), attach all forms. To begin the blank, utilize the fill camp; Internal revenue service (irs) to individuals. Amanda brown manager international hr services phone:

Form W7 COA Edit, Fill, Sign Online Handypdf

January 2012) department of the treasury internal revenue service application for irs individual taxpayer identification number for use by individuals who. Web 205 hayes road buffalo, ny 14214 need help completing the form? Web tips on how to fill out the itin w7 fillable form online: Complete, edit or print tax forms instantly. It may also be filed in person.

Form W7 YouTube

Upload, modify or create forms. Amanda brown manager international hr services phone: To begin the blank, utilize the fill camp; Web tips on how to fill out the itin w7 fillable form online: Internal revenue service (irs) to individuals.

IRS Form W7 2016 2019 Fill out and Edit Online PDF Template

The name of the form speaks for itself, it's used to. Upload, modify or create forms. Generally, you shouldn’t apply for an. Ad access irs tax forms. Try it for free now!

25 W7 Form Templates free to download in PDF

It may also be filed in person at any irs tax assistance center in. F signature of applicant (if delegate, see. Check both f (nonresident alien student) and h. Amanda brown manager international hr services phone: Generally, you shouldn’t apply for an.

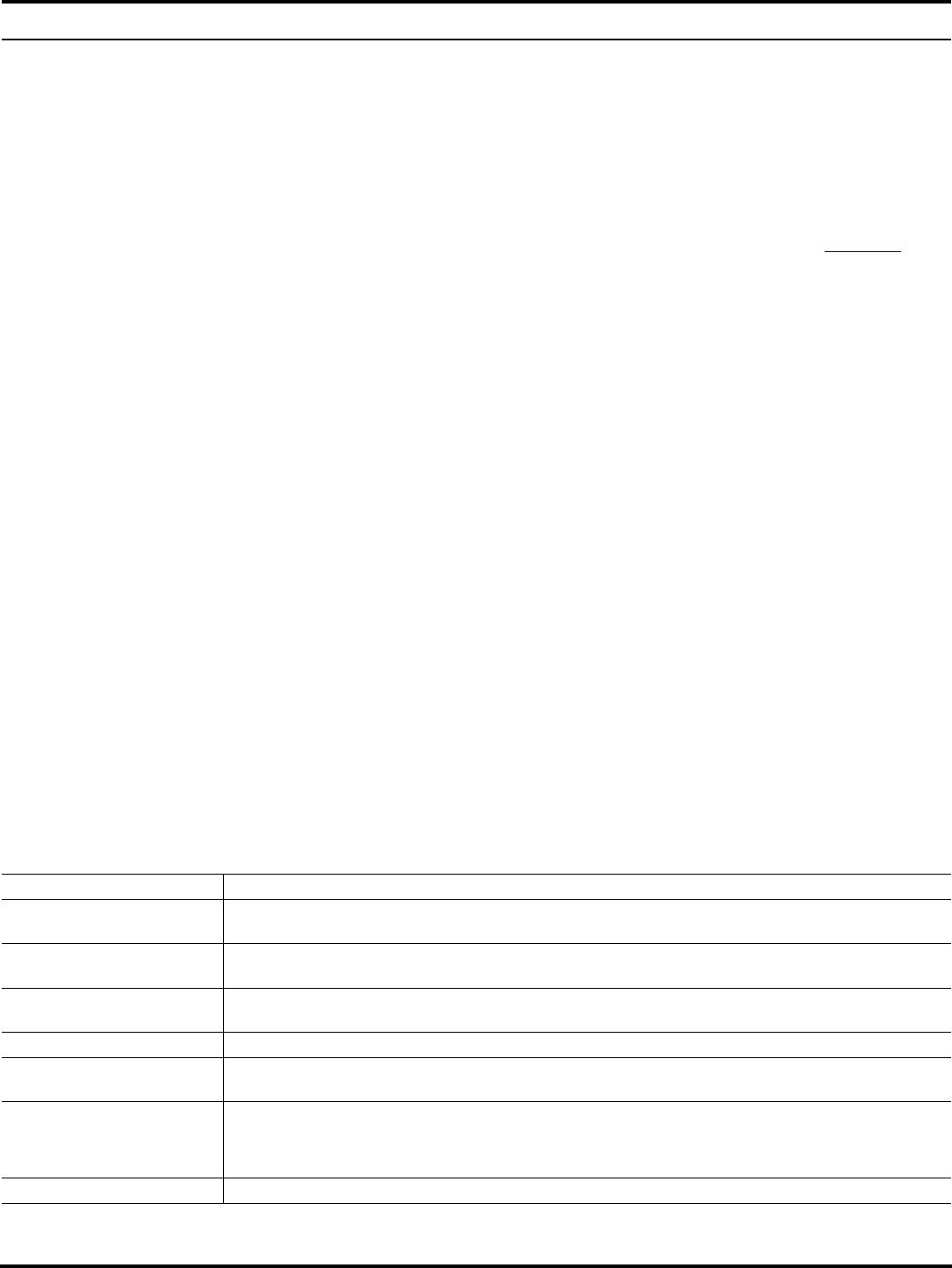

Download Instructions for IRS Form W7 Application for IRS Individual

You can also use this form to. It may also be filed in person at any irs tax assistance center in. Web tips on how to fill out the itin w7 fillable form online: Try it for free now! Sign online button or tick the preview image of the form.

January 2012) Department Of The Treasury Internal Revenue Service Application For Irs Individual Taxpayer Identification Number For Use By Individuals Who.

Upload, modify or create forms. F signature of applicant (if delegate, see. Ad access irs tax forms. Web tips on how to fill out the itin w7 fillable form online:

Internal Revenue Service (Irs) To Individuals.

Solicitud de número de identificación personal del contribuyente del. To begin the blank, utilize the fill camp; Check both f (nonresident alien student) and h. For examples of acceptable employment authorization.

You Can Also Use This Form To.

The name of the form speaks for itself, it's used to. Any individual who isn’t eligible to get an ssn but who must furnish a taxpayer identification number for u.s. If you are applying for more than one itin for the same tax return (such as for a spouse or dependent(s)), attach all forms. Try it for free now!

Complete, Edit Or Print Tax Forms Instantly.

This irs form can also be used for an itin renewal or for an itin that has already expired. Sign online button or tick the preview image of the form. Generally, you shouldn’t apply for an. Web 205 hayes road buffalo, ny 14214 need help completing the form?