Form Sd 100

Form Sd 100 - Web fill every fillable field. Web we last updated ohio form it sd 100 in december 2022 from the ohio department of taxation. Web form sd 100es is an ohio individual income tax form. Prepare and report accurate taxes with signnow remotely. Indicate the date to the document with the date feature. Web screen, check the checkbox for school district income tax (form sd 100) then press continue you can get more information about ohio school district tax at. File a separate ohio sd 100 for each taxing school district in which you lived. Get ready for this year's tax season quickly and safely with pdffiller! There is a balance due of $527. Check here if this is an.

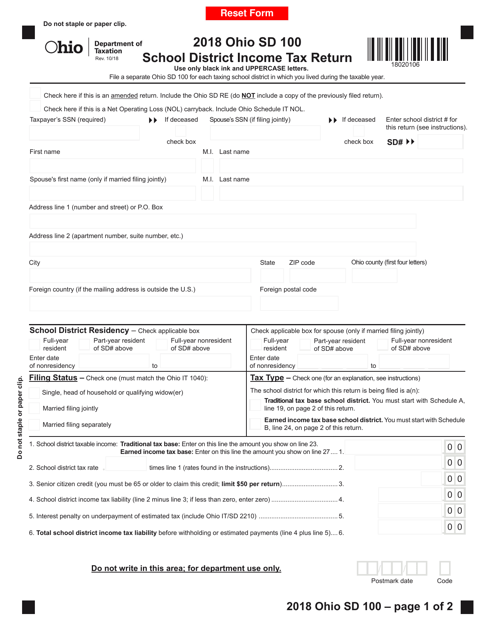

This form is for income earned in tax year 2022, with tax returns due in april. Web school district income tax return use only black ink/uppercase letters.21020102file a separate ohio sd 100 for each taxing school district in which you lived during the tax. There is a balance due of $527. Web 74 votes quick guide on how to complete ohio school district tax form forget about scanning and printing out forms. Utilize the guidelines on how to fill in the. Use our detailed instructions to fill out and esign your. Prepare and report accurate taxes with signnow remotely. Web form sd 100 pay your taxes by credit card (see page 7) use the finder to verify your school district and tax rate (see page 8) cut through the red tape. 22020102 file a separate ohio sd 100 for each taxing school district in. Click on the sign icon and.

Indicate the date to the document with the date feature. School district income tax return. There is a balance due of $527. Check here if this is an. Web form sd 100es is an ohio individual income tax form. Prepare and report accurate taxes with signnow remotely. Web screen, check the checkbox for school district income tax (form sd 100) then press continue you can get more information about ohio school district tax at. Web 74 votes quick guide on how to complete ohio school district tax form forget about scanning and printing out forms. 22020102 file a separate ohio sd 100 for each taxing school district in. Save yourself time and money using our fillable web templates.

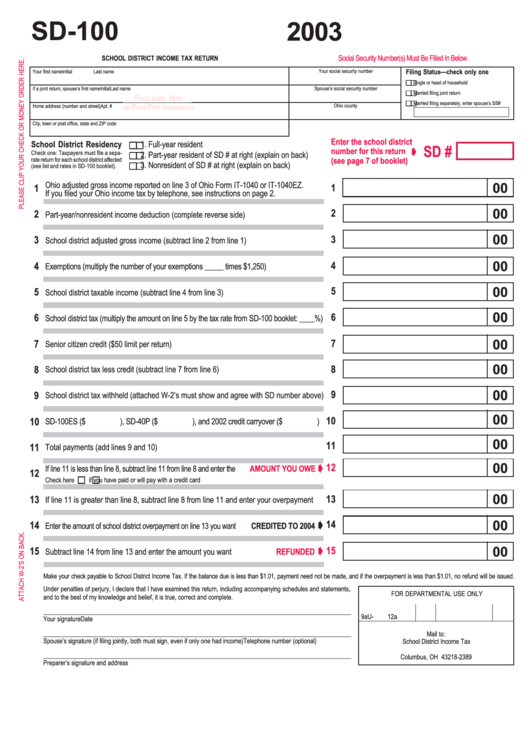

Fillable Form Sd100 School District Tax Return 2003

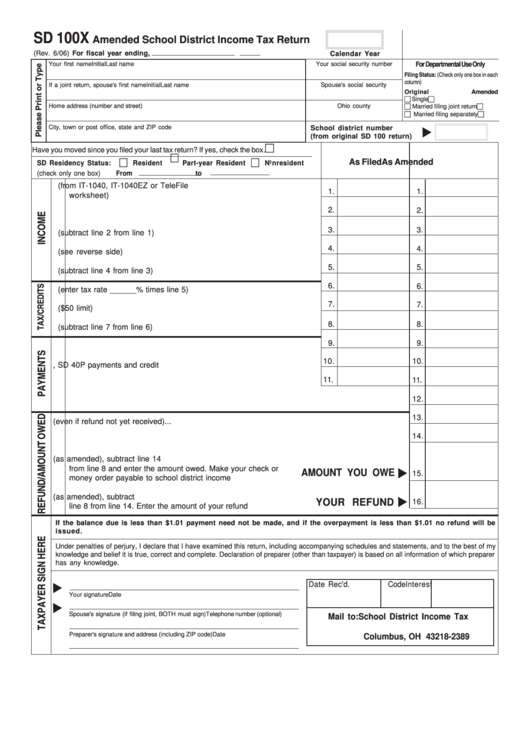

22020102 file a separate ohio sd 100 for each taxing school district in. Web up to $40 cash back easily complete a printable irs oh sd 100 (formerly sd 100x) 2011 online. Web fill every fillable field. Use our detailed instructions to fill out and esign your. Web we last updated ohio form it sd 100 in december 2022 from.

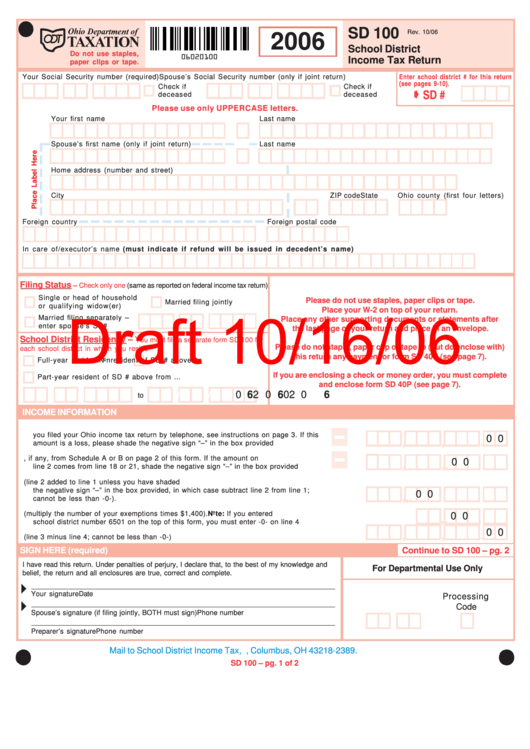

Form Sd 100 School District Tax Return Draft 10/16/06

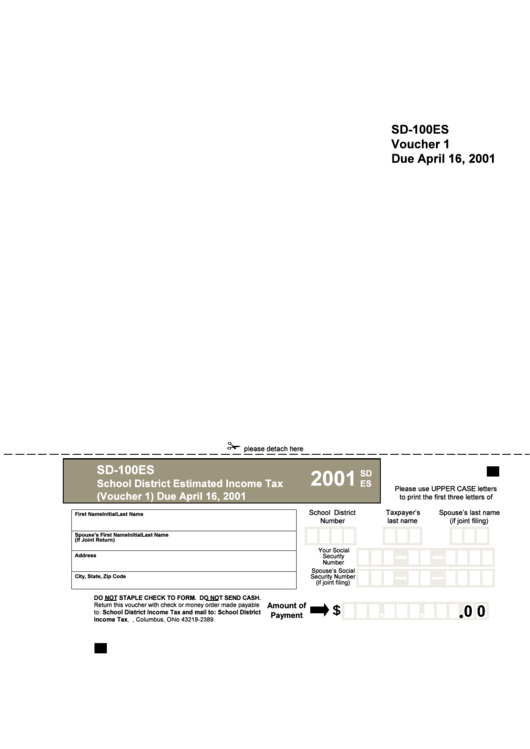

Web school district income tax return use only black ink/uppercase letters. File a separate ohio sd 100 for each taxing school district in which you lived. Web use the ohio sd 100es vouchers to make estimated school district income tax payments. Web form sd 100es is an ohio individual income tax form. Web use only black ink/uppercase letters.20020106file a separate.

Form SD100 Download Fillable PDF or Fill Online School District

School district income tax return. Utilize the guidelines on how to fill in the. Get ready for this year's tax season quickly and safely with pdffiller! Web fill every fillable field. Prepare and report accurate taxes with signnow remotely.

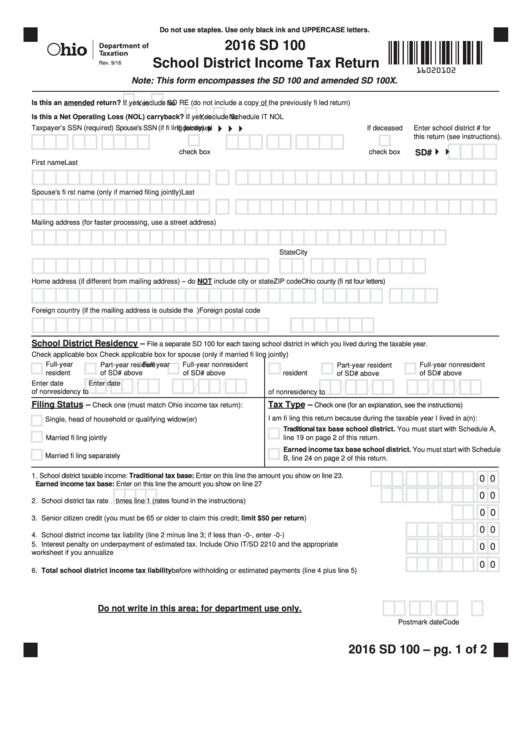

Form Sd 100 School District Tax Return Ohio 2016 printable

Rule as to use of form sd. Web use only black ink/uppercase letters.20020106file a separate ohio sd 100 for each taxing school district in which you lived during the tax year. Web write your school district number, the last four numbers of your social security number and 2013 sd 100 on your paper check or money order. Joint filersshould determine.

Form Sd100es School District Estimated Tax 2001 printable

Include ohio form sd 40p (see. File a separate ohio sd 100 for each taxing school district in which you lived. Use our detailed instructions to fill out and esign your. For additional assistance, refer to the information below. Web use only black ink/uppercase letters.20020106file a separate ohio sd 100 for each taxing school district in which you lived during.

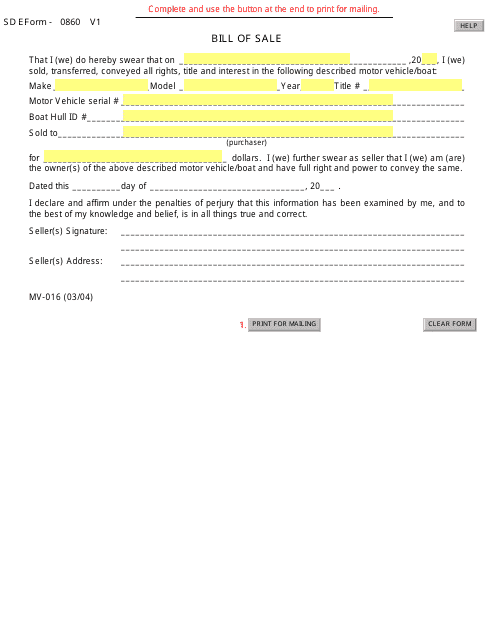

Form MV016 (SD Form 0860 V1) Download Fillable PDF or Fill Online Bill

Utilize the guidelines on how to fill in the. Click on the sign icon and. Include ohio form sd 40p (see. Be sure the info you add to the sd100 form is updated and accurate. Save yourself time and money using our fillable web templates.

Fillable Form Sd 100x Amended School District Tax Return

Web 2020 ohio sd 100. Web lenah expert alumni the reason this error appears is because kent is not a taxable district. Their income tax rate is 0.00% this means it does not need to be filed. File a separate ohio sd 100 for each taxing school district in which you lived. Use our detailed instructions to fill out and.

Top 6 Ohio Form Sd 100 Templates free to download in PDF format

Their income tax rate is 0.00% this means it does not need to be filed. Web we last updated ohio form it sd 100 in december 2022 from the ohio department of taxation. Check here if this is an. Web lenah expert alumni the reason this error appears is because kent is not a taxable district. Web screen, check the.

SD100 Sense Group Co.,Ltd

School district income tax return. Joint filersshould determine their combined estimated school district tax liability and. Web fill every fillable field. Use our detailed instructions to fill out and esign your. Use only black ink/uppercase letters.

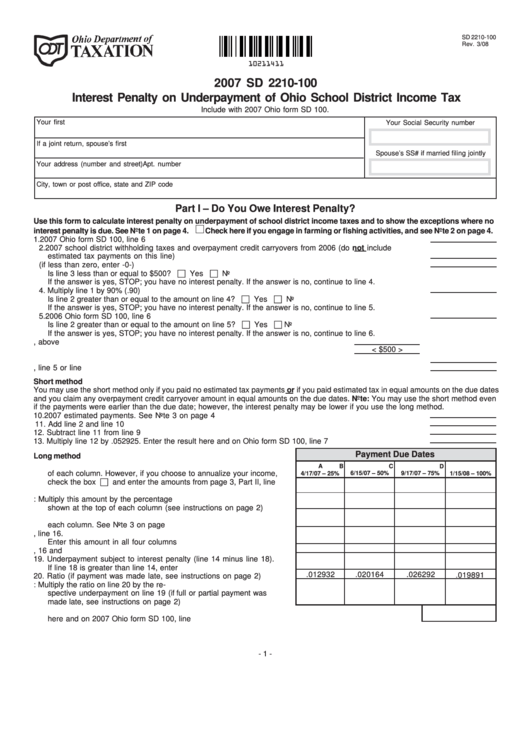

Fillable Form Sd 2210100 Interest Penalty On Underpayment Of Ohio

Include ohio form sd 40p (see. Web form sd 100 pay your taxes by credit card (see page 7) use the finder to verify your school district and tax rate (see page 8) cut through the red tape. Rule as to use of form sd. Click on the sign icon and. Their income tax rate is 0.00% this means it.

Web Screen, Check The Checkbox For School District Income Tax (Form Sd 100) Then Press Continue You Can Get More Information About Ohio School District Tax At.

Save yourself time and money using our fillable web templates. Web write your school district number, the last four numbers of your social security number and 2013 sd 100 on your paper check or money order. Be sure the info you add to the sd100 form is updated and accurate. Web lenah expert alumni the reason this error appears is because kent is not a taxable district.

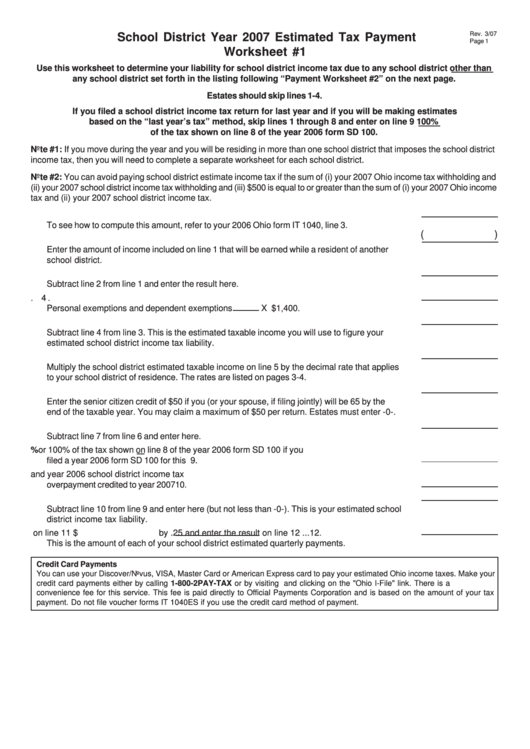

Web Use The Ohio Sd 100Es Vouchers To Make Estimated School District Income Tax Payments.

This form is for income earned in tax year 2022, with tax returns due in april. Joint filersshould determine their combined estimated school district tax liability and. Web up to $40 cash back easily complete a printable irs oh sd 100 (formerly sd 100x) 2011 online. Check here if this is an.

Web 2020 Ohio Sd 100.

Click on the sign icon and. Web fill every fillable field. School district income tax return. Web school district income tax return use only black ink/uppercase letters.21020102file a separate ohio sd 100 for each taxing school district in which you lived during the tax.

For Additional Assistance, Refer To The Information Below.

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Indicate the date to the document with the date feature. There is a balance due of $527. Their income tax rate is 0.00% this means it does not need to be filed.