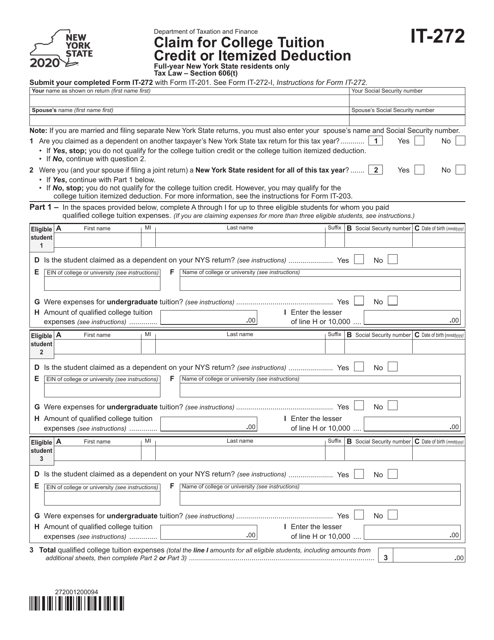

Form It 272

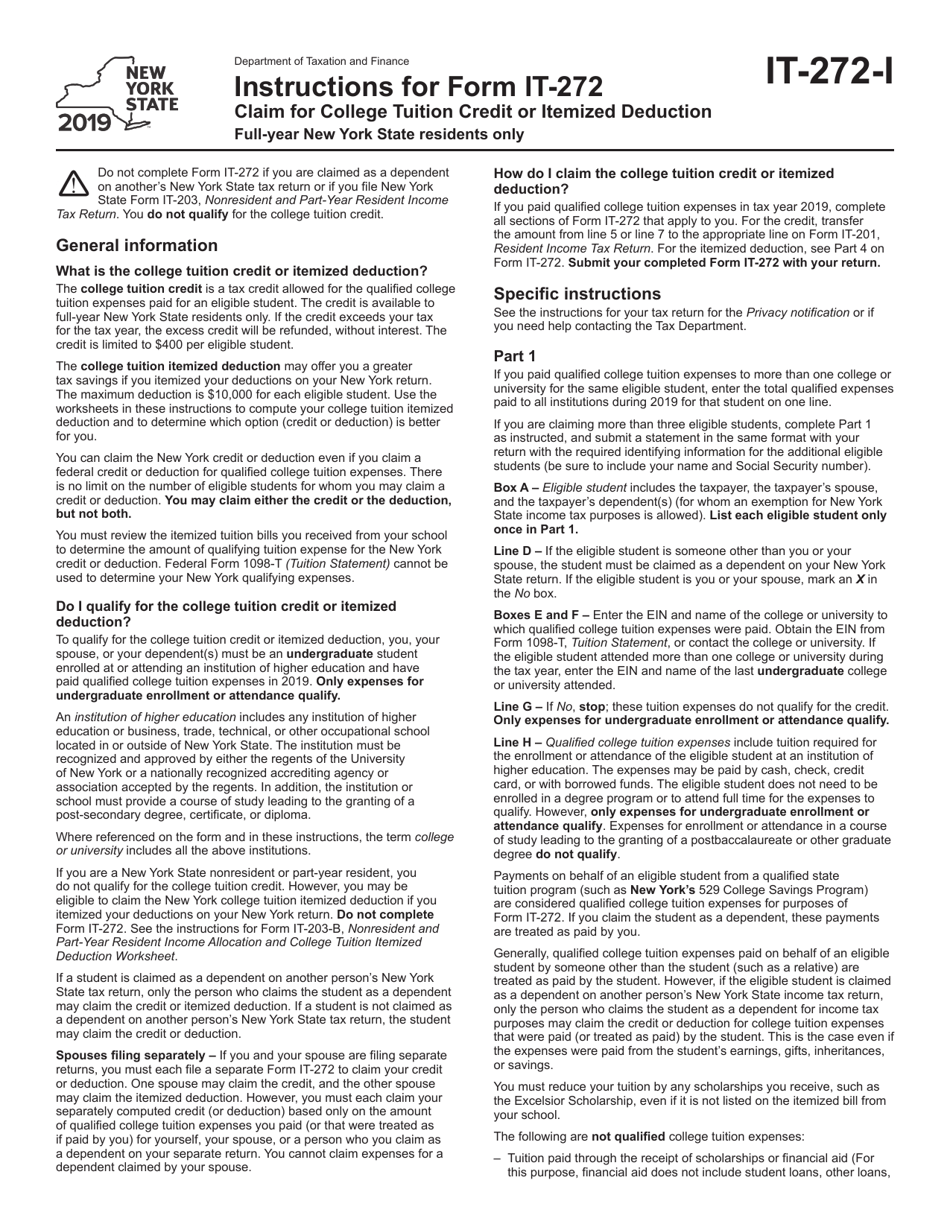

Form It 272 - • attach this form to your. Compute the amount by which your credit or deduction would have been reduced if the refund,. On page 2, 2nd column, the instruction as to how to claim the credit should read: Part 3 is completed if line 3 is $5,0000 or more. You can take either a tax credit or an itemized tax. Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. Web current tax year net income (before distributions): The college's ein must follow one of the following formats: Calculated new york > credits:.

Web • complete this form to compute your college tuition credit. You can take either a tax credit or an itemized tax. Compute the amount by which your credit or deduction would have been reduced if the refund,. Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. • in column (a), enter the amount from part i, line 24b • in column (b), enter the amount from part i, line 25b • attach this form to your. Calculated new york > credits:. Who qualifies for ny tuition credit? The college's ein must follow one of the following formats: Web current tax year net income (before distributions):

The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. If you cannot claim all of your credit because it is more than your new york state tax less other credits, you can carry over the unused amount of credit to the following 10. Compute the amount by which your credit or deduction would have been reduced if the refund,. You can take either a tax credit or an itemized tax. Calculated new york > credits:. Part 3 is completed if line 3 is $5,0000 or more. Web current tax year net income (before distributions): Who qualifies for ny tuition credit? The college's ein must follow one of the following formats: Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms.

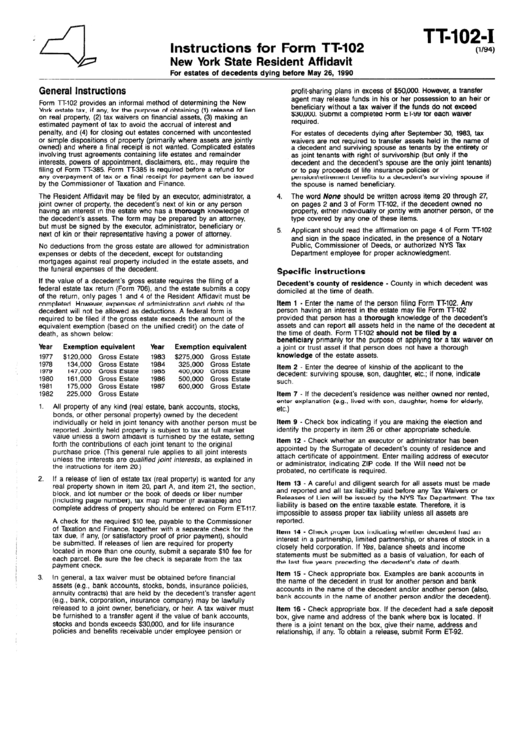

Form Tt102I Instructions New York State Resident Affidavit

On page 2, 2nd column, the instruction as to how to claim the credit should read: The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. • in column (a), enter the amount from part i, line 24b • in column (b), enter the amount from part i, line 25b The college's ein.

The Eye Has It 272/365 Thanks for looking. Here's my album… Flickr

Compute the amount by which your credit or deduction would have been reduced if the refund,. Calculated new york > credits:. Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. • attach this form to your. On page 2, 2nd column, the instruction as to how to claim the credit.

It 203 b instructions

Compute the amount by which your credit or deduction would have been reduced if the refund,. You can take either a tax credit or an itemized tax. On page 2, 2nd column, the instruction as to how to claim the credit should read: Part 3 is completed if line 3 is $5,0000 or more. Web • complete this form to.

NY DTF IT2104 20212022 Fill out Tax Template Online US Legal Forms

The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. The college's ein must follow one of the following formats: Calculated new york > credits:. Part 3 is completed if line 3 is $5,0000 or more. Who qualifies for ny tuition credit?

USM Form 272 and 272A Service Of Process Pleading

If you cannot claim all of your credit because it is more than your new york state tax less other credits, you can carry over the unused amount of credit to the following 10. On page 2, 2nd column, the instruction as to how to claim the credit should read: The college's ein must follow one of the following formats:.

Form IT 272 College Tuition Credit Miller Financial Services

The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. Who qualifies for ny tuition credit? Web current tax year net income (before distributions): Part 3 is completed if line 3 is $5,0000 or more. • in column (a), enter the amount from part i, line 24b • in column (b), enter the.

Form IT272 Download Fillable PDF or Fill Online Claim for College

If you cannot claim all of your credit because it is more than your new york state tax less other credits, you can carry over the unused amount of credit to the following 10. The college's ein must follow one of the following formats: • attach this form to your. Part 3 is completed if line 3 is $5,0000 or.

Download Instructions for Form IT272 Claim for College Tuition Credit

If you cannot claim all of your credit because it is more than your new york state tax less other credits, you can carry over the unused amount of credit to the following 10. The college's ein must follow one of the following formats: Calculated new york > credits:. Web as you enter your federal information, taxact automatically calculates and.

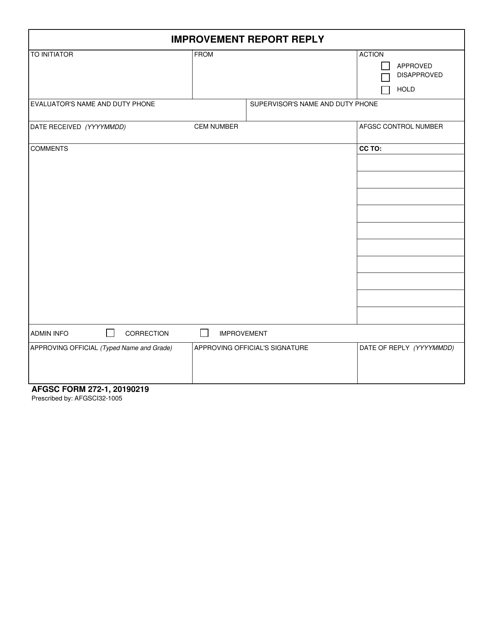

AFGSC Form 2721 Download Fillable PDF or Fill Online Improvement

Part 3 is completed if line 3 is $5,0000 or more. The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. You can take either a tax credit or an itemized tax. Compute the amount by which your credit or deduction would have been reduced if the refund,. • attach this form to.

How Do I Reset Canon Printer? (18882729758) My Geeks Help

• in column (a), enter the amount from part i, line 24b • in column (b), enter the amount from part i, line 25b You can take either a tax credit or an itemized tax. Part 3 is completed if line 3 is $5,0000 or more. • attach this form to your. If you cannot claim all of your credit.

On Page 2, 2Nd Column, The Instruction As To How To Claim The Credit Should Read:

Compute the amount by which your credit or deduction would have been reduced if the refund,. • attach this form to your. Part 3 is completed if line 3 is $5,0000 or more. Calculated new york > credits:.

If You Cannot Claim All Of Your Credit Because It Is More Than Your New York State Tax Less Other Credits, You Can Carry Over The Unused Amount Of Credit To The Following 10.

Web as you enter your federal information, taxact automatically calculates and enters your data into your state tax forms. The federal lifetime learning credit allows a credit for any type of continuing education on form 8863. Who qualifies for ny tuition credit? • in column (a), enter the amount from part i, line 24b • in column (b), enter the amount from part i, line 25b

Web • Complete This Form To Compute Your College Tuition Credit.

You can take either a tax credit or an itemized tax. Web current tax year net income (before distributions): The college's ein must follow one of the following formats: